Sweden Riksbank Preview (Mar 20): Time to Pause?

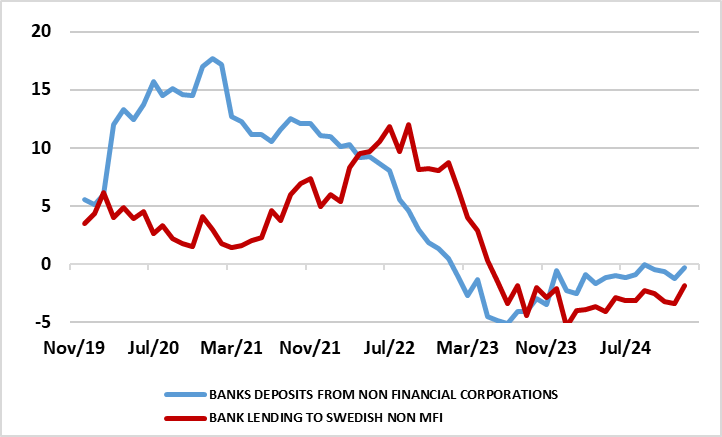

Having delivered in January, the widely-expected sixth successive rate cut, the Riksbank adhered to the assessment made in December that the easing cycle has drawn to an end with the policy rate (down to 2.25%) having dropped 1.75 ppt in eight months. Especially given the recent upside CPI surprises, this very much points to no move at the looming (Mar 20) decision and with a stable policy outlook likely to be reinforced by updated projections that may continue to point to above-consensus growth this year and next. But even with the fiscal situation likely to become somewhat easier into 2026, we continue to think that amid global uncertainties, and given still negative monetary dynamics (Figure 1), the Riksbank will have to make a downgrade to its real activity outlook. Alongside further rate cuts from neighbouring central banks, we think this will trigger what may be a final Riksbank cut, not least if the current surge in the exchange rate persists. But any such further 25 bp may be deferred until the June meeting, if not later!

Figure 1: Bank Lending and Deposit Growth Still Negative – Even Nominally

Source: Riksbank, % chg y/y

This outlook is consistent with Riksbank thinking, at least reading between the lines. It has implied that the Board remains open to further easing; while the December outlook which envisaged just one more cut is essentially unchanged, the Riksbank did note that it is prepared to act if the outlook for inflation and economic activity changes. Indeed, some degree of concern that policy did need to be eased again can be seen from both the lack of dissent to January decision and the fact that the cut was exercised so soon in the six-month window that the Board had pointed to. In addition, while the Riksbank is right to note the emergence of better economic signs, the Riksbank is still over-estimating the real economy backdrop and outlook.

In this regard, while the Riksbank did revise down its slightly above-consensus GDP outlook out to 2027, whilst still suggesting inflation will settle around target, its projections still imply a very upbeat real activity picture through this year. Indeed, in the five quarters to end-2005, cumulative GDP growth is expected to be around 3%. Admittedly, upbeat GDP outcomes into last quarter suggest some revival in growth, but these may be fleeting, particularly in light of, and largely accepted by the Riksbank, risks emanating from the global economy (eg regarding trade) remain, if not having intensified, while the impact of the rapid Riksbank easing in H2 last year has already been partly unwound by the rise in market rates. The latter may partly explain why in spite of the rapid Riksbank rate cuts bank lending and deposit growth remain negative, this a clear cause for concern in regard to the outlook

Moreover, after repeated and very vocal worries about the weak currency the krona has staged a marked bounce of late, with the trade weighted index (KIX) now some 5% above the assumed average projection for the year as a whole. Admittedly, this is a result of what have been successive upside CPI inflation surprises, albeit partly if late due to the re-weighting of the CPI basket. WE still see underlying price pressures as being subdued enough to warrant and need more easing – in due course. This may take some of the wind out of the current appreciation, but possibly marginally so as FX markets will note that the easing cycle is still near, if not then as its end!