Soaring Inflation Hits Two-Year High in March with 10.3% YoY

Bottom Line: According to Russian Federal Statistics Service (Rosstat) data, inflation ticked up to 10.3% YoY in March after hitting 10.1% in February, remaining well above the Central Bank of Russia’s (CBR) midterm target of 4%, due to surges in services and food prices, huge military spending, labor force crisis and elevated inflation expectations. We think that risks to the inflation outlook will remain upside until the war in Ukraine comes to an end while it appears the way to a full-scale peace deal in Ukraine will be very bumpy.

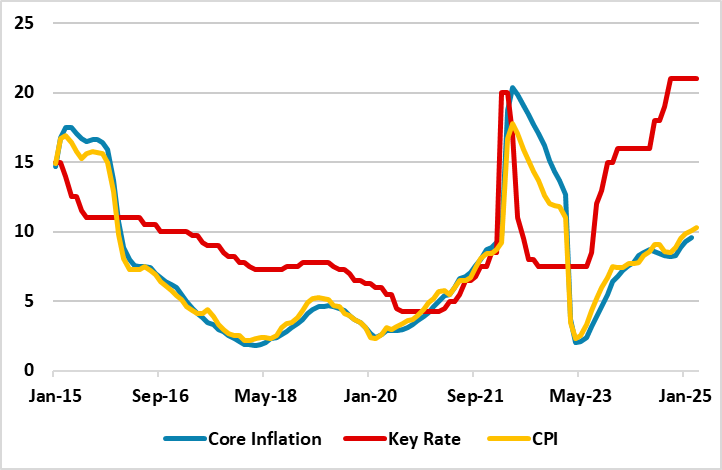

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – March 2025

Source: Continuum Economics

According to Rosstat figures, the inflation rate hit 10.3% % YoY in March, the highest reading since February 2023. MoM price growth fastened to 0.7% in March driven by the services and food prices. The prices of food and services soared by 12.4% and 12.9% in annual terms, respectively, in March. Consumer prices surged by 0.7% MoM and nonfood prices ticked up by 0.14% monthly and 5.9% YoY.

Speaking about the inflation, CBR governor Nabiullina stated on April 8 that she remains very concerned that inflation has exceeded the target for four consecutive years. Nabiullina emphasized the importance of maintaining low inflation for the overall economy mentioning CBR will act prudently concerning key rate lowering and there is a need to make sure that the deceleration of price growth rates remains sustainable.

Correlatively, according to a recent assessment by CBR, a long period of keeping tightened monetary conditions is required in their base case scenario. CBR highlighted that it will consider lifting the key rate if the disinflation rate proves to be insufficient for the return to the inflation target by 2026.

Despite lagged impacts of monetary tightening, it appears the economy remains overheated as the growth in domestic demand is still significantly outstripping the capabilities coupled with strong fiscal support to military staff and their families and elevated inflation expectations.

Under current circumstances, we continue to feel reaching 4% target will be very tough even in 2026 since cooling off inflation will take longer than CBR anticipates taking into account that demand stays elevated and inflation expectations of households and businesses continue to edge up due to sanctions.

We foresee a probable Russia-friendly peace deal in Ukraine could ease some pressure on inflation, alleviate demand-supply imbalances within Russia's economy, and be a relief for war-torn economy despite it appears the way to a full-scale peace deal will be very bumpy. We think that risks to the inflation outlook will likely remain upside until the war Ukraine comes to an end.