Sweden Riksbank Review: Shifts to Easing Bias?

Having delivered the widely-expected sixth successive rate cut this month, the Riksbank adhered to the assessment made in December that the easing cycle has drawn to an end with the policy rate (now at 2.25%) having dropped 1.75% in eight months. But the Board remains open to further easing; while the December outlook which envisaged just one more cut is essentially unchanged, the Riksbank did note that it is prepared to act if the outlook for inflation and economic activity changes. We think this will be the case and that a further 25 bp cut will occur later in H1. Indeed, some degree of concern that policy may need to be eased again can be seen from both the lack of dissent to this decision and the fact that the cut was exercised so soon in the six-month window that the Board had pointed to. In addition, while the Riksbank is right to note the emergence of better economic signs, the Riksbank is still over-estimating the real economy backdrop and outlook.

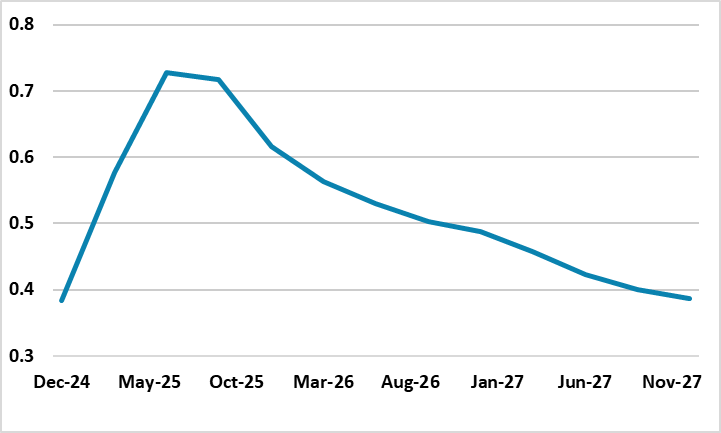

Figure 1: Upbeat GDP Outlook Too Rosy?

Source: Riksbank Dec MPR, q/q GDP projections

In this regard, while the Riksbank did revise down its slightly above-consensus GDP outlook out to 2027, whilst still suggesting inflation will settle around target, its projections still imply a very upbeat real activity picture through this year. Indeed, in the five quarters to end-2005, cumulative GDP growth is expected to be around 3% (Figure 1). Admittedly, early insights into last quarter suggest some revival in growth, but even if the 0.2% q/q flash GDP estimate released earlier today proves accurate, it would be half of what the Riksbank has pencilled in.

In addition, and largely accepted by the Riksbank, risks emanating from the global economy (eg regrading trade) remain, if not having intensified, while the impact of the rapid Riksbank easing in H2 last year has already been partly unwound by the rise in market rates. Indeed, that latter rise may have been part of the rationale for a move this month merely to show markets its policy intentions have not been diluted, also leaving the March meeting to update the policy outlook when fresh projections will be offered. Admittedly, there are risks seemingly on the opposite side emanating from the krona, but we think such concerns are both overdone and unlikely to emerge.

Those updated projections may show an even friendlier inflation backdrop and outlook, something already evident in adjusted core CPIF inflation readings which are now down to rates last seen prior to the pandemic when Sweden saw persistent undershooting of its inflation target. This all makes still clear Board worries about price pressures seen in some business surveys and from a weaker currency overdone

Policy Front-Loading Being Paused?

Since the spring, it has been very much a question of how fast, not if, as far as policy easing was concerned for the Riksbank, with policy thinking having been markedly reshaped this year. From the Board’s perspective, by initiating easing relatively early in May Last year, it was both reacting to weak data (both real and price wise), but more notably in giving itself flexibility to pursue what it then thought needed to be a gradualist approach to further easing. That now has changed and increasingly radically with policy put into a faster gear to front-load. From the Riksbank’s perspective, this now argues for the more tentative approach when monetary policy is formulated going forward. But amid all the risks and the extent to which we feel the Riksbank outlook is too rosy, then further policy insurance is likely!