Outlook Overview: Rate Cuts Into 2024

- The prospect of DM rate cuts in most countries remains high in 2024, as growth slows and inflation comes back closer to target. Fed, ECB and BOE could start gradually, both to avoid real interest rates increasing and also to ensure that core inflation follows headline inflation lower. However, our analysis suggests that inflation will come to target or just above target, while the EZ/UK will see very weak growth and the U.S. meagre growth. Central bank concerns will likely pivot towards avoiding recessions and hasten persistent rate cutting in 2024 and 2025. We see 125bps from the Fed, 100bps from BOE and 75bps from the ECB. The BOJ will be the exception with a 35bps hike in the policy rate and an end to yield curve control, but a further shift from ultra-easy policy will then be unlikely.

· Uncertainty still prevails around this central view. The impact of lagged monetary tightening could be greater than our estimates and deliver mild recessions in some DM countries. We also feel that the disinflationary process could be stronger and this would help bring inflation back to target quicker. This means that the skew on DM monetary policy outlooks is for more aggressive action than our baseline forecasts.

• EM central banks in contrast are driven largely by domestic fundamentals and geopolitics. Mexico/India/Indonesia/South Africa are among some of the central banks that will likely join Brazil in cutting interest rates, but the pace will vary depending on the degree of restrictive policy and how soon inflation is projected to get sustainably back to target. Weaker EM and frontier economies can still be adversely impacted by debt distress and sticky inflation, as the lagged feedthrough to an era of higher global interest rates still feeds in during H1 2024.

• 2024 is key for elections including U.S./India/Indonesia/S Africa/Russia/Mexico and Taiwan. The DPP will likely win the Taiwan presidential election race, which will likely then see large military exercises/gray warfare by China in spring/summer and raise the geopolitical temperature – though we think the risk of an invasion remain low (here). The Ukraine war will likely remain deadlocked and a frozen conflict, unless Donald Trump is elected U.S. president and threatens to curtail Ukraine funding and U.S. membership of NATO. Meanwhile, a third term for prime minister and Bhartiya Janta Party leader, Narendra Modi is anticipated in India.

• Financial markets will focus on the shift towards DM easing, which should help equity sentiment. However, with the U.S. overvalued it is unlikely to outpace other DM equity markets and we like the UK helped by really cheap valuation and the prospect of a more EU friendly Labour government. India and Brazil are favored in EM equities, with China economic headwinds remaining large meaning that any outperformance is likely temporary. Short-dated bond yields will likely come down noticeably, though much less at the long-end of the curve as real rates are not now excessively high in the DM world. H1 2025 could also see a further U.S. debt ceiling drama and risk of U.S. ratings downgrades.

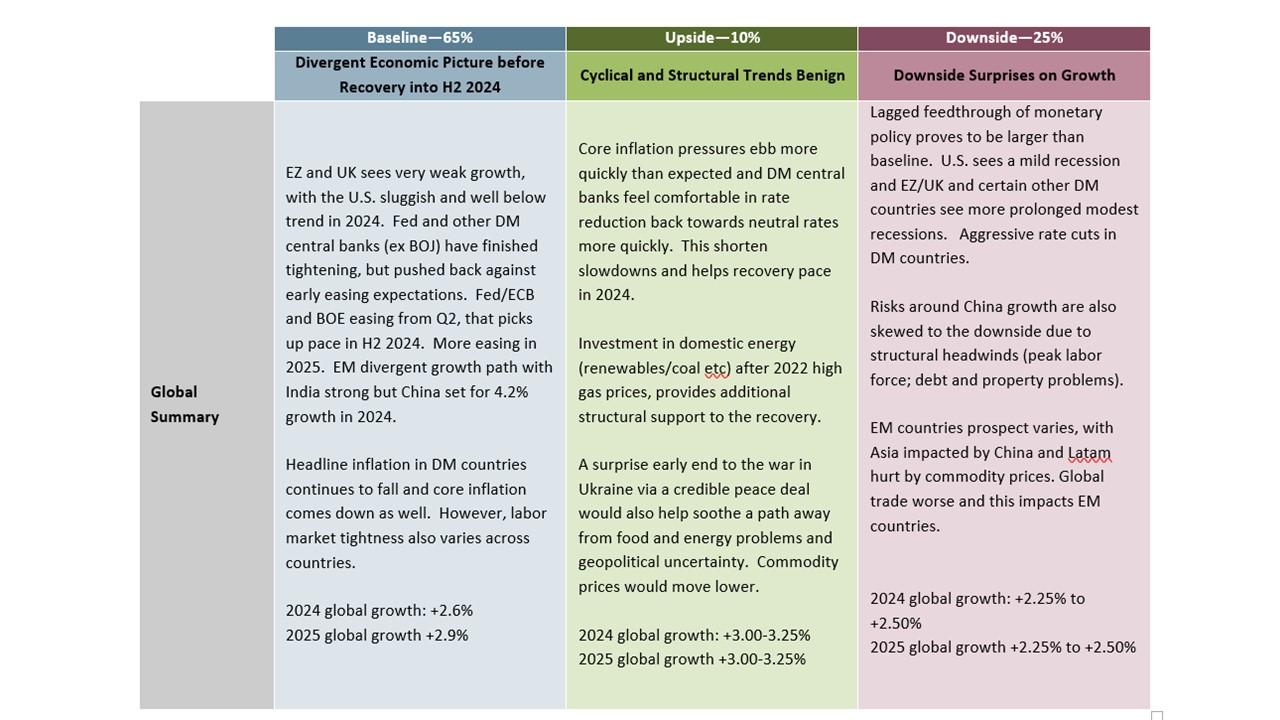

Risks: DM countries could see stronger lagged effects on the economy from the 2022-23 monetary tightening that could prolong the EZ/UK recession or move the U.S. slowdown towards a mild recession. Separately, in China the impact of the residential construction decline could be stronger than expected in economic and financial instability terms and cause noticeable downside risks to our baseline China forecast. This may negatively affect EM economies. (Figure 1).

Figure 1: Economic Scenarios

Source: Continuum Economics

Figure 2: Policy rate and 10yr Yield Changes Since Start of 2022 (%)

Source: Continuum Economics, latest December 18

Market Implications

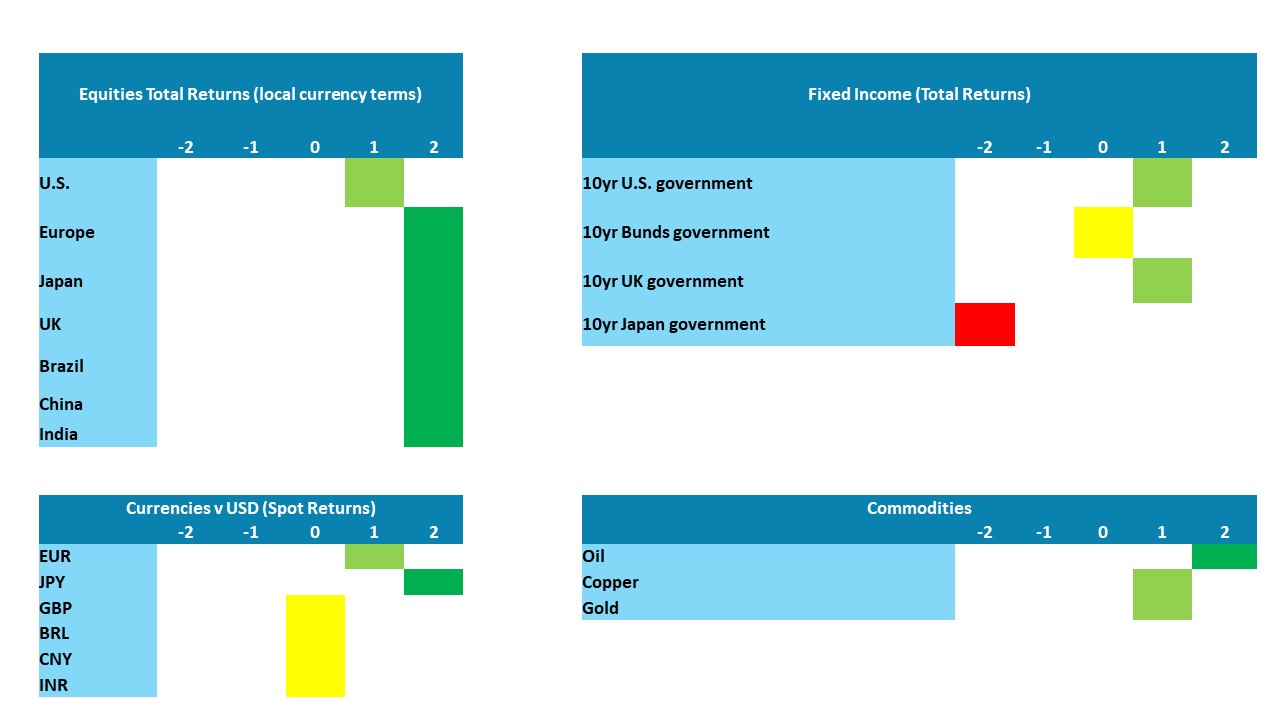

Figure 3: Asset Allocation for 12 Months to end-2024

Source: Continuum Economics. Note: Asset views in absolute total returns from levels on December 18 (e.g., 0 = -5 to +5%, +1 = 5-10%, +2 = 10% plus).

· Government bonds: Short-dated yields are not discounting the multi-year easing we projected for most DM countries and remains the favored part of the curve. Long-dated bonds will see the traditional swing back to a positive yield curve and also face QT and U.S. budget concerns. This should mean that the decline in long-dated yields is much less. We see U.S. 10yr yields at 3.70% and 3.90% for end 2024 and end 2025.

· Equities: Rate cuts and decline in short-dated bond yields helps improve risk sentiment towards equities, but gains are modest (circa 4-10%) in DM countries. Strong nominal GDP growth and corporate earnings means India remains one of our favored markets in EM, alongside Brazil helped by persistent rate cuts.

· FX: USD loses ground modestly against DM currencies, as Fed rate cuts undermine USD sentiment against the starting point of an overvalued USD. JPY is the most out of line and can see a noticeable adjustment. EM currencies mixed against the USD, as some cut interest rates (e.g. Brazil/Mexico/India) or have structural problems (e.g. China). Lower U.S. inflation will also mean that inflation differentials are an issue as well for most EM currencies.

· Commodities: Oil demand downgrades should stabilize with a recovery in the global economy into 2025 and OPEC+ sustain production cuts through most of 2024. This can help produce a modest rise in oil prices and we see WTI at $87 by end 2024.

Figure 4: Key Events and Critical Uncertainties

January 13, 2024

| Taiwan Election

| The ruling Democratic Progressive Party (DPP) according to recent opinion polls continue to enjoy a clear lead and are likely to win with the two main opposition parties having failed to agree on a single candidate. China opposes the DPP and post-election an increase in gray warfare will likely be seen involving more military exercises and posturing, though we see an invasion as highly unlikely (here). |

February 14, 2024

| Indonesian General Election

| The outcome of Indonesia’s upcoming presidential and legislative elections remains uncertain, as in the run-up several coalitions are being formed. It is expected to be a close contest. For now, it appears that Prabowo Subianto in the leading presidential candidate. Additionally, while no clear majority is expected, the current largest party, the Indonesian Democratic Party of Struggle (PDI-P) is anticipated to retain top spot. |

March 31, 2024

| Turkiye Local Election

| After Erdogan won presidential elections and AKP won parliamentary majority in May, 2023, AKP wants to “win” major cities back in local elections on March, 31, 2024. Currently CHP mayors administer the municipalities of Istanbul, Ankara and Izmir. We think the election outcomes for Ankara and Istanbul are too close to call this far out while Izmir will likely remain administered by a CHP mayor. Whoever wins, the budget deficit is expected to surge particularly in Q1 2024 due to pre-election spending, which would squeeze the beleaguered economy further. |

March 17, 2024

| Russia Presidential Election

| Presidential elections are scheduled to be held in Russia on March 17, 2024 to appoint a leader until 2030. Putin remains as the strongest candidate according to various polls and we think he would win the elections as he is seen as the most popular political figure in Russia. Putin announced his candidacy on December 8. As the opposition remains weak in Russia, it’s highly likely that Putin will be in office until at least 2030, and could continue his tenure until 2036. |

April to May 2024

| India Elections

| Given the ruling Bhartiya Janta Party’s recent victories in key Indian states, it appears that the up-coming national elections will see another Narendra Modi wave. Mr Modi remains the top candidate for the position of prime minister, and will likely secure a majority in the upcoming 2024 national elections. Opposition alliance is only likely to dent the majority margin, albeit only marginally. |

May 2, 2024

| UK Local Elections (Possible General Election)

| Local Council are up for re-election in many parts of England, with the ruling Conservative government having to defend major gains when they were last held back in 2021. This would be the last election before a general election that has to be held by January 2025, but if there is a giveaway Budget in March, the government could call an early general election to be held alongside these local ones. |

May to August 2024

| S Africa Election

| General elections in South Africa is due in 2024. We think ANC is at risk of losing its majority as ANC’s popularity is in decline due to power cuts, unemployment, inequality, the rising cost of living, and corruption. Democratic Alliance, the second largest party, together with the Inkatha Freedom Party and other smaller parties initiated the Multi-Party Charter for South Africa to unite opposition, but left Economic Freedom Fighters outside, which is the third largest party. According to recent polls, a coalition government at national level seems probable, for the first time in country’s history, as support to the ANC is below 50% according to most of the pools. We think a clear ANC victory would be a positive surprise if Ramaphosa remained president, but the election outcome is close to call this far out. |

June 6-9, 2024

| European Parliamentary Elections

| MEPs have recently vote to increase EU Parliament size as a disagreement with national ministers continues. MEPs on the aim one year ahead of the election is create 11 extra seats in the European Parliament while also saving 28 for the potential creation of a transnational constituency. Given recent national election results and polls, the performance of right-wing Eurosceptics will be the most scrutinized. |

July 2024

| Mexico General Election

| Mexicans are going to elect the President to serve a six-year term, bear in mind that incumbent President Manuel Lopez-Obrador is not going to be a candidate as Mexican Constitution vetoes re-election. Additionally, 128 members of the Senate will be elected for a 6-year term and 500 members of the Chamber of Deputies for a 3-year term. Lopez-Obrador Party, MORENA, is likely to win the Presidential election and hold the majority of the two chamber, but a 2/3 control, which would allow MORENA to pass legislation by itself, is an unlikely scenario as the traditional parties PRI and PAN will also hold a significant number of seats. |

October 2024 | Brazil Municipal Elections | All Brazilian municipalities will hold elections to decide the mayor of the municipality and the members of the local assemblies. |

November 5, 2024

| U.S. Elections

| For President, another contest between President Joe Biden and former President Donald Trump looks increasingly likely. It will be close though we still lean to a win for Biden. Trump’s current lead in the polls largely reflects views on Biden. Come the election, negativity towards Trump may outweigh negativity towards Biden. The contests for Congress will also be close. Republicans look likely to regain control of the Senate, where the Democrats are defending more vulnerable seats, but dysfunctional Republican leadership in the House gives the Democrats a good chance of regaining control there. |