Asia/Pacific (ex-China/Japan) Outlook: Election Spending to Drive Growth

· In 2024, growth trends across emerging Asia will exhibit a mixed pattern. Encouragingly, there will be a resurgence in demand for global electronics following a period of stagnation in 2022‑23, which will provide a boost to regional trade. Moreover, the initiation of monetary policy easing in the U.S. and Europe is anticipated to create room for policy adjustments in Asia, fostering optimism towards emerging markets in the region.

· The momentum of economic activity in emerging Asian economies is anticipated to remain broadly stable. Economic activity is expected to remain resilient despite several challenging factors. These include a tight oil market, as well as constrained liquidity conditions and the effects of the tightening measures implemented in 2023. Additionally, unbalanced growth in China, climate change-related incidents and supply chain disruptions from the Red Sea crisis, may pose further challenges.

· The prevailing theme for Asian economies in H1-2024 revolves around pre-election spending and a general uptick in government expenditure, notably in Indonesia and India. With Indonesia’s elections now completed, all eyes will on the investor favourite India for the upcoming Q2-2024. India heads to elections in April, with results expected on June 4. Prime minister, Narendra Modi’s victory is anticipated and therefore concerns around policy continuity will remain contained. Over H2-2024, growth is expected to be buoyed by interest rate cuts, private investment and private consumption.

· A significant decline in inflation is unlikely due to persistent pressures from food prices, which could dampen consumer confidence. Additionally, renewed vulnerabilities in currencies may exacerbate the situation. Furthermore, disruptions in the global supply chain resulting from conflicts in the Middle East are poised to hinder Asia's exports. Escalating transportation costs and delayed orders are expected outcomes, posing challenges to the region's economic performance.

· The anticipated global monetary loosening is expected to create conditions conducive to interest-rate cuts across Asia in 2024. However, central banks are likely to exercise caution in implementing such measures early or rapidly due to concerns about currency depreciation and the potential for upside inflation risks stemming from El Niño events and disruptions in global shipping. Consequently, we foresee that interest-rate cuts will not commence across the region until the latter half of 2024, with any adjustments being gradual.

· Forecast changes: Higher than anticipated growth in India and persistently elevated food prices have prompted changes to our growth forecast for India and Indonesia. We now anticipate higher growth in India and slightly higher inflation than earlier in Indonesia.

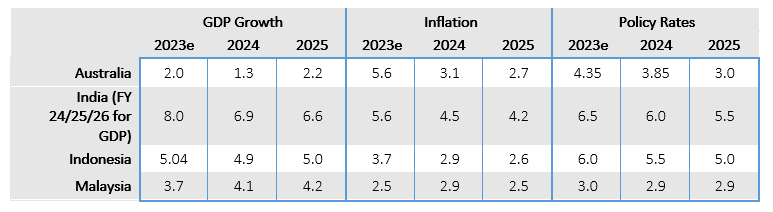

Our Forecasts

Source: Continuum Economics

Risks to Our Views

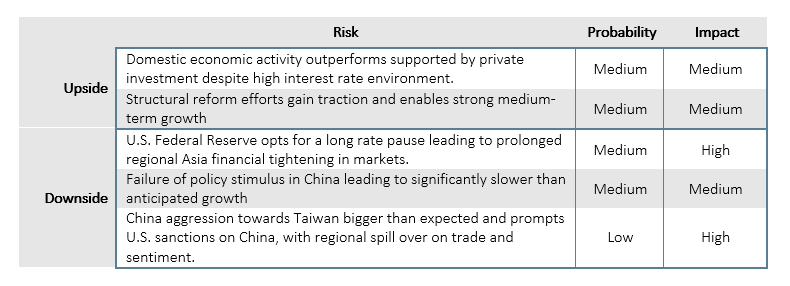

Source: Continuum Economics

Regional Dynamics: Mixed Prospects in 2024

In the first half of 2024, akin to the trends observed in 2023, the emerging economies across Asia are anticipated to maintain their superior performance compared to other emerging markets, showcasing remarkable resilience in contrast to developed economies. Forecasts indicate that Asia is positioned to exert a substantial influence on global economic growth in 2024, with significant contributions anticipated from major players such as India, China, and Indonesia. It is noteworthy, however, that while Asia's economic growth is decelerating, it is projected to outpace growth rates in other regions and sustain its resilience throughout 2024-25

Figure 1: Real GDP Growth Forecast 2024 (% change, yr/yr)

Source: Continuum Economics

The regional growth outlook for 2024 displays a mixed trajectory, with expectations of a global demand recovery primarily in the latter part of the year, which is anticipated to be supportive. However, several economies still grapple with challenges stemming from the delayed effects of rapid monetary tightening experienced during 2022-23. China's real GDP growth is forecast to remain modest and unbalanced, with ongoing efforts directed towards stabilizing the economy post the arduous COVID-19 recovery phase. The Chinese government endeavours to bolster consumer sentiment by easing property market regulations and steadying foreign investment inflows are so far not enough and we see downside risks to our 4.4% GDP forecast (here). However, for export-driven economies such as Indonesia, Singapore, Taiwan, and Vietnam a significant portion of demand is expected to come from an ongoing economic expansion in the U.S. in 2024.

The global electronics cycle is poised to improve in the latter half of 2024 as the inventory surplus comes under control, offering benefits to economies with strong domestic demand and natural resource endowments. South-east Asian nations including Indonesia, Malaysia, and the Philippines are expected to capitalize on investor interest, supply chain diversification, and sustained domestic demand. Meanwhile, South Asian countries comprising Bangladesh, Bhutan, India, the Maldives and Sri Lanka anticipate a favourable growth outlook for 2024, though for different reasons with some still structurally fragile. Pakistan and Sri Lanka will see gains in the aftermath of favourable IMF reviews. Not a lot of progress is expected in Pakistan, meanwhile, Sri Lanka will attempt to secure a debt restructuring agreement before its presidential elections in October.

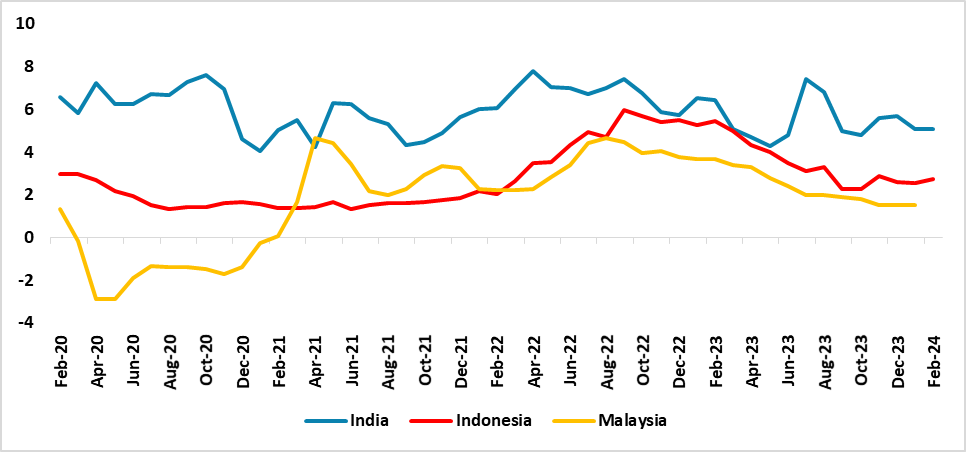

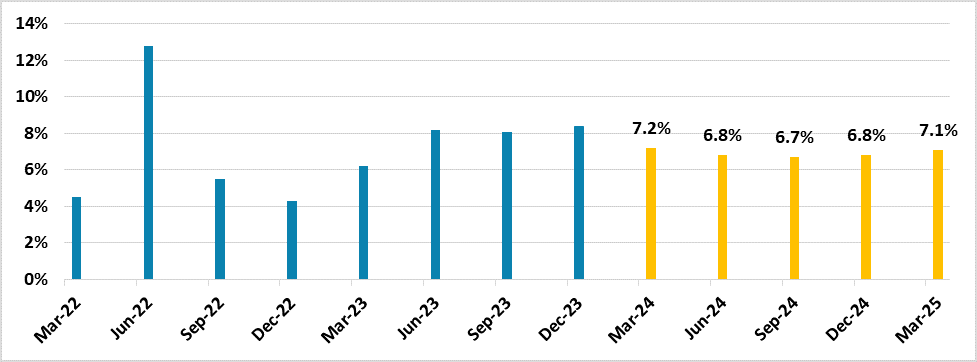

Asia’s Inflation Battle Will Sustain

The Q3 and Q4 of 2023 witnessed somewhat disappointing scenarios for Asian economies in terms of inflation, with some countries experiencing higher-than-anticipated price increases. The overall outlook suggests manageable price pressures extending into 2024-25. Contrary to our earlier expectations, Asian economies will not witness a quick decline in inflation. Food prices will remain a major factor prompting price surges throughout 2024. India and Indonesia particularly remain susceptible to this. Another potential risk to this inflation forecast arises from the tightly regulated oil market, with OPEC+ planning to sustain production cuts throughout 2024, potentially leading to elevated crude oil prices.

Figure 2: Asia Inflation Trajectory (% change, yr/yr)

Source: Continuum Economics

Fiscal Retrenchment Will Follow Election Spending

Fiscal retrenchment is anticipated in Asia for H2-2024 and beyond, driven by heavy fiscal outlays during the pandemic and the cost-of-living crisis. Governments across Asia have maintained high levels of capex and provided subsidies in the run up to the elections. However, this is likely to change over 2024 and 2025. Governments are expected to consolidate public finances, implementing measures such as higher taxes to raise public revenue. Further, subsidy rationalisation is expected in some countries such as Malaysia. Meanwhile, balance-of-payment-strained countries under IMF programs, like Bangladesh, Pakistan and Sri Lanka will adopt various measures to broaden revenue bases, with richer countries likely to follow suit.

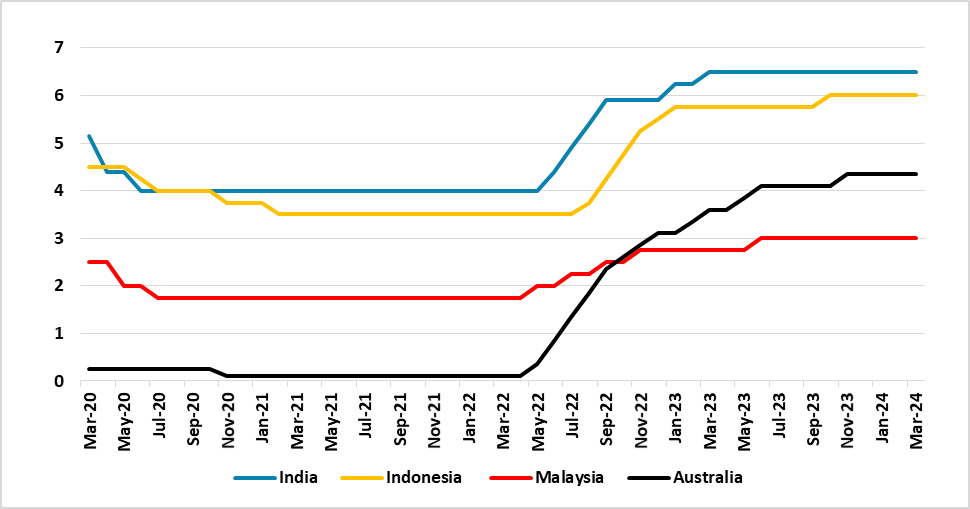

Monetary Easing Will Provide Buttress

The prospect of global monetary loosening will set the stage for interest-rate cuts across Asia in 2024. However, central banks are likely to exercise caution in implementing such measures, primarily due to concerns surrounding currency weakness and potential upside inflation risks resulting from El Niño and global shipping disruptions. Consequently, we anticipate that interest-rate cuts will not commence across the region until the latter part of 2024. Even then, any adjustments are expected to be gradual. The prevailing high-interest-rate environment is expected to weigh on consumption and private investment, while also diminishing access to low-cost financing for governments. As a result, the overall pace of monetary easing across Asia is likely to be measured, reflecting a balance between stimulating economic growth and managing inflationary pressures and currency stability concerns.

Figure 3: Benchmark Policy Rate (%)

Source: Reserve Bank of India, Bank Indonesia, Reserve Bank of Australia, Bank Negara Malaysia

India

India's economic performance has been robust, outpacing market expectations in the recent quarters, displaying resilience amid global economic challenges. However, there are underlying concerns regarding inflationary pressures and the sustainability of growth rates. While India remains a favourite among investors globally, the country is up for a few months of volatility as it heads to polls.

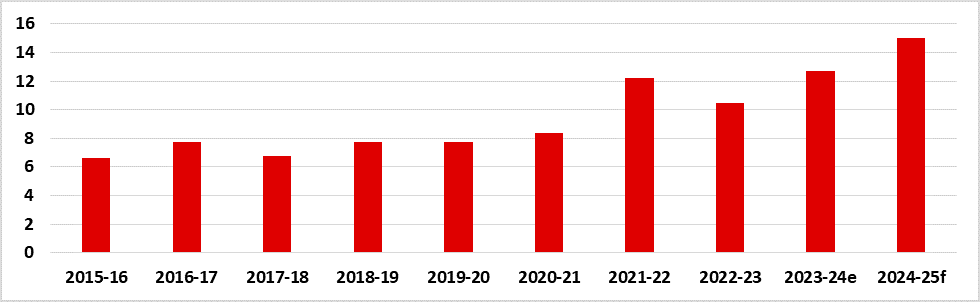

Figure 4: India GDP Forecast (% change, yr/yr)

Source: Continuum Economics, MOSPI

India's GDP growth has been impressive, with consecutive quarters of growth above 8.0% yr/yr, positioning it as one of the fastest-growing economies in Asia (here). Despite this strong performance, the economy is projected to witness a slight slowdown in the coming fiscal year FY25, compared to FY24. This moderation is attributed to various factors, including global economic conditions and internal challenges. However, robust fixed investment, supported by structural reforms and trade deals, will remain a key driver of growth. We anticipate GDP expanding by 7.9% in the ongoing FY24, and growth moderating to 6.9% yr/yr in FY25. Over the medium term, India is expected to sustain its growth momentum with a 6%+ growth rate. FY26 growth is projected at 6.6% yr/yr.

Figure 5: Government Capital Expenditure (INR tn)

Source: Ministry of Finance, Continuum Economics

India’s growth story is attracting global interest and therefore certain factors are key in understanding the trajectory. India’s growth over FY24 has been supported by government spending ahead of the up-coming elections in April-June 2024. India's fiscal policy is expected to remain supportive of economic growth, with emphasis on infrastructure development and investment in key sectors such as railways, roads, highways and defence. The government's focus on capital expenditure allocations is aimed at driving long-term growth and improving productivity. However, government spending is expected to wane over H2-2024 and 2025, as fiscal prudency takes priority.

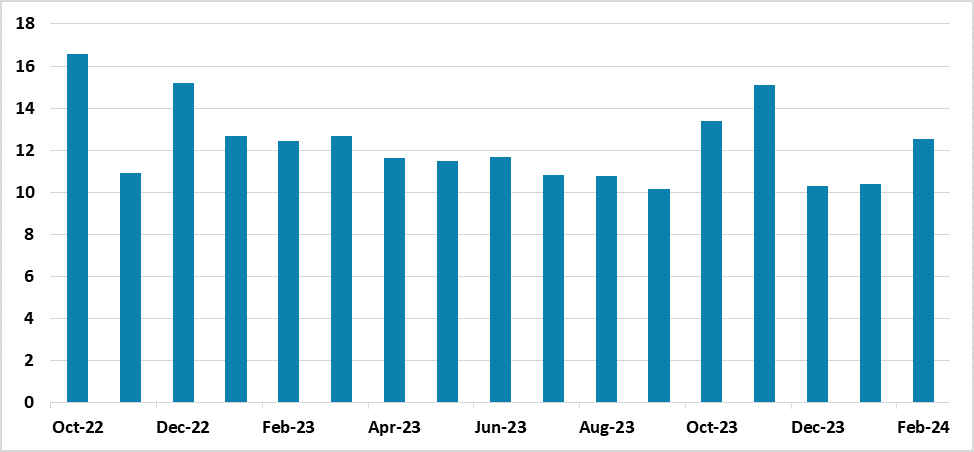

Figure 6: India Goods and Services Tax Collection (% yr/yr)

Source: Ministry of Finance, Continuum Economics

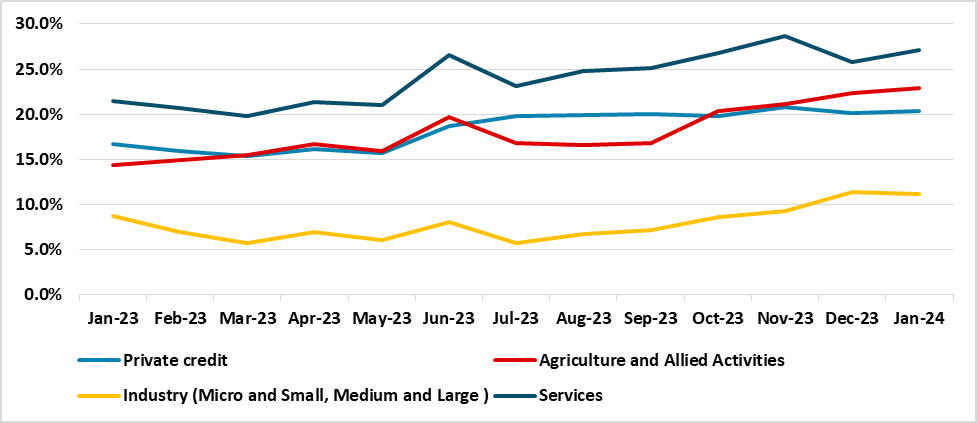

This slight cut back on government spending / capital expenditure is expected to be partially offset by a recovery in private spending. It is worth noting that private investment capex has been slow to recover but latest credit data from the Reserve Bank of India (RBI) reveals an above 20% yr/yr growth trend across the services and medium-scale and small scale industrial sector. Further, domestic retail vehicle sales (often a proxy for overall retail sales) also recorded a high in January. Retail vehicle sales rose 15% yr/yr during the month. This includes two wheeler sales which are a proxy for demand from lower income groups and rural sector demand and tractor sales, which account for a large part of India’s overall population involved in agriculture. Concurrently, India’s other high frequency indicators such as fuel consumption levels, industrial output and goods and services tax collection have all mirrored similar trends, underscoring strong sustained economic activity levels. Meanwhile, India's external sector performance, particularly in merchandise exports, has shown resilience, with accelerated growth in February. However, merchandise imports have also increased, resulting in a widening trade deficit. Efforts to enhance export competitiveness and manage import dependency are underway, but will only show results over the medium term. The government’s focus on the “Make in India” policy is aimed at addressing a twofold problem of unemployment and export substitution. Other schemes such as the Production Linked Scheme will also be supportive of manufacturing activity in the country over 2024-25. India’s focus on signing free trade agreements and comprehensive agreements with the UK, UAE, European Free Trade Union etc. will also provide an impetus to the economy.

Figure 7: India private credit growth (%yr/yr)

Source: Reserve Bank of India, Continuum Economics

Turning towards price pressures, inflation has remained stable but slightly above the midpoint of the RBI’s target range of 2.0–6.0%. Our expectation is that inflation will remain elevated in H1 due to heightened food prices (despite supply side measures) and increased household spending given pre-electoral handouts by the government and other political parties. We anticipate consumer prices to average 4.5% yr/yr in 2024 before moderating further to 4.2% yr/yr in 2025, indicating a manageable inflationary environment.

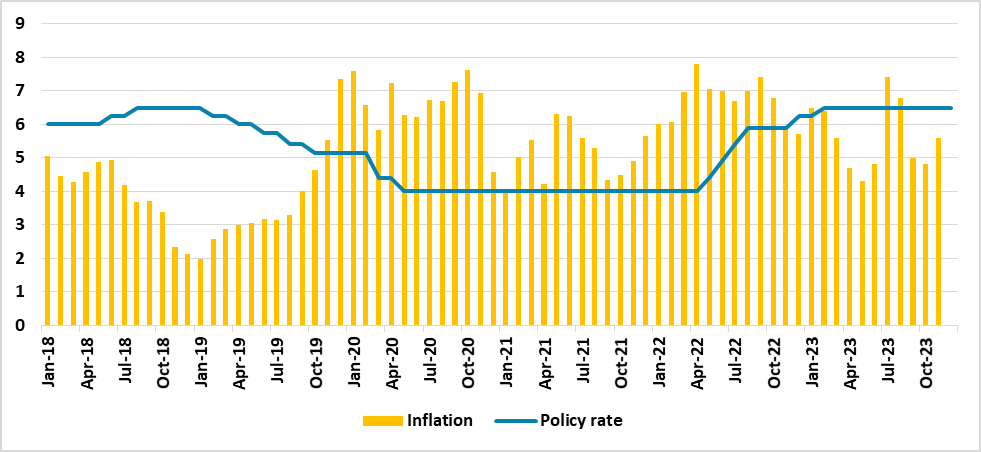

Figure 8: India Inflation and Policy Rate Trajectory (%)

Source: Continuum Economics

Meanwhile, moderating inflation will provide sufficient headroom to the central bank. The Reserve Bank of India (RBI) has maintained the main policy rate unchanged at 6.5%, signalling a cautious approach towards monetary policy. However, with expectations of slowing growth and manageable inflation and potential rate cuts by the Federal Reserve, our view is that the RBI may start reducing the policy rate in H2-2024. The main policy rate is expected to be 6% by end of 2024 (50bps of cuts), and 5.25% by end-2025.

In conclusion, India's economy is poised to maintain a solid growth trajectory, albeit with some moderation in the coming years. Efforts to address inflationary pressures, stimulate investment, and enhance export competitiveness will be critical for sustaining economic resilience and attracting foreign investment. A clean majority is expected for the ruling Bhartiya Junta Party (BJP) in the up-coming election and prime minister, Narendra Modi will secure a third term. From an economic standpoint, we view this as a positive as policy continuity with respect to the push for manufacturing, attracting foreign direct investment and measures to enhance the business environment.

Indonesia: Stable Sustained Growth Trajectory

Indonesia's economic landscape is characterised by election related volatility in H1-2024. The outcome of February's general elections, which saw Prabowo Subianto emerge victorious, introduces new dynamics into the economic landscape. The second half though is expected to see strong levels of economic activity supported by fresh government spending, continuation of projects and a global economic recovery as monetary tightening eases. GDP growth in Indonesia has shown resilience, with a notable uptick observed in Q4-2023. This acceleration was driven by rebounds in public spending and exports, offsetting softer expansions in private spending and fixed investment. Indonesia is expected to have retained the growth momentum going into 2024 and will sustain high levels of economic activity throughout 2024. High levels of public spending in the run up to the elections in February is expected to have supported growth in Q1 2023, while the remaining three quarters will see an impetus from an easing monetary policy, recovering global demand, strong tourism uptick and sustained improvement in the manufacturing sector. Recent high frequency data lends credence to our view. Retail sales have shown accelerating growth in 2024 so far. Retail sales growth was recorded at 1.1% in January, and is expected to touch 3% yr/yr in February. Despite concerns over democratic backsliding and human rights, Prabowo Subianto's victory in the presidential elections and his pledge to target annual GDP growth of 8% yr/yr over the next five years also injects optimism into the economic outlook.

GDP is expected to expand at a broadly similar pace to 2023, with stronger domestic demand fuelling momentum. The global electronics sector upturn and rising tourism levels are poised to boost exports growth. However, downside risks include the potential impact of a severe El Niño weather event and unbalanced/weaker-than-expected activity in China (here). We project GDP to expand by 4.9 yr/yr% in 2024 and 5% yr/yr in 2025, signalling steady growth prospects amidst evolving global dynamics.

Fiscal discipline remains a priority for Indonesia, with ongoing policies and reforms aimed at shoring up investor sentiment. The recent decline in the state budget surplus (between January 1 to March 15) underscores the need for prudent expenditure management amidst declining revenues and escalating expenditures. The surplus amounted to 0.1% of GDP. This has implications for government spending, which could see some moderation over Q4 2024, as private investment picks up.

Figure 9: Indonesia Current Account (in US$ bn)

Source: Continuum Economics, Bank Indonesia

Inflationary pressures in Indonesia have moderated from the highs recorded in 2023, but the trend remains choppy. Inflation was seen rising to 2.8% in February, primarily driven by intensified food price growth. However, the government’s decision to import rice pre-emptively (especially from India) will ease the price pressures. Looking ahead, inflation is expected to tick up in the coming quarters, largely due to drought fuelling food costs. However, it is anticipated to moderate in Q4, and average below the rate recorded in 2023 and remain within the central bank, Bank Indonesia's target band of 1.5-3.5%. Upside risks include the possibility of a prolonged El Niño and premature monetary policy easing.

Bank Indonesia (BI) has maintained its main policy rate at 6% to shore up the rupiah and manage inflation within the target band. We foresee BI cutting the policy rate by 50 bps by the end of 2024, contingent upon external factors such as commodity price shocks and any depreciation pressures on the rupiah. Two rate cuts of 25bps each are expected over H2-2024. The timing of rate cuts by the U.S. Fed will be a key factor to watch. BI is likely to take its cue from the Federal Reserve’s rate cut movements and there is a low probability of an additional 25bps cut in 2024. For now, we expect the BI rate to end 2024 at 5.5% and 2025 at 4.75%, reflecting a gradual easing stance to support growth.

Figure 10: Indonesia Inflation, Core Inflation and Main Policy Rate (%)

Source: Continuum Economics

Overall, looking ahead, the rebound in global demand and recovery of the tourism sector are expected to bolster exports growth. However, risks persist, including a wider-than-expected current account deficit, a slow pickup in industrial sector investment and persistent inflation denting household demand.

Australia: Data Dependency Continues

Domestic demand in Australia has begun to show signs of weakness as households try to balance savings with spending, as inflationary pressure persists. While yr/yr household spending has rebounded from 1.9% to 3% throughout 2023, recent import figure suggest domestic demand is weakening. The strength of Australian labor market has descended from its top in H1 2023 yet remain healthy (4.1% unemployment rate and 66.8% participation rate). The previously tight labor market has pushed the yr/yr wage price index to its highest level at 4.2%, but the pace of growth is expected to moderate in the coming quarter. Household balance sheets remain restrained by mortgage payment despite house prices recover after a brief correction from the peak. Real wage are moving closer to be positive with January monthly CPI moderated to 3.4% yr/yr but we do not expect an immediate rebound in consumption. Meanwhile, solid commodity prices and increasing coal exports are supporting the Australian economy. Even so, the RBA highlighted the uncertainty in the global economy and are concerned about the Chinese economy where they are forecasting a mixed outlook. RBA are trying to balance between inflation and economic growth with data dependency guiding their path currently. Our central forecast is unchanged and believe the Australian economic growth will tread lower till Q3 2024 when we see RBA eases and household consumption also faring better on positive real wage.

Global demand for Australian commodities are strong with increasing demand for Australian coal. Coal export has exceeded iron for the first time in decades. Regional DM (Japan and China) are the biggest customers and EM (Vietnam, Philippines and Thailand) are the growing demand. While the Chinese property acquire less iron, other sectors within China seems to have cover the gap and create solid demand for Australian iron ore. Export expanded five months in a row with a strong trade balance. Overall, we kept GDP growth in 2024 at 1.3% as soft domestic demand in H1 2024 will be compensated by the rebound in H2 2024 with real wage turning more positive throughout the year and global demand for Australian commodities. We forecast average growth at 2.2% in 2025, benefiting more from RBA rate cuts and inflationary pressure easing.

We forecast headline yr/yr CPI to ease in Q1-3 2024 and tilt higher in Q4 2024 to Q1 2025 as wage growth filters into the economy, then we expect it to resume its course of moderation throughout 2025. 2024 CPI has been revised lower from 3.4% to 3.1%, as negative real wage exhibits a disinflationary nature. RBA has also revised the inflation forecast lower (Q4 2024 3.2% from 3.5%) but continue to expect inflation to be back to target range by year end 2025. The transitionary inflation factors have mostly dissipated yet core inflation requires more time to return to target range. The pace of moderation has gathered momentum on soft domestic demand and should continue until Q2 2024. Food inflation, the largest inflationary factor in 2022, has rotated lower but there may still be occasionally spikes of energy prices as geopolitical tension persists. Meanwhile, though housing cost and housing investment have retreated from peak levels on higher mortgage rates, in recent months we are seeing a recovery in housing prices with demand outpacing supply. The RBA is recognizing the healthy correction in labor market and forecast wage growth in slow in coming quarters, thus the revision lower in the CPI forecast.

The RBA has kept the door open on by suggesting the rate path to be dependent on data. But realistically, there is little room for the RBA to tighten without damaging the economy as the Australian economy will be treading lower in 2024 than 2023. Unless there is a structural shift in the global inflationary picture, the headline inflation should return to target range by year 2025 even if we see a spike in CPI by transitory factors. It is also wise for the RBA to be cautious with its tightening step as the potential crash in the housing market from aggressive interest rate increase would create more trouble for the central bank. And in fact, the latest change in forward guidance could be read as the RBA is also ready to ease once data confirms CPI is sustainably in target range. We believe RBA will hold cash rate at 4.35% before cutting in Q3 2024 as inflation inch closer to 3%. We see 50bps of cuts in 2024 and the RBA moving back towards neutral policy rates of 3.0% rates by end 2025.

Malaysia: Export-led Recovery

Moving into 2024, Malaysia’s economy appears to be undergoing a resilience test. The nation's GDP growth, which experienced a slowdown in Q4 2023, is poised for a rebound in Q1 2024, fuelled primarily by a resurgence in private spending. However, external challenges, such as the weakening ringgit and persisting geopolitical tensions, threaten to dampen the momentum.

Despite the headwinds, Malaysia's GDP is forecast to expand by 4% yr/yr in 2024, outpacing the previous year's growth of 3.7% yr/yr, mainly attributed to the recovery of the global electronics sector and robust private spending. The rebound in exports, particularly in the electronics segment, is expected to be a key driver of economic growth over H2. However, uncertainties loom on the horizon, including weaker-than-expected activity in China and potential weather events such as a prolonged El Niño. Malaysia’s exports rose 8.7% yr/yr in January before contracting by 0.8% yr/yr in February on account of Lunar New Year holiday season. However, January data revealed an uptick in electrical and electronic products, petroleum products and palm oil. On the other hand, as seen across other emerging Asian economies like India and Indonesia, government spending remained strong over Q4 2023 and this trend is expected to sustain over H1. Household consumption remains strong supported by benign inflation levels. However, consumer sentiment remains cautious, reflecting uncertainties surrounding the global economic outlook and domestic policy changes. A recovery in tourism (driven by increased intra-ASEAN tourism) too is expected to support overall growth prospects in Malaysia. The industrial sector, a vital contributor to Malaysia's economic growth, witnessed a notable uptick in January, with industrial production growing by 4.3% yr/yr.

Nonetheless, risks remain tilted to the downside. A slower than anticipated pickup in external demand, prolonged monetary pause and an adverse impact of subsidy normalisation policy could see a lower headline growth during the year.

On the price front, inflation is anticipated to rise modestly in 2024, reaching an average of 2.9%. This uptick is attributed to the reduction of fuel subsidies and the continued impact of El Niño on food prices. The government is following a policy of subsidy normalisation, which could see prices of essentials go up. Our expectation is that prices will normalise towards the end of 2024, moderating to 2.5% yr/yr in 2025. It is worth noting that the central bank of Malaysia, Bank Negara Malaysia has announced that it will not be reacting to the price surge created by the fiscal policy changes. BNM has stated that it expects the price rise to be transient and therefore no monetary policy action is expected regarding this. However, there are other factors that may impact inflation levels in the country, which could prompt a response from BNM. This includes higher input costs due to exchange rate movements and uncertainty around global commodity prices.

BNM has opted to maintain the overnight policy rate (OPR) at 3.0% so far to shore up the ringgit, which hit a 26-year low against the USD in February. The BNM's stance aims to strike a balance between supporting economic growth and ensuring price stability. BNM is likely to cut interest rates by 10bps in H2-2024.

Overall, Malaysia’s growth prospects remain favourable over 2024 supported by an export-led recovery. Monetary easing will also facilitated both private consumption and private sector investment. Furthermore, the government’s Industrial Master Plan 2030 will drive growth over the medium term. Real GDP growth is expected to rise to 4.2% yr/yr in 2025.