India GDP Review: Growth Outpaces Expectations as Q4 GDP Hits Four-Quarter High

India’s economy grew 7.4% y/y in Q4 FY25, beating expectations and capping full-year growth at 6.5%. Strong gains in construction, services, and agriculture underpinned the recovery, while private consumption and investment strengthened. However, sustaining momentum in FY26 will hinge on broad-based demand and stable global conditions.

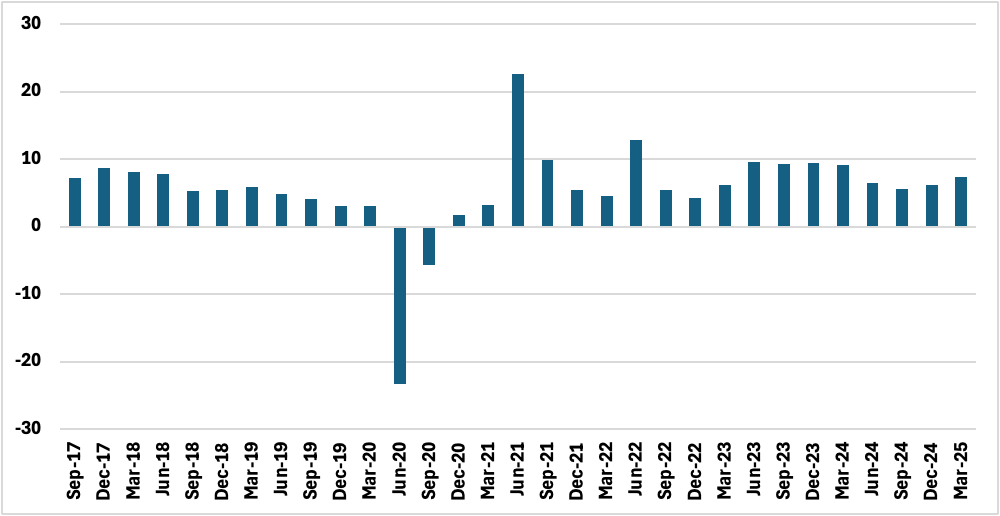

India’s economy capped FY25 with a robust fourth-quarter performance, providing policymakers with welcome momentum as they enter the new fiscal year. Data from the Ministry of Statistics and Programme Implementation show that real GDP expanded by 7.4% yr/yr in Q4 FY25, exceeding both our expectations and the Reserve Bank of India’s (RBI) forecast of 7.2%. This marked the fastest quarterly pace of the year, lifting full-year GDP growth to 6.5% yr/yr—slightly below the RBI’s earlier 6.6% projection but firmly in line with India’s position as the world’s fastest-growing major economy. At 6.5% yr/yr, the FY25 forecast was in line with our predictions.

Figure 1: Real GDP Growth (% yr/yr)

The rebound is particularly notable when compared with the soft patch seen earlier in the year: Q2 growth had slipped to a seven-quarter low of 5.4% before recovering to 6.2% in Q3. The latest quarterly figures reflect broad-based strength, with multiple sectors contributing to the upturn. Nominal GDP growth, at 10.8% y/y in Q4, also provided a fiscal tailwind, enabling the government to trim the FY25 fiscal deficit to 4.7% of GDP—slightly better than its revised 4.84% target.

Construction was once again a standout performer, expanding 10.8% y/y in Q4, buoyed by strong public infrastructure spending and sustained real estate activity in key urban centres. Public administration, defence and other services grew 8.7%, while the financial and professional services segment expanded by 7.8%. Importantly, the agriculture sector, often vulnerable to weather volatility, showed a healthy 5.4% growth in Q4, sharply up from just 0.8% a year earlier. The primary sector’s full-year performance was similarly strong at 4.4%, pointing to improved rural resilience. It is noteworthy that the monsoon is expected to be favourable this year and therefore agriculture output over FY26 is also likely to be strong.

On the demand side, private consumption—the backbone of India’s economy—showed renewed vigour. Private Final Consumption Expenditure (PFCE) rose 6% yr/yr in Q4 and 7.2% yr/yr for the full year, a notable pick-up from 5.6% in FY24. Investment demand also gained traction, with Gross Fixed Capital Formation (GFCF) rising by 9.4% yr/yr in Q4. This suggests that capital spending, mostly public, remains on a solid footing—an encouraging sign for medium-term growth prospects.

Yet risks to the outlook persist. The recovery in private capex, while improving, remains uneven, and urban consumer demand—though better in Q4—is still constrained by elevated interest rates and lingering global uncertainties. The external backdrop is also challenging, with global trade frictions, including tariff tensions, and weak foreign investment trends posing headwinds.

Looking ahead to FY26, GDP growth is likely to moderate somewhat. The RBI projects 6.5% growth, broadly aligned with our expectation of 6.6% yr/yr for the current fiscal year, and while this remains strong by global standards, sustaining broad-based momentum will require careful policy calibration. Government capital expenditure will continue to play a key role, but further private-sector participation is essential to unlock India’s full growth potential. Encouragingly, the near-term outlook is supported by several factors. The early arrival of the monsoon should bolster rural incomes and temper food inflation. Meanwhile, with inflation expectations now more anchored, the RBI retains room to maintain an accommodative stance. Additional rate cuts later this year remain on the table if global conditions permit.