U.S. September Preliminary Michigan CSI - Lower as 5-10 year inflation expectations rebound

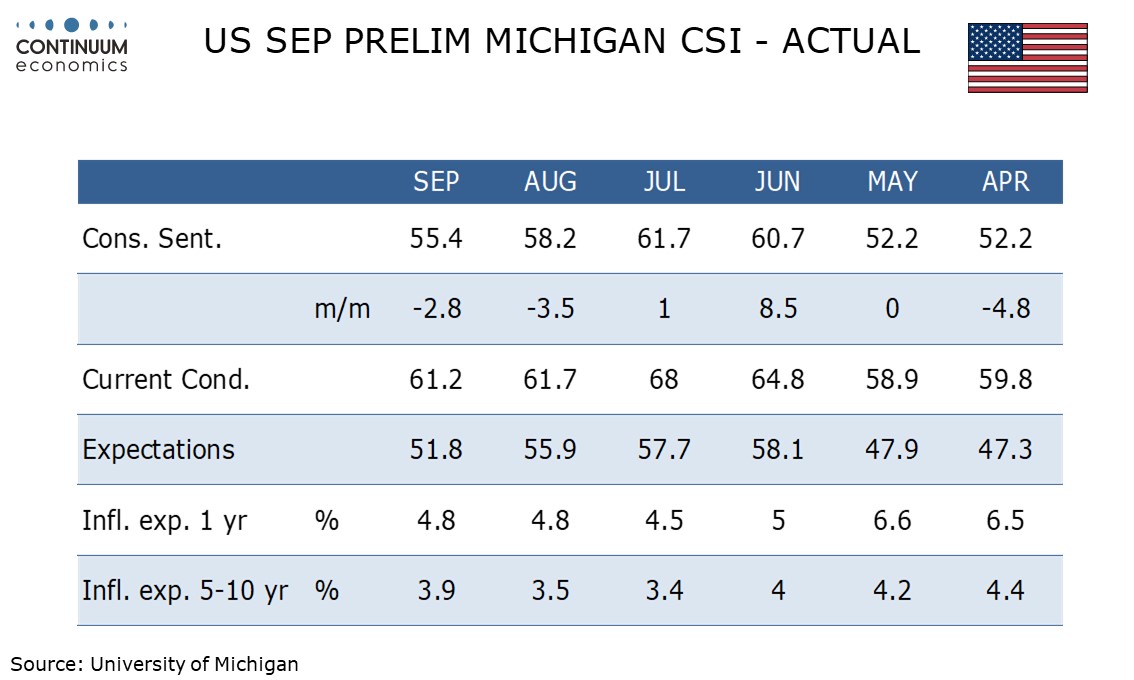

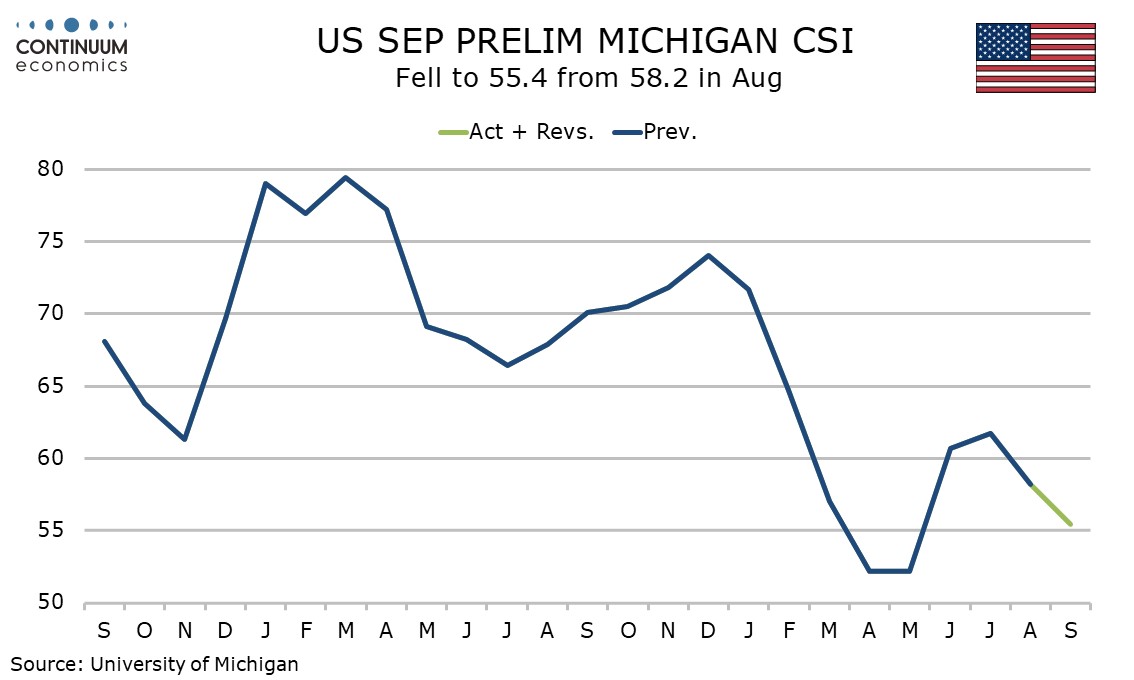

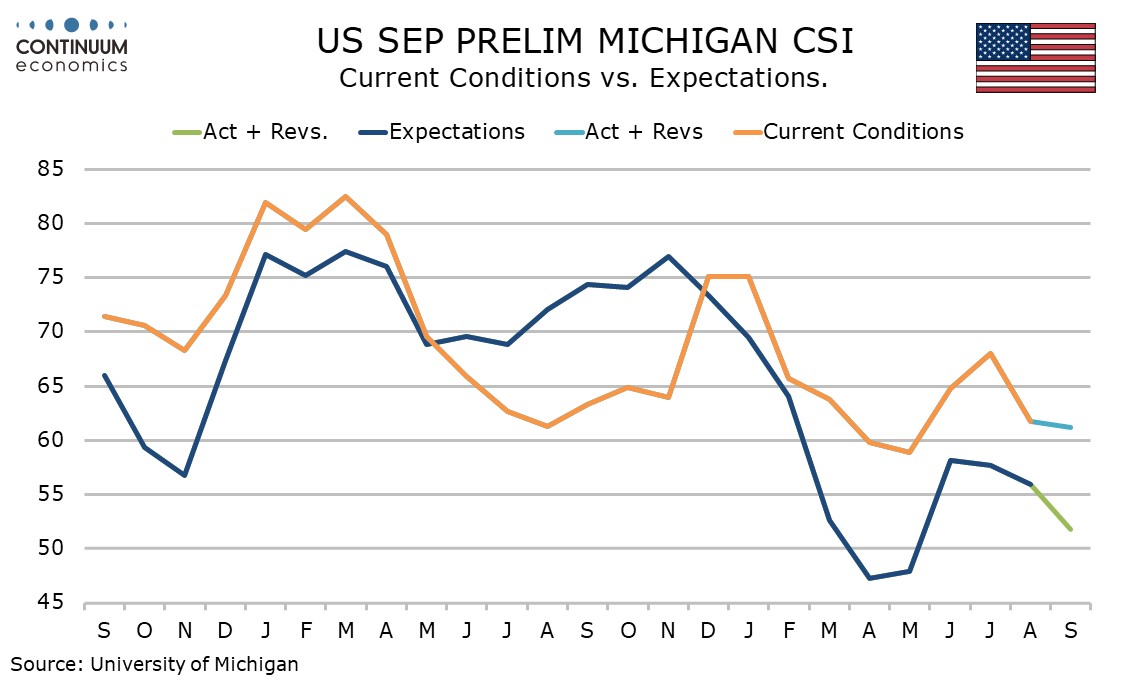

September’s preliminary Michigan CSI of 55.4 is down from 58.2 and weaker than expected, if still above April and May levels. Worries seem to be longer term, with expectations down by more than current conditions and longer term inflation expectations bouncing while the 1-year view is unchanged.

Every month of 2025 to date with the exception of January’s 71.7 has been weaker than each month of 2024, with the lows of 52.2 coming in April and May in the aftermath of the April 2 tariff announcement. A recovery in June and July has faded in August and September.

Current conditions at 61.2 are only marginally down from August’s 61.7 but well below July’s 68.0. 6-month expectations saw more significant slippage in September to 51.8 from 55.9 in August, exceeding a drop from 57.7 in July. Both series remain above their levels of April and May.

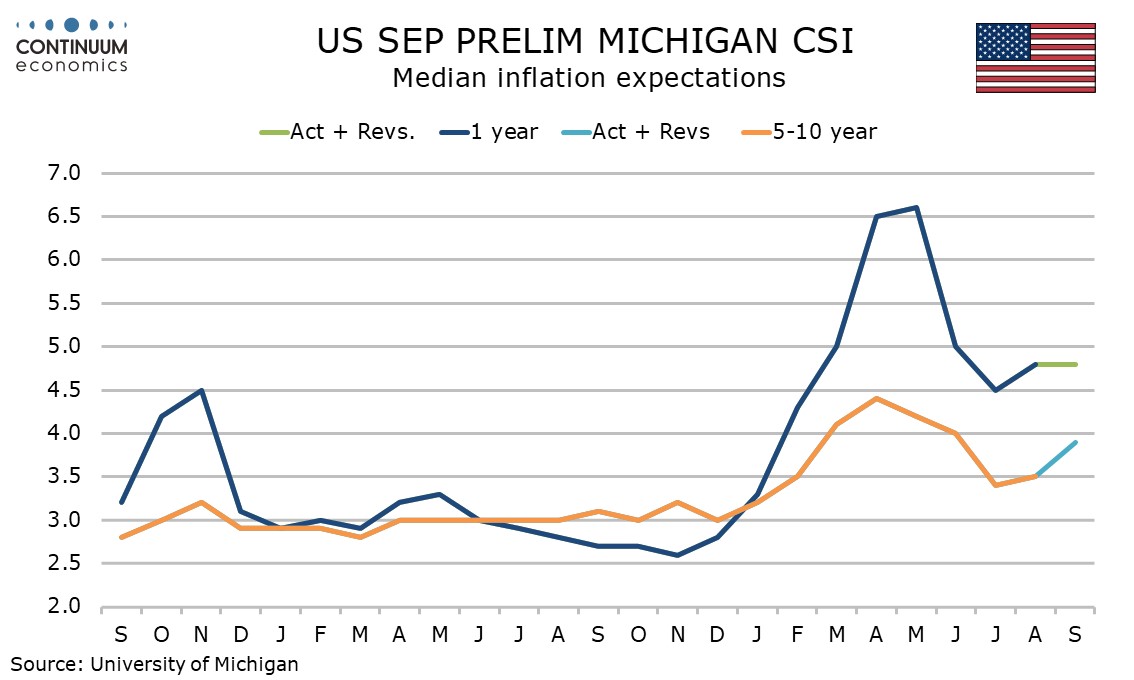

The 1-year inflation expectation of 4.8% is unchanged from August but well elbow May’s high of 6.6% (May’s preliminary was even higher at 7.3%.

The 5-10 year view of 3.9% in up from August’s final of 3.5% but is back at the preliminary August level, if still below levels above 4.0% in April and May. The recent volatility of what had been a very stable series near 3.0% through 2024 shows considerable consumer uncertainty over the impact of tariffs.