China Outlook: The Struggle to Hit 5% Growth

China’s 5% growth target will likely be tough to meet with residential property investment likely to knock 1.0-1.5% off GDP and net exports a small negative. With sluggish private investment, this means some of the old engines of growth are not firing. Some additional fiscal stimulus will likely be seen on top of March’s Yuan1trn announcement, but we feel that this will not be enough – we have marginally increased our 2024 real GDP forecast to 4.4% from 4.2%.

· More serious is that we project CPI inflation at +0.5% in 2024. Even if pork prices stabilize, aggressive disinflation is coming from an excess of production over consumption. This is being compounded by a redirection of some exports into the domestic market and core inflation will likely remain below 1% in 2024 and 2025.

· Further monetary policy stimulus will likely be delivered, though policymakers’ caution on the Yuan and not overstimulating old economy sectors points to a further 30bps cut for the 1yr medium-term lending facility (MLF) and 50bps for large bank reserve requirement ratio (RRR) in 2024. Further fiscal stimulus later in 2024 is also likely but we see this as being measured rather than targeted, as China’s authorities remain worried about the overall debt/GDP build-up in China’s economy.

· Risks to the Outlook. The risks are skewed to the downside for real GDP growth, as the adverse feedback loops from the sharp fall in new construction of residential property could be larger than our baseline and causing multiple problems for developers/households/local authorities and weaker banks. Thus we attach a 25% probability to a 3.0% GDP growth in 2024.

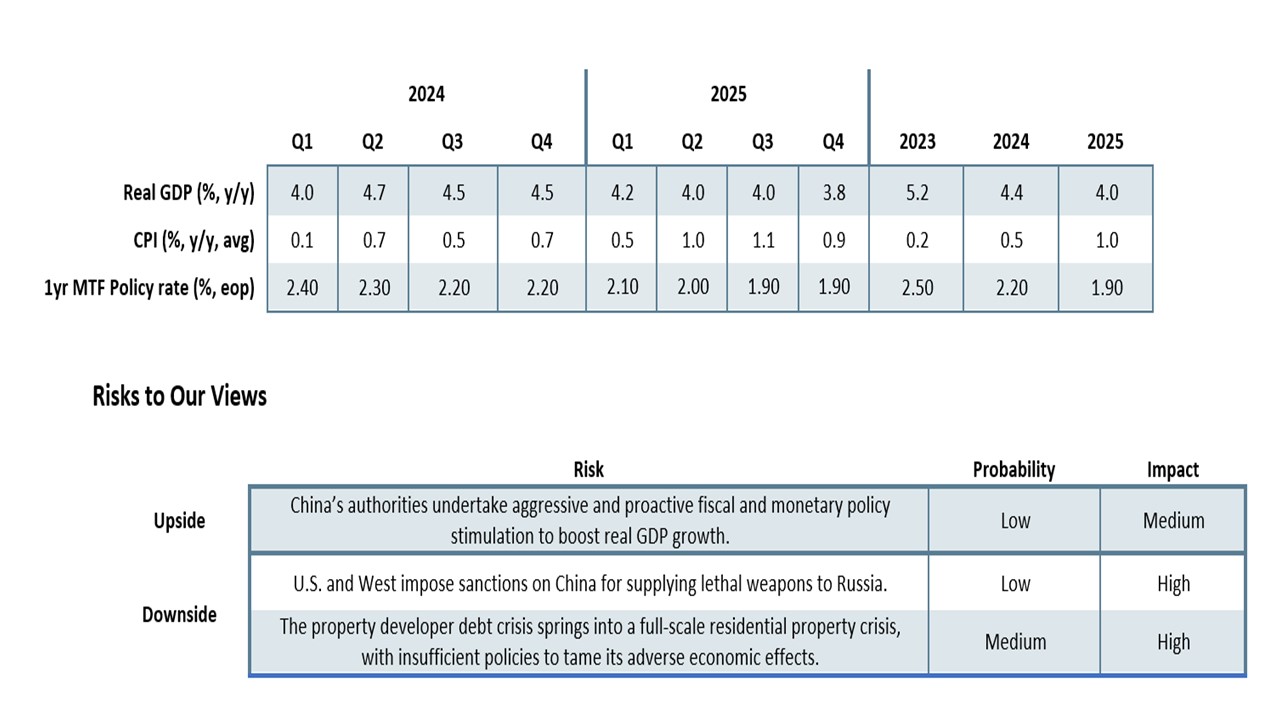

Our Forecasts

Source: Continuum Economics

Many Headwinds to Growth

Figure 1: Estimate Average Annual Housing Demand (Mln Sqm)

Source: IMF Article IV 2024, selected issues (here)

China has set a 5% goal for 2024 real GDP growth as widely expected. To help, Premier Li Quang also announced a Yuan1trn extra-long dated special sovereign bond issue, beyond the official 3% target for the central government deficit. This will be used for major projects and national security issues, which will boost public investment. This will help push up GDP growth up a small amount, as local government investment is restricted in the most heavily indebted regions.

While this new fiscal spending will help, it will be insufficient to really hit 5% growth. Firstly, the fallout from the sharp decline in residential construction will still be negative on the economy in 2024, with home sales weak over the crucial lunar New Year period (here). Household sentiment towards buying residential property has been severely hit by the crisis among developers, while developers also have a large excess inventory – especially in tier 3 cities. Fundamental demand for new houses is also on a multi-year downtrend, both due to population aging and a slowing pace of urbanization (Figure 1). While China’s authorities’ central view is that the housing market should stabilize, the negative feedback loops remain through lower employment; weaker local government finances and spending and less steel and cement production growth. Indeed, the interaction of an overhang of excess inventory and the structural slowdown in demand will likely mean that residential investment knocks 1.0-1.5% off GDP in 2024 and will still likely see negative contribution to GDP in 2025-27. The official resistance to accept large house price declines to clear the market means that the hangover from the residential property construction bust of 2021-22 will last at least half a decade. This points to an L shaped future for residential property investment contribution to GDP growth.

Secondly, net exports are also likely to be a small drag on GDP in 2024, both due to slower global growth in 2024 and some supply chains shifting away from China (here). Global companies have shifted some supply chains back onshore post COVID for resilience, while the Ukraine war has prompted a move towards some friendly shoring. Additionally, the tensions between China and Taiwan cause global companies nightmares around a China/Taiwan war scenario. While we see the risk of a war as low in the next 5 years (here), global companies will only slow or stop the precautionary shift of some China centric supply chains when Beijing signals peace with Taiwan – highly improbable politically.

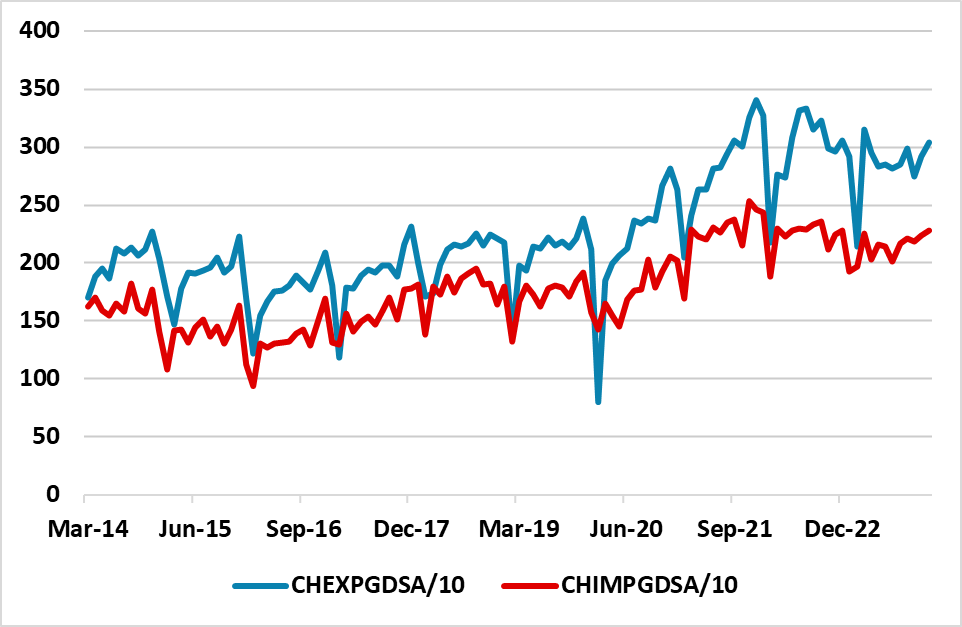

Figure 2: Monthly Export and Trade Balance Level (USD Blns)

Source: Datastream/Continuum Economics

Moreover, Donald Trump’s threat to impose up to 60% tariffs on China should he be elected president is yet another reason for global companies to diversify supply chains away from China, which would only intensify if he won in November. Meanwhile, China’s authorities are reluctant to see too much Yuan weakness, though we see some weakness once the Fed starts cutting and a move to 7.40 on USDCNY is forecast for end 2024. This means that the adverse drag from net exports will remain.

Finally, private investment is only showing weak growth outside of the high priority sectors (renewables and high tech manufacturing), as the government crackdown on various sectors has sapped business optimism and the boom years of 1990-2019 are gone. The other dimension is that private companies are the largest employers in China and less optimism means less employment growth and hence lower income growth for households.

This leaves private consumption and public consumption and investment as the key drivers to hit 5% GDP growth. Private consumption is still seeing a rebound from suppressed demand during the zero COVID period and this will certainly help real consumption momentum in H1 2024 via travel/eating out and entertainment. However, this is partially counterbalanced by weakness of consumption related to housing e.g. furniture and white goods. Monthly retail sales data will be vital to watch for the true momentum in the economy. The other alternative is that the government could do more policy stimulus (see below). We still forecast 4.0% growth in 2025, as post COVID pent up demand will have been satisfied and the structural headwinds for residential property/net exports and private sector investment remains.

One argument for further cyclical policy stimulus is the significant undershoot of inflation compared to the 3% inflation target for 2024. We forecast a mere +0.5% for 2024 CPI inflation, which reflects anticipation that official guidance to curb pig production will help to stabilize pig prices and the drag on CPI headline inflation. Nevertheless, core inflation reflects the disinflationary pressures from excess production exceeding modest demand growth internally. With some production being redirected from exports to the domestic economy, plus high production from the state owned enterprise sector, the prospect is that core inflation will likely fall back below 1% in 2024 and 2025. Not deflation but certainly aggressive disinflation.

This does not appear to be helping the economy cyclically through higher real wages, as private sector employment has slowed. Additionally, with nominal GDP set to be 5.0-5.5% in 2024, the total non-financial sector debt/GDP (295% of GDP in 2023) is projected to keep on rising in 2024 as debt growth outstrips nominal GDP growth. Lending to inefficient SOEs means debt growth is having less of an impact in boosting public consumption and investment.

Policy

Further policy measures are likely over 2024. The 50bps cut in the reserve requirement ratio (RRR) in January and 25bps in the 5yr loan prime rate (LPR) in February shows that the authorities are becoming more proactive. Even so, China’s authorities are concerned that cuts in short-term rates could trigger Yuan weakness and capital flight from China, while also being reluctant to restimulate investment too much. A 10bps cut in the medium term lending facility (MLF) is only likely late Q2 and then we look for two further 10bps cuts in the remainder of 2024 once the Fed starts cutting the Fed Funds rate. Additionally, we look for a further 50bps cut in the RRR for large banks to help them sustain M2 lending growth, as weaker city and rural banks slow lending growth. However, this will be insufficient in itself, given weak household demand for loans (close to zero).

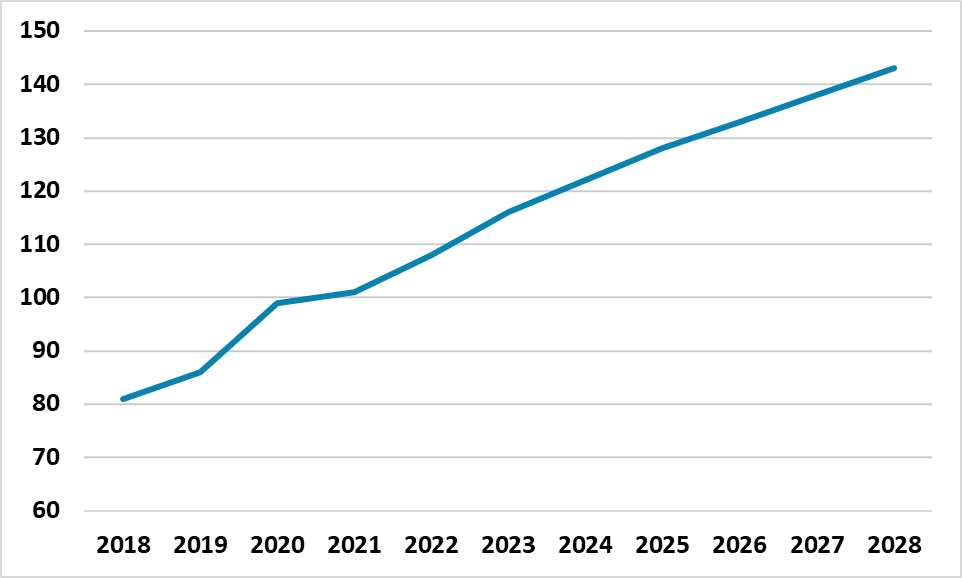

Figure 3: Augmented General Government Debt/GDP

Source: IMF article IV 2024

This means fiscal policy needs to do the heavy lifting in 2024. However, China authorities know that the previous 3% fiscal target for central government does not reflect China’s overall fiscal stance. The IMF have an alternative augmented general government deficit/GDP measures, which includes local authorities’ financing vehicles and other off balance sheet central government funds. This is projected at a huge 13.3% of GDP in 2024, which is excessive. While China authorities will not acknowledge this alternative IMF measure, recent official comments to the IMF suggest caution of additional fiscal stimulation in Beijing (here). This all means that real GDP will likely fall short of the 5% target, though the actual numbers could end up being 5% given measurement errors and government pressure to hit the number. However, we now forecast a mere 0.5% for CPI inflation in 2024, which means that nominal GDP will be around a low 5.0-5.5% of GDP – not enough to stop debt/GDP rising still further. This is not just an issue for household and corporate debt, but also government debt. The IMF augmented debt/GDP measure has jumped from 86% in 2019 to 116% in 2023, as China has used off balance sheet fiscal policy to sustain the economy. However, with no fiscal tightening this would leave the trajectory towards 143% of GDP in 2028 (Figure 3). China’s authorities’ control of domestic debt investors means that they can control the debt market, but it does show the fiscal stimulus space is limited.