Stubborn Inflation Jumped to Record High at Year-End Amid Ruble Woes

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data released on January 15, inflation ticked up to 9.5% YoY in December after hitting 8.9% in November, remaining well above the Central Bank of Russia’s (CBR) midterm target of 4%, due to surges in services and food prices, huge military spending, weakening Ruble (RUB) after new set of U.S. sanctions on January 10, and elevated inflation expectations. We think that risks to the inflation outlook remain upside as RUB weakens and inflation surges, which could likely compel CBR to continue tightening cycle on February 14, 2025.

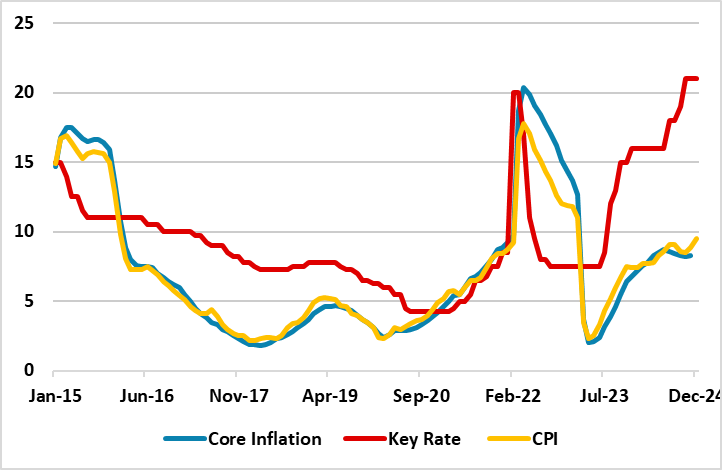

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2024

Source: Continuum Economics

According to Rosstat figures, the inflation rate continued to stay elevated at 9.5% YoY in December, the highest since February 2023. MoM price growth fastened to 1.3% in December driven by the services and food prices. Higher prices were recorded for services (+11.5% vs. +11.4% in November) and food (+11.1% vs. +9.9% in November).

In addition to high military spending and elevated inflation expectations, we believe the weakness of the currency continues to adversely impact inflation outlook as RUB lost about 6% of its value against the USD only in December. Despite CBR halted foreign currency purchases in response to the RUB fall, the RUB continues to stay well above 100 thresholds, hovering around 102 as of January 14.

A plunge in the ruble on the back of new U.S. sanctions and a surge in consumer demand continue to pump up inflation despite high borrowing costs. (Note: The U.S. announced a new set of sanctions on January 10 targeting Russia's oil sector, which included restrictions on two major oil producers. The U.S. sanctioned more than 200 entities and individuals involved in Russia’s energy sector and identified more than 180 vessels as blocked property).

Despite monetary tightening continues in Russia given inflationary risks and CBR’s hawkish forward guidance, it appears the economy remains overheated as the growth in domestic demand is still significantly outstripping the capabilities coupled with strong fiscal support to military staff and their families. Bloomberg cited on January 15 that CBR governor Elvira Nabiullina recently compared inflation in the economy to a sick person running a high temperature, and warned such overheated growth isn’t sustainable.

Despite CBR’s inflation target for 2025 remains at 5%-5.5%, we think it will be very tough to reach this target level under current circumstances and CBR should revise its inflation projections for 2025 soon to regulate expectations. (Note: We predict annual average inflation to stand at 7.4% and 5.1% in 2025 and 2026, respectively). As restrictive monetary policy partly suppresses prices with lagged impacts, we feel cooling off inflation will take longer than CBR anticipates since inflation expectations of households and businesses continue to edge up.

It appears that above mentioned economic strains are not going to ease any time soon and the CBR will likely have hard times particularly in H1 2025 until inflation starts softening, RUB stabilizes and inflation expectations converges to CBR’s forecasts. In this high-inflation environment, it was also interesting to see CBR decided to hold the key rate constant at 21% on December 20. As noted, we think that risks to the inflation outlook remain upside, which could likely compel CBR to continue tightening cycle on February 14, 2025.

Of course, the key will be how Ukraine war will go in 2025. We feel a ceasefire in Ukraine in 2025 is likely under new Trump administration which could lower military spending, relieve the pressure on RUB and help inflation to cool off in the medium term, while Trump-Putin meeting(s) will be pivotal.