Federal Reserve

View:

August 22, 2025

Fed Powell: Signals September Cut

August 22, 2025 2:35 PM UTC

Fed Chair Powell spent the first 10 minutes at Jackson hole reviewing current data and discussing the policy stance. Powell clearly signaled a September cut, given downside risks to employment after the July employment report revisions. However, Powell did not signal whether the move will be 25b

August 18, 2025

U.S. Strategic Fiscal Comparisons

August 18, 2025 9:05 AM UTC

The U.S. short average term to maturity is a structural fiscal weakness if higher rates lift U.S. government interest costs close to the nominal GDP trend. Hence, Trump’s pressure for fiscal dominance of the Fed to deliver lower policy rates and reduce U.S. government interest rate costs. Howeve

August 14, 2025

U.S. Markets: Soft Versus Hard Landing

August 14, 2025 1:02 PM UTC

A mild recession would likely trigger the Fed to ease quickly to 2.0-2.5%, which would produce yield curve steepening but would likely drag 10yr yields down to 3.50-3.75%. The S&P500 would likely fall to 5000 in this scenario, as corporate earnings are axed; buybacks slow and the price/ea

August 13, 2025

September Fed ease now more likely than not, but far from assured

August 13, 2025 3:29 PM UTC

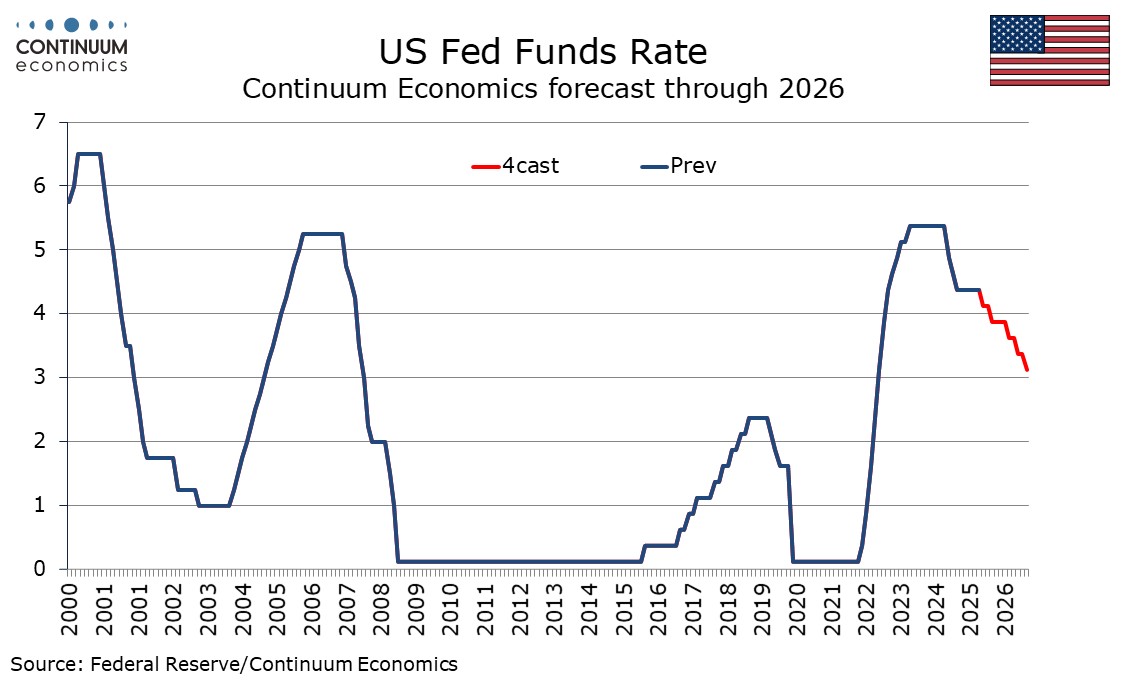

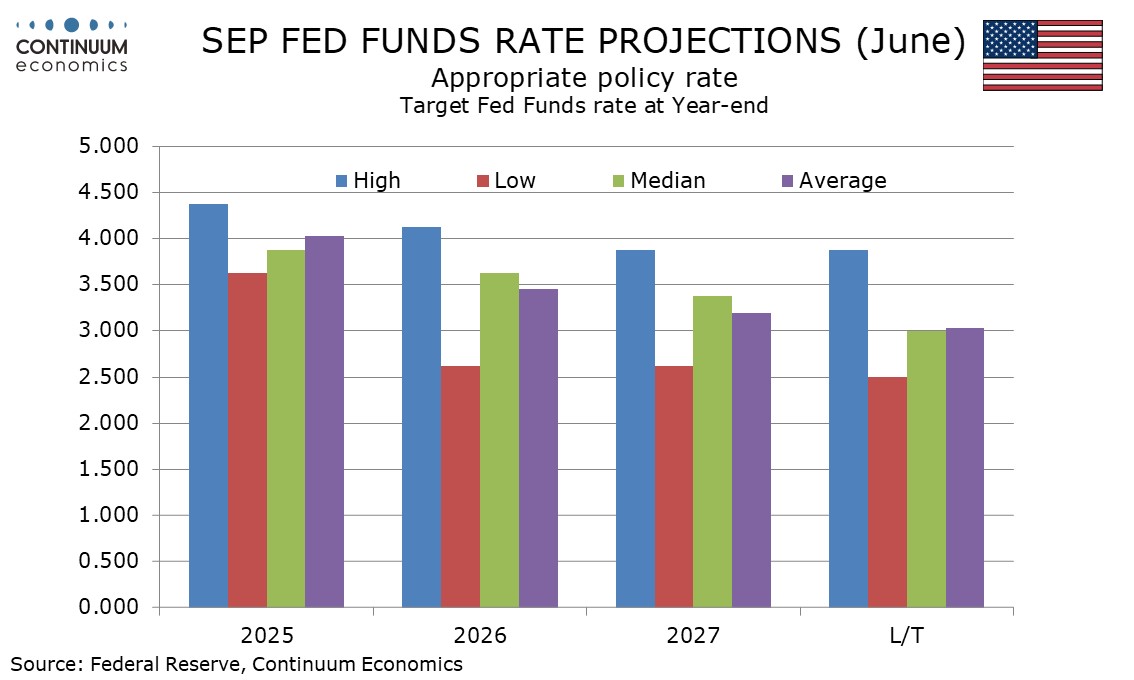

A September FOMC easing now looks more likely than not, but remains far from a done deal. We are however revising our call to two 25bps FOMC easings this year, in September and December, from just one, in December. 2026 is harder still to call given threats to Fed independence, but we continue to ex

August 12, 2025

August 08, 2025

August 07, 2025

EM Rates: Domestic Fundamentals Dominate

August 7, 2025 9:30 AM UTC

Once trade is agreed with the U.S., the good fundamentals actually argue for a 10yr Mexico-U.S. spread close to 400bps and this is our favored strategic risk reward for big EM government bonds. In Brazil a case can be made for a 12.75% policy rate end 2026 and 10% in 2027, but this could only mean 1

August 06, 2025

U.S. Immigration Slowdown and the Labor Market

August 6, 2025 7:58 AM UTC

Overall, slower illegal and legal immigration will likely slow employment growth and curtail the rise in the unemployment rate from the U.S. economic slowdown. More older workers or an increase in the percentage of female workers would help, but are not a priority for the Trump administration and

August 05, 2025

DM Rates: Slowdown Debate Trump’s Independence Question for Now

August 5, 2025 9:50 AM UTC

U.S. Treasury spreads versus other DM government bond markets or 10-2yr U.S. Treasuries are not yet showing a risk premium from the Trump administration attacks on the Fed and economic data. Debate over whether the U.S. is seeing a soft or hard landing are reemerging and this will dominate the outlo

August 04, 2025

Trump Tougher Posture with Russia

August 4, 2025 8:31 AM UTC

We suspect that Trump will not follow-through with an across the board secondary sanction on importers of Russia oil, as it would freeze U.S./China trade again and could boost U.S. gasoline prices – high inflation is one main reason for Trump’s softer approval rating. Trump could agre

August 01, 2025

Reciprocal Tariffs: Some Hikes, Deals and Delays

August 1, 2025 8:40 AM UTC

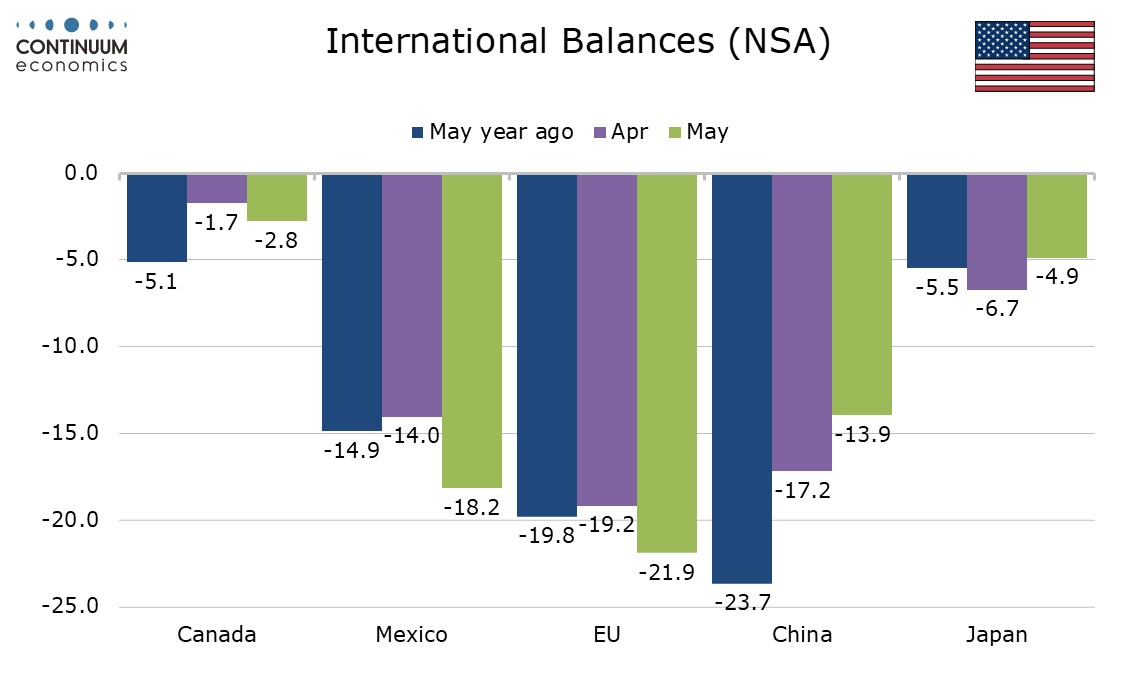

Though high reciprocal tariffs with some countries catches the headline, five of the top 10 countries with large bilateral deficits have reached framework trade deals, two have delays and three have higher tariffs imposed. With exemptions on some USMCA Canada/Mexico goods, plus phones/ semicondu

July 30, 2025

Fed's Powell Remains Cautious Over Tariff Risk

July 30, 2025 7:34 PM UTC

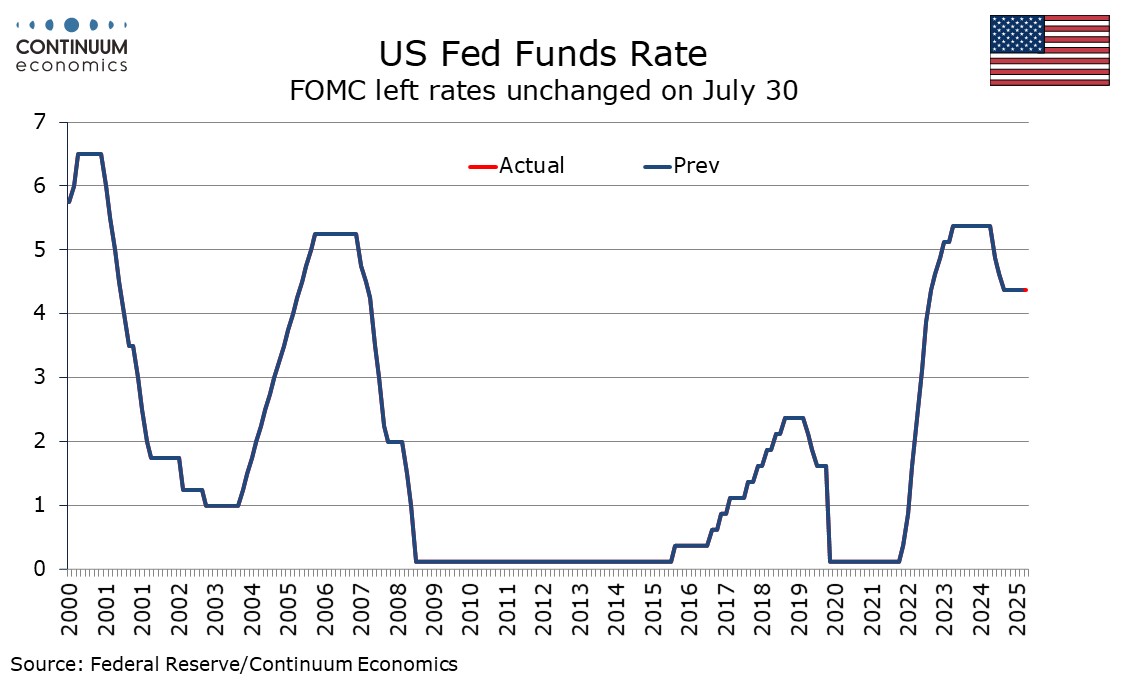

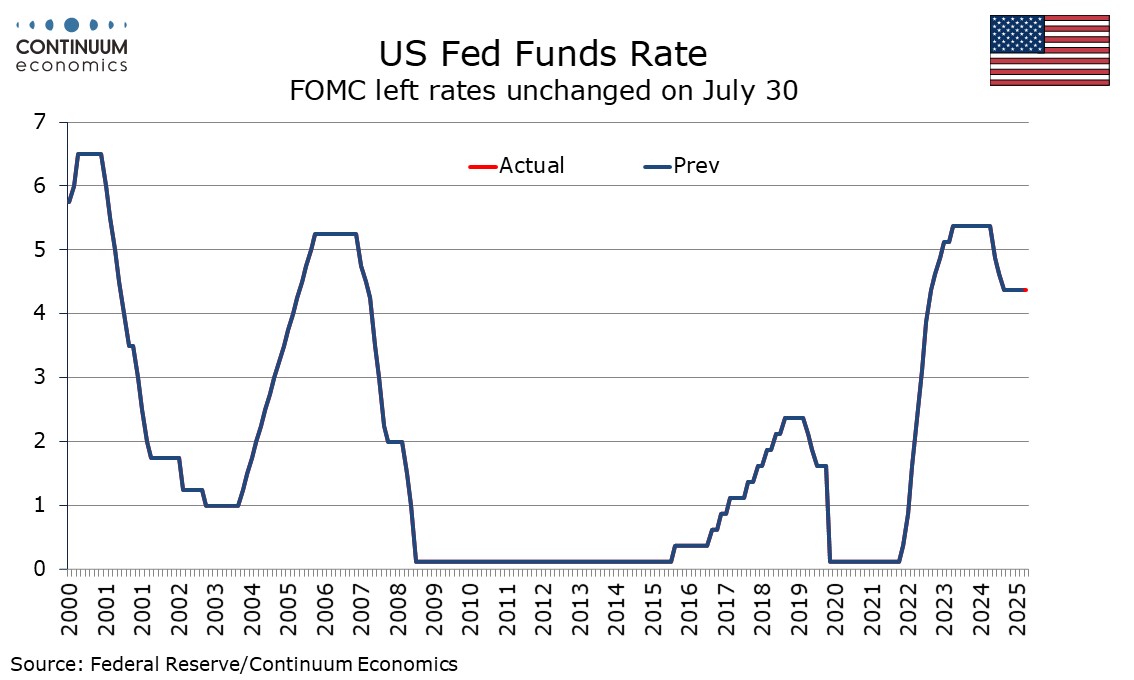

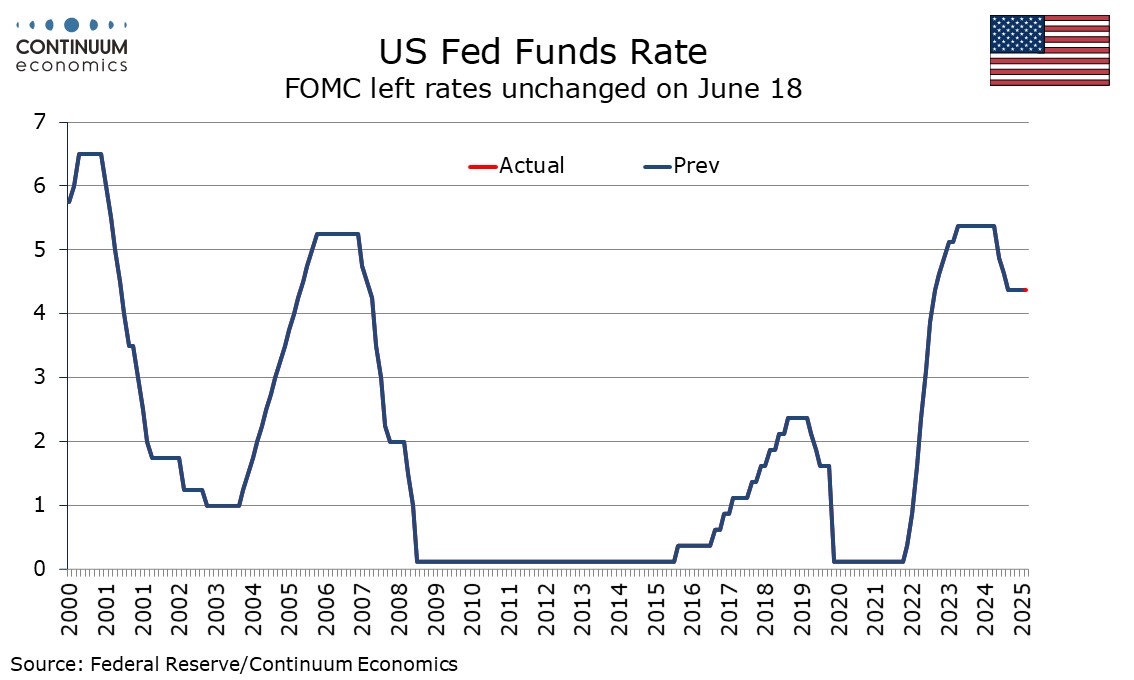

The FOMC left rates unchanged at 4.25-4.5% as expected, though there were two dissenting votes for easing, from Governors Waller and Bowman, who had already given signals in that direction. The statement made a concession to the doves stating that growth moderated in the first half of the year, but

FOMC leaves rates unchanged, two dissents for easing, language more dovish on growth

July 30, 2025 6:16 PM UTC

The FOMC left rates unchanged at 4.25-4.5% as expected, though there were two dissenting votes for easing, from Governors Waller and Bowman, who had already given signals in that direction. The wording of the statement also contains a dovish shift, stating that growth moderated in the first half of

DM Household Sluggish Borrowing

July 30, 2025 10:45 AM UTC

· Overall, restrained credit supply from banks; abundant employment/income or wealth for most households but restrained financial conditions for low income households could have restrained household lending growth to GDP. However, the surge in government debt and ensuing fear of fut

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

July 24, 2025

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

July 23, 2025

Trump Deals: Japan, Philippines and Indonesia

July 23, 2025 8:26 AM UTC

• Other countries cannot be guaranteed to get a Japan style deal, both as Japan is the key geopolitical ally in the Asia pivot against China and as Trump is keen to agree deals by August 1. India and Taiwan are trying to finalize deals, but the EU is more difficult. China 90 day deadlin

July 18, 2025

Trump’s and Fed Easing

July 18, 2025 9:34 AM UTC

• Trump goal of substantially lower short-term rates could be achieved with a recession, but otherwise is unlikely even when Fed chair Powell is replaced. The majority of voting FOMC members will make decisions based on economics not politics. However, Trump fixation with lower rates an

July 17, 2025

Trump’s Tariffs and Markets

July 17, 2025 12:00 PM UTC

The assumption in financial markets is that some trade framework deals will be done by August 1; some countries will make enough progress to be given an extra 30 days and some countries could have higher tariffs implemented. This would be broadly consistent with the average 15% tariff that is widely

July 16, 2025

July 15, 2025

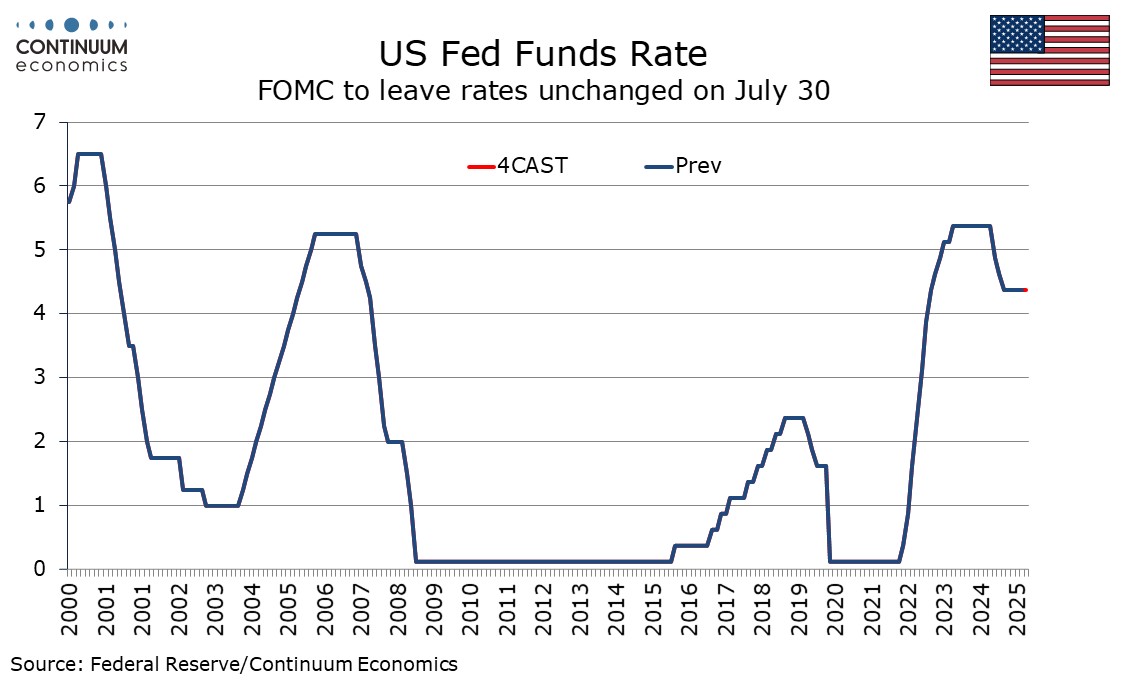

FOMC Preview for July 30: No change given uncertainty on tariffs and their consequences

July 15, 2025 6:15 PM UTC

The FOMC meets on July 30 and recent data suggests no reason to move rates from the current 4.25-4.50% level, though Q2 GDP data due on the morning on the decision will impact the wording of the statement. This meeting will not see an update to the dots leaving focus on Chairman Powell’s press con

July 14, 2025

Tariffs: Seeking a Trigger for the TACO Trade

July 14, 2025 4:28 PM UTC

It has been fairly clear for some time that 10% represented a likely floor for the eventual Trump tariff regime. However, expectations that Trump would not be willing to go dramatically above that are being tested. A rate in the mid-teens still looks the most likely outcome, as the economic damage t

July 11, 2025

July 10, 2025

July 09, 2025

FOMC Minutes from June 18 - Doves in the minority

July 9, 2025 6:48 PM UTC

FOMC minutes from June 18 show agreement to leave policy at 4.25-4.50%, and general agreement that the FOMC was well positioned to wait for more clarity. While there was some debate over the future outlook, doves appear to be in the minority. A couple were open to easing at the next meeting in July,

July 07, 2025

Putting Names to the FOMC Dots

July 7, 2025 5:35 PM UTC

There are nineteen FOMC dots. Seven hawks expect no easing this year, and two expect only one 25bps move. Eight are on the median seeing two 25bps moves, while two doves are looking for three. While only two have clearly signaled what their personal dot is, reasonable estimates can be made to identi

July 02, 2025

DM Central Banks: Overlooking Lagged 2021-23 Tightening and QT?

July 2, 2025 8:30 AM UTC

We are concerned that DM central banks are underestimating the lagged impact of 2021-23 tightening and ongoing QT, which impacts the transmission mechanism of monetary policy. Central banks need to consider cyclical and structural issues, but also need a more rounded view of the stance and implica

July 01, 2025

Trump Tariffs: Poker Face?

July 1, 2025 12:55 PM UTC

Our central scenario (but less than 50%) is towards a scenario of compromise, with some agreements in principle or trade framework deals, delays for most other negotiating in good faith but with one or two countries seeing a reciprocal tariff rise e.g. Spain and/or Vietnam. This could still be fol