Sweden – Riksbank Review: Fresh Easing Hints Confirmed?

The very much expected stable policy decision at this Riksbank verdict was the second in succession but where the Board veered away from its previous assertion that that, with the policy rate now at 2.25%, this may be the end of the easing path. Instead, and amid the stronger currency and softer CPI figures, and with weaker real activity signs, it was a little more open about the possibility of additional rate cuts. While underscoring that monetary policy is currently well-balanced and that it is wise to await further information to obtain a clearer picture of the outlook, the Riksbank did note that that it is somewhat more probable that inflation will be lower than that it will be higher than envisaged in its March forecast. From the Riksbank perspective, this could suggest a slight easing of monetary policy going forward.

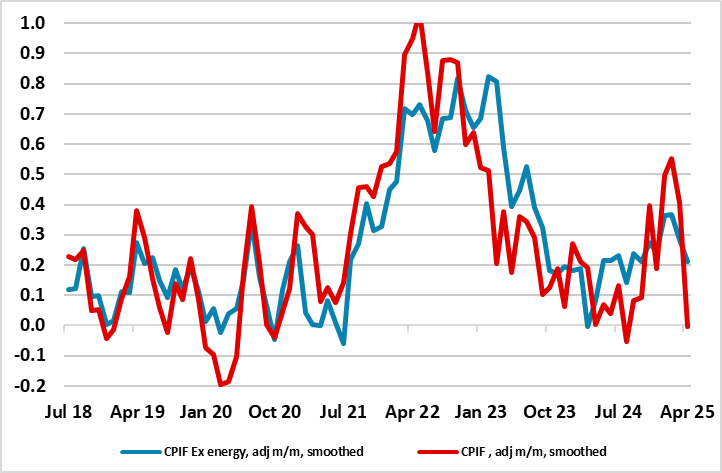

Figure 1: Inflation Scare Reverses

Source: Stats Sweden, CE, smoothed is 3-mth mov avg

As no new forecasts were due until the June 18 Board verdict, the Riksbank did resort to rhetoric to hint at a revised policy outlook without recourse to formal projections. We still see a further rate cut albeit maybe not as soon in June and also suggest that the risks of further moves both as the recent inflation scare recedes and the Riksbank takes note of the likely further rate cuts we think is in the offing from the ECB. In this regard the effective exchange rate has appreciated to a five-year high and to almost what was envisaged by the Riksbank into 2026.

Forecasts Need Adjusting

Having delivered the widely-expected sixth successive rate cut in January, the Riksbank in March adhered to the assessment made in December that the easing cycle has drawn to an end with the policy rate (down to 2.25%) having dropped 1.75 ppt in eight months. Perhaps as notable in the March forecast update was that little changed with largely stable projections for growth, output gap and even inflation, save on the latter for a spike higher now factored into this year but with a return to target from early 2026. This now seems to have changed with the Board now suggesting that with uncertainty in the global economy having increased significantly since the change of US president, not least as a result of the new US trade policy, growth prospects have deteriorated where lower demand may put downward pressure on inflation. However, it did assert that developments are very hard to assess. Overall, and possibly helped by April CPI flash data, the Riksbank asserted that new information supports the March assertion that the higher inflation see so far this year will be temporary. The weaker economic outlook indicates lower inflation beyond the near term. Indeed, we judge that the inflation jump has almost fully reversed, looking at the latest set of m/m adjusted data (Figure 1).

Has Been Too Complacent?

But even with the fiscal situation likely to become somewhat easier into 2026 (an election year), we think that amid global uncertainties, and given still negative monetary dynamics, the Riksbank is justified in a likely downgrade to its real activity outlook – as it still points to 2%-plus GDP growth for the next three years annually. We think that this consensus picture is too optimistic and it is noteworthy that the Riksbank has accepted a weaker consumer outlook but where the impact on GDP has been offset by a fall in import growth. Indeed, to us, that 2025 outlook of around 1.5% GDP growth also comes with downside risks which encompass a consumer recovery that may be much more feeble reflecting labor market uncertainty and what may be a sustained rise in household savings. The consumer picture is made more uncertain as an unfolding sharp rise in unemployment should mean that wage growth this and next year may fall from last year’s 3.8%.

Tariff Threat Detailed

As for the threat of tariffs, for Sweden exports corresponded to around 55% of GDP with the major sales being road vehicles and machinery, pharmaceuticals, paper products and iron, steel and iron ore and where after other European countries, the U.S. is the third largest single export destination. We do not see a major direct impact, but we do note that, as with many other countries, it is the indirect impact on matters like confidence and uncertainty that may wreak the most damage. This is very much evident in a recent Riksbank survey about import tariffs and their impact on companies’ operations.