Markets: Rate Cuts or Geopolitics?

Israel will likely counteract Iran, which will prompt a further missile attack by Iran. However, our bias remains that Israel main aim is to have a buffer zone in southern Lebanon up to the Latani river and not fight a prolonged war with Iran. This limits the economic fallout globally and on oil prices. The U.S. presidential election will move markets however, but not until the result is seen after Nov 5. The bigger issue will remain rate cuts, where we see the Fed and ECB delivering most of the cuts discounted. The market is underestimating cumulative BOE easing prospects however, while not discounting the 75bps of BOJ rate hikes we see by mid-2025.

In terms of asset allocation over the next 15 months, the situation is trickier for government bonds. 10yr U.S. and EZ real yields need to be positive in an environment where QT is occurring rather than QE. More importantly, less globalization for DM countries/climate change investment/tighter labor markets means inflation is unlikely to fall sustainable below target. For equities, the U.S. equity market remains overvalued and 2025 corporate earnings expectations are too high. This leaves the market vulnerable to a correction in the next 3-6 months. On a 15 month view, we see lower corporate earnings growth mainly going into P/E multiple derating and the S&P500 being choppy but not really gaining ground. This will likely spill over to restrain gains in other equity markets.

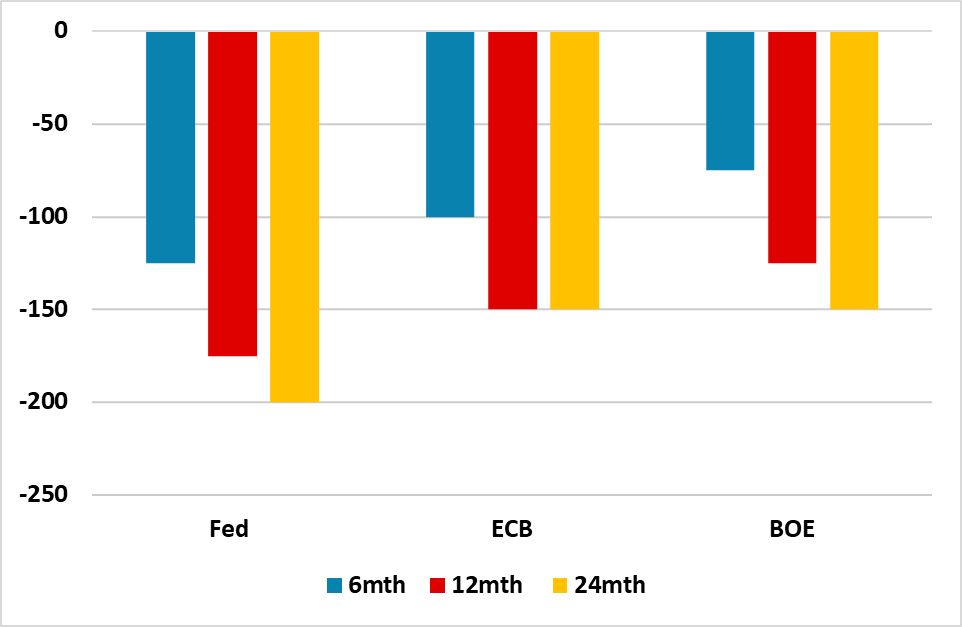

Figure 1: Fully Priced BOE Rate Cuts (%)

Source Bloomberg/Continuum Economics

Global markets have a geopolitical dimension to deal with, with Iran’s ballistic missile attack on Israel and a highly likely counterattack by Israel on Iran. Will the focus switch from rate cuts to geopolitics? Israel is being opportunistic and senses that Iran regime does not want an all-out war with Israel. This could see Israel go beyond the symbolic counterattack seen in April and attack Iran nuclear facilities. In turn this could prompt more Iran missile attack on Israel. Then events are uncertain and could either lead to a vicious cycle of escalation to all-out war or exchange of missiles that seek to save face and deescalate. We will watch the situation closely, but our bias remains that Israel main aim is to have a buffer zone in southern Lebanon up to the Latani river and not fight a prolonged war with Iran. This limits the economic fallout globally. Oil prices have been subdued by weak China oil demand and OPEC+ considering reversing production cuts (here). However, global markets would see risk off, if Iran tried to close the straits of Hormuz and oil prices surged.

The other key near-term geopolitical issue remains the outcome of the U.S. presidential election, which on national and state level polls remains too close to call – though polls still point to Republicans winning the Senate and the Democrats the House. More focus remains on what policy would have priority under a president Trump, given that a split congress would likely mean that Kamala Harris tax policies would be difficult to enact if she becomes president. We still feel that Trump priority would be restricting immigration (though policy details are lacking on the deportation issue) and renewing 2017 tax cuts that are due to lapse – though jawboning on extra China tariffs would also likely be evident in 2025 under Trump. We would see an aggressive deportation policy as being a headwind to U.S. job and economic growth. Our view remains that a Trump election would be mildly negative for U.S. equities, while Harris would likely be a neutral force medium-term – though a close victory would likely see Trump contesting the election result and hurting U.S. equities. However, the market is reluctant to take this view until the election result is seen.

This leaves rate cuts remaining the major driver of markets. A lot is now discounted for the Fed and the ECB (Figure 1). However, most of this should be delivered on our baseline view U.S. soft landing view of the Fed cutting to 3.00-3.25% (here) and it is largely a question of pace. If the alternative scenario of a harder landing occurs due to data weakness in the coming months, then the Fed would likely cut more than the market to a 2.5% or 2.0% Fed Funds rate by end 2025 (here), so market expectations are not overstretched until a soft landing is confirmed and thoughts turn to recovery.

In the EZ, the starting point is worse, with the EZ economy trying to recover from the H2 2023 recession but momentum having stalled. We feel that this is due to the lagged effects of tight monetary policy, which will now prompt the ECB to cut 25bps in October and December (here). Easing can then occur at a quarterly pace through 2025, as the ECB will be surprised by how wage and service inflation comes down and the focus switches to ensuring an economic recovery into 2026.

In terms of asset allocation over the next 15 months, the situation is trickier for government bonds. 10yr U.S. and EZ real yields need to be positive in an environment where QT is occurring rather than QE. More importantly, less globalization for DM countries/climate change investment/tighter labor markets means inflation is unlikely to fall sustainable below target. Starting yields will dominate total returns for 10yr U.S. Treasuries and Bunds (Figure 2). 2yr yields can come down, but not much. However, we do feel that the market is not discounting enough cumulative easing from the BOE under our baseline (here) and the BOE policy rate can come down towards 3.0% in 2026 and help gilts outperform in 2025. In contrast, JGB’s are not discounting the prospect of a further 75bps of BOJ hikes, with a real risk of a 25bps October hike. This can see clear losses in 10yr JGB’s over the next 15 months, given the yield curve is not steep (here).

Figure 2: Asset Allocation for the next 15 Months (%)

Source: Continuum Economics Note: Asset views in absolute total returns from levels on October 2 2024 (e.g., 0 = -5 to +5%, +1 = 5-10%, +2 = 10% plus).

For equities, the U.S. equity market remains overvalued and 2025 corporate earnings expectations are too high. This leaves the market vulnerable to a correction in the next 3-6 months. On a 15 month view, we see lower corporate earnings growth mainly going into P/E multiple derating and the S&P500 being choppy but not really gaining ground. This will likely spill over to restrain gains in other equity markets (Figure 2). We still prefer the UK over the EZ or Japan. EZ equities have valuation support/ECB easing but need an earnings recovery story. For UK equities, the market is underestimating the scale of BOE easing and for Japan is not discounting the prospect of further JPY strength (here). Over the next 15 months, we have also switched from an India centric bias to preferring EM Asia ex China. This gives some India exposure but also taps into better Indonesia/Malaysia and S Korea valuations that can benefit from the sentiment shift with Fed rate cuts.

Meanwhile, the China equity market rally over the last week has been overdone. The monetary easing is not a game changer, as it does not remove the huge excess of complete and incomplete residential properties or the prospect of multi-year declines in property prices. Additionally, China’s consumers are suffering a balance sheet recession. Some further short-term upside could be seen for China equities after the holidays, as extra fiscal stimulus is likely. However, this will likely be an additional Yuan1-2trn rather than Yuan10trn that sections of the market feel is needed medium-term. As economic data remains soft, we feel that China equities will decline in 2025 and prospect are for around a 5% loss by end 2025 from current levels. Copper has also now run up to our end 2025 target on China optimism and we still stick with USD10000 by end 2025 (here).

In terms of FX, we would highlight a couple of our forecasts from the September outlook for the next 15 months. We see scope for USD to decline versus DM currencies, as the level of U.S. rates not just the yield differential has kept the USD overvalued in the last few years and we see this reversing further e.g. 1.20 on EUR/USD (here). From here, we still look for substantial JPY gains over the next year, with 125 a target for the end of 2025. This is not just a reflection of JGB yields rising in contrast to other DM countries, but also the scale of real undervaluation given lower Japanese inflation in recent years. In the EM space, we feel that cumulative Fed easing will shift the focus back to carry trades, with the Brazilian real (BRL) being the most appealing (here).