Sweden Riksbank Review: Slightly Less Gradual

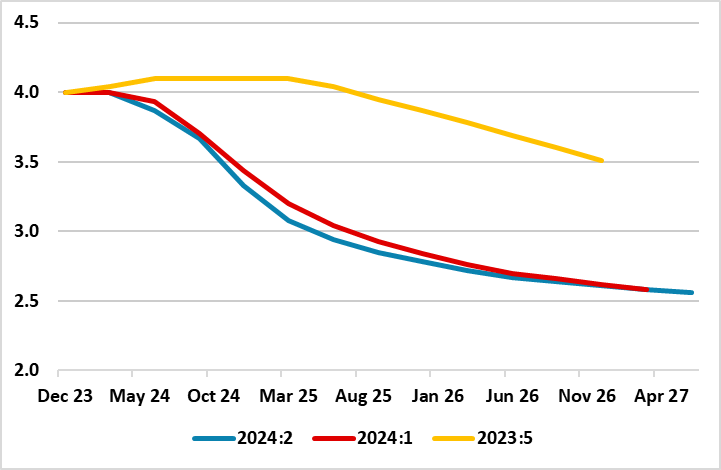

The Riksbank is more confident in the current disinflation process. While none expected any further cuts at this policy verdict today, especially after the 25 bp rate cut it made last month, the Board updated Monetary Policy Report suggested there may an additional such cut in H2 over and beyond the two further such moves it previously suggested. This though is merely a slightly less gradual policy easing outlook with the picture further out practically unchanged (Figure 1), still implying a terminal, if not perceived neutral rate of around 2.5%. Indeed, this reflects inflation returning to the 2% target at the end of the forecast horizon, the question being whether it will subsequently remain there or diverge afresh. It seems that a partly energy induced faster than previously expected fall in inflation through the coming year (Figure 2) reflects economic activity being somewhat weaker, and the krona exchange rate being a little stronger, in turn suggesting the rationale for why the forecast for the policy rate has been adjusted down somewhat. At this juncture, we stick to the two further cuts this year but also to the slightly speedier journey to a 2.5% policy rate we still see occurring by end-2025!

Figure 1: Policy Outlook Details

Source: Riksbank last three Monetary Policy Reports

It was very much a question of how fast, not if, as far as policy easing was concerned for the Riksbank, with Figure 1 underscoring how policy thinking has been markedly reshaped this year. By initiating easing relatively early last month, the Board was both reacting to weak data (both real and price wise), but more notably in giving itself flexibility to pursue what it thinks needs to be a gradualist approach to further easing. That has not changed fundamentally, even given the slightly faster policy path now been flagged - a move is now very likely at the next meeting (Aug 20), with three meetings then left in the remainder of the year to deliver the 1-2 added cuts.

This slight shift in thinking is all the more notable given stronger than expected Q1 GDP reading and disappointing May CPI data, at least in terms of service prices. But the Riksbank (with justification) see both being aberrant. Indeed, as the Riksbank stresses the Q1 GDP jump was largely due to a temporarily large contribution from inventories, while. Interest-sensitive parts of the economy, such as household consumption and housing investment, continued to develop weakly. We would add that monthly outcomes for production and consumption, and confidence indicators for households and companies on the whole indicate weak growth during the current quarter. Meanwhile, the pick-up in the May CPI data was probably a clear aberration due to one-off special entertainment events. This disinflation is very evident in seasonally adjusted m/m core CPI readings which have showed a much softer profile prior to May, very much hinting that ex-energy (core) inflation on this basis is already undershooting target, this having persuaded the Riksbank to bring forward its forecast for CPIF annual inflation to hit target from its previous circa-Q1 2026 forecast by the Riksbank. Indeed, the Riksbank now echoes our long-standing call that CPIF inflation (the actual targeted measure) may drop below target in coming months, this all the more notable given a revised back projection of a negative output gap.

Figure 2: Inflation Weaker This Year But Then Gradual Move Back to Target

Source: Riksbank last three Monetary Policy Reports

Policy Considerations

Despite the firm Q! GDP reading, and for the reasons highlighted above, we remain less optimistic about the scale of the recovery. But even with the Riksbank pointing to the economy picking up and growing in 2025 at and then above trend at over 2% in 2026, this still generates a negative output gap persists almost out to end-2026. We think this growth outlook is somewhat optimistic. But the point is that the Riksbank still accepts that even this more upbeat real economy outlook delivers price stability, if not a risk of a persistent slight target undershoot. The question is if growth disappoints into 2025 will the Riksbank ease further than it is now flagging – much may depend on fiscal policy!