India CPI Review: CPI at 2.82%: Disinflation Deepens, But Risks Linger

India’s retail inflation dropped to a six-year low of 2.82% in May, driven by easing food prices and supported by favourable base effects. While disinflation continues to create monetary space, RBI's next rate cut will be data driven.

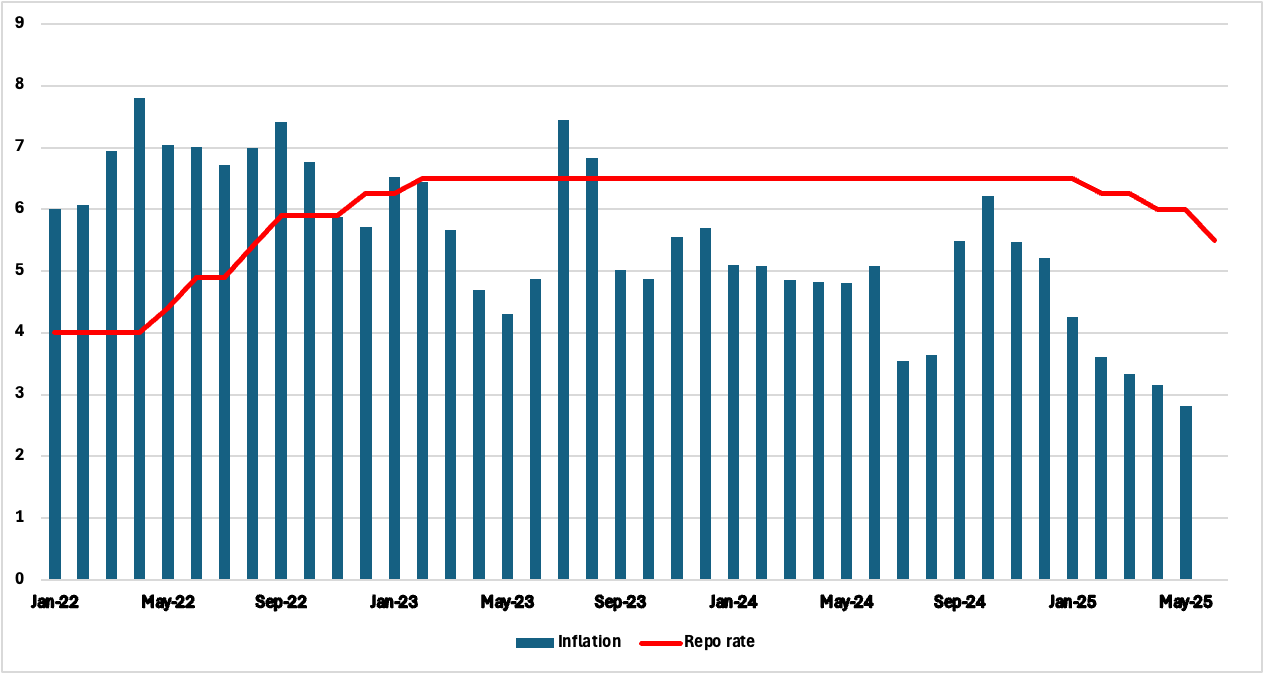

India’s retail inflation eased to 2.82% yr/yr in May, a 75-month low and the fourth straight month below the Reserve Bank of India’s 4% target. The headline figure undershot both our expectations and the RBI’s own inflation forecast, reaffirming the strength of the disinflationary trend. But while price pressures appear firmly contained on the surface, the composition of the latest print suggests emerging friction beneath the aggregate calm.

Figure 1: India CPI and Repo Rate (%)

Food Disinflation Drives the Decline

The sharp moderation in headline CPI was once again driven by a collapse in food inflation, which fell to just 0.99% y/y—its lowest level since late 2021. This reflects broad-based easing in vegetable prices, with tomatoes, onions and potatoes registering double-digit year-on-year deflation. Cereal and pulse prices also softened meaningfully, benefiting from improved supply and favourable base effects. This is now the third consecutive month with food inflation below 3%, offering relief to household budgets and helping anchor expectations.

However, the food basket is far from uniformly benign. Edible oil inflation surged to 17.9%—its highest level in over three years—despite recent import duty cuts. Inflation in milk, another high-frequency staple, rose for the second month in a row, while fruit prices, though easing marginally, remained in double digits for the fifth straight month. These trends, if sustained, could complicate the soft narrative around food prices in the second half of the year.

Core Pressures Not Fully Subdued

Core inflation continues to hover near 4.2%, with persistent pricing pressure in categories like health, education, personal care and housing. Sequential momentum in service prices remains firm. Transport and communication inflation edged up to 3.85%, reflecting fuel price volatility, while clothing and footwear inflation ticked higher as well.

The May print reinforces the RBI’s recent decision to front-load rate cuts—delivering a cumulative 100 bps since February—and to move to a neutral stance. With inflation clearly under control, there is space for a pro-growth monetary bias. But that space is narrowing. While another cut later in the year remains on the table, the RBI has rightly signalled a pause. Early monsoon onset bodes well for food prices but given global uncertainties the next move will be highly data dependent.

Outlook: Favourable But Fragile

Near-term disinflation may continue into June, aided by a favourable base. But the trajectory beyond will hinge on the monsoon’s performance, pass-through from recent commodity price volatility, and the shape of rural demand recovery. For now, India enters H2 of 2025 with inflation anchored, policy growth-friendly, and macro fundamentals stable. Given these dynamics, we have revised our 2025 forecast for inflation down to 3.2% yr/yr.