U.S. November Preliminary Michigan CSI - Weak, possibly on shutdown or labor market worries

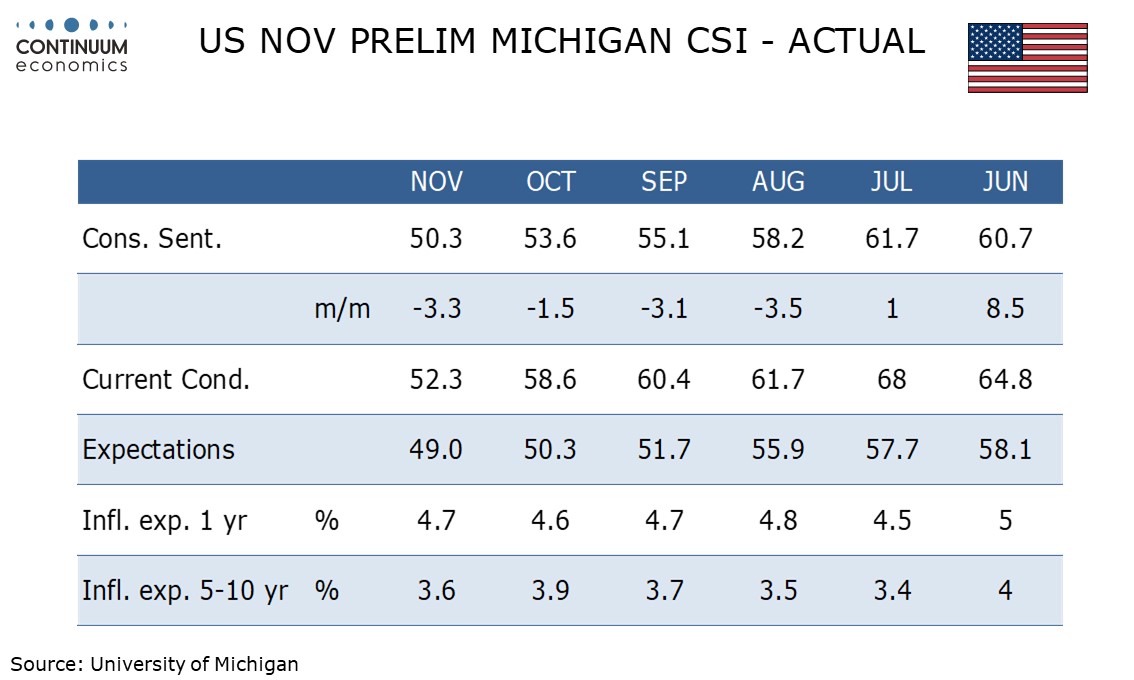

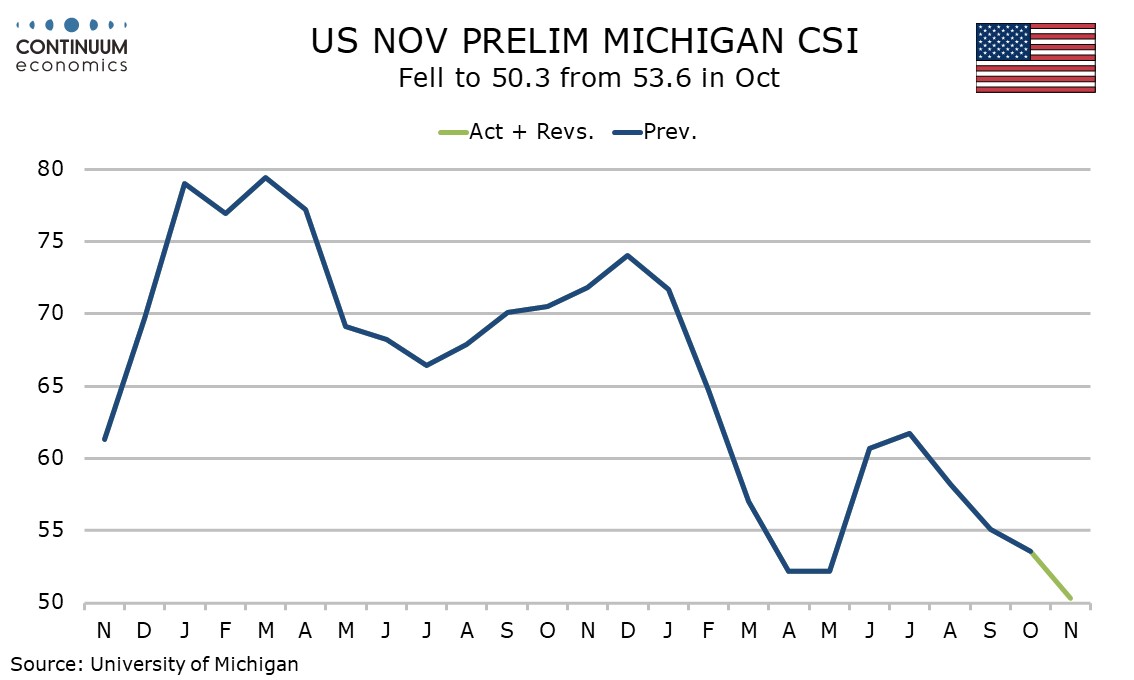

November’s preliminary Michigan CSI of 50.3 has seen a significant dip from 53.6 in October to reach its lowest level since June 2022. Current conditions led the slowing, perhaps due to the government shutdown or weakening in the labor market. Inflation expectations are mixed but within the recent range.

This is the fourth straight monthly dip since July reached 61.7, and takes it below the 52.2 seen in both April and May after the introduction of tariffs. June 2002 at 50.0, when inflation was surging in the aftermath of Russia’s invasion of Ukraine, is the only relatively recent outcome below the latest one.

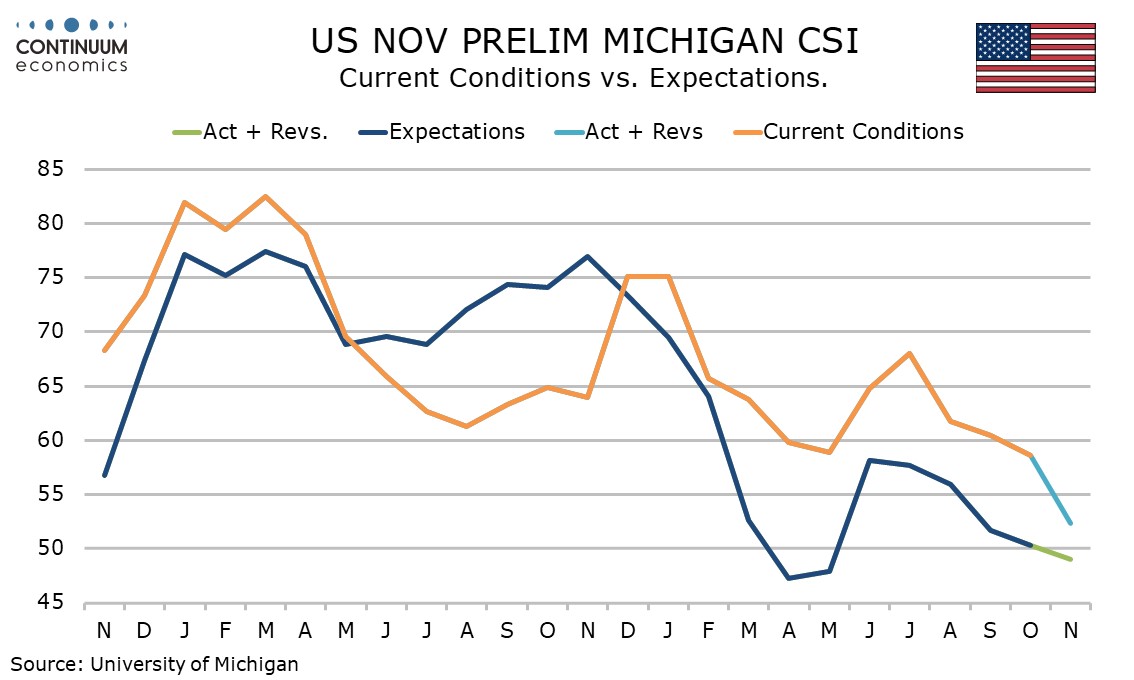

Current conditions at 52.3 from 58.6 have fallen particularly sharply. The government shutdown may be causing increasing concern, but there is also a risk that consumers are perceiving deterioration in the labor market. Expectations slipped too, but only modestly to 49.0 from 50.3, and remain above April’s low of 47.3.

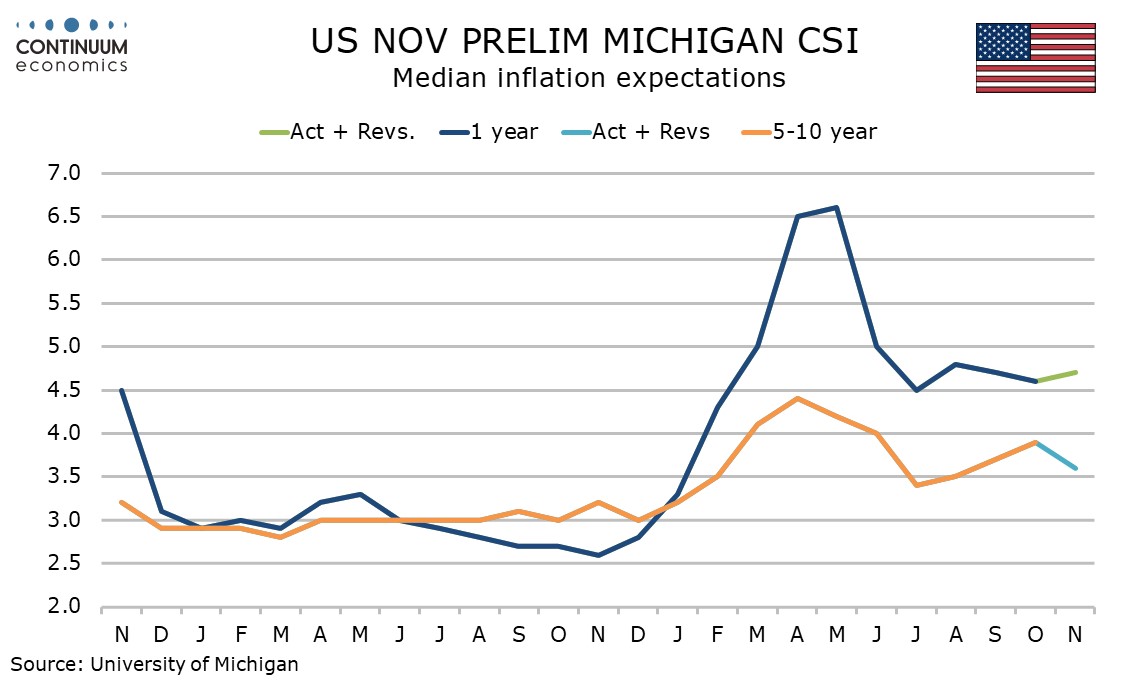

The 1-year inflation view edged up to 4.7% from 4.6% while the 5-10 year view slipped to 3.6% from 3.9%. The 1-year view has been in a 4.4% to 4.9% range since July and the 5-10 year view has been in a 3.4% to 3.9% range in the same period. The 5-10 year view has been quite volatile within this range, even between preliminary and final releases.

Both inflation series remain off recent highs, of 7.3% for the 1-year and 4.6% for the 5-10 year both seen in May’s preliminary (the final month peaks were 6.6% and 4.4% respectively). This suggest tariff concerns are past their peak if still a worry, and the fresh deterioration in sentiment is likely to have other explanations.