U.S. December S&P PMIs - Less positive, particularly services

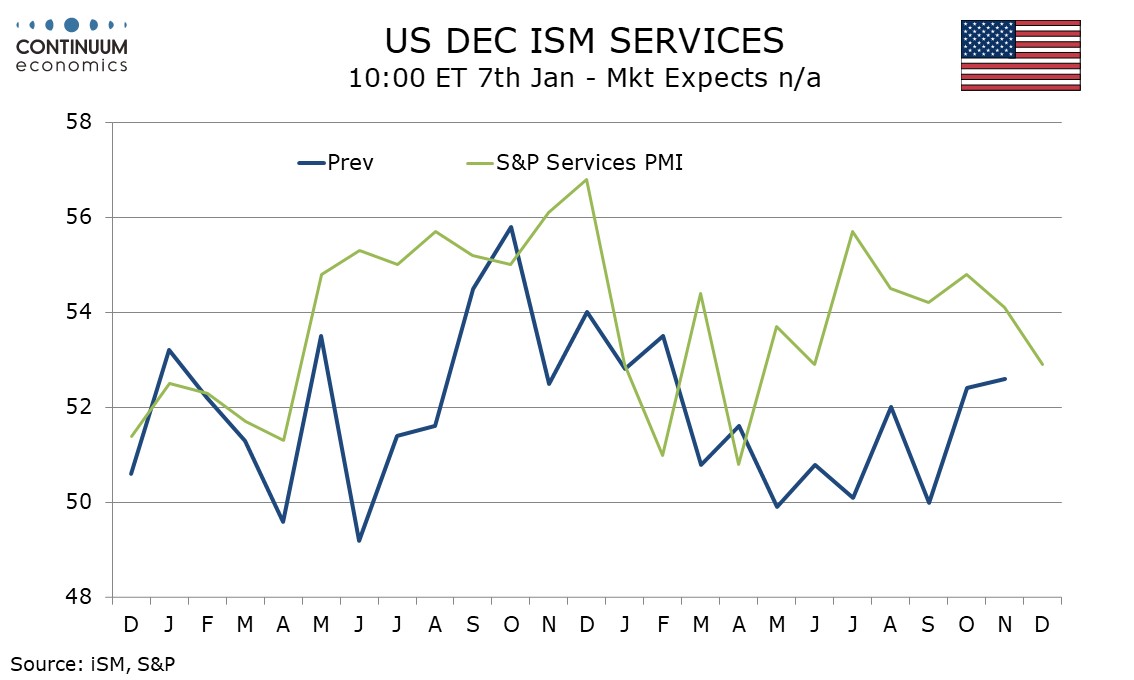

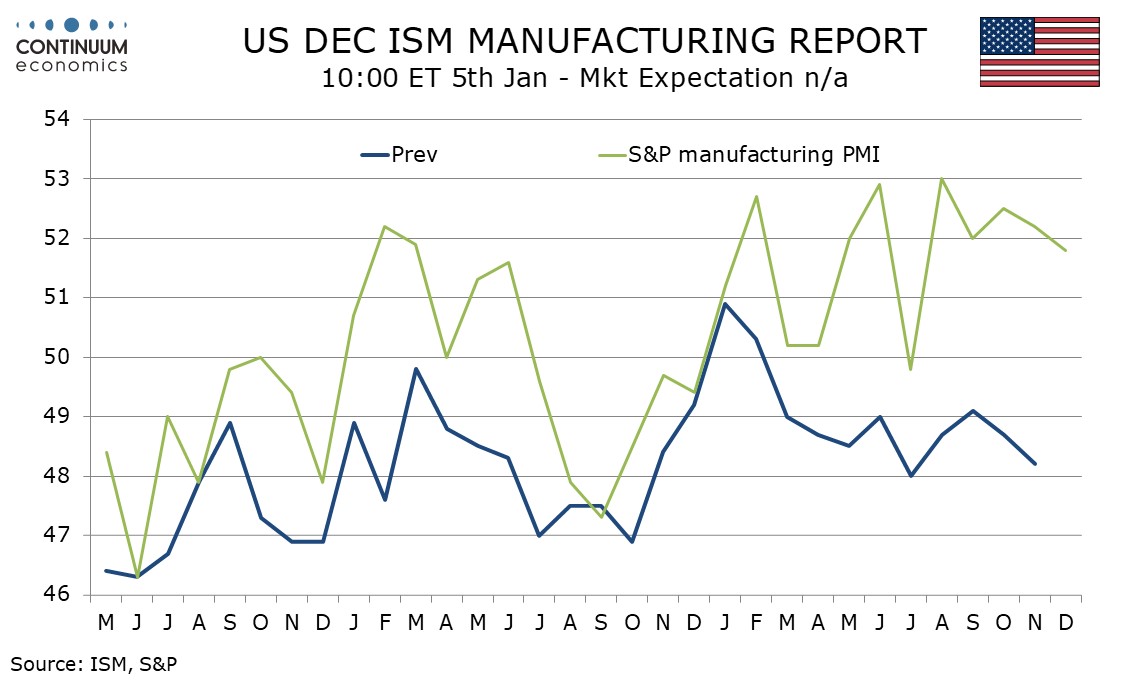

December’s preliminary S and P PMIs are both weaker and below consensus, manufacturing only marginally at 51.8 from 52.2 but services more significantly at 52.9 from 54.1. The composite fell to 53.0 from 54.2.

The S and P manufacturing index has been consistently outperforming the ISM’s, and the dip in December’s S and P index follows a weaker Empire State survey in December. However there is still little direction to trend, with the S and P index steady a little above 50 while the ISM is steady a little below. Manufacturing payrolls have seen seven straight modest declines.

The S and P’s services index has also been outperforming the ISM’s, but December’s index is a significant break in trend and puts it not far above November’s ISM services index of 52.6, as well as reaching its weakest level since June. The Empire State released its December services index today, and it remained weak at -20.0 from -21.7. We do see risk that consumer spending could lose momentum in Q4 with Q3 spending having run well ahead of disposable income, but October retail sales were resilient outside a dip in autos.