Preview: Due September 16 - U.S. August Retail Sales - Autos to slip, but core rates to maintain trend

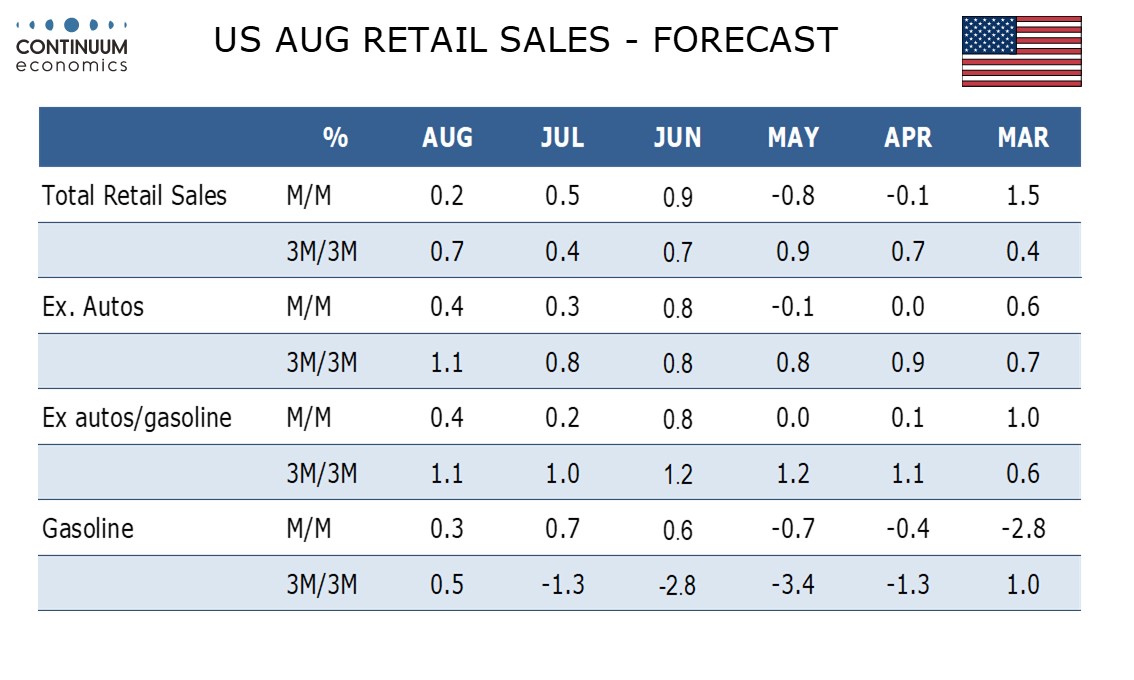

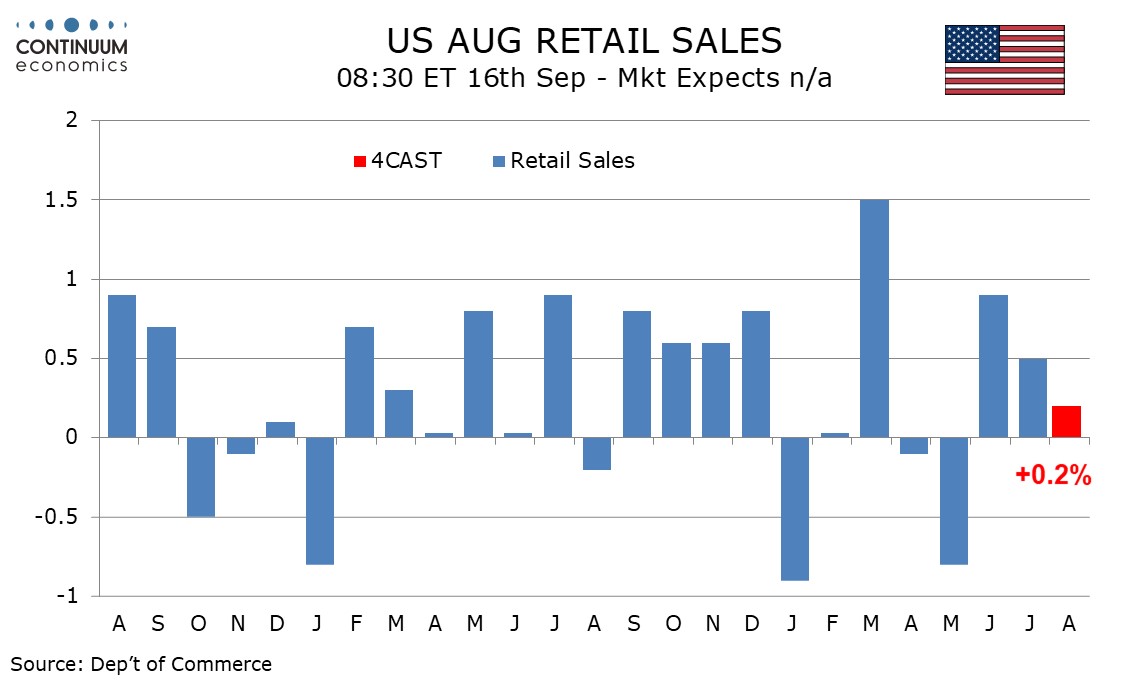

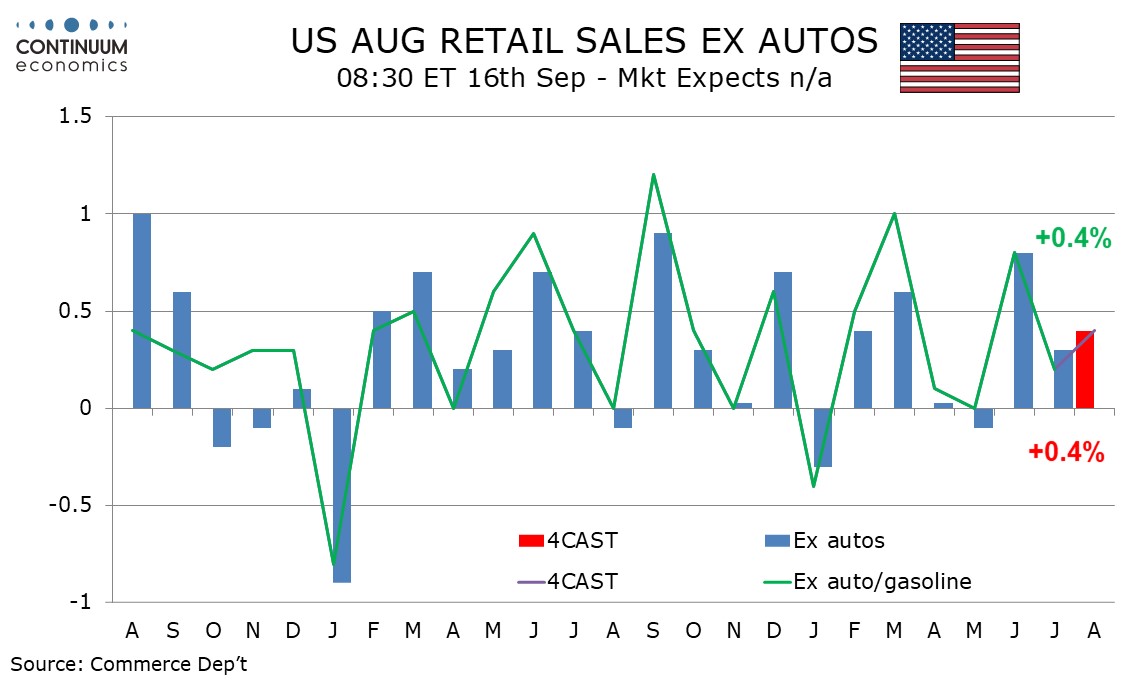

We expect a modest 0.2% increase in August retail sales restrained by a correction lower in auto sales. However we expect the core rates ex autos and ex autos and gasoline to maintain trend with gains of 0.4%.

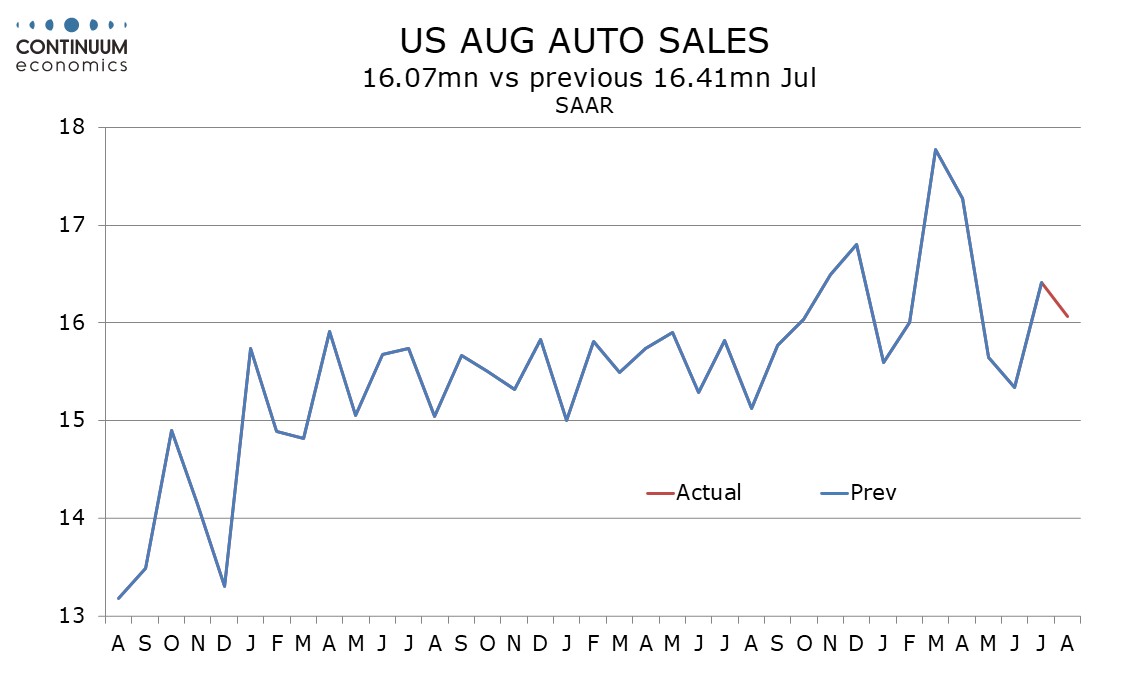

Industry data shows auto sales saw a partial correction from a July increase, and that suggests weaker retail auto sales. However after having seen some strength earlier this year, probably in anticipation of tariffs, auto sales have not shown any real subsequent weakness.

Real disposable income has generally been keeping pace with consumer spending through July, giving no clear signal of consumer weakness despite some jitters in confidence data. Gains of 0.4% ex auto and ex auto and gasoline would be consistent with recent trend.

Our forecast is a little softer than a Chicago Fed estimate for a 0.6% increase in retail sales ex autos, which it sees as up 0.3% adjusted for inflation.

Gasoline prices are likely to be supportive in August but with gasoline sales having outperformed prices in July we expect gasoline sales in August will underperform prices, and be near neutral for sales.