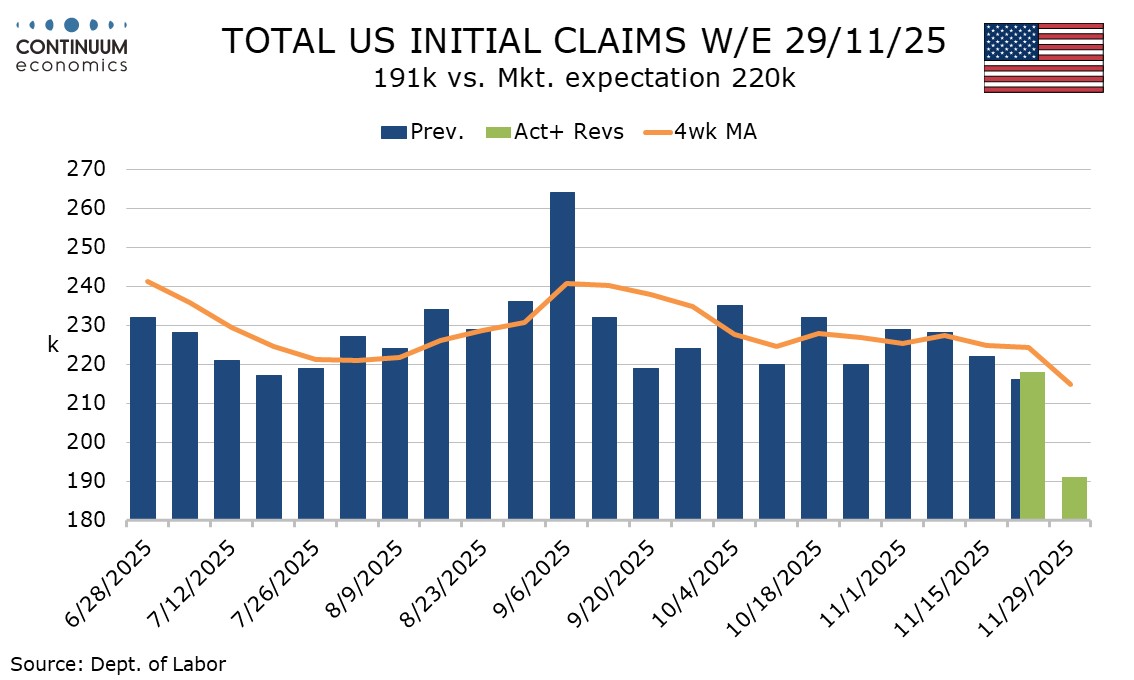

U.S. Initial Claims fell sharply in Thanksgiving week, other labor market signals mixed

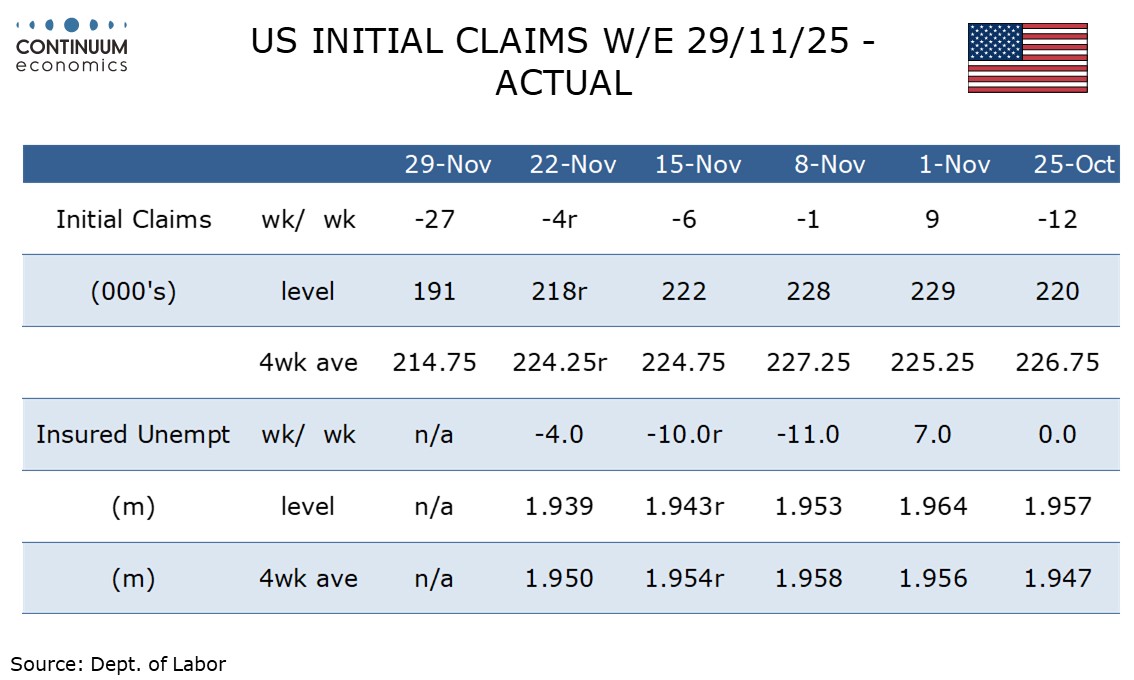

Weekly initial claims at 191k from 218k are exceptionally low but there may be some seasonal adjustment issues with Thanksgiving. Unadjusted however initial claims also fell, by 49k to 197k. While this fall in initial claims may be overstated it is the fourth straight decline.

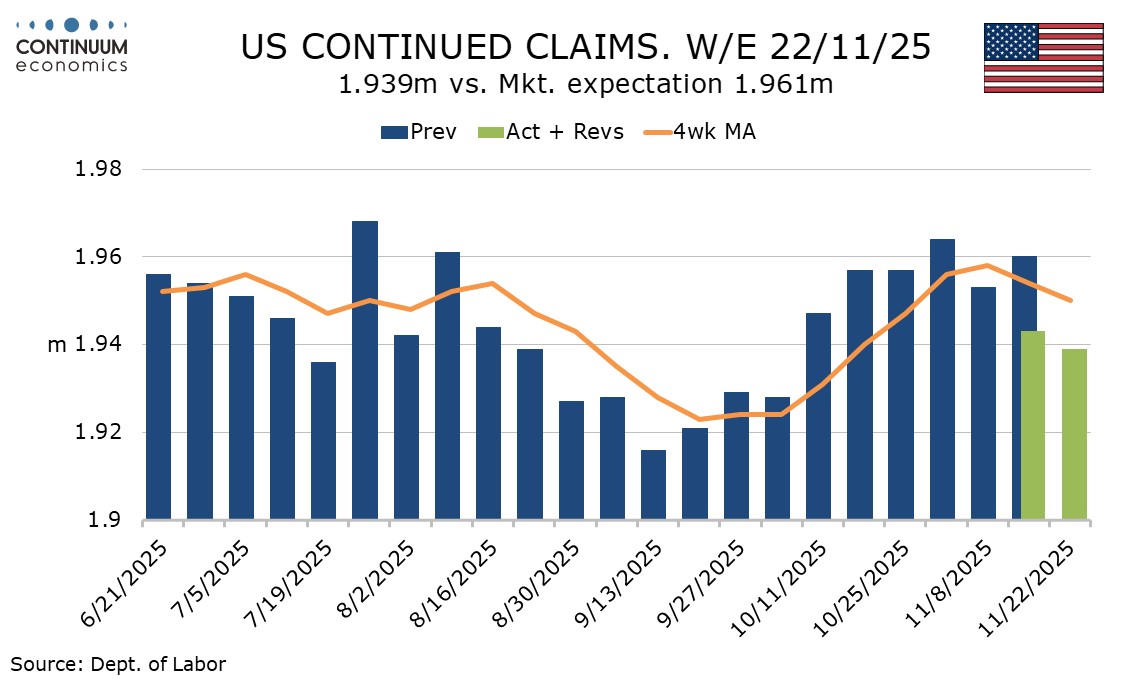

Continued claims cover the week before initial claims and are also lower than expected, falling by 4k to 1.939m with last week revised down by 17k to 1.943m. This is the third straight fall in continued claims and an upturn there appears to be peaking. November’s non-farm payroll survey week came two weeks ago in the case of initial claims and one week ago in the case of continued claims, so the signals may be positive more for December’s payroll than November’s.

Today Revelio Labs, a private sector organization, gave its estimate of November non-farm payrolls, which at -9k was quite weak and following a 15.5k decline in October. With the public sector up by 10.4k this means a 19.4k November decline in the private sector, not quite as weak as the 32k ADP drop, though ADP was following a positive October.

Earlier today November layoffs data from Challenger, Gray and Christmas were less alarming than those of October, down to 71.321k from 153.074k, though still up from 55.727k in November 2024.

In another release today, the Chicago Fed estimated a stable unemployment rate of 4.4% in November. Despite the very low initial claims number, most signals are for a fairly flat labor market with limited hiring and firing. The initial claims data however suggests we should not be expecting deterioration in December.