Preview: Due September 16 - U.S. August Industrial Production - Aggregate hours suggest a decline

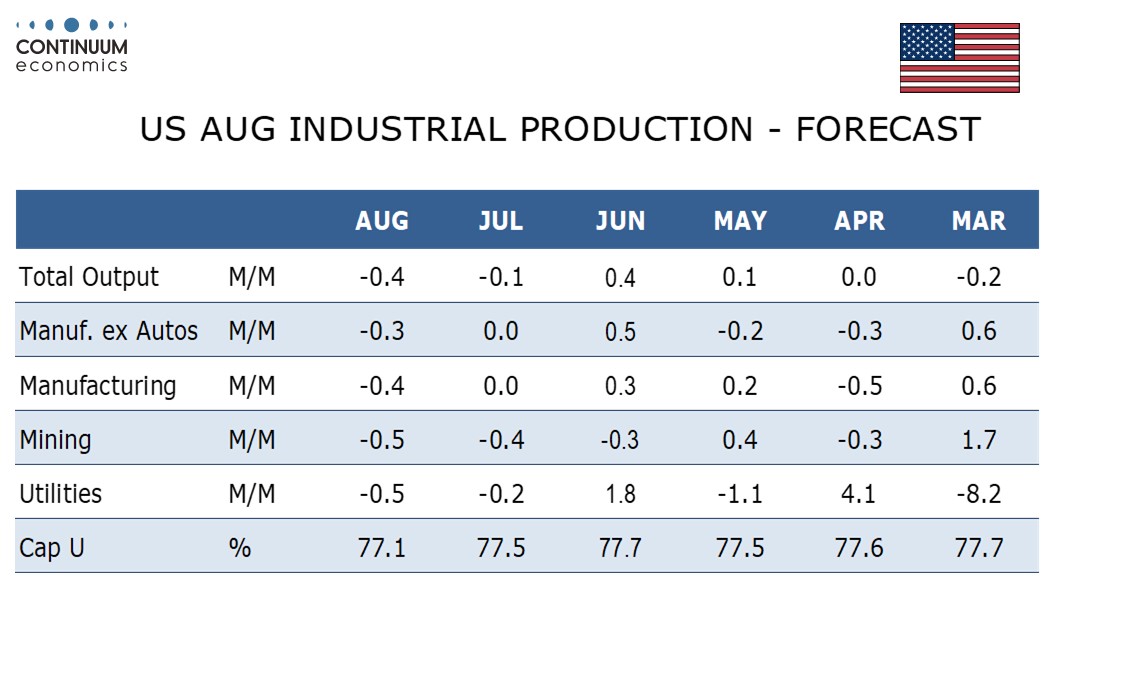

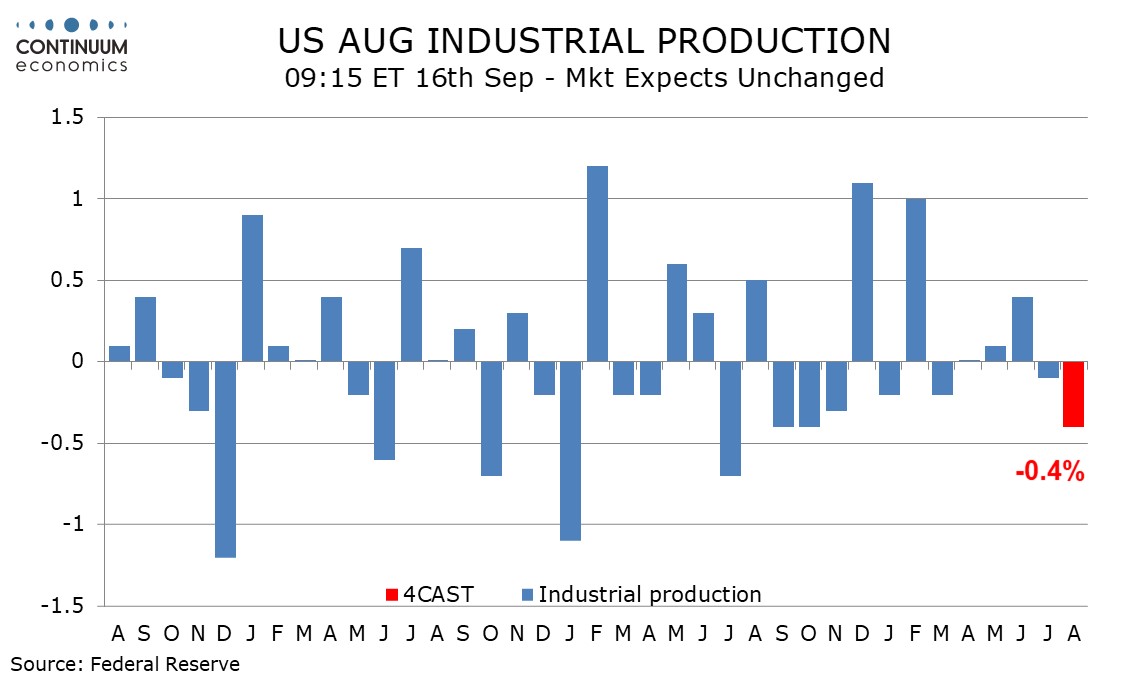

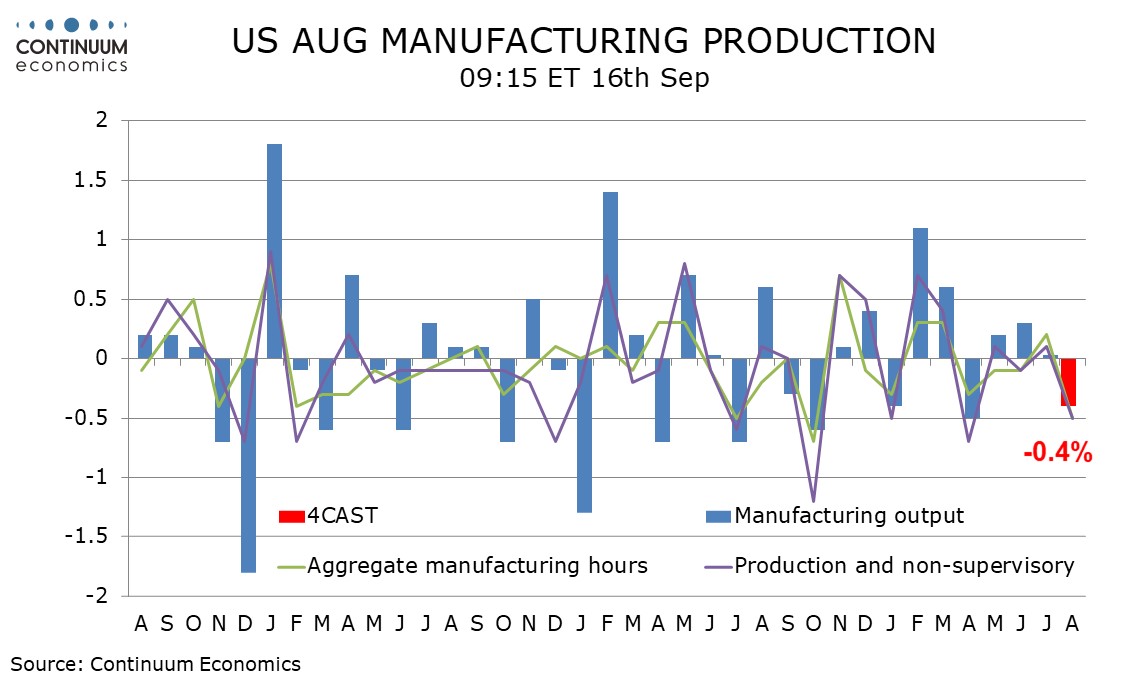

We expect August industrial production to fall by 0.4% with a matching 0.4% decline in manufacturing. This will be the steepest decline overall since October 2024 and the first decline in manufacturing since a 0.5% drop in April.

The non-farm payroll showed aggregate manufacturing hours worked falling by 0.5% both overall and for production and non-supervisory workers, while the ISM manufacturing production index fell back below neutral in August after marginally positive data for June and July. This suggests a decline in manufacturing output even if productivity manages a modest increase.

We expect autos to be particularly weak though expect a 0.3% decline in manufacturing ex autos. Aggregate hours worked data slipped for mining too while weekly electrical output suggests a modest decline in utilities. We expect both mining and utilities to fall by 0.5%.

We expect capacity utilization to fall to 77.1% from 77.5% to its weakest level since November 2024 while manufacturing capacity utilization falls to 76.3% from 76.8, reaching its lowest level since January.