U.S. November ISM Services - Rise led by delivery times

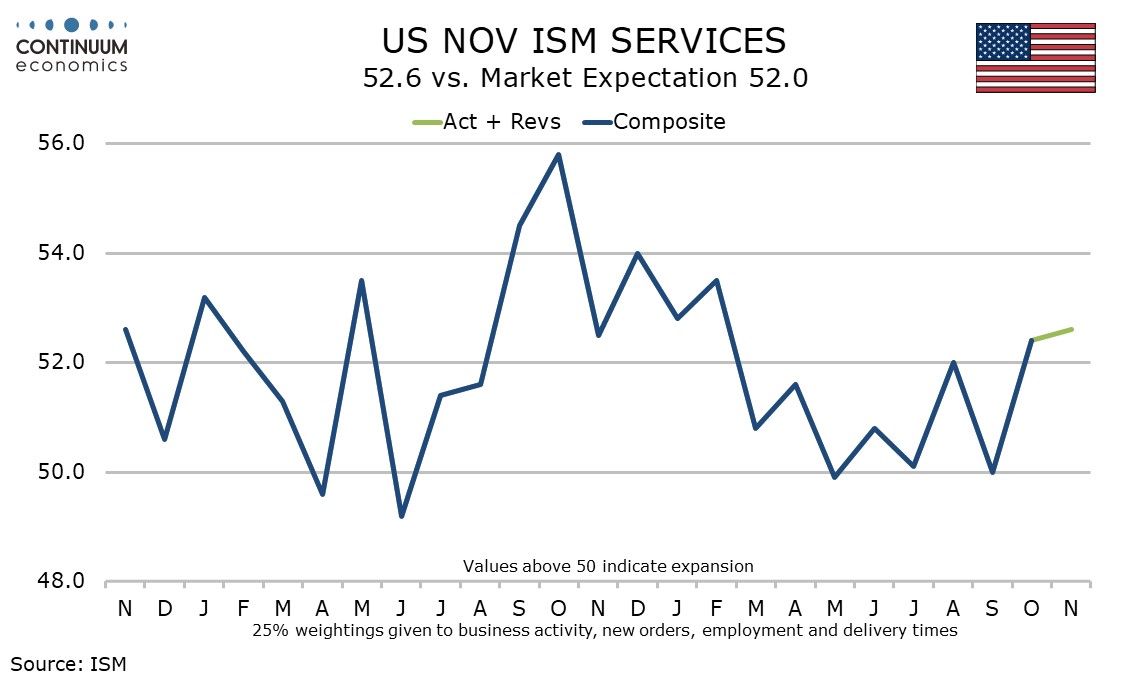

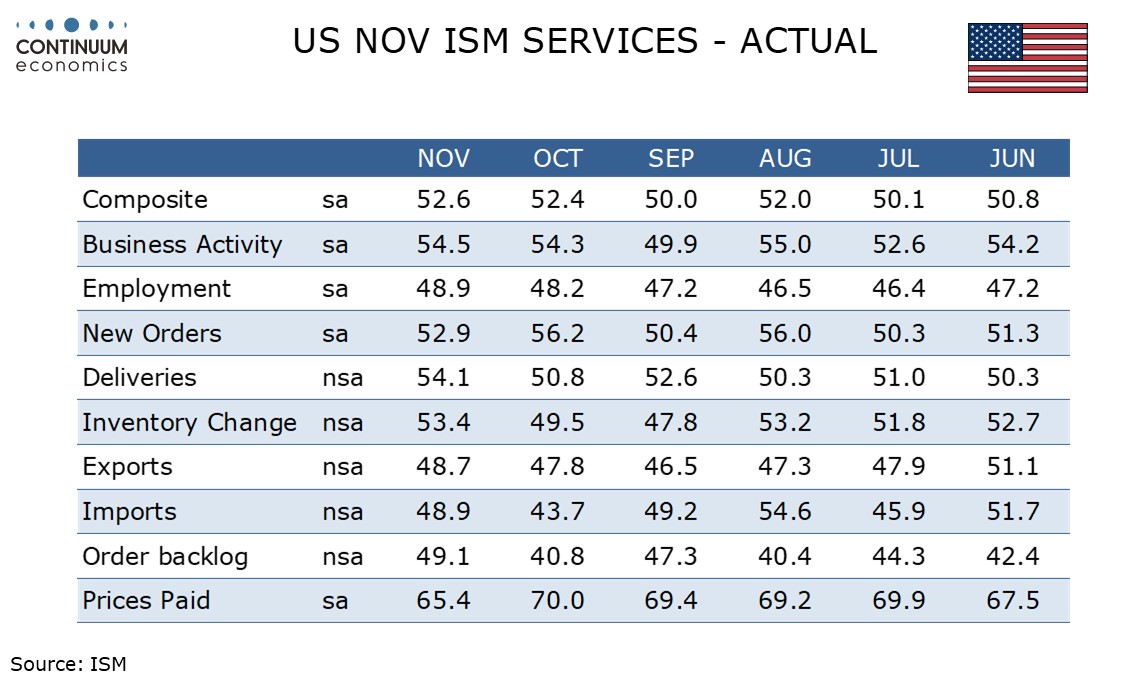

November’s ISM services index has marginally extended an October bounce, and at 52.6 from 52.4 is at its highest since February. Details are less impressive but the latest two months suggest the economy is still expanding, if moderately, and worries over tariffs, which may have contributed to a dip below the neutral 50 in May, are easing.

Not so impressive in the detail is a dip in new orders to 52.9 from 56.2. Business activity at 54.5 from 54.3 and employment at 48.9 from 48.2 saw marginal improvements but the latter remains negative.

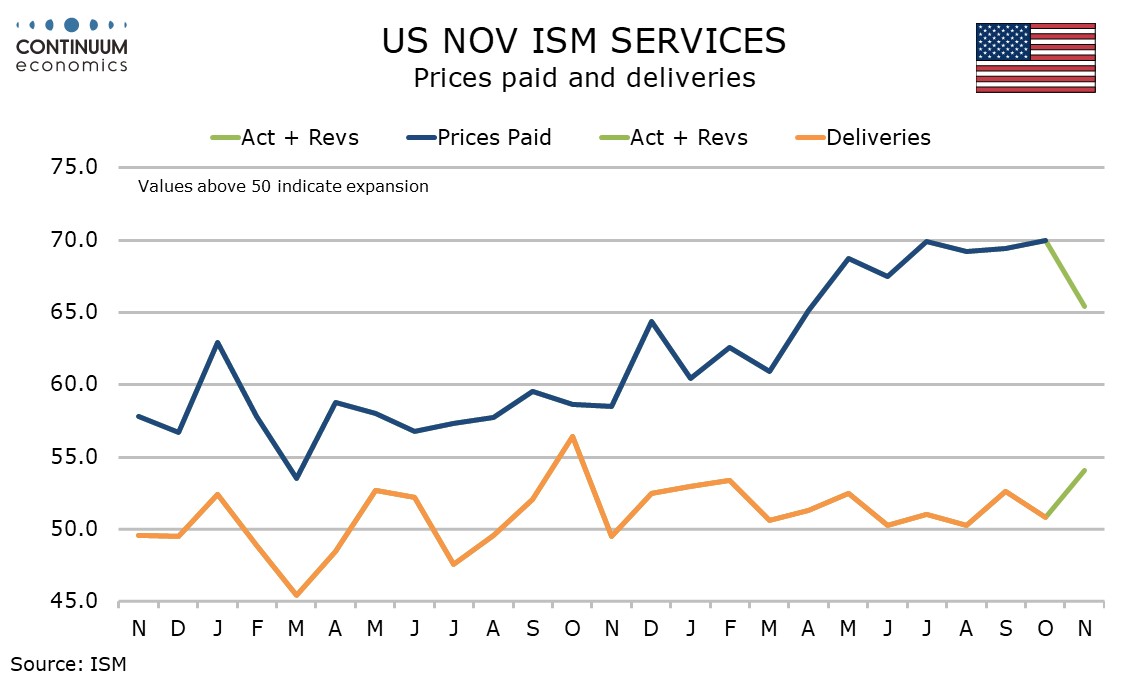

The main source of strength in the four components that make up the composite was a rise in deliveries to 54.1 from 50.8, and this is not a clear signal for economic strength.

Sometimes strength in deliveries is seen as an inflationary warning but with prices paid (which do not continue to the composite) down to 65.4 from 70.0, reaching their lowest since April, this report will not raise inflationary worries.

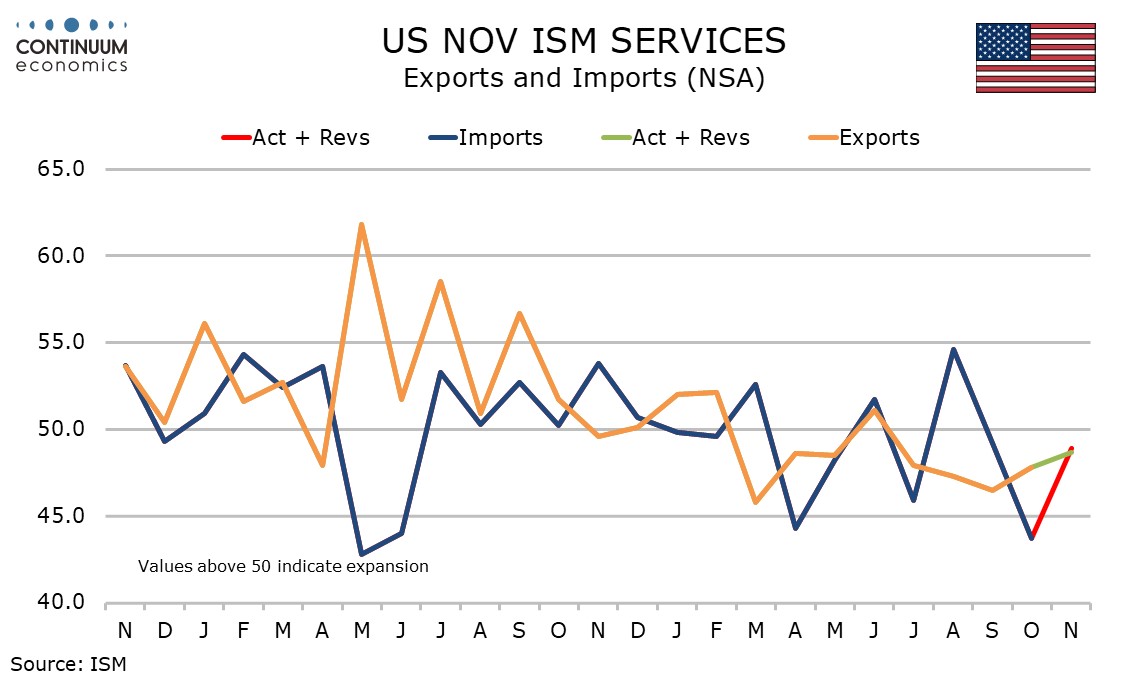

Exports and imports also do not contribute to the composite. Both increased, exports to 48.7 from 47.8, and imports to 48.9 from 43.7, though both remain quite weak. Exports are the highest since June but imports were higher as recently as September.