EMEA Outlook: Rate Cuts in 2025 Despite Global Uncertainties

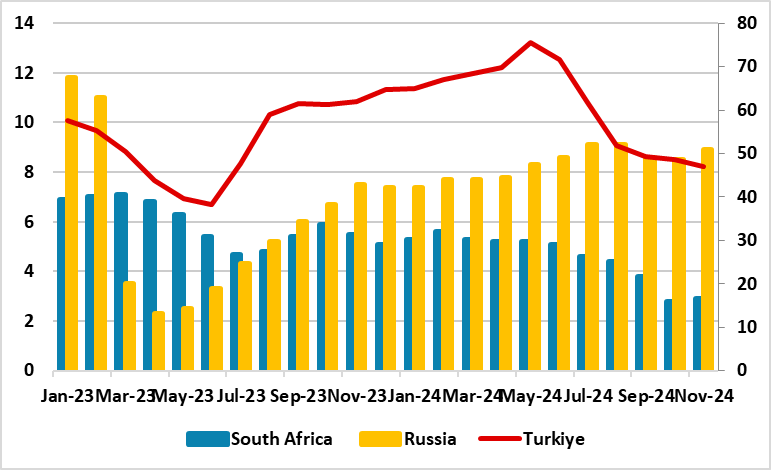

· In South Africa, our end-year policy rate prediction remains at 7.0% for 2025 and 6.5% for 2026. We foresee headline inflation will fall to 4.2% and 4.6% in 2025 and 2026, respectively, considering power cuts (loadshedding) are relieved and the domestic fiscal outlook is moderately stable after the coalition government formed in July. We see growth to stand at 1.5% and 1.6% in 2025 and 2026, respectively, but the key will be coalition’s determination tackling loadshedding, logistical constraints, financing needs, and corruption. Risks to the outlook are broadly balanced, with faster reform implementation representing an upside risk to growth while uncertainty about the U.S. economy in 2025, slowing China demand, and oil price fluctuations could cause problems for growth.

· In Turkiye, despite decelerated fall in inflation in H2 2024, we foresee upside risks emanating from buoyant domestic demand, the stickiness of services inflation, and adverse geopolitical impacts leading average inflation forecasts to stand at 31.9% and 20% in 2025 and 2026, respectively. We think Central Bank of Republic of Turkiye (CBRT) will likely cut the rate by 500bps cuts in every quarter to 30% in 2025. On the growth front, we believe the economy to expand by 2.6% in 2025 and 3.6% in 2026 considering high inflation and tighter fiscal stance continue to dent GDP growth.

· In Russia, the war in Ukraine continues to create an increasing financial burden on Russia due to high military spending, strong fiscal stimulus in addition to aggravation of staff shortages. Our inflation projections for 2025 is are now higher at 7.4% due to an overheated economy. Our end-year policy rate prediction is 19% for 2025 and 12% for 2026 as we foresee CBR to start cutting rates late Q3 2025 unless inflation picks up and RUB loses value significantly. We envisage growth to hit 1.6% and 1.5% in 2025 and 2026, respectively, which is less than 2024 figure, as we foresee a ceasefire in Ukraine in 2025 (here) and likely lowering Russia’s military spending and fiscal stimulus.

Forecast changes: From our September outlook, we have increased the 2025 inflation forecast for Russia to 7.4% due to continued government spending. We now envisage Russia will start cutting policy rate in Q3 2025 since inflation stays far from the CBR targets. We slightly decreased South Africa inflation forecast thanks to lower fuel prices supported by suspended loadshedding for more than 8 months.

EMEA Dynamics: Complicated Picture Due to Global Uncertainties and Diverse Domestic Issues

Country specific factors, China slowdown, uncertainty about the U.S. economy, and pace of the rate cuts by the DM economies continue to rule the EMEA outlook heading towards 2025 and 2026. We think ongoing slowdown in China and trade tariffs by Trump would risk greater uncertainty over the EMEA medium-term prospects.

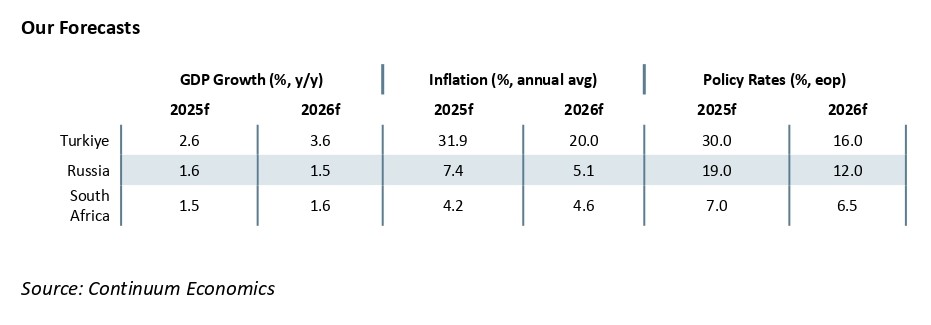

Inflation remains the major concern for EMEA economies since they stay above targets in Russia and Turkey as aggressive monetary tightening cycles are still feeding through. Taking into account that the inflation is now below the midpoint target of 4.5%, South Africa started cutting the policy rate as of September 19 and continued on November 21 with another 25 bps cut, lowering the key rate from 8.0% to 7.75%. Russia and Turkiye will be waiting the right time to start cutting rates in 2025, which would depend on inflationary pressures and domestic dynamics.

Apart from Russia, our growth trajectories remain unchanged for EMEA countries for 2025 when compared with September outlook. Russia economy likely expand higher-than-expectations in 2024, as the economy continues to rebound due to increased public spending in war-related industries and public spending is at unprecedented levels coupled with strong fiscal stimulus. We foresee a downturn in Russian economic growth in 2025 and 2026 as we feel a ceasefire is very likely in Ukraine in 2025 under new Trump administration as Putin seeks to gain concessions, which would lower Russia’s military spending and fiscal support to military staff and their families.

Fed and ECB easing could continue to help EMFX more broadly. We think particularly South Africa can use it as an opportunity for further policy rate cuts in 2025 but uncertainties about the U.S. and China economy coupled with the risk of a trade war could darken the prospects if it becomes aggressive. TRY is expected to continue to lose value in 2025 given strong inflation differentials and limited capital inflows.

Figure 1: South Africa, Russia (LHS) and Turkiye Inflation (RHS) (%, YoY), January 2023 – November 2024

Source: Continuum Economics, Datastream

South Africa

Despite South Africa continues to face challenges such as declining real per capita growth, rising level of public debt coupled with high unemployment and poverty rates, the economy is on track thanks to positive shift in the political landscape after the coalition government (GNU) took office in July. Inflation fell below 4.5%, sovereign risk premium improved, business confidence increased, and SARB started cutting cycle in September, as we expected. Additionally, inflation expectations continued to improve. (Note: According to BER Q4 inflation expectations survey announced on December 13, analysts, business people and trade union officials foresee consumer inflation stabilizing around the 4.5%-target midpoint from 2024 to 2026).

There was also good news from loadshedding. Eskom emphasized on December 6 that load shedding remained suspended for 254 consecutive days backed by structural generation improvements, better planned maintenance, and investments in generation recovery. In its outlook for the summer period, Eskom announced there will likely be a scenario of load shedding-free summer outlook and load shedding will be a thing of the past by March. Despite this, we think the fate of loadshedding will depend on GNU’s determination, continued investments and Eskom’s success in keeping the generation fleet up and running.

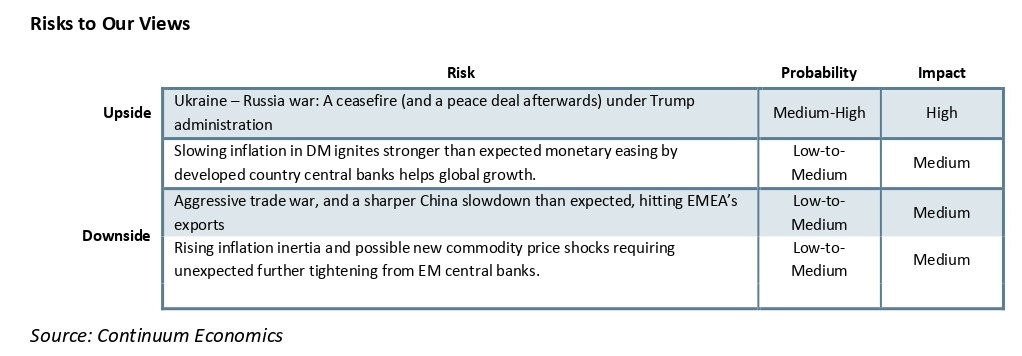

On the inflation front, inflation decreased to 2.9% YoY in November due to slowdown in costs for food, fuel, and housing, slightly up from a four-year low of 2.8% in October. (Note: The core inflation rate eased to 3.7% in November, its lowest level since February 2022). Since inflation is now below the mid-point of SARB’s target band of 3% - 6% and price pressures significantly relieved, we foresee average headline inflation will hit 4.2% and 4.6% in 2025 and 2026, respectively, given suspended loadshedding, lagged impacts of SARB’s previous tightening, decrease in inflation expectations and a relatively stable ZAR as Fed and ECB continue cutting cycles. The key for the inflation trajectory will be GNU’s determination to address the electricity shortages, logistical constraints, and financing needs. We feel it will be important for South Africa to monitor fuel prices, trade tariffs, and global oil price movements, as they could significantly impact inflation forecasts. (Note: According to sources, the weather outlook for 2025 seems positive, with a La Niña system predicted, so a good development for agricultural sector).

Figure 2: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2025

Source: Continuum Economics

As mentioned, the major risk on the inflation trajectory will likely be loadshedding which can ignite an acceleration in fuel and electricity prices in 2025. We are not 100% sure that loadshedding will be that bright all year long despite the outlook seems positive for now. (Note: Some energy analysts think that it is too soon to claim a full victory as the electricity system is still vulnerable, and continued investments are required). Additionally, it is worth noting that Eskom is planning to apply tariff hikes over the next two years 2025/2026: 36.15% and 2026/2027: 11.81%, which could lift CPI over expectations. Speaking about inflation outlook, SARB governor Kganyago stated that inflation could be higher than SARB’s baseline forecast given scenarios such as higher housing costs, larger electricity price increases, wage increases that outrun inflation and productivity growth or higher food inflation could cause uncertainty, demonstrating that SARB will be cautious about risks to the inflation outlook. However, a risk also exists that inflation could be below our baseline forecasts, if the lack of loadshedding causes more inflation control.

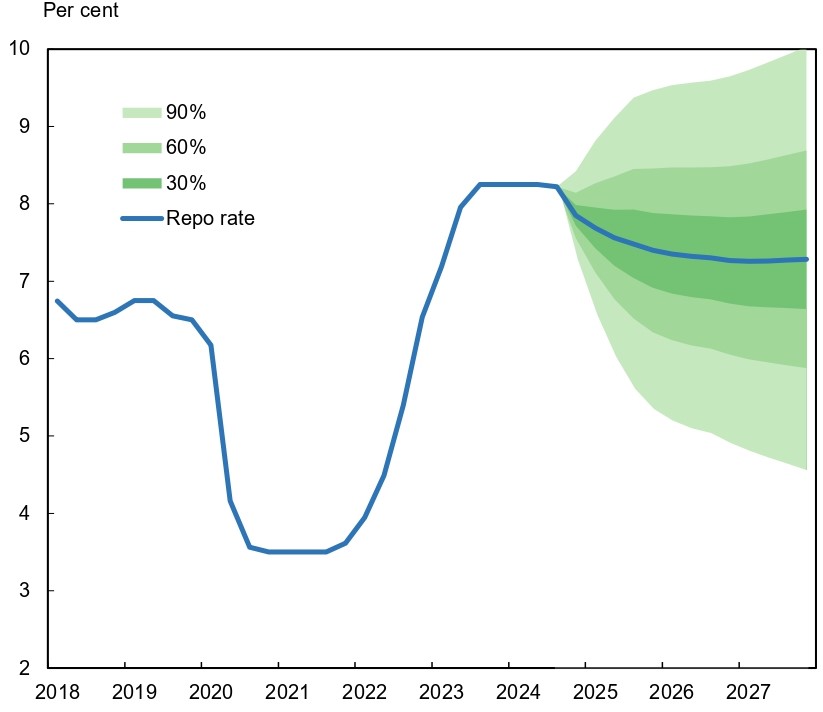

As SARB started its cutting cycle in September, we believe the easing cycle has been a partial relief for the consumers facing high costs of loans, as well as the automotive industry and the property sectors which have been hard hit by the elevated interest rates. As inflation remains well below 4.5% midpoint, we feel this continues to allow more space for rate cuts; as we foresee 25 bps cuts in the first three quarters of 2025. Cautious SARB will likely halt Q4 2025, particularly if the impacts of trade tariffs over the global economies will be harsher than expected. (Note: SARB governor Kganyago signaled this week that officials will proceed carefully on interest-rate adjustments, given the unpredictable outlook for the global economy). We believe data-dependent SARB will continue cutting the rates in 2026, -with a slower pace due to global uncertainties-, and cut by 25 bps in each half of 2026. Our end year prediction is 7.0% for 2025 end-year policy rate, and 6.5% for 2025.

Figure 3: SARB Interest Rate Forecast (%), 2018 – 2027

Source: SARB Forecast Report (November 2024)

Despite GDP growth at 0.3% in Q3 2024 (driven by a 28.8% QoQ decline in the agricultural sector due to drought reducing output), we assess the economy will grow by 1.5% and 1.6% in 2025 and 2026 on the back of improved investor sentiment, bettering electricity generation, subdued inflation, and rate cuts. Risks to the outlook are broadly balanced, with faster reform implementation representing an upside risk to growth while uncertainty about the U.S. economy in 2025, slowing China demand, and oil price fluctuations could cause problems for growth. (Note: Metals and ores, including platinum, aluminum sourced from countries such as South Africa and used as manufacturing inputs in the U.S., are among the key risk categories for increased import tariffs).

Turkiye

After Turkiye made a shift to traditional economic policies followed by orthodox monetary steps mid-2023, we see a wave of improving economic indicators despite some vulnerabilities remain significant.

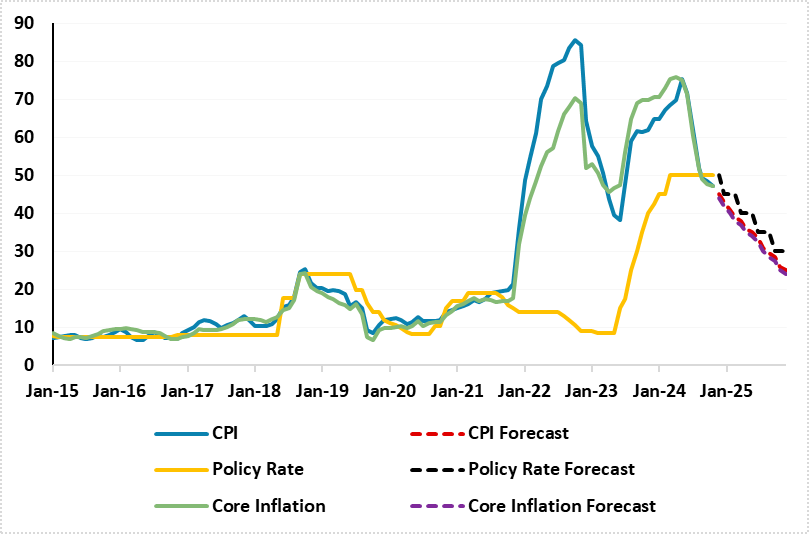

Despite slowing less-than-expected, inflation softened in H2 2024 backed by lagged impacts of the tightening cycle, relative slowdown in credit growth, and tighter fiscal stance. Inflation stood at 47.1% annually in November as food prices and housing costs continued to build. We envisage that inflation will continue to decelerate in 2025 supported by slowdown in demand and the decrease in the current account deficit (CAD), but the extent of the decline will be determined by minimum wage hike in January, administrative price adjustments and TRY volatility. We think upside risks emanating from the stickiness of services inflation, deteriorated pricing behavior, and adverse geopolitical impacts leading average inflation forecasts to stand at 31.9% and 20% in 2025 and 2026, respectively.

We think November inflation reading significantly reduced the prospect of an interest rate cut later on December 26. We expect cautious and hawkish CBRT will start rate cuts when there is a sustained decline in the underlying trend of monthly inflation is observed, as recently emphasized by CBRT governor Karahan. MoM inflation which rose by 2.24% in November demonstrated that monthly inflation kept above expectations signaling CBRT will have to remain highly attentive to inflation risks and distorted pricing behavior.

Under current circumstances, we feel the first rate cut will happen in Q1 2025 given residual inflationary risks. Our end year key rate prediction is 30.0% for 2025 as we foresee 500bps cuts in every quarter in 2025. We envisage CBRT will continue cutting rates in 2026 to 16%, but with a slower pace due to global economic uncertainties and geopolitical risks. Mth/Mth inflation readings will also be key, as CBRT will want to avoid reigniting inflation with too aggressive rate normalization. The pressure is growing from Turkish exporters and industrialists to start lowering its rates to reverse a marked slowdown in the economy, and this will also be an issue to consider for CBRT in 2025.

It is worth noting that another headwind for Turkish economy is currently the wage-inflation spiral. More than half of Turkiye’s working class is condemned to earn the minimum wage, and Turkish workers continue to suffer from galloping inflation since the government did not increase minimum wages in July 2024 to reduce aggregate demand and restrain inflation. Despite Turkish employers push for a solid minimum wage hike to cope with higher cost-of-living, we don’t expect the government to raise the minimum wage more than 25% in January 2025 which could cause limited social unrest, but proving the government’s determination to rein in chronic inflation. (Note: The IMF’s Turkiye mission chief highlighted in October that the country should avoid a repeat of its prior inflation-fueling minimum wage hike early 2024 and focus on support measures for the poorest part of the population instead).

Figure 4: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2025

Source: Continuum Economics

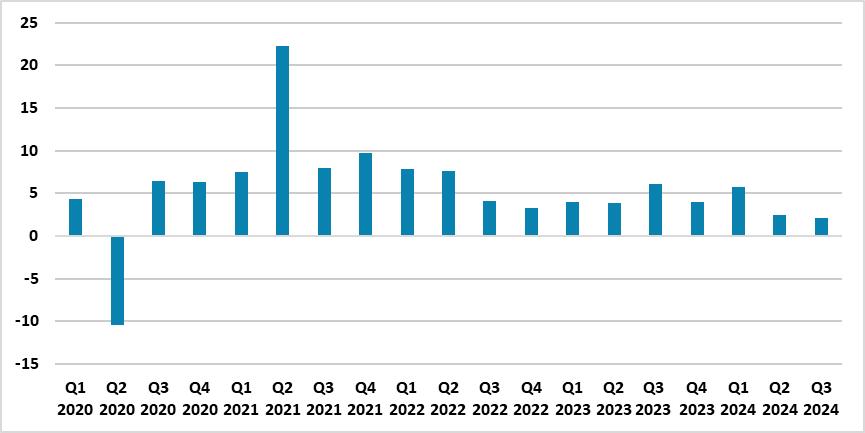

On the growth front, Turkish economy expanded by 2.1% YoY in Q3 driven by higher contribution from net exports. As we expected, the pace of the GDP growth decelerated in Q3 when compared to Q1 and Q2, as demand ebbed - especially in the services sector. We feel tight monetary and income policies will continue to suppress domestic demand next year and bring 2025 growth to 2.6%. We think there is still a downside risk to the growth trajectory considering all the tightening measures in place.

A drop in inflation and aggressive rate cuts could boost confidence and growth would rise back toward potential of 3.5-4% after 2025, hitting 3.6% in 2026. On the upside, rapidly falling headline inflation in H2 could feed into backward-looking inflation expectations, easing price pressures.

Figure 5: GDP Growth (%, YoY), Q1 2020 – Q3 2024

Source: Continuum Economics

2025 and 2026 will be significant for the Turkish economy from every angle while the key will be aligning fiscal, monetary, and incomes policies, which need to work together during the disinflationary process. Setting prices, wages, and other contracts (such as rents) annually and according to forward-looking inflation will be key to resetting expectations and protecting competitiveness.

Russia

The overall environment for doing business in and with Russia remains unfavorable due to the ongoing war in Ukraine. The war continues to create an increasing financial burden on Russia due to high military spending and fiscal support in addition to staff shortages.

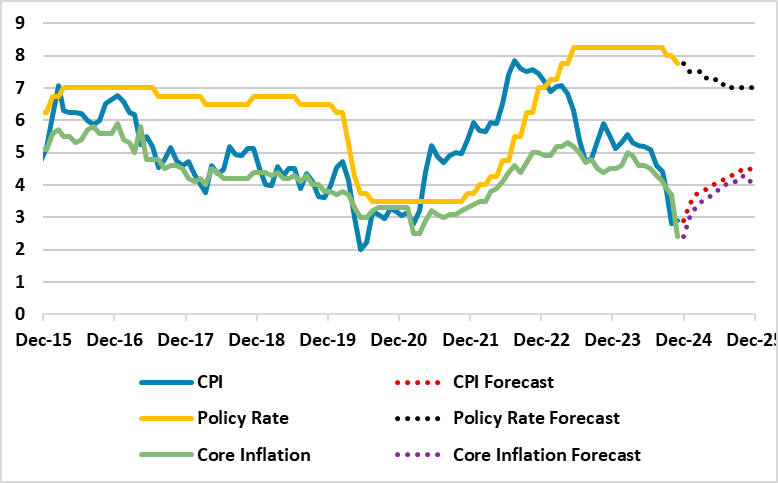

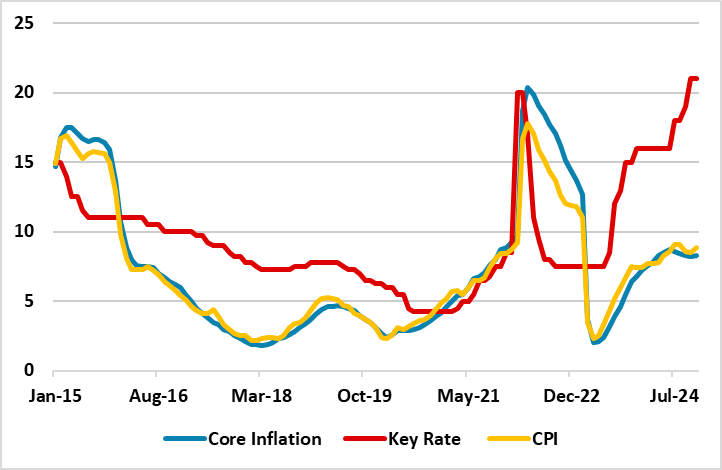

Russian economy is currently being squeezed with inflation spiking, fiscal deficit widening and RUB under pressure. CPI has steadily increased from the low of 2.3% in April 2023 to 8.9% in November 2024 as import suppression, labor shortages, supply-chain disruptions and a weaker currency exerted upward pressure on prices, considering inflation remains far above the CBR’s medium term target of 4%.

We predict annual average inflation to hit 7.4% and 5.1% in 2025 and 2026, respectively. Despite CBR’s inflation target for 2025 remains at 5-5.5%, we think it will be very tough to reach these targets under current circumstances. (Note: We think CBR shall revisit this target range, and help shift inflation forecasts). As restrictive monetary policy partly suppresses prices with lagged impacts, we feel cooling off inflation will take longer than the CBR anticipates since inflation expectations of households and businesses continue to edge up. Inflation is projected to moderately slow down after Q2 2025 as tight monetary policy will likely affect bank lending and private consumption, but the war in Ukraine will be critical for the inflation trajectory.

The inflation outlook continues to be affected negatively after the RUB lost about 15% against the USD due to panic buying of foreign currency in the wake of new U.S. sanctions on Russian banks including Gazprombank late November. Despite CBR halted foreign currency purchases in response to the RUB fall, the RUB stayed well above the 100 threshold. We expect RUB would remain volatile in 2025, inflationary pressures won’t likely start to soften and macroeconomic instability will remain substantial, though a ceasefire in Ukraine is likely (here) and this could underpin the RUB – a RUB recovery requires a peace deal to lift sanctions, which could take years. .

We think CBR will likely start considering cutting rates in Q3 2025 if inflation starts cooling off, RUB stabilizes and inflation expectations would converge to CBR’s forecasts. Our 2025 end-year key rate forecast is 19% and 12% for end-2026.

Figure 6: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – November 2024

Source: Continuum Economics

The main driver for the GDP growth remains the surge in military spending, supported by the improved consumer demand amid greater outlays on social support, higher wages and strong fiscal stimulus. There is an increased public spending in war-related industries and construction in Russia as public spending is at unprecedented levels as around 40% of the government budget is spent on the war. We envisage growth to hit 1.6% and 1.5% in 2025 and 2026, respectively, which is significantly less than 2024 figure, as we foresee a ceasefire declared in 2025 lowering Russia’s military spending and fiscal support.

On the war, despite the stalemate at the front lines due to harsh winter conditions, both Ukraine and Russia still try to gain negotiating power before the start of ceasefire and then peace negotiations which are more likely during Trump’s second term and given Putin feels concessions can more easily won. After Trump was elected for his second term, we foresee two major and one alternative scenario in Ukraine.

Our first scenario is based on a negotiated settlement backed by the Trump administration, which could help Russia to gain assurance of no NATO/EU entry in the foreseeable future for less than current territories (i.e. 10%-15% of Ukraine territory). As a second scenario (25%), Trump significantly cuts military and financial support to Ukraine immediately, and forces Ukraine for a Russia-friendly peace deal based on current territories and Russia occupying around 20% of Ukraine’s territory. This would also include no NATO/EU entry in the foreseeable future. Our alternative scenario (20%) sees a prolonged war after ceasefire talks fail since Putin insists on his peace terms. If a ceasefire takes place (and an effective peace deal is signed afterwards) in 2025/2026, Russian economy will feel the relief since RUB will likely strengthen, average headline inflation will soften, and fiscal pressure will ease.