Europe’s Ukraine Political Fallout and Market Hopes

European politicians are surprised and angry at the U.S. stance on a peace deal for Ukraine and less military support for Europe, but eventually they will have to accept the new reality. Europe is too divided to provide security guarantees to Ukraine on its own. A further increase and acceleration of existing defense spending plans is likely, but European politics and strained public finances means that this will vary across countries. Meanwhile, market optimism depends on a ceasefire this year turning into a peace deal that potentially boost cheap Russian gas imports to the EU. EZ equities also need signs of a European economic recovery as a catalyst for further noticeable gains.

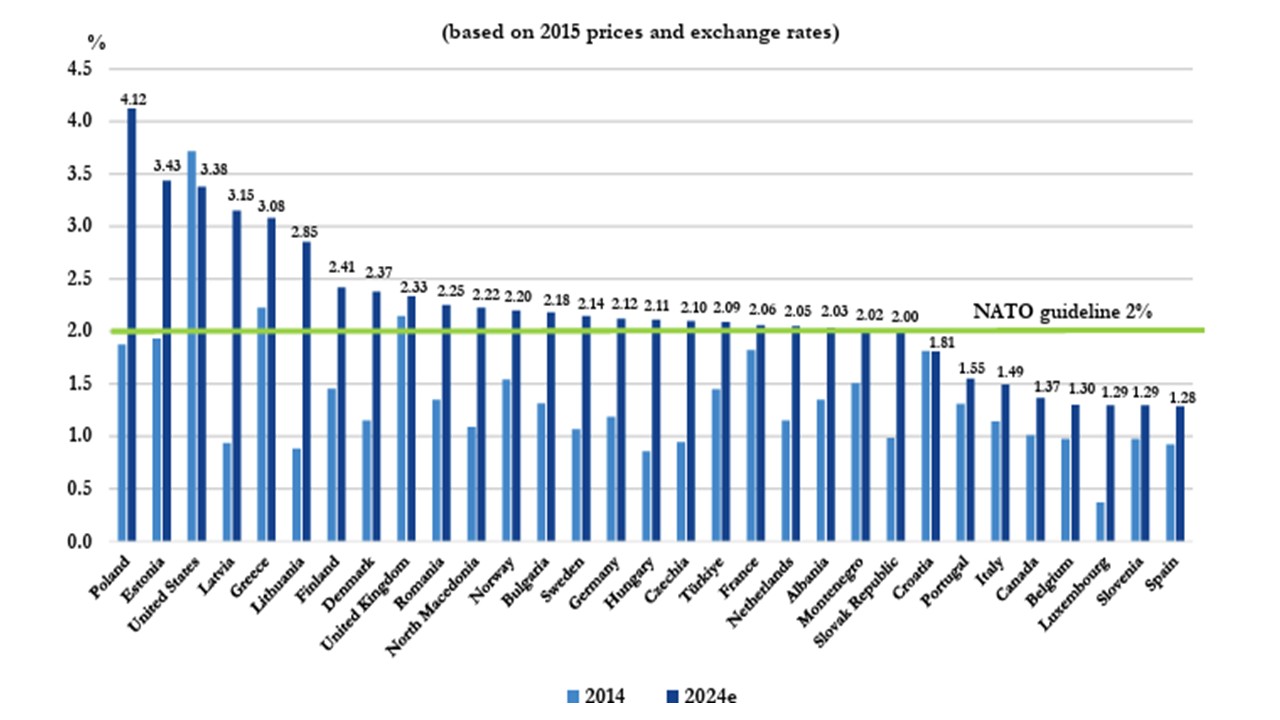

Figure 1: Military Spending to GDP (%)

Europe has been shocked by the rapid developments this week over ending the Ukraine war. While Europe wants a place at the negotiating table, this is unlikely to occur as discussions are driven on the Trump-Putin axis. The risk is that Ukraine also ends up being the junior partner in the discussions. We will outline our views on how the negotiations are more likely to land on a Russia friendly peace deal in a separate article later today. While some European politicians will initially be in denial and angry over this prospect, real politics means that the EU and other European countries will have to eventually accept a new reality going forward. On Ukraine, the internal divisions within Europe are large enough that the EU will not be able to give future security guarantees to Ukraine, given that the U.S. is blocking NATO access for Ukraine and peacekeepers being covered by article 5 protection. A UN centric peace keeping force is more likely, which will be a political gesture rather than a real army along the dividing line. The main long-term ramifications will likely be an acceleration of defence spending in the EU and among other European countries. U.S. Defence Secretary Hegseth made clear on Wednesday that though the U.S. is committed to NATO, that Europe needs to do more for its own defence and this represents a strategic shift from the U.S. post-World War II consensus.

The problem is that Europe is split in three on defence spending. Poland and eastern EU countries are committed to high spending (Figure 1) and further increases, given the fears of a further attack by Russia in the next 5-10 years. The UK and Nordics countries assess that the long-term Russia threat does require a long-term target of 2.5% to 3% of GDP. Finally, the bulk of EU countries accept that some increase in defence spending to GDP is required, and this could involve acceleration of existing defence spending increases planned for the next 10 years, but that the increase should be modest and is constrained by medium-term fiscal consolidation needs. Italy, Spain and Belgium still have not hit 2% of GDP. Germany is however fluid in this group, but will depend on the post-election government composition. The EU is also divided on whether it should buy more U.S. defence equipment or be more home grown – the U.S. could ask for extra spending on U.S. goods in any U.S./EU trade war (here).

Financial markets have initially seen a knee jerk bounce in EZ equities and the Euro on the hopes of a ceasefire and then peace deal that softens commodity prices and brings in a period of calmer European geopolitics over the next 1-3 years. Our EM EMEA economist feels that Putin will want to move away from the war economy given the inflation and interest rate strain, while also wanting to consolidate the Russian military after a bruising war in Ukraine. This could be at least 3-5 years and it is by no means certain that Putin would attack a NATO country in Eastern Europe in the next 10 years. With EZ equities are still cheap versus government bonds, this can further help sentiment towards EZ equities though the real catalyst would be signs of an EZ recovery.

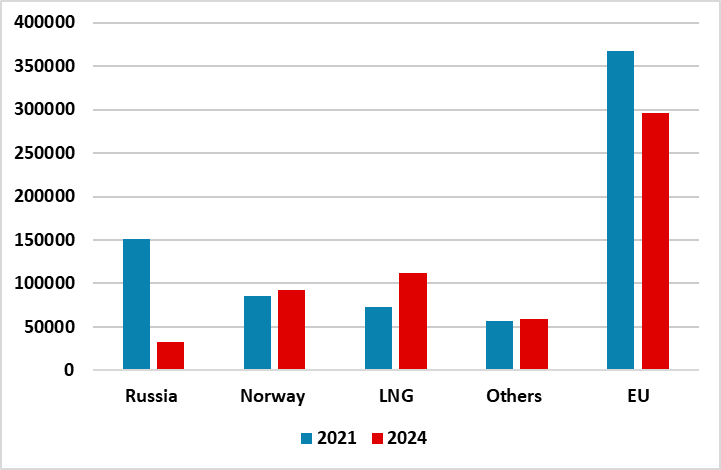

In terms of EU countries restarting gas pipeline imports from Russia - it is feasible, as the EU is still importing LNG from Russia and only recently stopped gas imports via the Ukraine pipeline – Figure 2 shows that Russia accounted for 11% of EU gas imports in 2024. However, some hardline EU countries could resist this process, while we would also caution that a ceasefire deal this year may not be followed by a peace deal for years. Even so, Russian gas will likely be cheaper than LNG and this could see commercial pressure to restart the gas pipeline and bring down currently high European wholesale gas prices (here).

Figure 2: LNG Supplies by Country (Mlns Cubic Metres)

Source: Bruegel/Continuum Economics