U.S. Initial Claims, September Durable Goods Orders - trends healthy

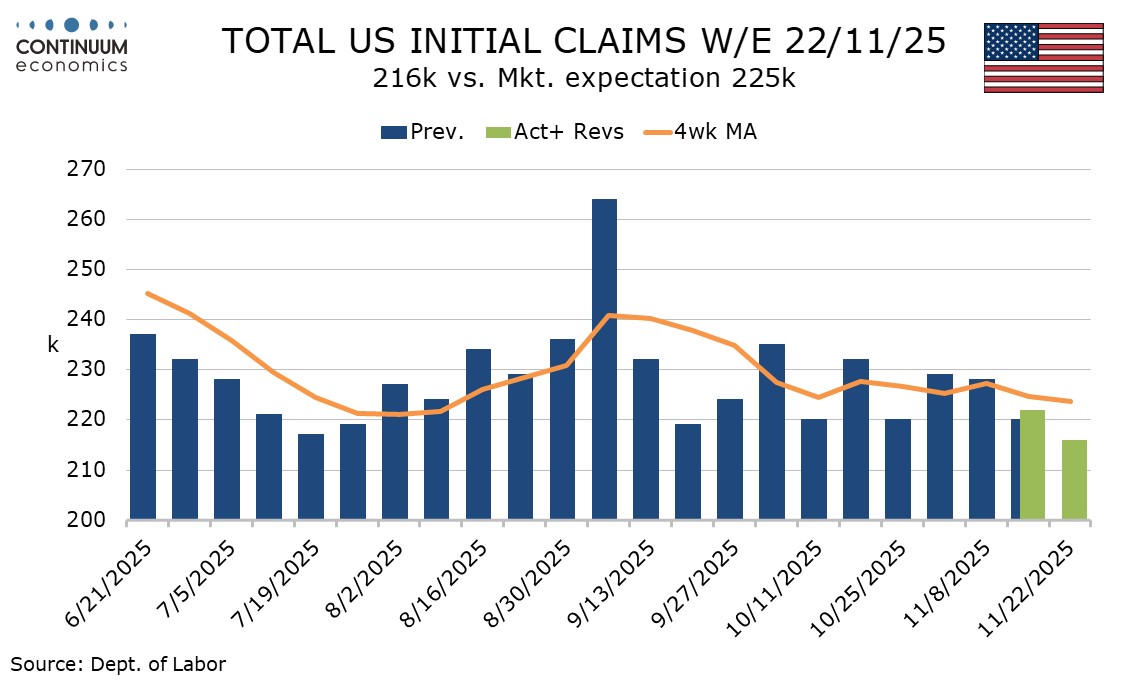

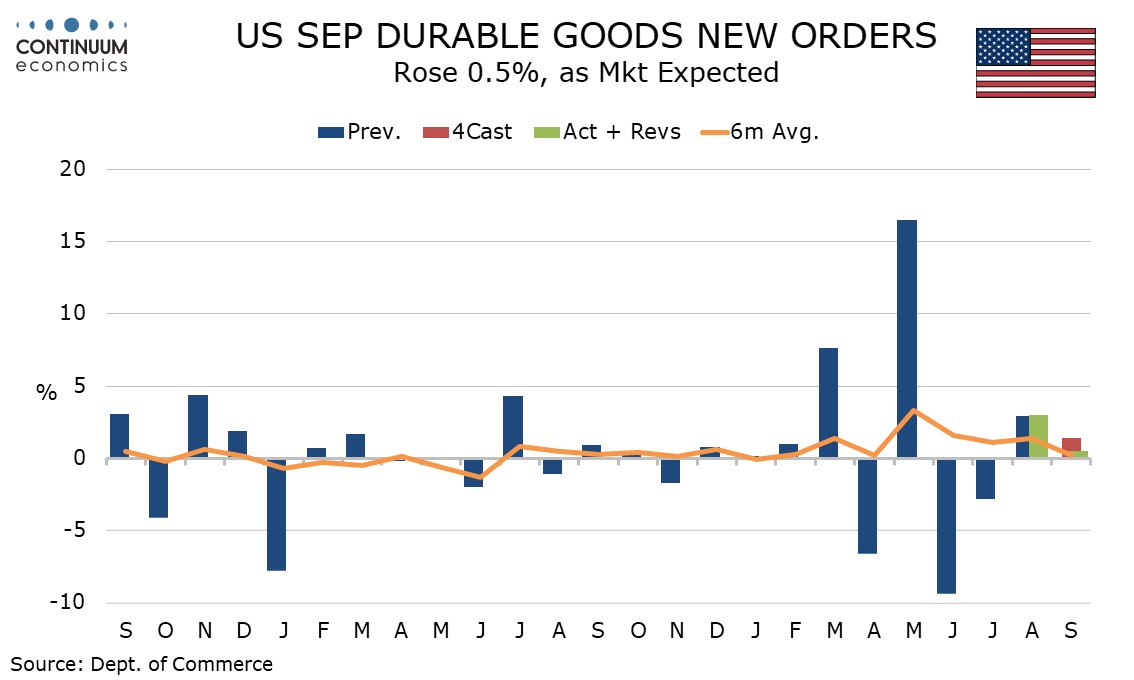

The latest set of US data is on the strong side of expectations, with initial claims at 216k from 222k the lowest since April. September durable goods orders are on consensus with a 0.5% increase but the ex-transport rise of 0.6% is on the firm side and trend is improving.

Last week’s initial claims data, which was revised up to 222k from 220k, covers the November non-farm payroll survey week. The 4-week average looks fairly stable though the latest level of 223.75k is the lowest since early August.

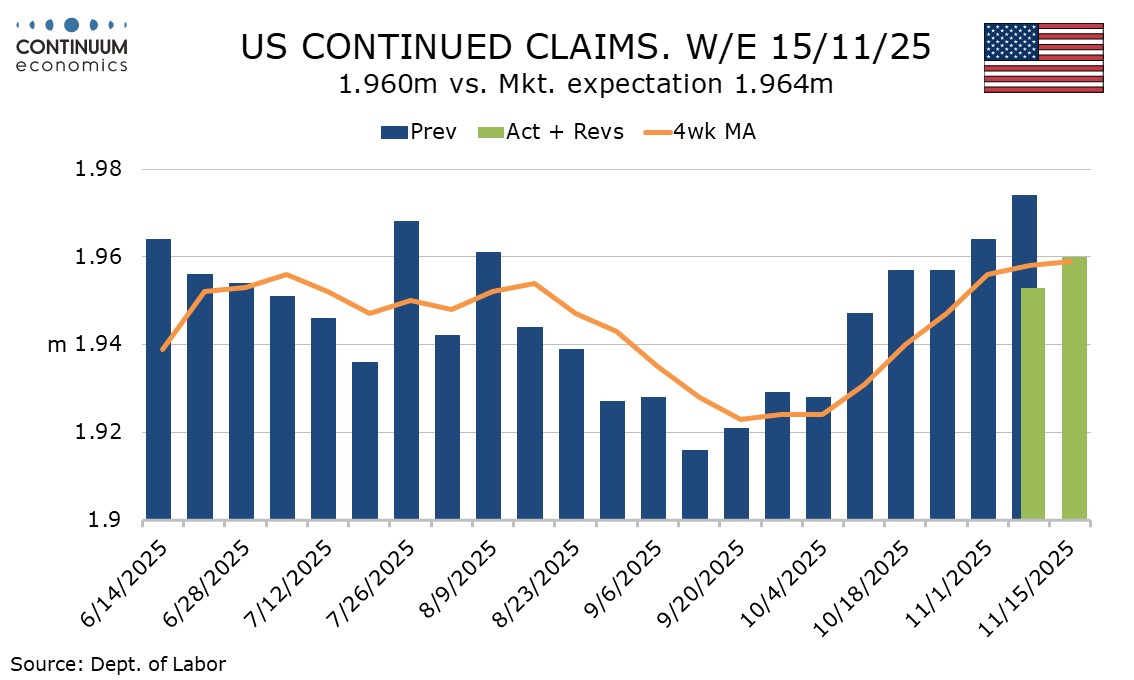

Continued claims cover the week before initial claims and thus the November payroll survey week. The latest level of 1.96m is in line with expectations but last week was revised lower to 1.953m from 1,.974m. The 4-week average is still rising but a recent acceleration may be losing momentum.

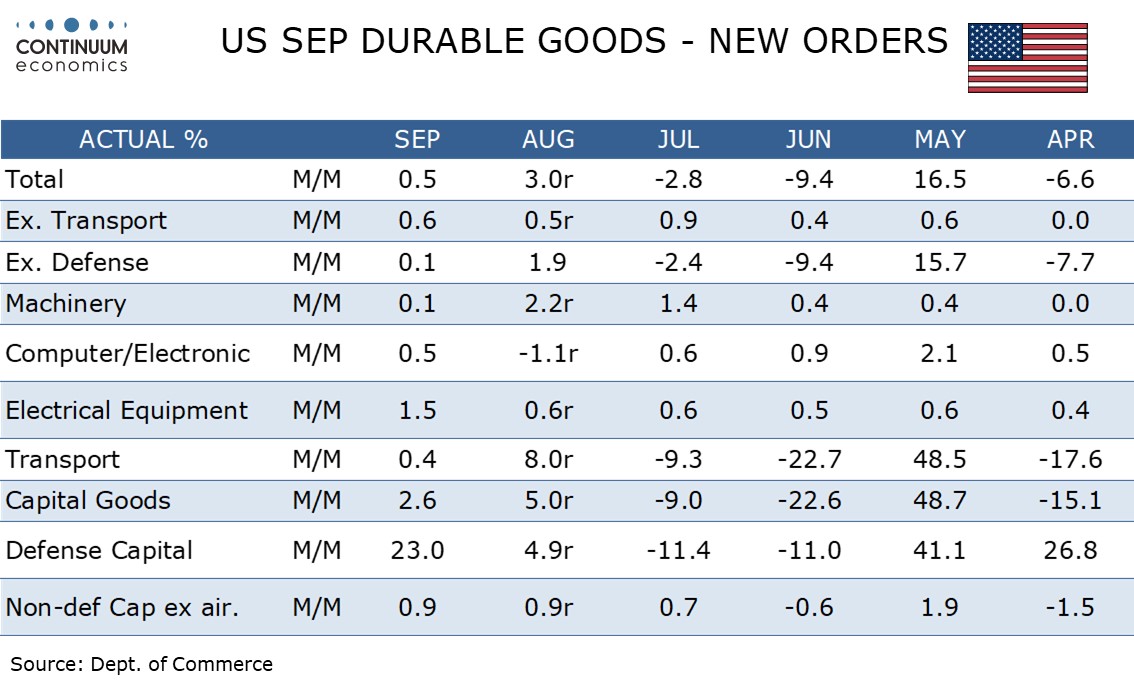

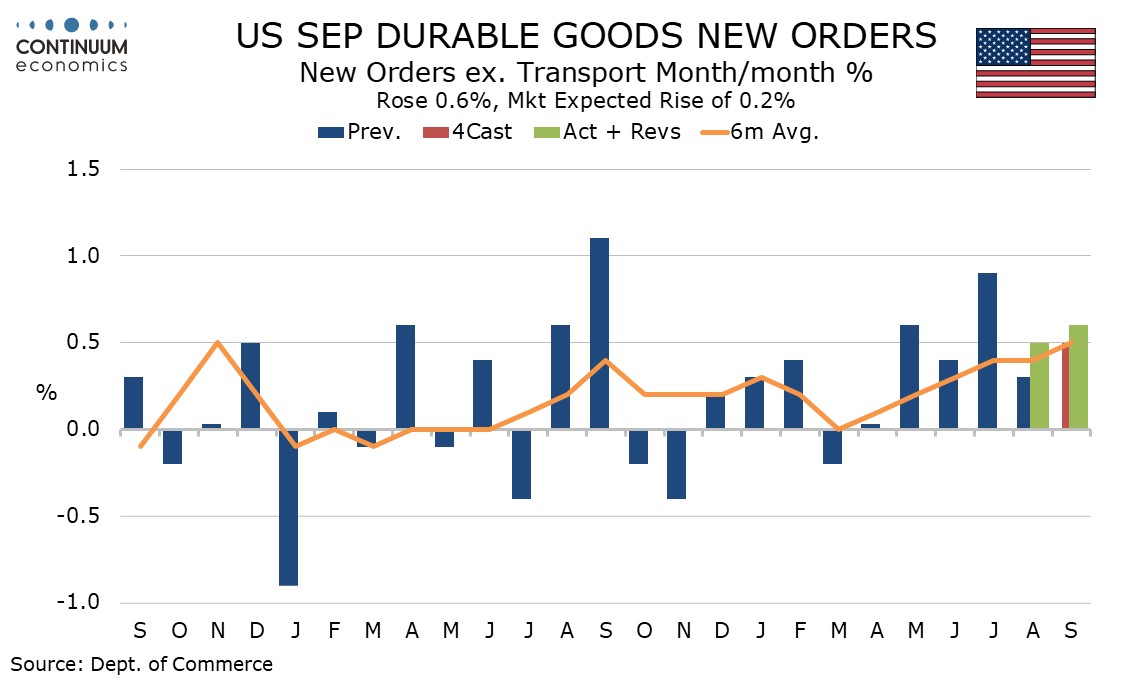

September durable goods with a 0.5% rise were in line with consensus and actually weaker than expected at 0.1% excluding a bounce in defense. However the ex-transport rise of 0.6% is a fifth straight of similar magnitude. The 6-month average of 0.5% is up from zero in March.

Transport orders rose by 0.4% with arise in defense aircraft outweighing a drop in civil aircraft, while autos saw a modest rise of 0.4%.

Non-defense capital orders ex aircraft, a key indicator of business investment, saw a second straight rise of 0.9% outperforming the ex-transport series while shipments in the sector also rose by 0.9%. The latter is positive for Q3 GDP if partially offset by a 0.1% decline in inventories.