U.S. December ISM Manufacturing - Weaker on reversal in inventories

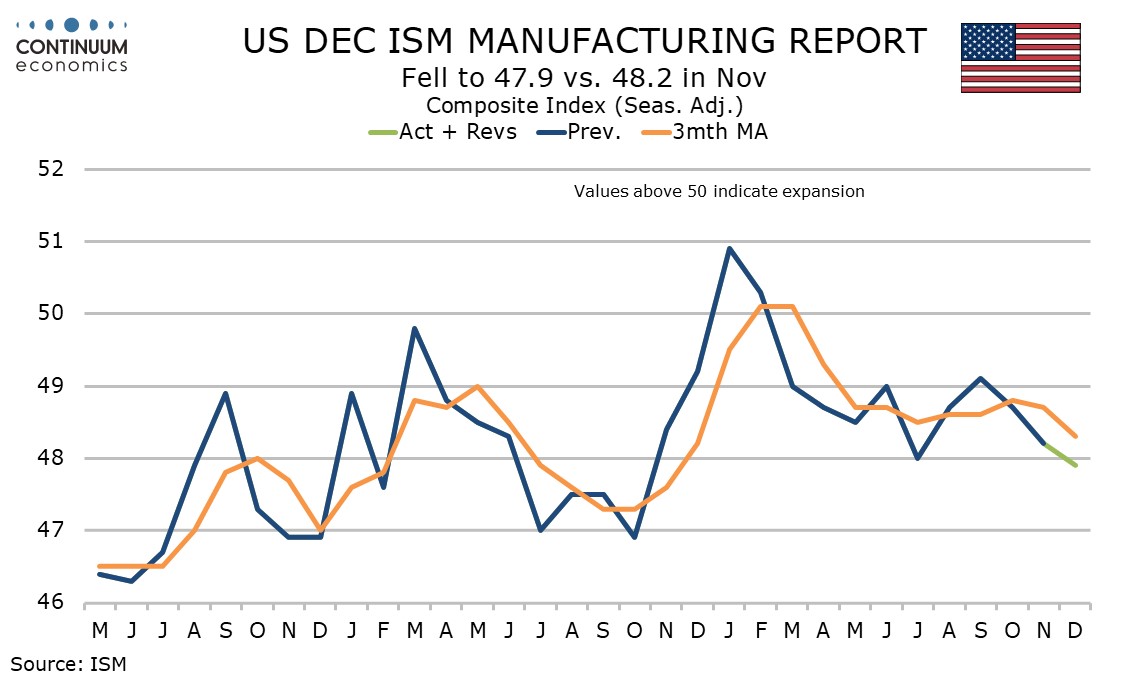

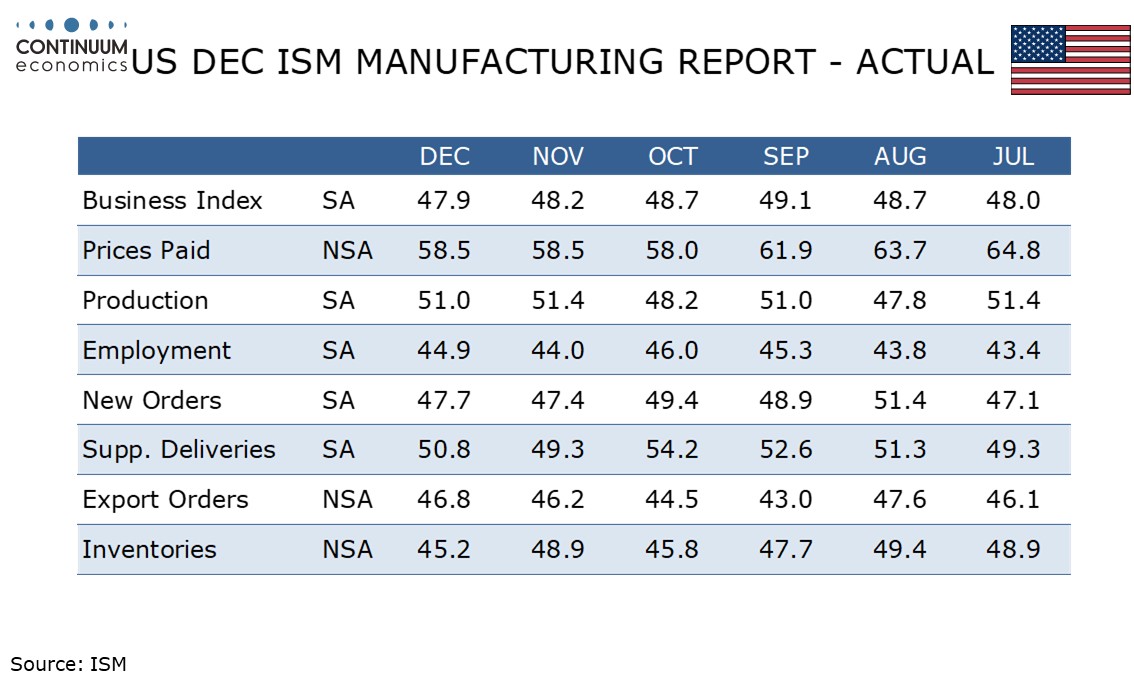

December’s ISM manufacturing index of 47.9 is unexpectedly down from 48.2 and the weakest since October 2024, though the details do not suggest much underlying change in the picture, which remains subdued and a little below neutral.

The decline in the composite came largely from a sharp fall in inventories to 45.2 from 49.9, more than fully reversing a November bounce from October’s 45.8. The only other component of the composite to slip was production, though at 51.0 from 51.4 in remains positive.

The other three components of the composite were marginally improved, though new orders at 47.7 from 47.4 and employment at 44.9 from 44.0 remain weak. Completing the breakdown was a rise in deliveries to 50.8 from 49.3.

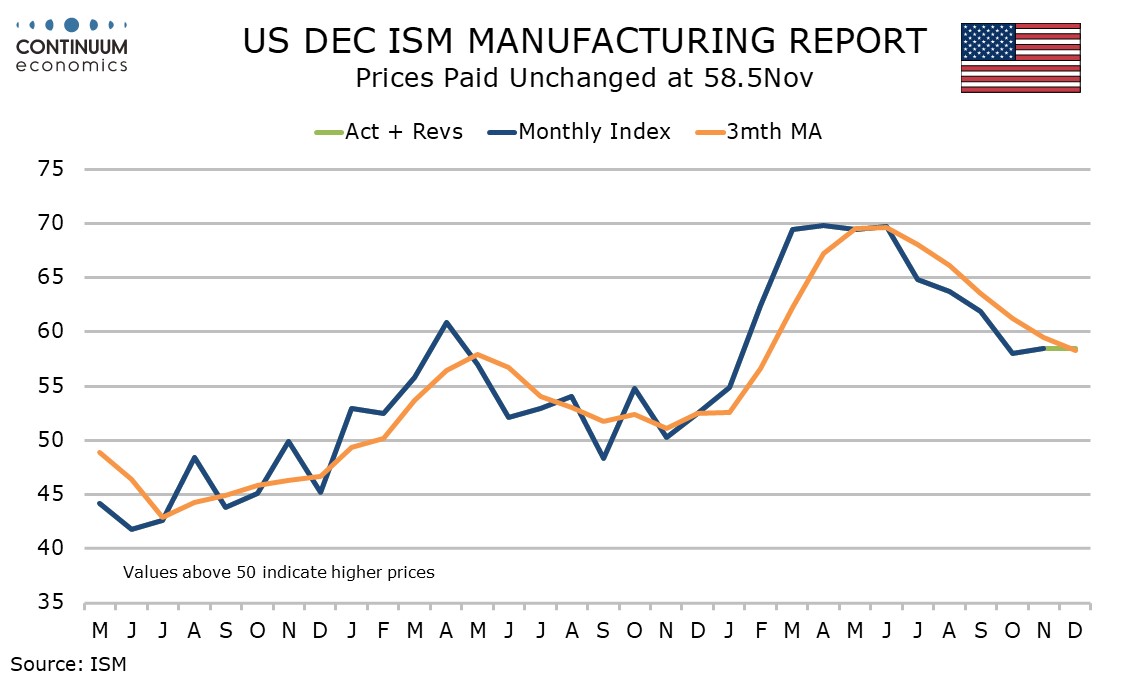

Prices paid, which do not contribute to the composite, were unchanged at 58.5 and seem to be stabilizing at a still clearly positive pace after coming off April’s tariff-induced high of 69.8.

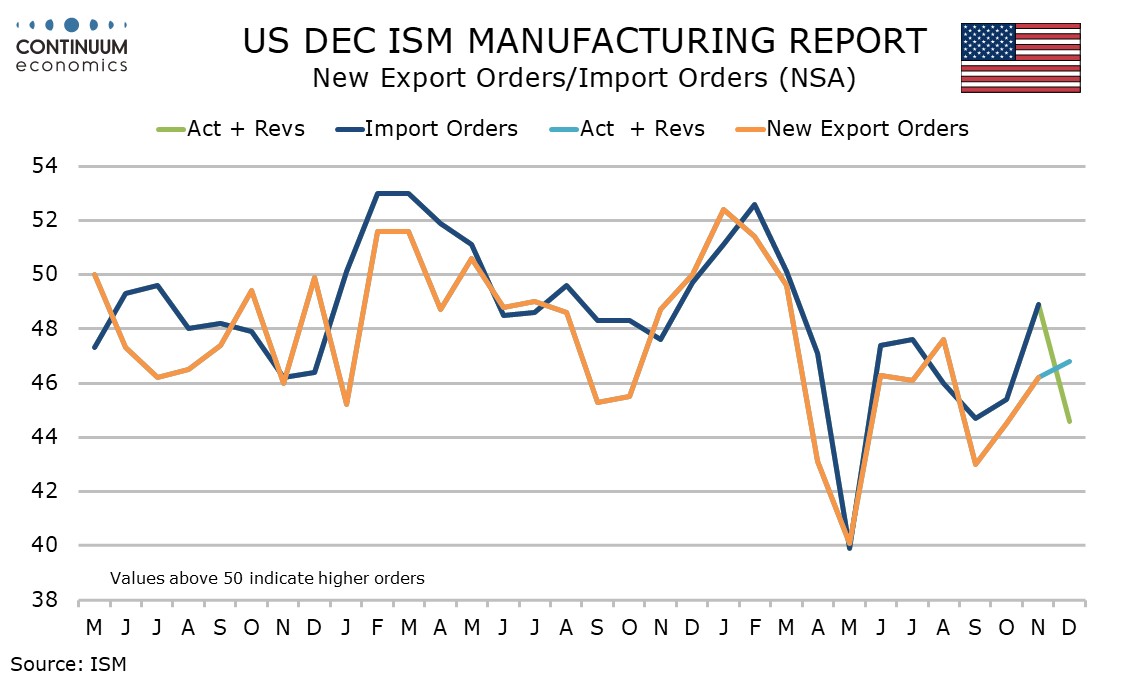

Exports and imports also do not contribute to the composite. Exports saw a modest rise to a still weak 46.8 from 46.2 but imports slipped significantly to 44.6 from 48.9, like inventories more than fully reversing a November bounce from October’s 45.4.