U.S. September/October JOLTS report - Mostly a resilient message

The Labor Dep’t has released the JOLTS report on labor turnover for both September and October, with the September data being partial but the October release surveyed as originally planned. The picture is on the strong side of expectations and the pre-shutdown trend.

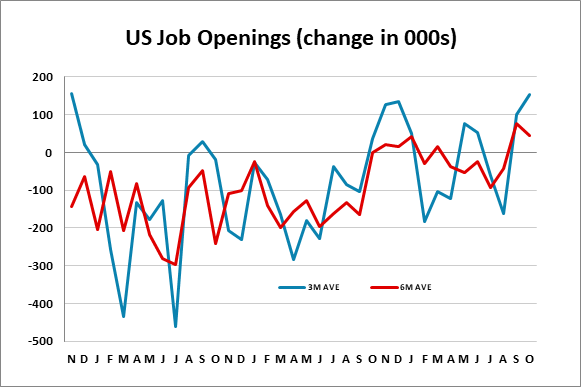

Openings rose by a modest 12k in October but by a strong 431k in September, that following a 19k rise in August, with the three straight gains totaling 462k, not quite reversing two straight declines in June and July that totaled 504k, but suggesting that openings are still holding up.

Hirings fell by 218k in October after a 241k increase in October, while separations fell by 214k in October after a 153k increase in September. The difference between hires and separations was 99k in October after a 103k increase in September, both stronger than seen in June, July and August. September’s difference is close to consistent with a 119k increase in September’s non-farm payroll. October’s 99k difference suggests October payrolls may hold up better than most expect.

Less positive is a 187k fall in October quits after a 37k increase in September, with falling quits suggesting less optimism about the state of the labor market. Overall, the report is however on the firm side of expectations. That September data is partial suggests we should not draw too many conclusions over the differences between the September and October reports, but the levels see in October look resilient for openings and in their implications for employment, if less so for quits.