Asset Allocation: Pausing for Breath

Into Q2, data and policy (actual and perceived) will dominate DM markets. The ECB will likely take the spotlight with a 25bps cut on June 7, as the Fed face a better growth/more fiscal policy expansion and a tighter labor market than the EZ but also with a better productivity backdrop and outlook to consider. However, global equity markets have run a long way and could consolidate/correct in Q2, while DM government bond markets also want/need to see the Fed actually easing. In EM, elections in India/Mexico and S Africa are the highlights in Q2, though we see rate cuts from Brazil/China and Mexico. China equities can see a tactical bounce, but strategically we still prefer India.

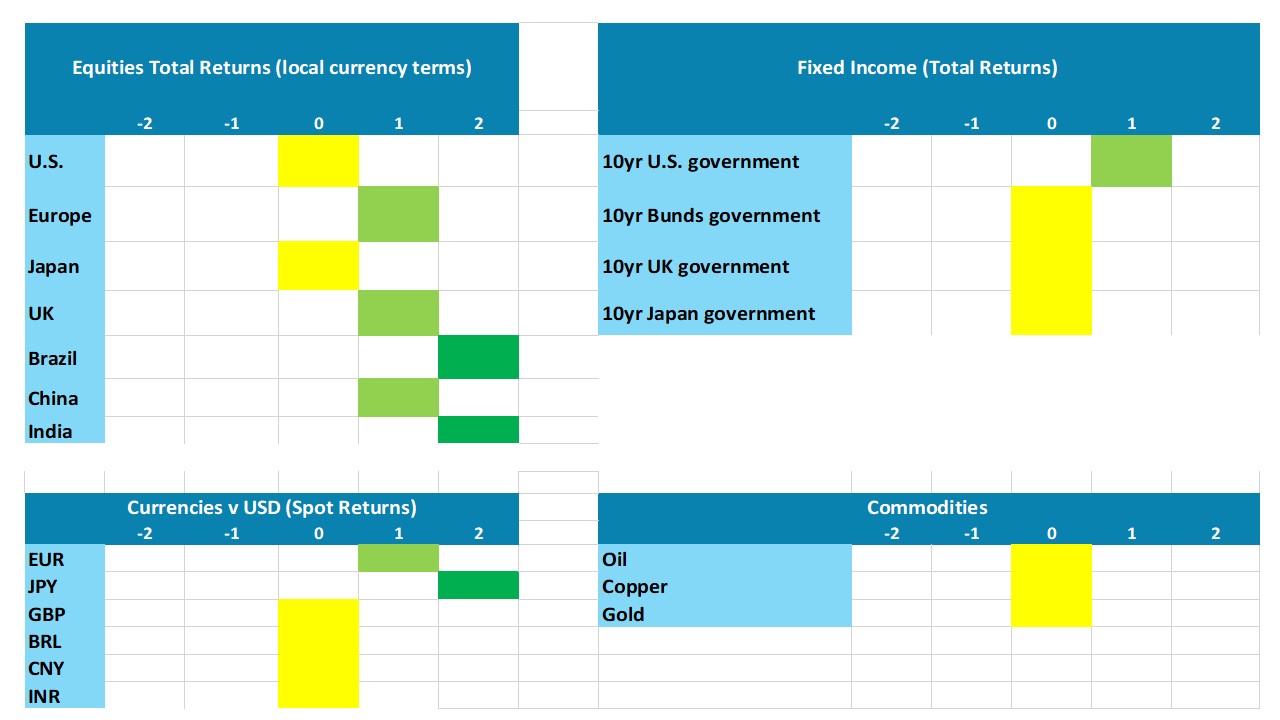

Figure 1: Asset Allocation for the next 9 Months

Source: Continuum Economics. Note: Asset views in absolute total returns from levels on March 22 2024 (e.g., 0 = -5 to +5%, +1 = 5-10%, +2 = 10% plus).

The prospects for global assets in Q2 depends on the growth/inflation and policy story in most major DM countries, after a Q1 that has seen less optimism on rate cuts push government bond yields modestly higher. But DM equity markets that have rallied on a goldilocks idea of inflation slowing to target but avoiding a prolonged recession and with rate cuts approaching – except Japan.

The U.S. and the Fed are most important issues as we enter Q2, but the May 1 FOMC meeting could be too soon for the Fed to change tune compared to the March FOMC meeting. The Fed are reluctant to draw conclusions from one month’s data and this puts more importance on the June 12 FOMC meeting, where we expect some signs of Q2 slowing to prompt a move dovish tone into Q3 (here for our U.S. outlook). We have penciled in a 25bps cut in July, but this can be fine tuned depending on the incoming data and Fed guidance – Fed views are unlikely to change on interpretation alone and will require data surprises.

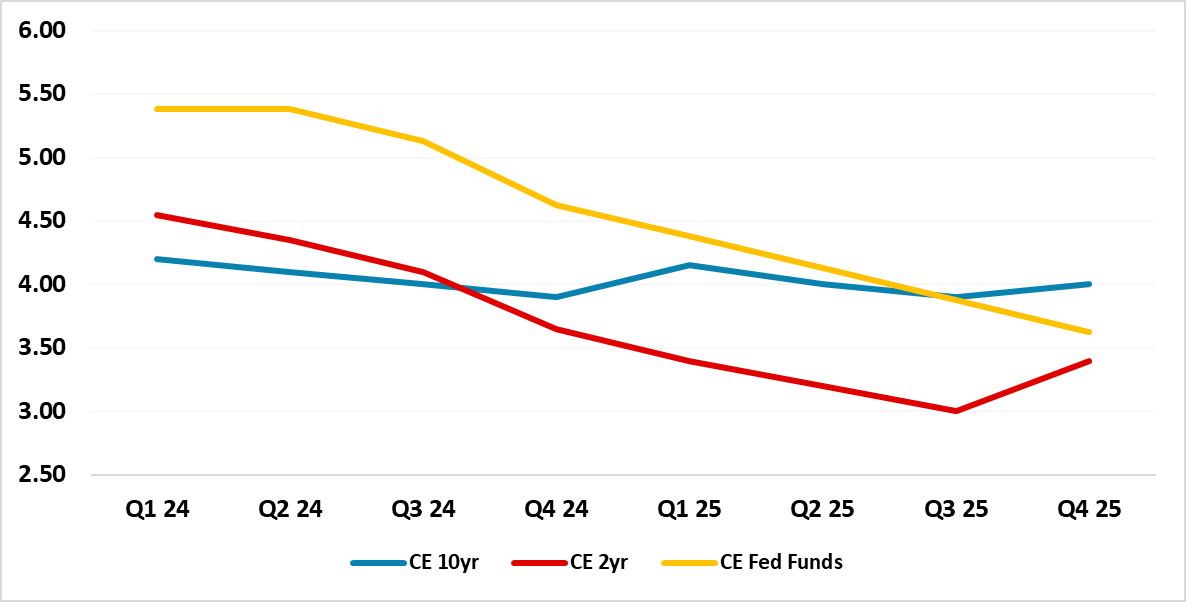

For global equities and government bonds, the U.S. view is key. We look for small to modest declines in yields in our baseline view, as the 2yr will not decline more noticeably until the Fed is actually close to cutting (Figure 2). For U.S. equities, this is not a problem in itself and providing the economic slowing in Q2 is small to modest rather than large. However, at current valuations, any deviation from the goldilocks triple view on growth/inflation and policy could prompt a 5% correction (here). Q2 is also too early for clear bets on the outcome of the U.S. elections in November, which suggest data and policy will dominate.

Figure 2: Continuum Economics Forecast Fed Funds, 2 and 10yr U.S. Treasury Yields (%)

Source: Continuum Economics

Perhaps the ECB will take the limelight in Q2. The SNB has already cut and the BOE (here) or Riksbank (here) could cut in May and add to the belief that policy rates are coming down across Europe. However, ECB importance overshadows the other DM central banks. We remain of the view that the ECB is moving towards a 25bps cut at the June 7 Council meeting. This could be signaled at the April 11 ECB meeting, as the weak recovery and soft inflation data already mean that forward looking policy should be cutting in Q2. However, ECB forward guidance at press conferences has been weak and this could mean that only hints could be seen on April 11, though we would still see a June 7 cut unless a significant upside surprises is seen in real sector data and inflation numbers.

The EZ government bond market will welcome the start of an easing cycle, but 2yr Bund yields are at a big discount to the ECB deposit rate. Close to 175bps of cuts are discounted in the next 2 years, but that then gets the market close to the perceived neutral policy rate around 2% -- ECB are reluctant to provide guidance on this. In contrast, U.S. money markets are 100bps above the Fed’s estimate of the neutral policy rate in 2 years and Fed easing can fuel expectations that the terminal policy rate is lower than the 3.50% currently in money markets. The ECB could go below the neutral policy rate eventually, if the economy is soft and inflation threatens to persistently undershoot. However, money markets and short dated government bond yields will not discount this scenario 2 years ahead without hard evidence. Thus we see 2yr Bund yields only declining slowly and 10yr yields hardly at all (here for DM Rates Outlook).

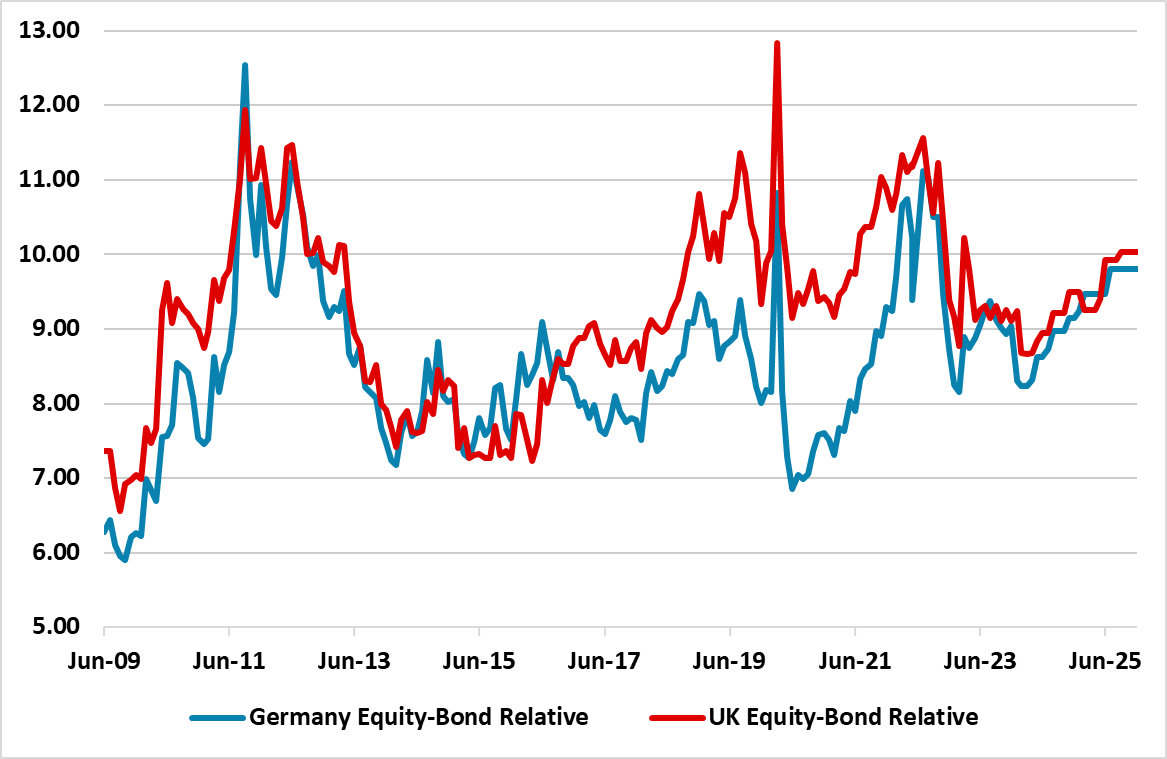

EZ equities can be helped by the ECB rate cutting cycle starting, though it is more important that the real sector gains ground to help corporate earnings momentum. EZ and UK equities are also cheapening versus government bond yields (Figure 3). We forecast +0.2% for Q2 EZ GDP versus zero in Q1, but better days will only really come into H2 and H1 2025. The EZ economy is suffering from the lagged effects of higher interest rate and restrictive lending growth while a swing to positive real wage growth (due to inflation coming down quicker than wages so far) is the only plus. The ECB needs to provide confidence on the pace and magnitude of cuts, which splits in the (still unwieldly large) ECB council argue against. Thus EZ equities benefit could be short-lived and it will be back to follow U.S. equities (here).

Figure 3: Germany/UK 12mth Earnings Yield minus 10yr Real Government Bond Yield (using 10yr breakeven inflation)

Source: Continuum Economics. Continuum Economics projections until end-2025 using 10yr breakeven inflation and Bund/Gilt yield forecasts. Baseline see 2.20% 10yr yields end 2024, end 2025 2.20% and 10yr gilts 3.80% and 4.00%.

Elsewhere, Japan watchers expect more equity gains; a weak JPY and the BOJ next hike in September/October. However, the BOJ has moved away from ultra-easy policy quicker than markets have forecast and we highlight in our Japan Outlook (here), why we see the BOJ hiking by a further 10bps in June. We would also note that the Japanese Yen is the most misaligned DM currency and is too weak relative to short-term fundamentals. Thus we forecast 135 on USDJPY by end 2024 (here for our DM FX outlook). Optimism could carry Japanese equities somewhat higher, but we feel a correction is coming. Corporate earnings are at risk both from a rebound in the JPY and also as Japanese consumers rejecting higher prices from companies. Moreover, the BOJ’s Ueda notes that ETF sales are one option and QT ETF sales could a concern for the market later in the year. We see a flat Nikkei by year-end (here for Equities Outlook).

EM will be a combination of policy and politics. Elections in S Africa (May 29), Mexico (June 2) and India (results June 4) mean that politics will be followed closely and will be the dominant theme shaping markets. India (here) and Mexico (here) should have no surprises and stable or positive policy momentum. In S Africa, we expect a coalition government (75% chance) bringing some political uncertainty, and this is likely to struggle with structural issues that the country faces. However, given the results in India and Mexico, this will likely be seen as S Africa specific and not having EM spillover. Meanwhile, geopolitical risks are unlikely to escalate. In the Ukraine war, we see a stalemate between the two sides, as Putin hopes for a Trump victory in the U.S. The war in Gaza will also have a heavy human toil, but will likely remain a local affair without wider Middle East spillover. Finally, the election of a pro-China speaker to the Taiwan parliament presumably means that China will not escalate tensions too far with Taiwan (here) and fears of a war in the next few years are overdone.

Figure 4: 9mth Total Returns Versus the USD (%)

Source: Continuum Economics

Rate cuts will come in Q3 in India/Indonesia/S Africa and Russia according to our economists, both on domestic fundamentals and after the Fed has made the first cut and sends the USD on a soft trend. Brazil, Mexico and China are forecast to cut rates in Q2. The Brazil and Mexico cases reflect success in getting inflation back towards their targets and healthy rate spreads versus the U.S. means that the USD is not an issue. In China’s case, unbalanced growth means that a 10bps 1yr medium-term lending facility rate is likely in Q2 and a further 20bps in H2 2024. Government spending/consumption are not enough to hit China’s 5% growth target, with negative residential investment; a drag from weak exports and slow private sector employment growth (here for our China Outlook). We see China’s authorities allowing some exchange rate weakness to 7.40 on USD/CNY to help exports. CNY has the most negative Outlook for EM currencies (Figure 4), with the Indonesian Rupiah (IDR) eventually benefitting from a softer USD, with an eventual recovery in the S African Rand (ZAR) later in the year – Brazil and Mexico total returns largely come from yield pick-up with currency stability forecast in Q2/Q3.

In terms of EM equities, China’s equity market undervaluation has reached the point that a short covering bounce has arrived, as the economic news is not currently deteriorating. Indeed, a tactical recovery will likely extend and China could outperform the U.S. by a further 5-10% in the next 3-9 months. However, we would not change the strategic underweight view on China in EM portfolios, as the market is too optimistic on corporate earnings growth multi year and the structural headwinds point to just above 5% nominal GDP growth. We prefer India due to high nominal GDP growth and corporate earnings growth prospects (Equity Outlook here).