Sweden Riksbank Preview (Aug 20): Still Trying to be Gradual?

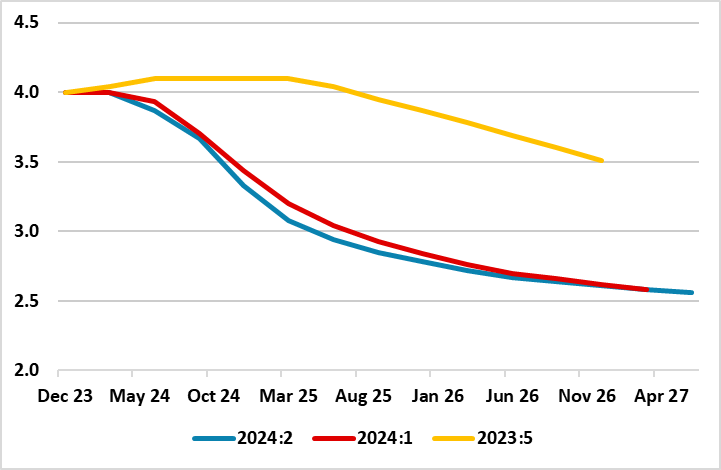

Recent data have justified the Riksbank’s increased confidence in the current disinflation process and is highly likely to exercise its easing bias with a second (in three months) 25 bp rate cut (to 3.5%) at the Sep 20 policy verdict. As for future policy, in a Board meeting with no fresh projections, it is likely to repeat existing guidance which implies at least one more such cut this year. The question is whether the run of softer-than expected data releases of late, GDP as well as CPI numbers undershooting its expectations, may harden the Board into firming an outlook of two more moves this year after this one. This though will still be framed as a slightly less gradual policy easing outlook with the picture further out practically unchanged (Figure 1), still implying a terminal, if not perceived neutral rate of around 2.5%. Indeed, this reflects inflation returning to the 2% target at the end of the forecast horizon, the question being whether it will subsequently remain there or diverge afresh. At this juncture, we stick to the two further cuts this year but also to the slightly speedier journey to a 2.5% policy rate we still see occurring by end-2025!

Figure 1: Policy Outlook Seen Clear Change

Source: Riksbank last three Monetary Policy Reports

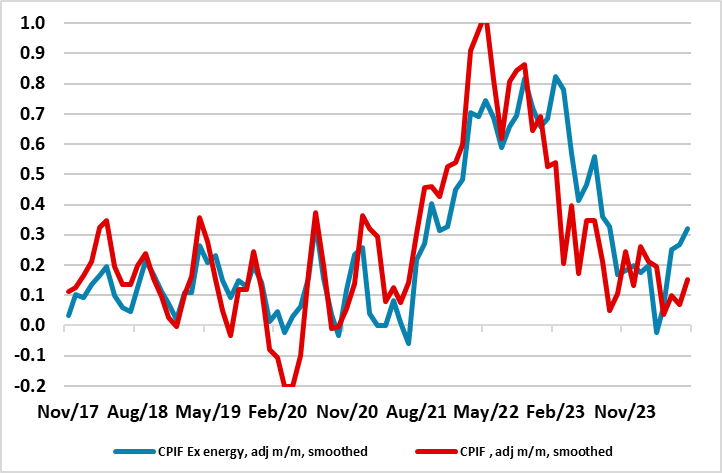

Since the spring, it was very much a question of how fast, not if, as far as policy easing was concerned for the Riksbank, with Figure 1 underscoring how policy thinking has been markedly reshaped this year. From the Board’s perspective, by initiating easing relatively early in May, it was both reacting to weak data (both real and price wise), but more notably in giving itself flexibility to pursue what it thinks needs to be a gradualist approach to further easing. That has not changed fundamentally, even given the slightly faster policy path now been flagged, this coming after marked swings in how the main economic indicators have swung to and fro. Indeed, this is all the more notable given how a stronger than expected Q1 GDP reading and disappointing May CPI data, have seen the tables turn to the extent that GDP in Q2 looks to have sunk materially while CPI data has fallen short of Riksbank expectations and is well below target. Admittedly, July CPIF inflation did pick-up and the below-target current reading is mainly energy-based, but the thrust of short-term price dynamics remains friendly (Figure 2).

Figure 2: Short-term Inflation Dynamics Down Markedly

Source: Stats Sweden, CE, smoothed is 3 mth mov avg

Policy Considerations

Especially given the seemingly-feeble Q2 GDP reading, this reinforces our relative pessimism about the scale of the recovery. But even with the Riksbank pointing to the economy picking up and growing in 2025 at and then above trend at over 2% in 2026, this still generates a negative output gap of over 1% of potential GDP and only turns positive into 2027. We think this growth outlook is somewhat optimistic. But the point is that the Riksbank still accepts that even this more upbeat real economy outlook delivers price stability, if not a risk of a persistent slight target undershoot. The question is, if growth disappoints into 2025, will the Riksbank ease further than it is now flagging – much may depend on fiscal policy with the 2025 Budget due next month! But given our economic projections, we stick to the two further cuts this year but also to the slightly speedier journey to a 2.5% policy rate we still see occurring by end-2025!