LatAm Outlook: Getting Deeper in the Cutting Cycle

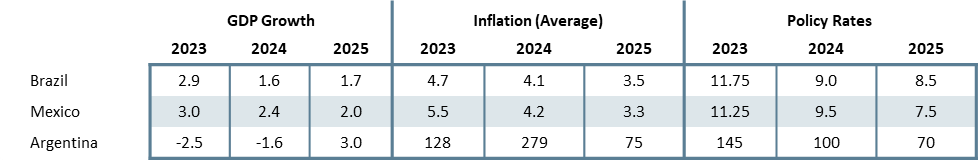

· Brazil and Mexico growth will decelerate from the growth rates seen in 2023. The stronger basis of comparisons in 2023 and the tight monetary policy will diminish growth during 2024. Brazil robust agricultural growth will not repeat in 2024, while Mexico growth is restrained by a tight labor market. Argentina will see a contraction in 2024 due to the strong fiscal and monetary adjustment while we expect some recover from it in 2025.

· Both Brazil and Mexico were able to significantly reduce their inflation rate. We see the fall of inflation slowing down in 2024 as result of inertia and core prices stickiness. We see inflation converging to their Central Bank target only in 2025 although there will be some reduction in 2024. For Argentina, the triple digits’ inflation will continue in 2024 and only slowing down to 75% in 2025.

· In terms of interest rates, we see Brazil and Mexico cutting their interest rate further in 2024. Brazil who started earlier is likely to reduce the pace cuts to 25bps from 50bps and ending the year at 9.25%. Mexico is likely to cut at a 25bps pace meaning their policy rate ends 2024 at 9.5%.

· Forecast changes: From our December outlook, we have lowered marginally our inflation forecast for Brazil and Mexico while we have significantly raised it for Argentina. We have also reduced our policy rates forecast for 2024 as we don’t see either of their central banks applying a pause on their cutting cycle. We have reduced our growth forecast for Argentina in 2024 due to the impacts of the policy adjustment.

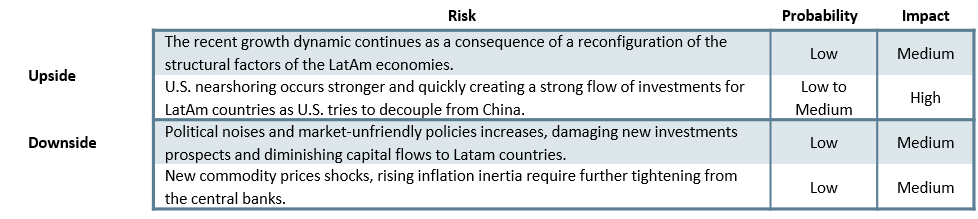

Risks to Our Views

Source: Continuum Economic

Risks to Our Views

Source: Continuum Economics

Brazil: Will it surprise again?

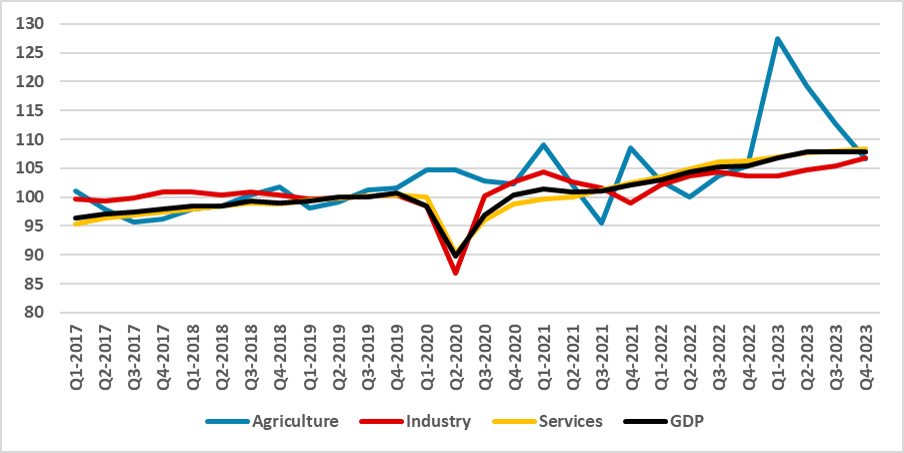

The Brazilian economy has shown robust growth of 2.9% in 2023, surprising most analysts who were initially projecting a 0.8% growth. However, the main story during that year was the spectacular growth in the agricultural sector, expanding by 15% during the year and pushed by strong soybean production. In 2024, the agricultural sector is expected to be somewhat stagnated and not repeat under any circumstances the same performance as last year. Additionally, the Brazilian economy stagnated in the second half of 2023, revealing potential challenges for 2024.

Figure 1: Brazil’s GDP by Sectors (Seasonally Adjusted, 2019=100)

Source: IBGE

We expect most of the growth in 2024 to be generated by internal demand. First, the labor market has been quite strong in the last year, coupled with both job creations and wage increases. Additionally, the minimum wage was readjusted above inflation, and due to the state and municipal elections, government spending at the subnational level will increase this year. This will account for a push in growth, especially in the first half of 2024. We forecast the Brazilian economy to grow around 1.6%, a bit below the general consensus of 1.8%.

In 2025, the story for growth will be much more difficult to predict. Although there is some room to grow through labor absorption, we believe this will be limited by the ending of the demographic bonus. Additionally, although new investments are being pushed, they are still timid and looking externally Brazil’s main trading partner, China, will decelerate. We expect Brazil to be poised to come back to its pre-pandemic trend, and one thing to look at is whether the government will seek to increase growth through additional spending or not. We forecast 1.7% growth for 2025, which is close to our long-term growth forecast.

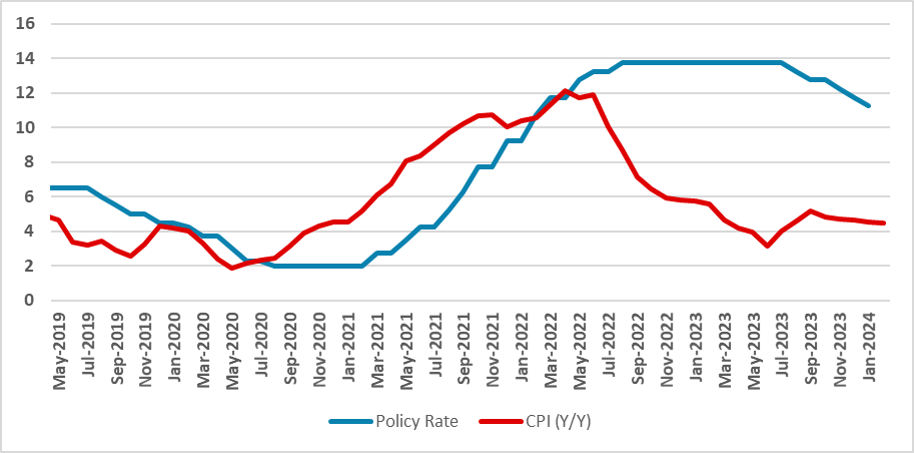

Looking at the inflationary outlook, it is difficult to deny the work of the Brazilian Central Bank (BCB) to lower it. At the moment, inflation is at 4.5% (y/y), just at the upper bound of the BCB band (1.5%-4.5%), but still a bit far from the central target. We expect inflation to be a bit stickier in 2024 and falling slower. One risk in the short term is the impact of El Niño on the prices of food and beverages, although we don’t expect it to be catastrophic, there will be some impact in the first half of the year. We expect the CPI to end 2024 at 4.1% (y/y average). In 2025, we believe inflation will slow down to 3.5%.

Figure 2: Brazil’s CPI and Policy Rate (%)

Source: IBGE and BCB

The Brazilian Central Bank has already started to cut interest rates, which are now at 11.25%, dropping from the peak of 13.75%. Due to the recent communication of the bank and the inflationary outlook, we are no longer seeing the BCB undertaking a pause in rate cuts but rather only diminishing the pace of cuts to 25bps from the current 50bps. We believe this drop is likely to occur in June. Therefore, with all the cuts, the policy rate will finish 2024 at 9.0%. In 2025, we believe the BCB will apply an additional three 25bps cuts and end the cutting cycle at 8.5%.

It will also be relevant who is going to be the new BCB President. In December, the government will appoint a new President, and Roberto Campos Neto, appointed by Bolsonaro, will leave the office. The most likely to assume office is Gabriel Galipolo, who is currently a member of the board. Although the government has been critical of the current BCB administration, we expect the BCB to keep its technocratic analysis and decision making, and they will not enter into any unorthodox strategy as it has in the past.

In October 2024, Brazil will hold state and municipal elections. It will be interesting to see whether Lula’s Party (Worker’s Party) will perform against the main opposition led by former President Jair Bolsonaro. Lula, who won the 2022 elections by a small margin, has seen a drop in his popularity recently. Although, Bolsonaro will not be allowed to participate in the 2026 general elections, we expect his force to continue to be relevant as the main opposition against Lula. Due to the advances of the investigations against an alleged coup attempt, we expect Bolsonaro to face jail time at some point during Lula’s government.

Mexico: Elections Push

The Mexican economy continued to show resilience during the second half of 2023, and although it showed marginal 0.1% growth in the last quarter of 2023, the Mexican economy accumulated a robust 3.2% growth during 2023, surpassing most expectations. One of the biggest drivers of this growth was the strong demand from the U.S. and the expansion of investments. Consequently, the industrial sector benefited the most during 2023, although we also saw some important recovery in the services sector.

Figure 3: Mexico GDP (2019 = 100, Seasonally Adjusted)

Source: INEGI

Growth in 2024 is set to continue strong, with a projected 2.4% expansion during 2024. We expect the demand from the U.S. to continue to be robust and investments to continue to boost Mexico's industrial capacities in 2024. Additionally, the Mexican government has increased its primary fiscal deficit for 2024 to 1.4% from a 0.1% surplus in 2023, expanding expenditures to develop the southern part of the country. The higher fiscal spending is also set to boost growth in 2024. Additionally, López-Obrador's policy of raising the minimum wage above inflation will also be another buffer to boost growth. The reason for deceleration from 2023 is mostly due to the base effect, as 2023 GDP is much higher than in 2022. One headwind for growth during this year is the lagged effects of tight monetary policy, which will continue to be strongly felt during the year.

For 2025, we expect the Mexican economy to enter a new cycle. First, it will be clearer who the next U.S. President will be and how nearshoring is set to continue. Our mainline scenario is that no substantial changes will be seen, and Mexico will continue to benefit from strong demand from the U.S., although the development of new value chains such as those related to microchips is still far away. We see the Mexican economy growing by 2.0%, which is close to its pre-pandemic trend.

In terms of inflation, Mexico has come a long way. Year-on-year CPI has reduced to 4.5% in February from 8.7% in September 2022. Tight monetary policy and the dissipation of inflationary shocks contributed to the easing of inflation. However, there are still some risks for the inflationary outlook. First, the labor market is still running hot, with wage inflation still in double digits. Second, fiscal policy will be looser in 2024, which will add inflationary pressures. We expect inflation to be stickier in 2024, which will prevent a rapid fall toward Banxico's 3% target. We see Mexico’s CPI ending 2024 with 4.2% growth (year-on-year average). In 2025, inflation is likely to continue to ease in response to easing demand and the accumulated effects of tight monetary policy, closing 2025 at 3.3% (year-on-year average).

Figure 4: Mexico’s Policy Rate and CPI (%)

Source: Banxico and INEGI

Banxico raised the policy rate to 11.25% in March 2023 and has kept the policy rate at this level for over 12 months now and has started the easing cycle in March (here). However, due to the risks, we believe Banxico will be cautious with the cutting cycle. Therefore, the most likely path for the policy rate will be more 25bps cuts. This means that the policy rate is likely to finish 2024 at 9.5%. In 2025, we forecast the cuts to continue at a 25bps cut until the policy rate reaches 7.5% at the end of the year.

Another important topic for Mexico is the general election scheduled for June. As re-elections are vetoed by the Mexican Constitution, incumbent President Lopez-Obrador will not participate in the elections. However, he is eager to elect his successor, Maria Sheinbaum, current mayor of Mexico City and an important figure of Lopez-Obrador's Party, MORENA. The traditional Parties PRI and PAN will join forces in a unified front with Xotchil Galvez. Therefore, there will be a two-horse race for the Presidential seat, and Mexico will likely have its first female President. Due to the high popularity of Lopez-Obrador, Sheinbaum will likely be the winner, but we believe MORENA will not be able to gather the constitutional majority in the legislative houses. Therefore, it is very likely that we will see no major policy changes in Mexico.

Argentina: Shock Fiscal Plan

Javier Milei's first months in the Presidency have been turbulent, as one would expect. He failed to pass an ambitious deregulation project in Congress and now bets on the capacity of his government to produce a strong 2.0% primary surplus. One of the first measures of the government was raising the official exchange rate from 300 to 800, which has severe inflationary consequences. With inflation now higher than 15% per month for three consecutive months, Argentina is facing a contraction this year of around 1.5%. Then, in 2025, with things a bit calmer, we see Argentina bouncing back and growing by 2.0%.

The story for inflation will be similar. The government expects that fiscal adjustment and ceasing monetary financing will be able to control prices, but the adjustment will be costly in the first year. We see Argentina's inflation ending 2024 with over 275%, with this number falling to 75% in 2025.

In terms of monetary policy, Argentina is trying to make people move from Central Bank bonds to Treasury ones. At the moment, their policy rate is set at 100%, which is fairly negative in real terms. We will have a better idea of whether the government plans to raise the policy rate once the BCAR balance looks healthier. For the moment, we forecast the policy rate to be kept at 100% and then lowered to 70% in 2025.

It is important to state that Argentina was able to keep the IMF disbursements continuing, and this year's harvest will not be as bad as it was last year, which will allow the Central Bank to gather some dollars. However, with the current level of the Central Bank reserves it is impossible for Javier Milei to dollarize the economy. It remains to be seen whether he will seek this measure during his term.