U.S. November ISM Manufacturing - Weaker than expected but still in a tight range

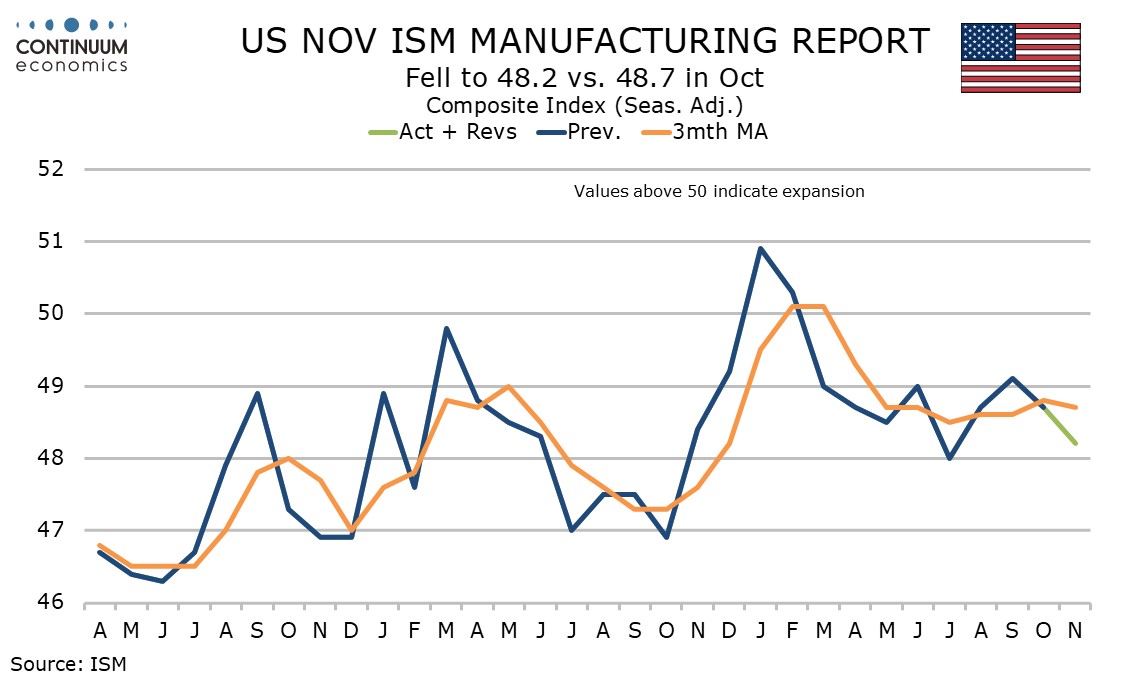

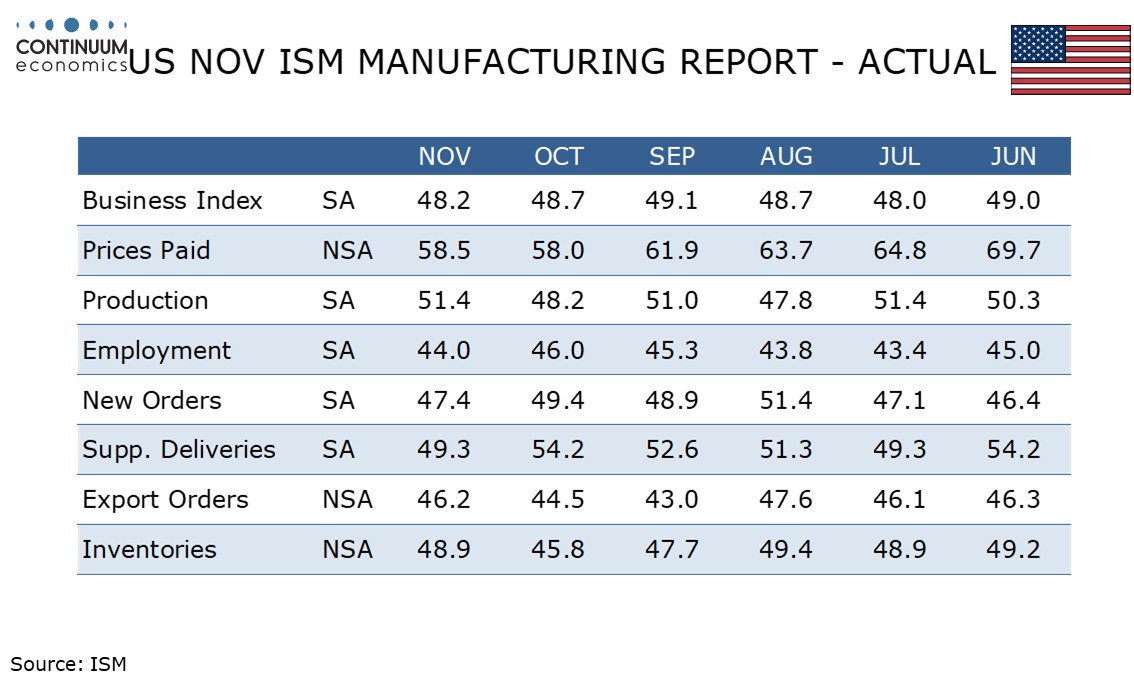

November’s ISM manufacturing index of 48.2 from 48.7 is weaker than expected and the signals of most if not all regional surveys, if not dramatically so. The index is the weakest since July but remains in a fairly tight modestly negative range, since moving above neutral in January and February.

Slowings were seen in new orders, to 47.4 from 49.4, to the weakest since July, and employment, to 44.0 from 46.0. to the weakest since August. Production however picked up to 51.4 from 48.2, reaching its highest since a matching July.

Completing the breakdown of the composite, delivery times at 49.3 saw a sharp correction lower from October’s strong 54.2, while inventories at 48.9 corrected from a weak October reading of 45.8.

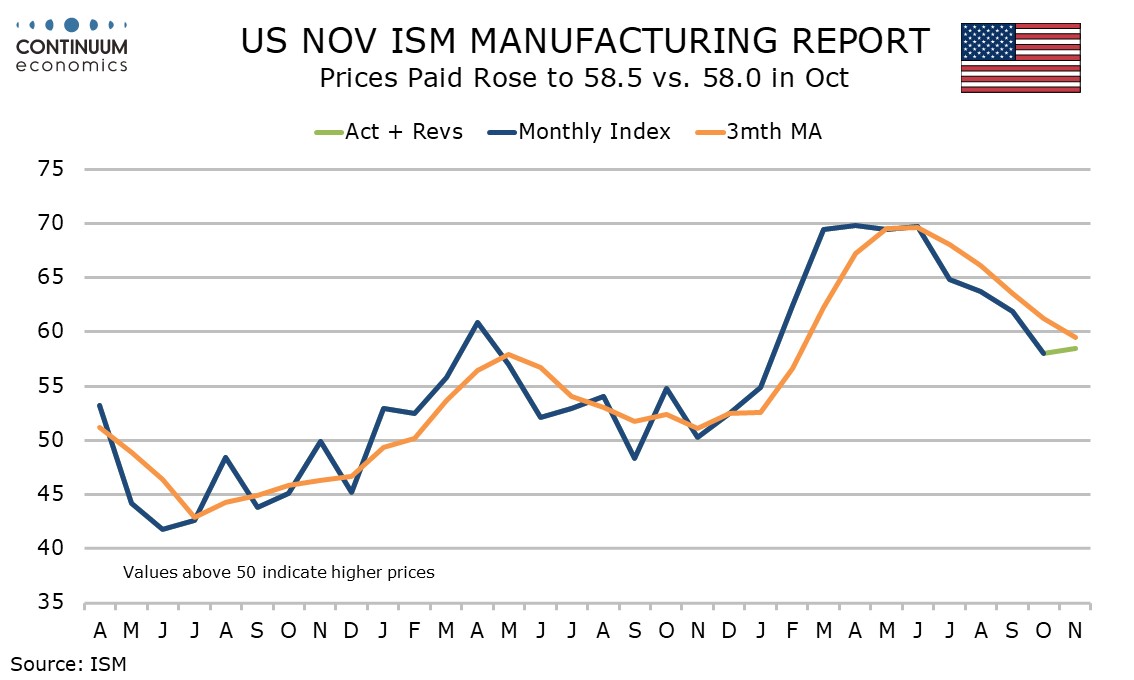

Prices paid do not contribute to the composite, and at 58.5 were slightly up from October’s 58.0, but this still makes two straight readings below 60 after eight above, suggesting that the worst of the tariff impact is behind us.

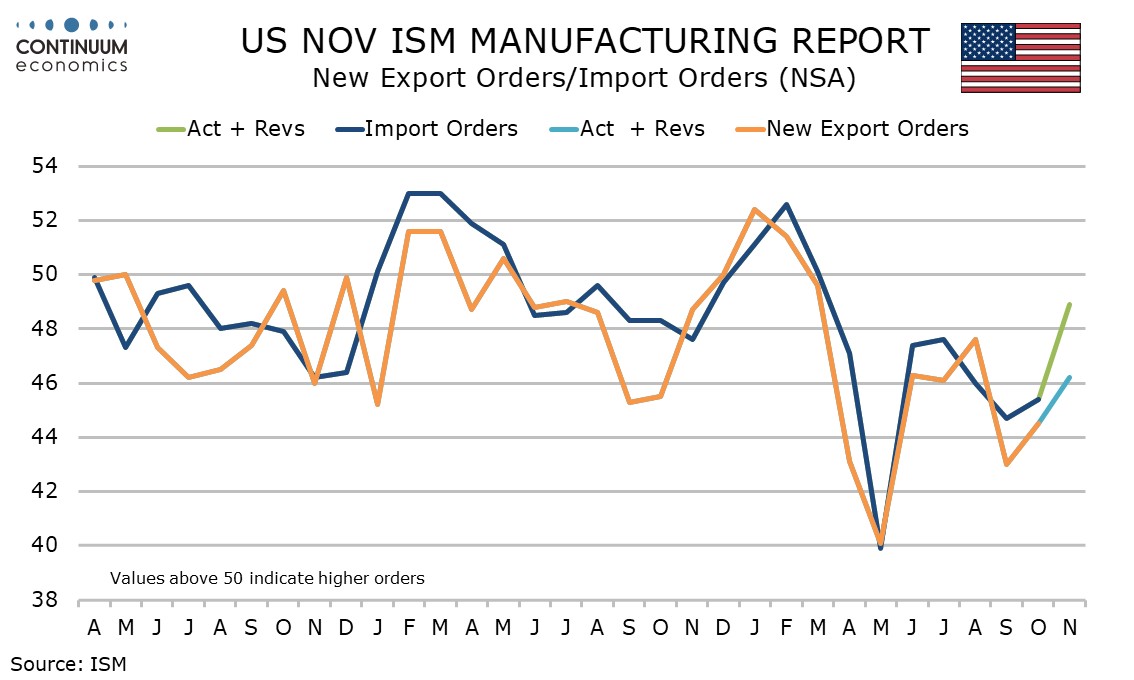

Exports at 46.2 from 44.5 are the highest since July while imports at 48.9 from 45.4 are the highest since March, also suggesting the tariff impact is fading.