Inflation in Russia Hits Two-Year High in February: 10.1% YoY

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation ticked up to 10.1% YoY in February after hitting 9.9% in January, remaining well above the Central Bank of Russia’s (CBR) midterm target of 4%, due to surges in services and food prices, huge military spending, labor force crisis and elevated inflation expectations. We think that risks to the inflation outlook will likely remain upside until the war in Ukraine comes to an end. We envisage CBR to maintain key rate at 21% during the next MPC scheduled on March 21.

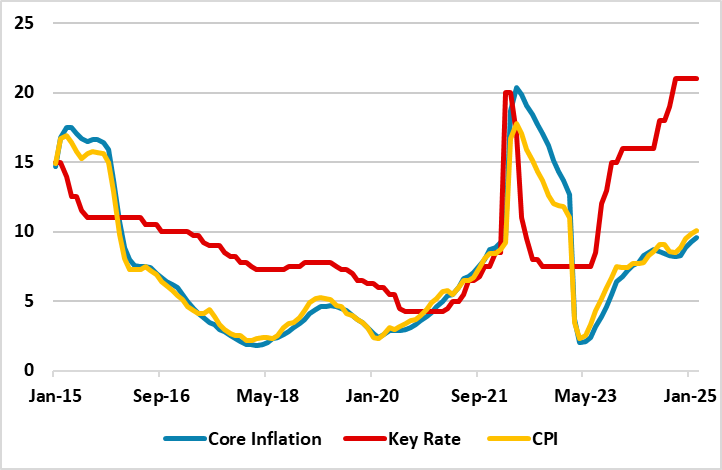

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – February 2025

Source: Continuum Economics

According to Rosstat figures, the inflation rate hit 10.1% % YoY in February, the highest reading since February 2023. MoM price growth fastened to 0.8% in February, marking the smallest increase in the last four months, driven by the services and food prices. The prices of food and services soared by 11.7% and 12.7% in annual terms, respectively, in February.

Despite lagged impacts of monetary tightening, it appears the economy remains overheated as the growth in domestic demand is still significantly outstripping the capabilities coupled with strong fiscal support to military staff and their families and elevated inflation expectations.

Despite the Ministry of Economic Development expects the inflation will reach 4% in 2026-2027, and CBR now envisages the inflation will hit 4% in 2026, we feel achieving this will be very tough since cooling off inflation will take longer than CBR anticipates taking into account that demand stays elevated and inflation expectations of households and businesses continue to edge up as it appears economic strains are not going to ease any time soon. (Note: CBR announced last month that it hiked its 2025 inflation forecast to between 7% and 8%, from 4.5% to 5%).

We foresee a probable Russia-friendly peace deal in Ukraine following talks between the U.S. and Russia could ease some pressure on inflation, alleviate demand-supply imbalances within Russia's economy, and be a relief for war-torn economy while it appears the way to a final peace deal will be bumpy. We think that risks to the inflation outlook will likely remain upside until the war Ukraine comes to an end. We envisage CBR to maintain key rate at 21% during the next MPC scheduled on March 21.