Sweden Riksbank Review: Rate Cuts – Faster and a Little Further?

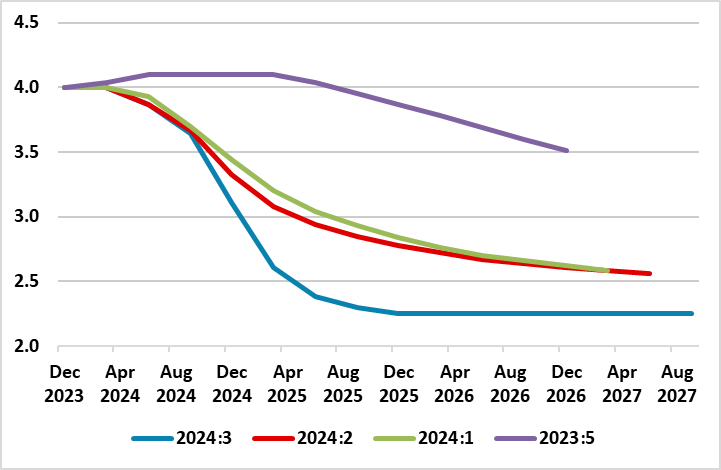

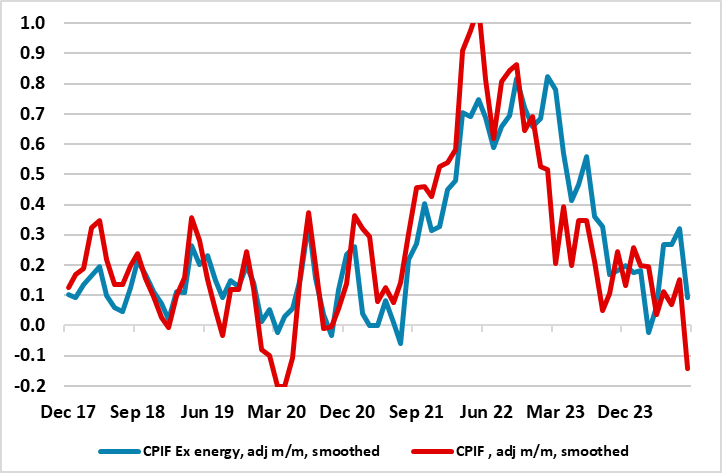

A third successive 25 bp rate cut (to 3.25%) surprised no-one at this month’s Riksbank meeting. More notably, updated forecasts more formally validated both the likelihood and the rationale for the two added cuts by end-year that the Board hinted at after the August easing and which largely are in line with the alternative (downside) policy scenario outlined in June. Indeed, the new projections in the fresh Monetary Policy Report (MPR) actually suggest even a 50 bp possible move at one of the meetings this year (Figure 1). Indeed, it is clear that while lower inflation (Figure 2) has provided the scope to ease policy in this speedier manner, the rationale is increasingly that from a weak economy. The latter is highlighted by a marked downgrade to the Riksbank’s’ 2024 GDP picture, partly offset by small upgrade to an above trend and what we think is an optimistic 1.9% 2025, albeit solely a result of the faster easing in its monetary stance bow being flagged. Notably, the Riksbank now points to additional easing some 25 bp lower than the circa-2.5% terminal rate its previous projections suggest may be the case., thereby now in line with our long-standing forecast.

Figure 1: Policy Outlook Details – No Longer Gradual

Source: Riksbank Policy Rate Outlook - last four Monetary Policy Reports

Since the spring, it was very much a question of how fast, not if, as far as policy easing was concerned for the Riksbank, with Figure 1 underscoring how policy thinking has been markedly reshaped this year. From the Board’s perspective, by initiating easing relatively early in May, it was both reacting to weak data (both real and price wise), but more notably in giving itself flexibility to pursue what it then thought needed to be a gradualist approach to further easing. That now has changed and increasingly radically with policy put into a faster gear to front-load, both a result of an undershoot of inflation (partly energy related but ever clearer in terms of short-run dynamics) but also due to a still weak economy which has failed to grow on balance since end-2021, albeit with clear quarter-to-quarter volatility.

Figure 2: Short-term Inflation Dynamics Down Markedly

Source: Stats Sweden, CE, smoothed it 3-mth mov avg

Terminal Rate Lowered

Especially given the seemingly-feeble Q3 GDP backdrop, this reinforces our relative pessimism about the scale of the recovery. But even with the Riksbank pointing to the economy picking up and growing in 2025 at and then above trend at over 2% in 2026, this still generates a negative output gap of over 1% of potential GDP that diminishes but persists into 2027. We think this growth outlook is somewhat optimistic. But the point is that the Riksbank still accepts that even this more upbeat real economy outlook delivers price stability, if not a risk of a persistent slight target undershoot. Admittedly the updated MPR reined in growth expectation somewhat for the rest of this year but upgraded the profile after this year. This would reflect not only the faster easing but the fact that Sweden is far more sensitive to short-term rate changes given that the bulk of the housing market is still biased to variable rate mortgages.

The question is, if growth disappoints into 2025, will the Riksbank ease further than it is now flagging – much may depend on fiscal policy with the 2025 Budget due next month! But given our economic projections, we now see two further cuts this year over and beyond that envisaged this month but also to the slightly speedier and more extended journey to a 2.25% policy rate we now see occurring by mid-2025, ie earlier than the Riksbank! However, even Riksbank now points a risk scenario in which the policy rate falls below 2%.