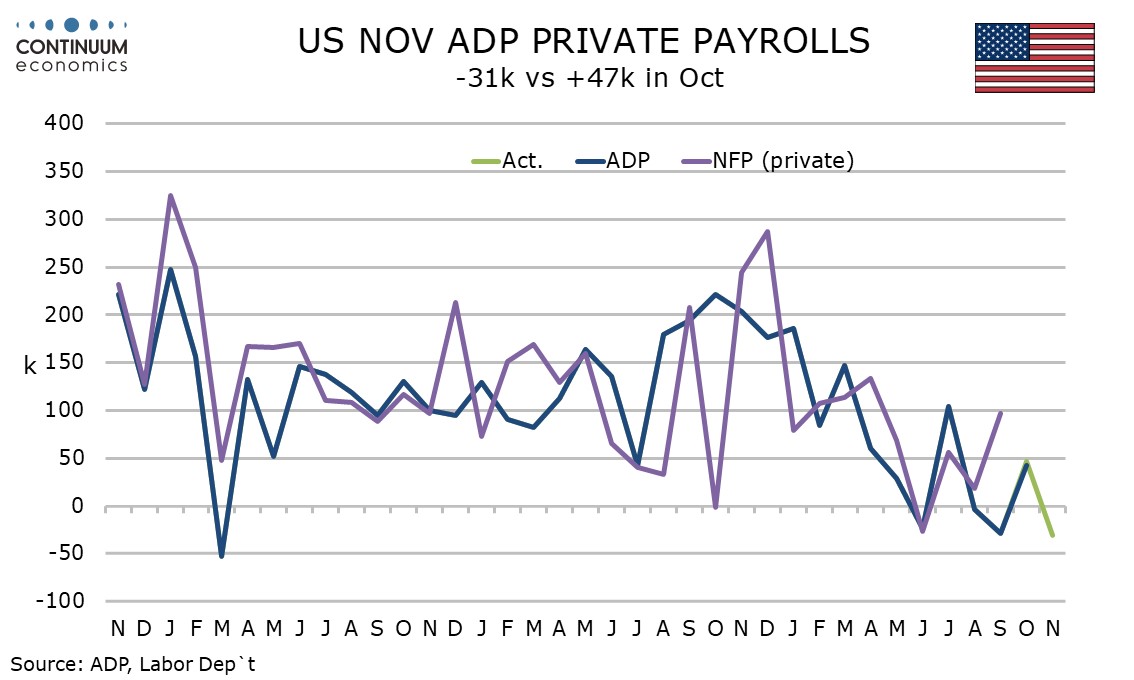

U.S. November ADP Employment leaves trend looking fairly flat

ADP’s November estimate of private sector employment of -32k does not quite reverse a 47k increase in October (revised from 42k) but leaves trend looking fairly flat. The data is consistent with negative signals from weekly ADP employment data released a week ago and also the finding of the latest Fed Beige Book that employment had declined slightly. The latter may be significant for next week’s FOMC decision.

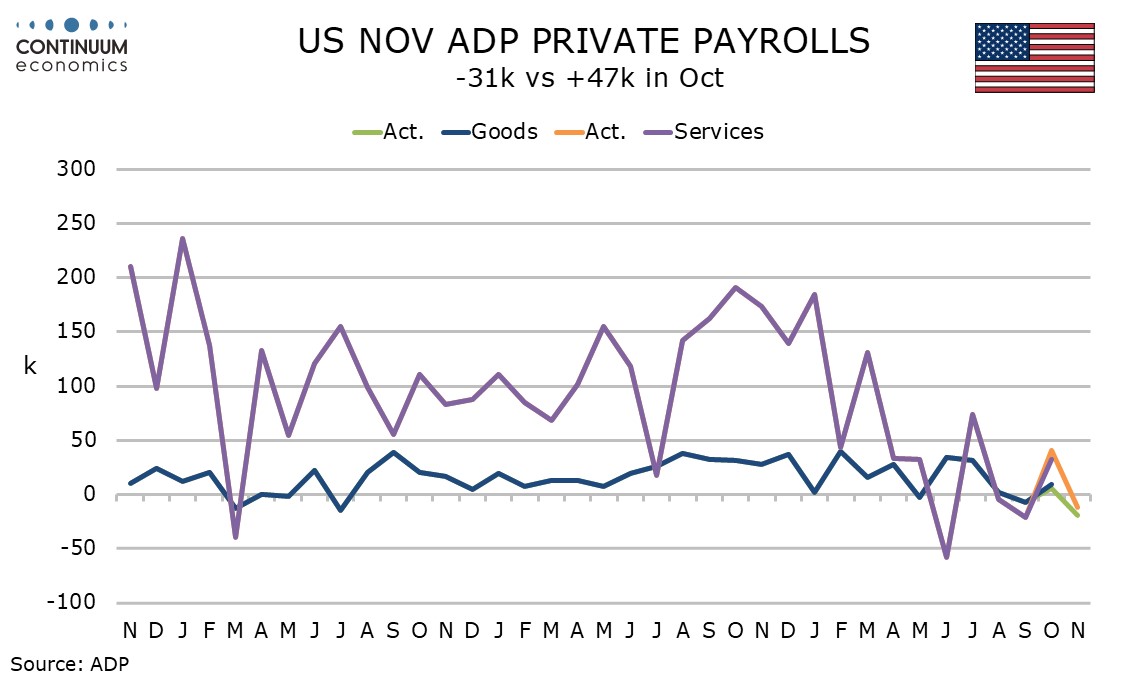

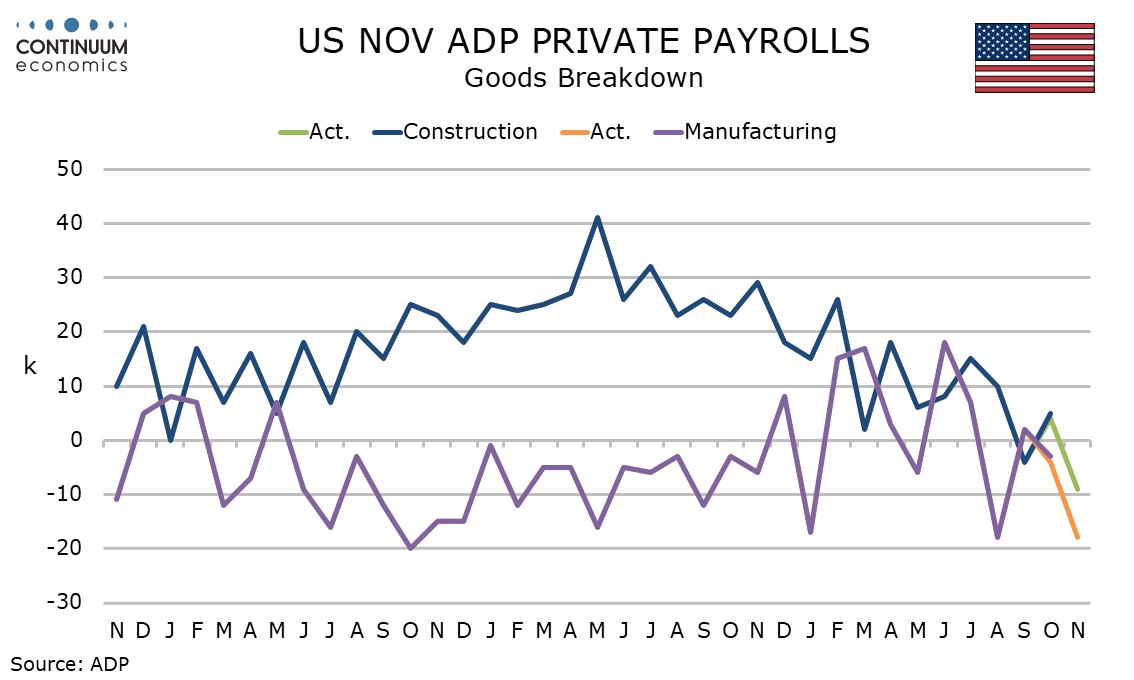

The ADP detail is generally quite weak, with goods down by 19k, with manufacturing particularly weak with a fall of 18k. Construction fell by 9k while natural resources and mining rise by 8k.

Service producing employment fell by 13k. Education and health, usually the main source of growth in non-farm payrolls this year, was up by 33k and leisure and hospitality rise by 13k. Weakness was seen in business and professional at -26k and information at -20k.

Wage growth was also softer, at 4.4% from 4.5% yr/yr overall with job changers down more significantly at 6.3% from 6.7%, a sign jobs are becoming harder to find.

The latest ADP data hints that September’s firmer payroll at 117k overall, 97k private, will be difficult to sustain. October’s payroll is likely to see a significant negative from government (not included in ADP data) as DOGE layoffs see their final six months of pay expire. December 16 will see payroll data for October and November, though an unemployment rate only for November.