U.S. November S&P PMIs - Still healthy

November’s preliminary S and P PMIs both remain at healthy levels, manufacturing modestly slower at 51.9 from 52.5 but still comfortably positive, while services have unexpectedly seen a modest increase to 55.0 from 54.8. The composite increased to 54.8 from 54.6.

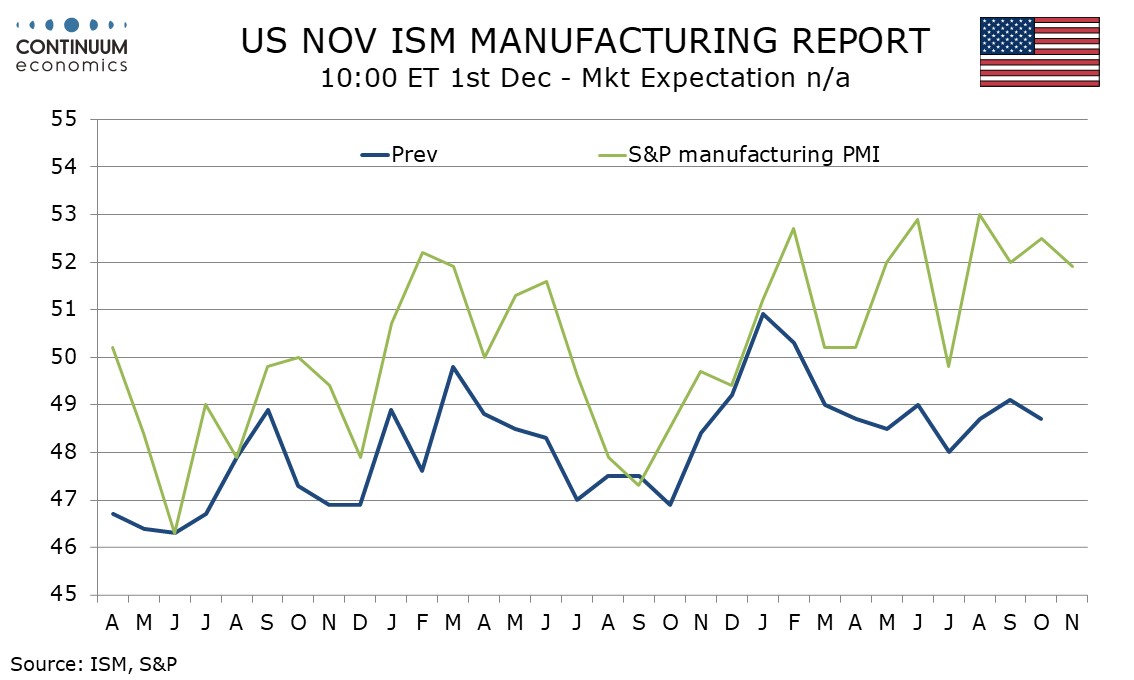

The S and P manufacturing index has been consistently outperforming the ISM’s, though October data which saw the S and P index pick up but the ISM’s slowing increased the contrast which we would not be surprised to see narrowing in November. November manufacturing surveys from the Empire State and Kansas City and Philly Feds were all stronger than in October, though the Philly Fed’s remained negative.

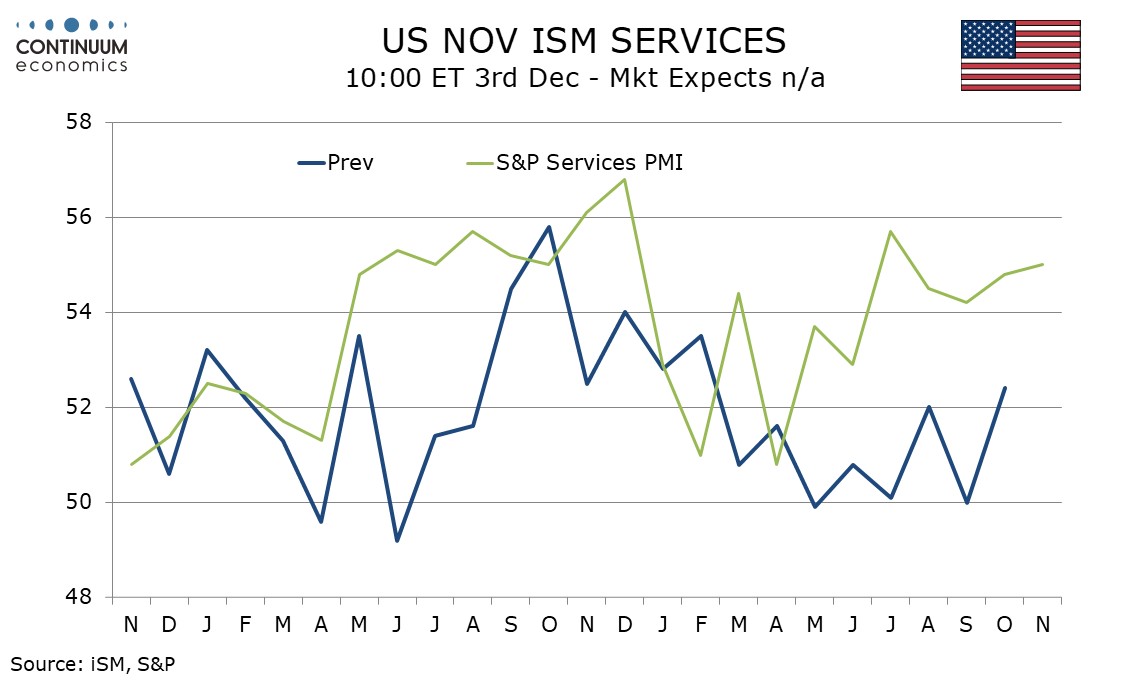

The S and P’s services index has also been outperforming the ISM’s, and is sustaining a strong Q3 picture in Q4 to date. Fed easing is supportive but the resilience is surprising given downside risks to consumer spending with Q3 strength there running ahead of disposable income. The ISM services index did see an improvement in October but despite the strength of November’s S and P services index, we cannot be confident the ISM’s will show similar strength.