Data

View:

September 17, 2025

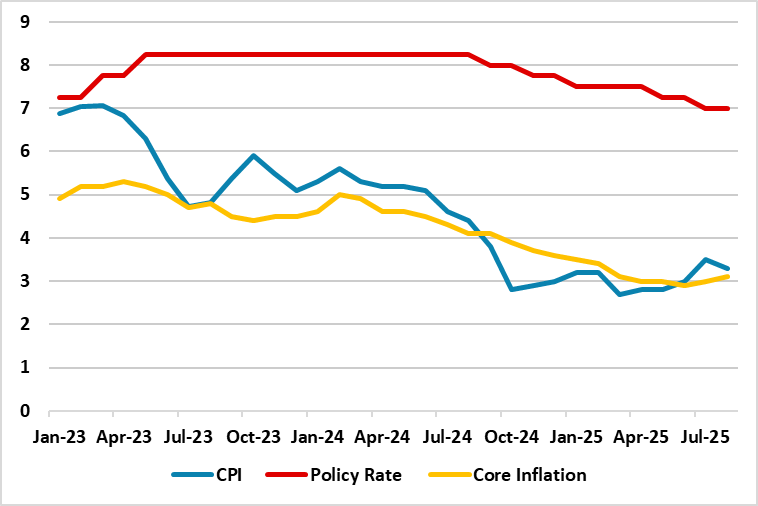

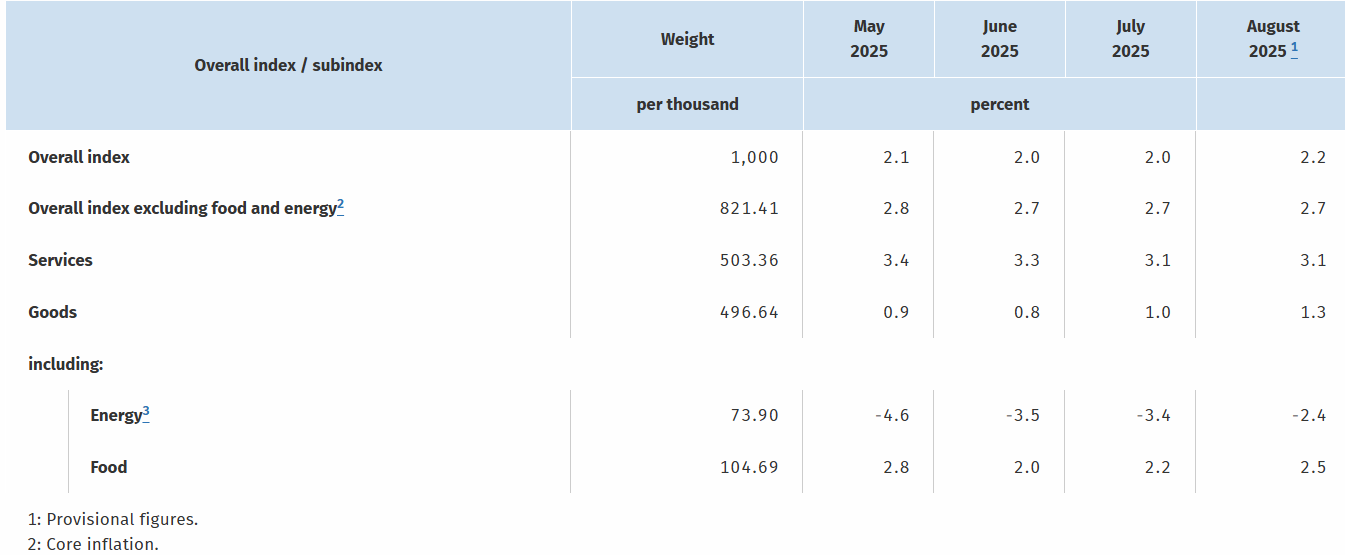

South Africa Inflation Slightly Softened to 3.3% YoY in August

September 17, 2025 1:17 PM UTC

Bottom Line: Statistics South Africa (Stats SA) announced on September 17 that annual inflation softened to 3.3% YoY in August from 3.5% in July thanks to slower food price growth and falling fuel costs. Despite inflation is still within the South African Reserve Bank’s (SARB) 3%-6% target rang

U.S. August Housing Starts and Permits - Broad based slippage

September 17, 2025 12:45 PM UTC

August housing starts with a fall of 8.5% to 1307k and permits with a fall of 3.7% to 1312k are both weaker than expected. Details in both series show declines in both singles and multiples, with the sharper declines in the volatile latter components.

September 16, 2025

Preview: Due September 26 - U.S. August Personal Income and Spending - Core PCE Prices moving higher

September 16, 2025 3:36 PM UTC

We expect August data to show 0.3% gains in both overall and core PCE prices, with personal income also up by 0.3% and personal spending slightly stronger at 0.4%. The data will incorporate historical revisions through Q2 due with the annual GDP revision scheduled for September 25.

Preview: Due September 25 - U.S. August Advance Goods Trade Balance - Returning to trend

September 16, 2025 2:44 PM UTC

We expect an August goods trade deficit of $96.0bn, down from $102.8bn in July and slightly wider than the average of July and June’s $84.5bn. The deficit will be similar to May’s and well below the Q1-pre-tariff levels, but not far from the pre-election trend.

U.S. August Industrial Production - Trend marginally positive

September 16, 2025 1:30 PM UTC

August industrial production gains of 0.1% overall and 0.2% in manufacturing are modest, but they exceed expectations and the implications of weak aggregate manufacturing hours worked data in the August non-farm payroll.

Canada August CPI - Subdued enough for a BoC easing

September 16, 2025 1:04 PM UTC

August Canadian CPI at 1.9% yr/yr reversed a July dip to 1.7% yr/yr and remains restrained by around 0.7% by the abolition of the carbon tax. Core rates remain above target but are on balance marginally softer while monthly details also look acceptably subdued. The data is not an obstacle to an expe

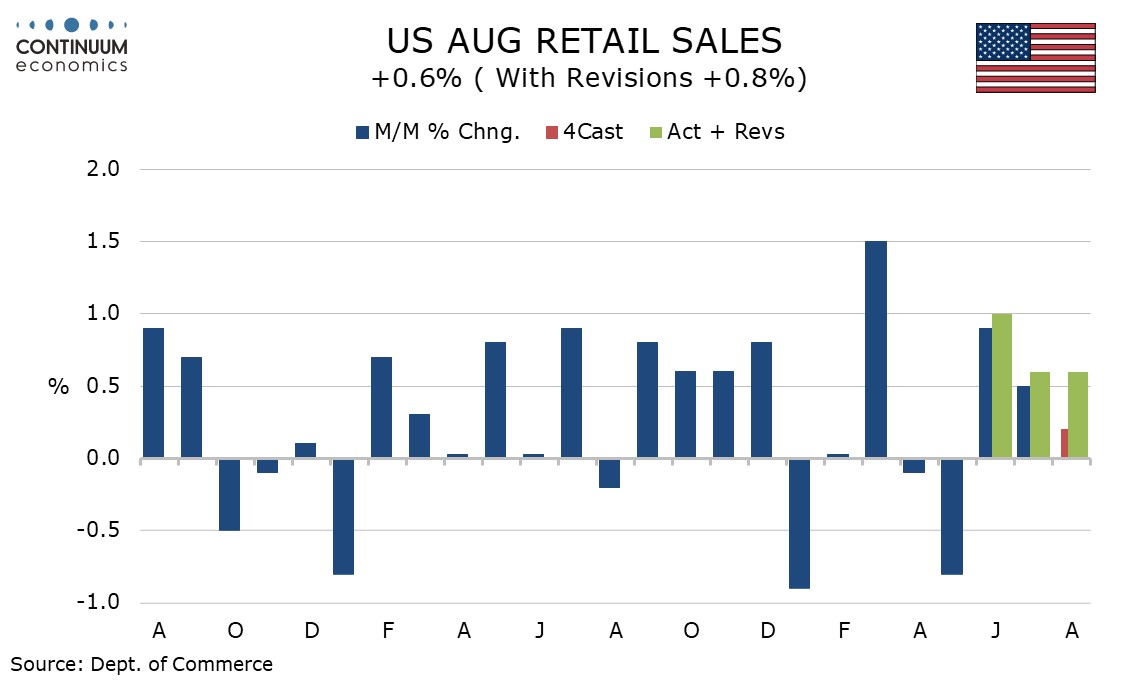

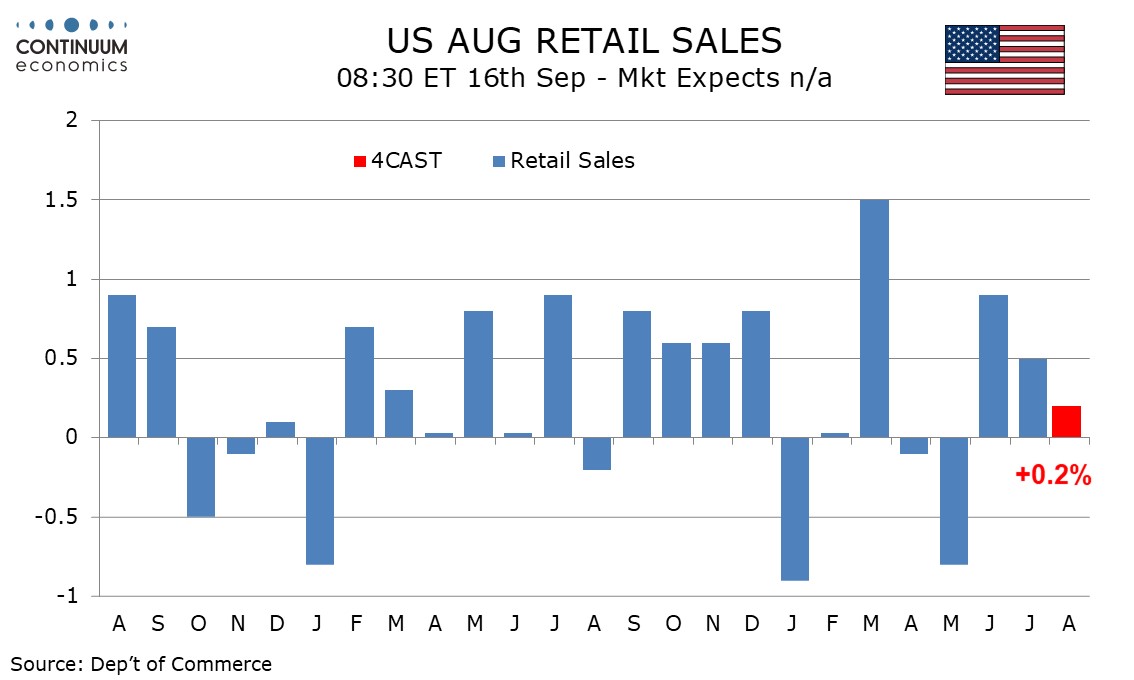

U.S. August Retail Sales - Still Resilient

September 16, 2025 12:48 PM UTC

August retail sales with a 0.6% increase, with the ex-auto and ex auto and gasoline gains both at 0.7%, are stronger than expected and suggest continued consumer resilience despite a slowing in employment growth. The rise modestly exceeds a 0.5% rise in CPI commodity prices in August.

September 15, 2025

Preview: Due September 16 - U.S. August Industrial Production - Aggregate hours suggest a decline

September 15, 2025 1:19 PM UTC

We expect August industrial production to fall by 0.4% with a matching 0.4% decline in manufacturing. This will be the steepest decline overall since October 2024 and the first decline in manufacturing since a 0.5% drop in April.

Preview: Due September 16 - Canada August CPI - Higher as year ago weakness drops out

September 15, 2025 1:09 PM UTC

Weakness a year ago is likely to see August Canadian CPI picking up on a yr/yr basis, we expect to 2.0% from 1.7%. The Bank of Canada’s core rates are likely to remain fairly stable, and above the 2.0% target.

U.S. September Empire State Manufacturing Survey - Softer but underlying picture near flat and prices still firm

September 15, 2025 12:48 PM UTC

September’s Empire State manufacturing index at -8.7 from a positive 11.9 has broken a string of three straight positives which followed four straight negatives. The index is volatile but now it looks like that the three straight positives were not signaling an untrend. The underlying picture is p

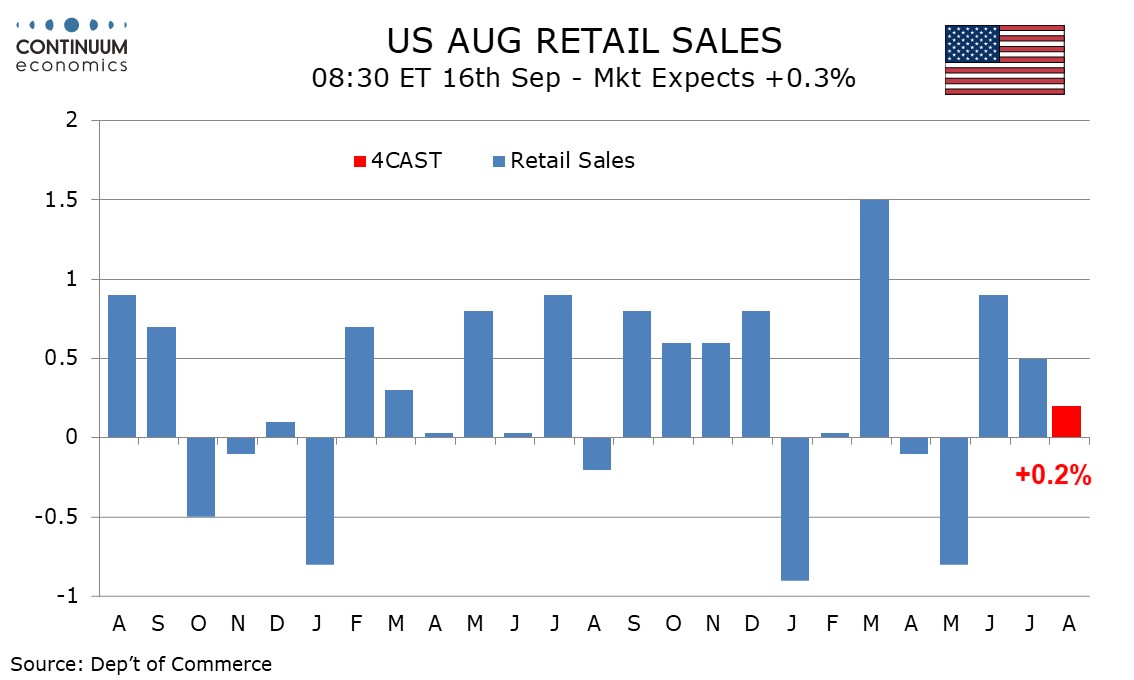

Preview: Due September 16 - U.S. August Retail Sales - Autos to slip, but core rates to maintain trend

September 15, 2025 12:16 PM UTC

We expect a modest 0.2% increase in August retail sales restrained by a correction lower in auto sales. However we expect the core rates ex autos and ex autos and gasoline to maintain trend with gains of 0.4%.

September 12, 2025

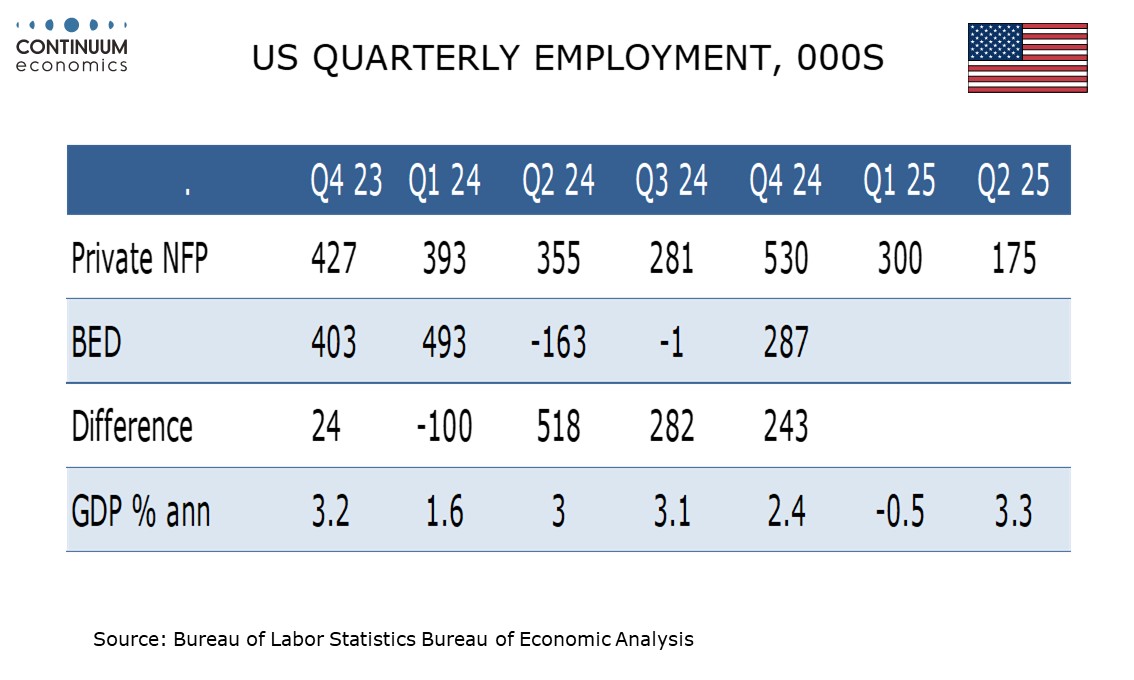

Preview: Due September 25 - U.S. Final (Third) Estimate Q2 GDP - Historical revisions due

September 12, 2025 6:30 PM UTC

We do expect any significant revision in the third (final) estimate of Q2 GDP from the second (preliminary) estimate of 3.3%. However the data will include historical revisions, and here risk is on the downside, particularly for 2024.

Preview: Due September 23 - U.S. September S&P PMIs - Recent strength difficult to sustain

September 12, 2025 5:13 PM UTC

We expect September’s S and P PMIs to slip, manufacturing to 51.5 from 53.0 and services to 53.5 from 54.5. We expect slippage more because recent strength looks difficult to sustain rather than because of any clear signals for weakness.

U.S. September Preliminary Michigan CSI - Lower as 5-10 year inflation expectations rebound

September 12, 2025 2:22 PM UTC

September’s preliminary Michigan CSI of 55.4 is down from 58.2 and weaker than expected, if still above April and May levels. Worries seem to be longer term, with expectations down by more than current conditions and longer term inflation expectations bouncing while the 1-year view is unchanged.

Preview: Due September 23 - U.S. Q2 Current Account - Correction from record pre-tariff deficit

September 12, 2025 1:22 PM UTC

We expect a Q2 US current account deficit of $256bn, down from the record $450.2bn in Q1, when imports surged in anticipation of tariffs, before correcting sharply lower in Q2. Q2’s deficit would then be the lowest since Q4 2023. As a proportion of GDP the deficit would be 3.4%, down from 6.0% in

September 11, 2025

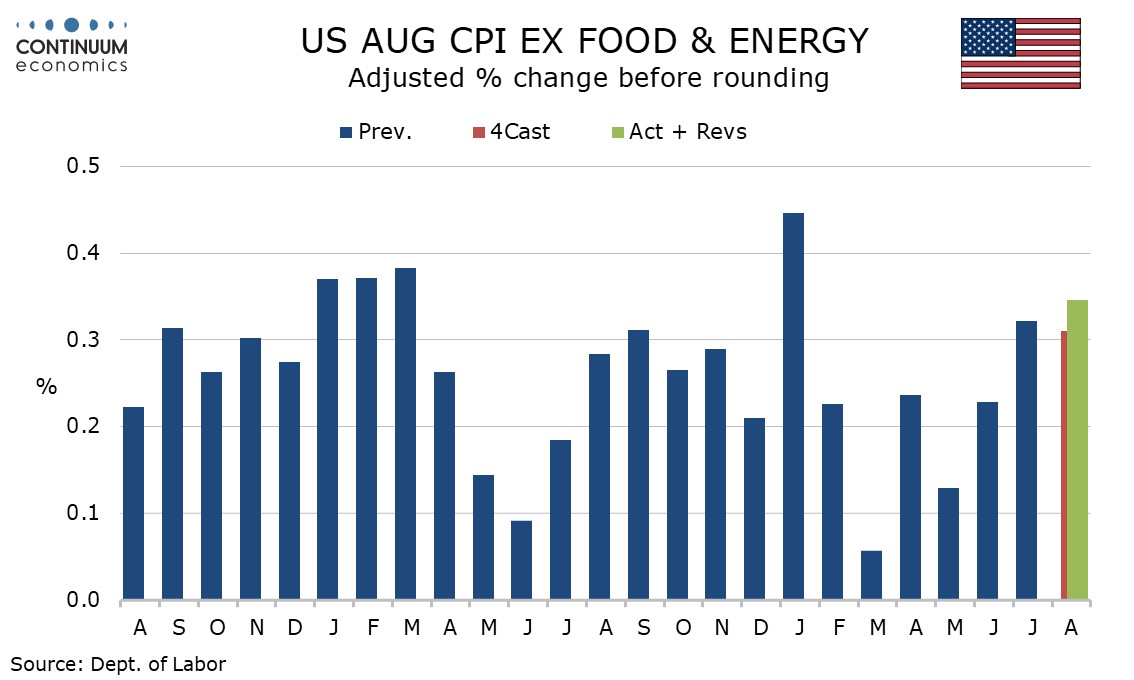

U.S. August CPI, Weekly Initial Claims - Risks on both sides of Fed mandate but possible seasonal adjustment issues for Claims

September 11, 2025 1:07 PM UTC

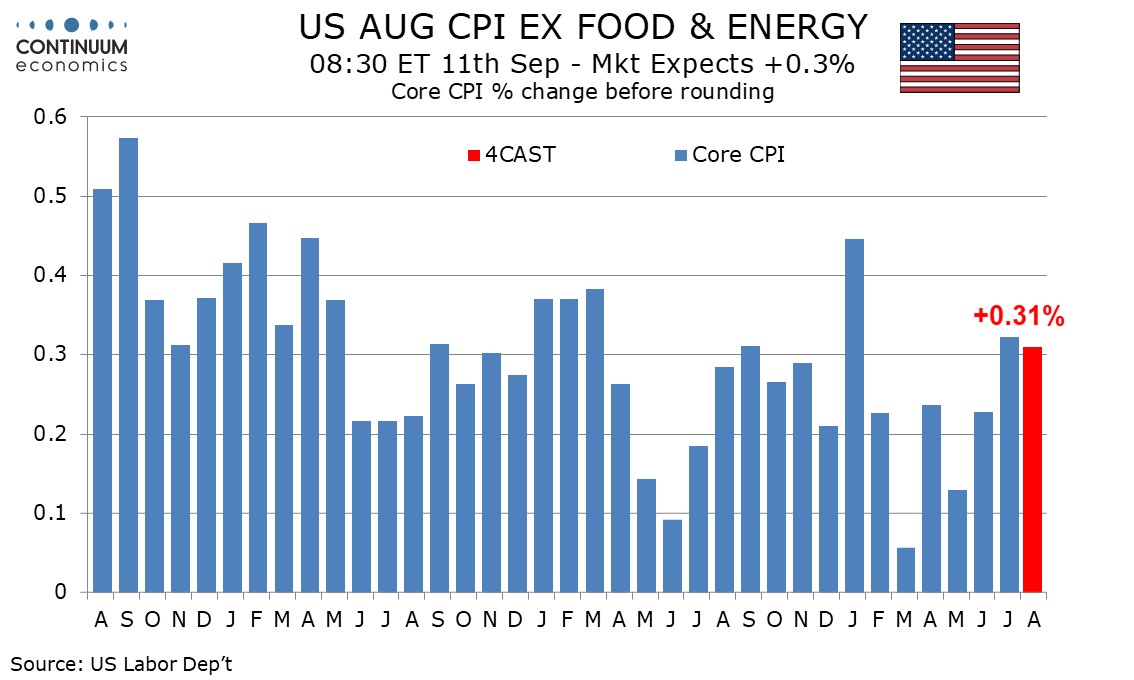

August CPI is firmer than expected overall at 0.4% and while the core rate was as expected at 0.3% its rise before rounding at 0.346% is uncomfortably high emphasizing the upside risks to the Fed’s inflation mandate. Initial claims at 263k from 236k however point to downside risks to the Fed emplo

September 10, 2025

Preview: Due September 25 - U.S. August Durable Goods Orders - Correcting lower

September 10, 2025 1:57 PM UTC

We expect August durable goods orders to fall by 1.0% in a third straight fall, though still not fully reversing a surge of 16.6% in May, while ex transport orders fall by 0.5% in a correction from a 1.0% July increase, that was the strongest of three straight gains.

Preview: Due September 11 - U.S. August CPI - Tariff impact slowly building

September 10, 2025 1:15 PM UTC

We expect August CPI to increase by 0.4% overall and by 0.3% ex food and energy, with the respective gains before rounding being 0.37% and 0.31%. This would be the second straight gains slightly above 0.3% in the core rate with the impact of tariffs starting to escalate.

U.S. August PPI - Correction from shocking July rise

September 10, 2025 12:52 PM UTC

August PPI has slipped by 0.1% both overall and ex food and energy, with the shocking gains of 0.9% in each both revised down to 0.7%, leaving a moderate average gain of 0.3% over the two months. PPI ex food, energy and trade however rose by 0.3% in August after a 0.6% rise in July.

September 09, 2025

Preview: Due September 24 - U.S. August New Home Sales - Stable trend, downside risk

September 9, 2025 2:58 PM UTC

We expect an August new home sales level of 625k, which would be a 4.1% decline if July’s 0.6% decline to 652k is unrevised. The level would be the lowest since October 2023. Trend has been fairly stable but the NAHB survey suggests there may be some near term downside risk.

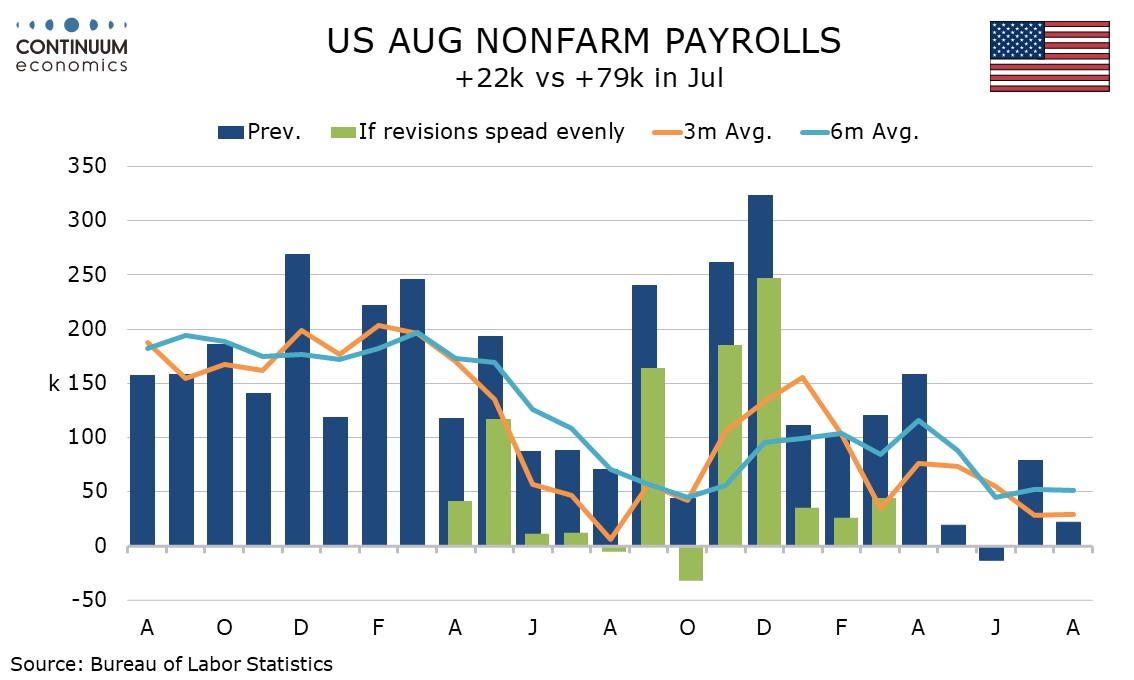

U.S. March 2025 Non-Farm Payroll Benchmark Revised Down by a Preliminary 911k

September 9, 2025 2:32 PM UTC

The preliminary estimate for the downward revision to the March 2025 non-farm payroll benchmark at -911k is steeper than generally than expected and exceeds even the unusually sharp 818k negative revision reported a year ago for the March 2024 benchmark. The data will be incorporated into the Januar

Preview: Due September 10 - U.S. August PPI - A moderate gain after a surge in July

September 9, 2025 12:40 PM UTC

We expect August PPI to rise by 0.3% overall and 0.2% ex food and energy, moderate gains after shocking surges of 0.9% in each series in July, which broke a string of mostly subdued outcomes from February through June. Ex food, energy and trade, we expect a 0.3% increase to follow a 0.6% rise in Jul

U.S. August NFIB survey - Optimism firmer while price signals slip

September 9, 2025 11:29 AM UTC

August’s NFIB index of Small Business Optimism at 100.8 from 100.3 has reached its highest level since January, extending a bounce from June’s pause at 98.6. Most encouragingly, inflationary signals have slipped for a second straight month after a bounce in June.

September 08, 2025

Preview: Due September 23 - U.S. August Existing Home Sales - Slightly weaker for sales and prices

September 8, 2025 7:12 PM UTC

We expect August existing home sales to slip by 2.5% to 3.91m to resume a modestly negative trend after a 2.0% increase in July. This would take the level to its lowest since September 2024.

Expecting a Negative Non-Farm Payroll Benchmark Revision

September 8, 2025 3:25 PM UTC

Tuesday sees the release of the preliminary Labor Dep’t estimate for the March 2025 non-farm payroll benchmark, with expectations for a significant negative, possibly as large as the -818k preliminary estimate for the March 2024 benchmark delivered a year ago. The eventual revision to March 2024 p

September 05, 2025

Preview: Due September 16 - U.S. August Industrial Production - Aggregate hours suggest a decline

September 5, 2025 5:10 PM UTC

We expect August industrial production to fall by 0.4% with a matching 0.4% decline in manufacturing. This will be the steepest decline overall since October 2024 and the first decline in manufacturing since a 0.5% drop in April.

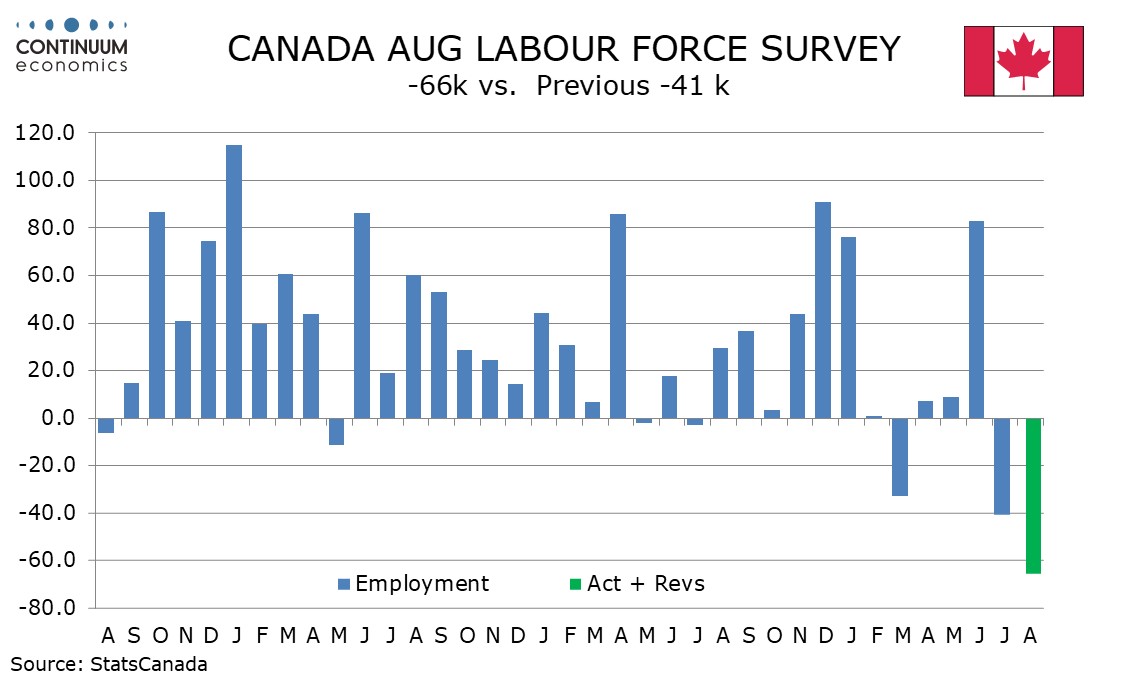

Canada August Employment - With Q3 looking weak, we now expect the BoC to ease in September

September 5, 2025 1:41 PM UTC

Canada’s August employment report with a 65.5k decline with unemployment up to 7.1% from 6.9% is much weaker than expected. While the detail is a little less weak than the headlines suggest, and the data has been volatile recently, we are revising our Bank of Canada call, and now expect a 25bps ea

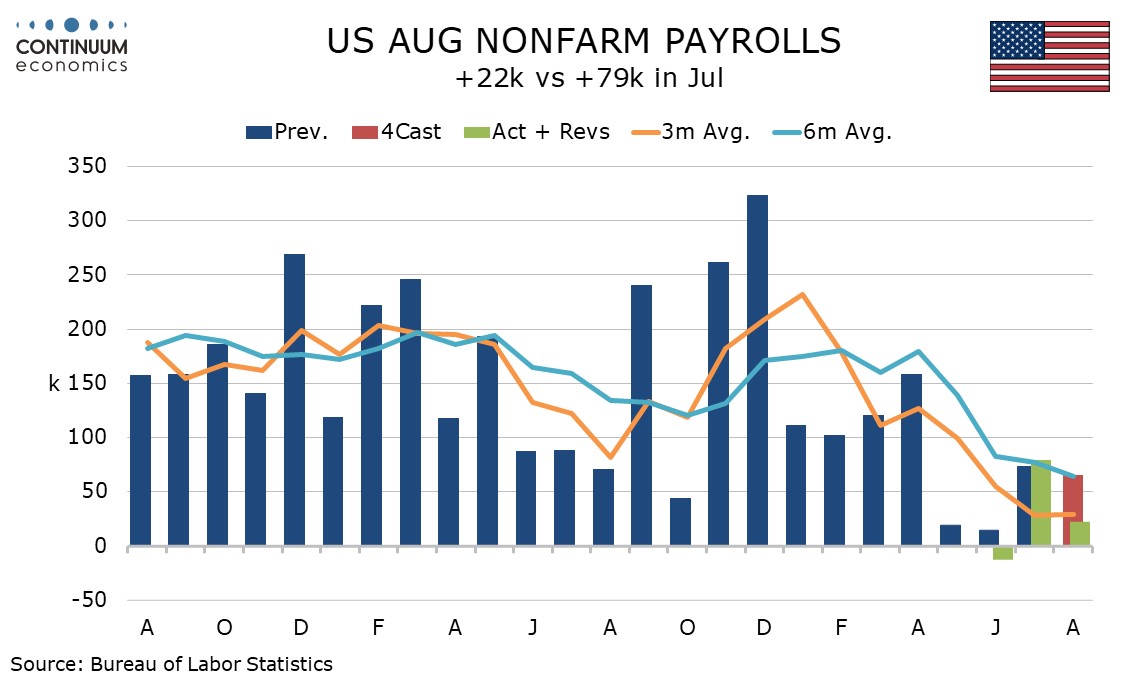

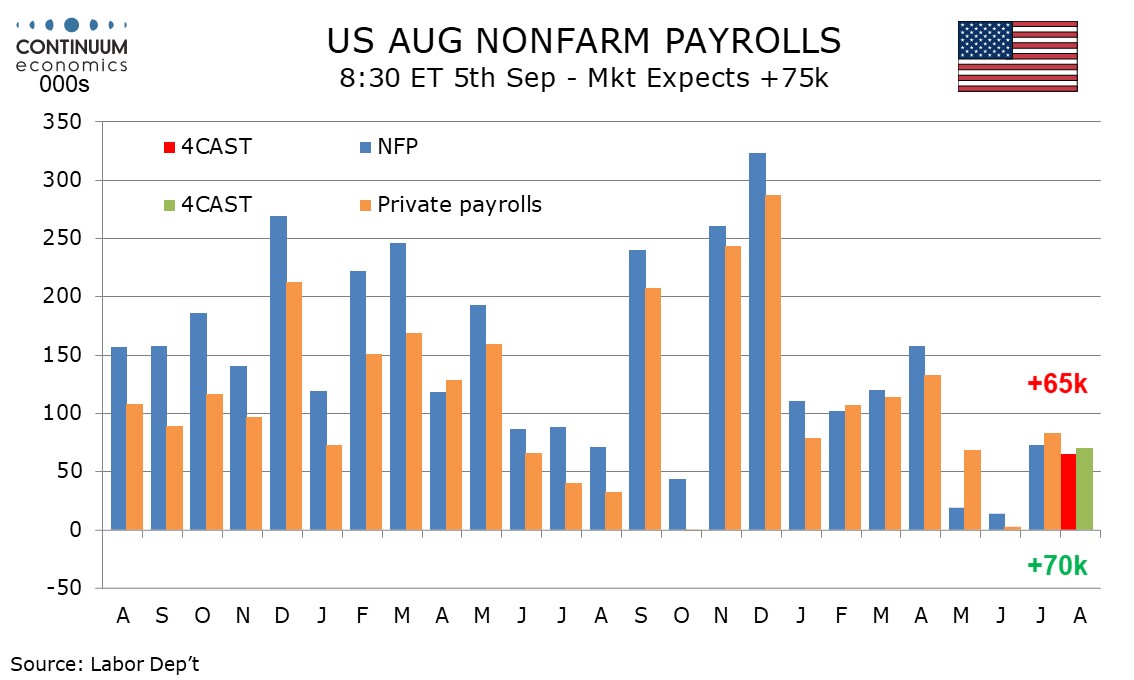

U.S. August Employment - Trend now close to flat, backing case for easing

September 5, 2025 1:03 PM UTC

August’s non-farm payroll shows that job growth is now minimal, with a rise of 22k almost completely offset by a modest 21k in net downward revisions. Unemployment rose to 4.3% from 4.2% while average hourly earnings rose by 0.3%, both as expected, though the workweek was weaker than expected. The

September 04, 2025

Preview: Due September 16 - U.S. August Retail Sales - Autos to slip, but core rates to maintain trend

September 4, 2025 6:53 PM UTC

We expect a modest 0.2% increase in August retail sales restrained by a correction lower in auto sales. However we expect the core rates ex autos and ex autos and gasoline to maintain trend with gains of 0.4%.

Preview: Due September 5 - U.S. August Employment (Non-Farm Payrolls) - Similar to July's, still not recessionary

September 4, 2025 2:45 PM UTC

We expect August’s non-farm payroll to look similar to July’s, with a rise of 65k versus 73k in July, above the 14k rise of June and the 19k rise of May but well below the trend that was running above 100k through April. We also expect unemployment to remain at July’s 4.2% rate and a second st

U.S. August ADP Employment - Trend now below 100k per month, Initial claims rise

September 4, 2025 12:49 PM UTC

ADP’s August estimate of private sector employment growth of 54k is only marginally below consensus but supports a picture of slowing employment growth in recent months, after a preceding 106k in July that corrected a 23k decline in June, while April and May both saw gains of less than 100k.

September 03, 2025

Turkiye’s Inflation Slightly Eased to 32.9% YoY in August... But, Monthly Inflation is Still Over 2.0%

September 3, 2025 4:11 PM UTC

Bottom line: Turkish Statistical Institute (TUIK) announced on September 3 that the inflation slightly softened to 32.9% y/y in August from 33.5% y/y in July driven by lagged impacts of previous monetary tightening, tighter fiscal measures and suppressed wages. August figure came in slightly above

U.S. July JOLTS report - Two weak months suggest trend is slowing

September 3, 2025 2:17 PM UTC

July’s JOLTS report is weaker than expected with openings down 176k to 7.181m with June revised down to 7.357m from 7.437m, now a 355k decline. The two straight declines do little more than reverse gains of 317k in May and 195k in April though the level is the lowest since September 2024.

Preview: Due September 4 - U.S. August ISM Services - Holding above neutral, with stronger prices

September 3, 2025 1:26 PM UTC

We expect an increase in August’s ISM services index to 51.5, up from 50.1 in July but still keeping the index in the subdued 49.9 to 51.6 range that has been seen since March.

Preview: Due September 4 - U.S. July Trade Balance - Deficit to rise as imports from China rebound

September 3, 2025 12:39 PM UTC

We expect a July goods trade deficit of $79.2bn, up from $60.2bn in June. The deficit will compare to a Q2 average of $64.0bn but remain well below Q1’s pre-tariff average of $130.2bn. It will be similar to where trend was before the November election result signaled higher tariffs were coming.

Preview: Due September 4 - U.S. August ADP Employment - Slower than July which corrected a June decline

September 3, 2025 12:23 PM UTC

We expect a rise of 60k in August’s ADP estimate for private sector employment growth. This would be a slowing from 104k in July which outperformed the non-farm payroll, with July’s improved data looking in part corrective from a 23k decline in June.

September 02, 2025

September 01, 2025

Hitting Beyond Expectations thanks to Construction Activities: Turkiye’s GDP Growth Rebounded Strong in Q2

September 1, 2025 10:55 AM UTC

Bottom Line: According to Turkish Statistical Institute’s (TUIK) announcement on September 1, Turkish economy increased by a strong 4.8% YoY despite political turbulence after arrest of Istanbul mayor and opposition’s presidential candidate Ekrem Imamoglu in Q2, prolonged monetary tightening eff

August 29, 2025

Preview: Due September 16 - Canada August CPI - Higher as year ago weakness drops out

August 29, 2025 7:15 PM UTC

Weakness a year ago is likely to see August Canadian CPI picking up on a yr/yr basis, we expect to 2.0% from 1.7%. The Bank of Canada’s core rates are likely to remain fairly stable, and above the 2.0% target.

Preview: Due September 4 - U.S. July Trade Balance - Deficit to rise as imports from China rebound

August 29, 2025 4:24 PM UTC

We expect a July goods trade deficit of $79.2bn, up from $60.2bn in June. The deficit will compare to a Q2 average of $64.0bn but remain well below Q1’s pre-tariff average of $130.2bn. It will be similar to where trend was before the November election result signaled higher tariffs were coming.

U.S. August Final Michigan CSI - Inflation expectations revised down

August 29, 2025 2:12 PM UTC

August’s final Michigan CSI of 58.2 is not much changed from the preliminary 58.6 but a little further off July’s 61.7. There are some surprises in the detail however, in particular a downward revision to the 5-10 year inflation view.

Preview: Due September 2 - U.S. August ISM Manufacturing - Back to neutral with firmer prices

August 29, 2025 1:52 PM UTC

We expect August’s ISM manufacturing index to rise to a neutral 50.0 more than fully reversing a dip to 48.0 in July from 49.0 in June. This would be the strongest reading since January and February edged above neutral for the first time since October 2022.

Canada Q2 GDP falls as exports plunge outweighs stronger domestic demand

August 29, 2025 1:34 PM UTC

Canada’s 1.6% annualized decline in Q2 GDP is weaker than the market expected, though in line with a -1.5% Bank of Canada forecast. Details are mixed with domestic demand positive and the GDP decline due to a plunge in exports due to US tariffs. June GDP was weaker than expected with a 0.1% declin

U.S. July Personal Income and Spending and Core PCE Prices as expected, but Advance Goods Trade Deficit up as imports rebound

August 29, 2025 12:58 PM UTC

July’s personal income and spending report is in line with expectations, with the 0.3% core PCE price index matching the core CPI, and gains of 0.4% in income and 0.5% in spending also as expected. However a rise in the July advance goods trade deficit to $103.6bn from $84.9bn is unexpected, and l

German HICP Review: Headline Back Higher But EZ Price Picture Still Reassuring?

August 29, 2025 12:12 PM UTC

Germany’s disinflation process hit a slightly more-than-expected hurdle in August, as the HICP measure rose 0.3 ppt from July’s 1.8% y/y, that having been a 10-mth low (Figure 1). This occurred largely due to energy base effects with food prices also contributing slightly. The result was that