BoE Review: Easing Bias Continues

Although no shock that the BoE vote to keep policy on hold this month, there was some surprise that all hawkish dissents ended, with the one MPC member instead still again calling for a cut. But despite recent CPI underlying falls, the majority continue to focus on assessing how ‘persistent’ are price pressures. Thus the MPC still suggested policy would need to remain restrictive for sufficiently long to return inflation to the 2% target but was also more open in accepting that the stance of monetary policy could remain restrictive even if Bank Rate were to be reduced. Indeed, an implicit easing bias was evident in the Committee still keep under review for how long Bank Rate should be maintained at its current level. Clearly, a fuller policy review will take place with an updated Monetary Policy Report at the May 9 MPC meeting. We think this will pave the way for the first cut in June and for around a total 100 bp of cuts this year and something similar in 2025.

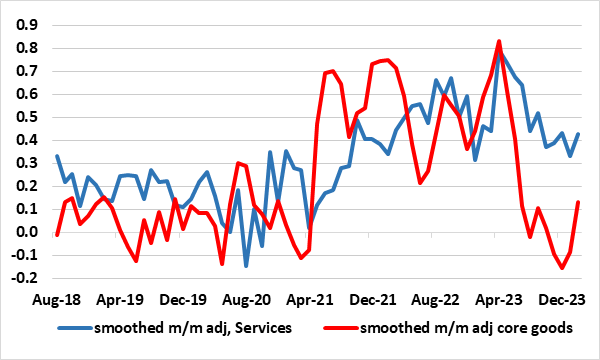

Figure 1: Services Inflation Down But Not Out?

Source: ONS, CE, smoothed is 3 mth moving average

Assessing Price Resilience

As was widely expected, the BoE kept policy on hold for a fifth successive meeting this month and again hinted that policy could be eased but stressed more evidence was needed before this could happen. But clearly the BoE accepts that even with signs it belies that the real economy is on the mend that price pressures are nevertheless still easing. It noted that CPI inflation fell to 3.4% in February, a result that was a little below the expectation in the February Monetary Policy Report. It was perhaps little less concerned about services price inflation. It has declined but while it remains elevated, at 6.1% in February, it noted that higher-frequency measures of core services inflation, such as the three-month on three-month annualised rate, had fallen to around 4½%. Such more coincident indicators are something we have been flagging for some time and while there are some signs such disinflation may have stalled we think more likely that weakness in demand will take a further toll. In this regard we echo BoE thinking in that ‘most indicators of short-term inflation expectations have continued to ease’.

In fact there is a question of just how much services inflation has to fall as, historically, it has exceeded (core) goods inflation as is the case at present. Indeed, as Figure 1 suggests, even current adjusted services inflation is not far from the pre-pandemic rates. The question is whether some of the MPC (ie the hawks) are thinking that the UK faces a new normal in which goods and services inflation have to equate.

BoE Thinking Still Shifting

Regardless, inflation has surprised on the downside of late and to a degree that even the BoE accepts the headline CPI rate may undershoot the 2% target next quarter (we see a clear undershoot). But unlike ourselves, the BoE sees this being short-lived with the rate back towards 3% by year-end before then easing back below target more durably only in the third year of its projection horizon, thereby remaining above target over nearly all of the remainder of the 2-year policy forecast period. This reflects what the BoE believes are persistent price pressures something it sees is embodied in currently high services inflation, this the MPC feels is the best indicator of domestic pressures. The question is whether this view will be reassessed for the May MPC meeting and the updated MPR – we think so, and where it is very much the case that the policy outlook is going to be guided by the projections as opposed to prevailing inflation.

Indeed, the BoE admits that the larger than expected fall is a result of an easing in global supply problems, something with which we concur. However, unless these global pressures resume and given the still weak domestic economy (and with around a third of the impact of policy hikes yet to come) through then why should inflation rise afresh.

Regardless, clearly MPC thinking had shifted a little further, not least as the rate hike demands have stopped amid a clear(er) acceptance that it is no longer a question of how restrictive policy needs to be but one of how long current restriction needs to stay in place. Particularly given what we think is over-pessimism about so-called persistent inflation pressures, we think that the implicit easing bias will be exercised soon, with rate cuts starting in Q2 and 100 bp on the cards for the whole of this year and something similar in 2025. The QT issue, will again be left to one side at least for the time being.