Sweden Riksbank Preview (Jan 29): Not Yet the End?

Having delivered the widely-expected fifth successive rate cut at the December Riksbank meeting, the Riksbank hinted that the easing cycle is drawing to an end. Indeed, this assertion was supported by a smaller move in December – ie a 25 bp move (to 2.5%) rather than the 50 bp cut seen previously. Moreover, its updated projections and policy statement suggested the policy rate would fall to 2.25% in H1 this year, the question being to what extent that line of thinking was driven at that juncture by data on the high side of expectations, including a small recovery in GDP and CPIF data. But the data has swung the other way in the last month, most notably an energy induced drop in inflation and every likelihood that Q4 2024 GDP may be negative. Moreover, the minutes to that last meeting showed that the Board majority favored exercising that cut at either the (looming) Jan 23 or Mar 20 meetings. We favor a move this month and still suggest that the Riksbank will have to ease even further to at least 2%, not least as we think its growth assumptions are far too optimistic.

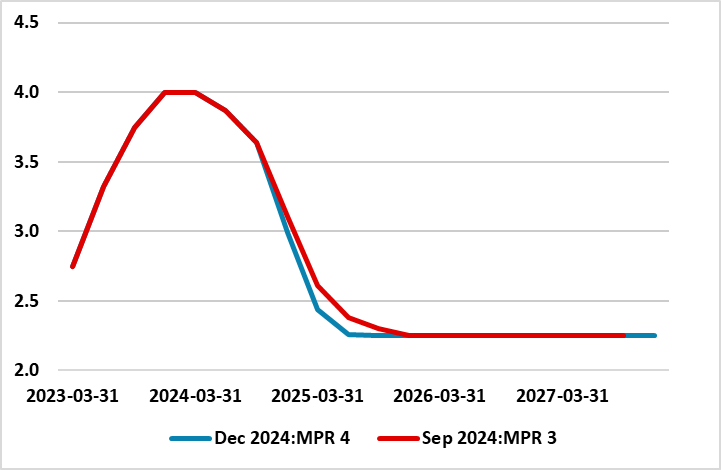

Figure 1: Inflation to Settle Around Target?

Source: Riksbank

In this regard, while the Riksbank did revise down its slightly above-consensus GDP outlook out to 2027, whilst still suggesting inflation will settle around target (Figure 1), its projections still imply a very upbeat real activity picture through this year. Indeed, in the five quarters to end-2005, cumulative GDP growth is expected to be around 3%. But the assumed Q4 2024 rise looks very unlikely. In addition, risks emanating from the global economy (eg regrading trade) remain, if not having intensified, while the impact of the rapid Riksbank easing in H2 last year has already been partly unwound by the rise in market rates. Indeed, that latter rise maybe provide a clear rationale that may make the Board opt for a move this month merely to show markets its policy intentions have not been diluted, also leaving the March meeting to update the policy outlook when fresh projections will be offered.

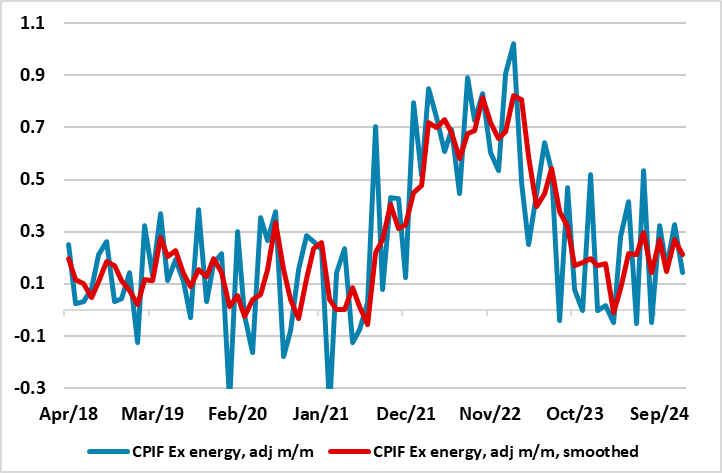

Those updated projections may show an even friendlier inflation backdrop and outlook, something already evident in adjusted core CPIF inflation readings which are now down to rates last seen prior to the pandemic when Sweden saw persistent undershooting of its inflation target. This all makes still clear Board worries about price pressures seen in some business surveys and from a weaker currency overdone

Policy Front-Loading Being Paused?

Since the spring, it has been very much a question of how fast, not if, as far as policy easing was concerned for the Riksbank, with policy thinking having been markedly reshaped this year. From the Board’s perspective, by initiating easing relatively early in May, it was both reacting to weak data (both real and price wise), but more notably in giving itself flexibility to pursue what it then thought needed to be a gradualist approach to further easing. That now has changed and increasingly radically with policy put into a faster gear to front-load. From the Riksbank’s perspective, this now argues for a more tentative approach when monetary policy is formulated going forward.

Figure 2: Soft(er) Short-Run Core Price Dynamics

Source: Stats Sweden, CE

Alternative Scenarios

The question is, if growth disappoints into 2025, will the Riksbank ease further than this final 25 bp move it is now flagging. This is entirely possible and is now a view we encompass to some degree – indeed, the Riksbank scenario analysis suggests that the policy rate could drop below 2%, at least temporarily. Supposedly, this would have to be a result of the weaker growth backdrop accentuating disinflation, this all the more likely given that we think is an optimistic 1.8% 2025 GDP outlook, turning out nearer 1%.

But other factors may come into play, not least policy moves elsewhere which may result in a greater and unwanted appreciation of the currency than currently envisaged by the Riksbank. A further factor may be the Riksbank’s view of neutral rates. Recent analysis from Deputy Governor Seim suggested that the long-term neutral interest rate, and thus the long-term normal policy rate, is probably between 1.5% and 3%, ie a full one percentage point lower than the range the Riksbank published in 2017 and view endorses by the last Policy Report. All of which very much suggests downside risk to the Riksbank baseline policy outlook!