U.S. July JOLTS report - Two weak months suggest trend is slowing

July’s JOLTS report is weaker than expected with openings down 176k to 7.181m with June revised down to 7.357m from 7.437m, now a 355k decline. The two straight declines do little more than reverse gains of 317k in May and 195k in April though the level is the lowest since September 2024.

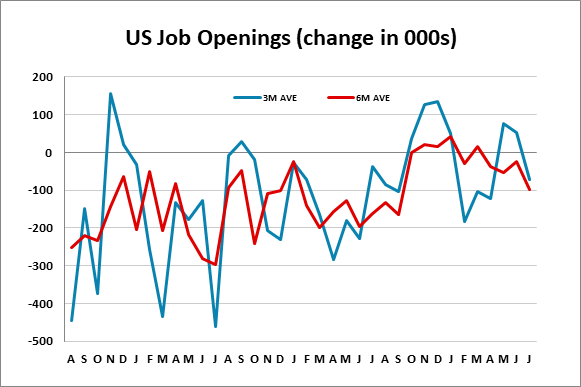

The 3-month average of -71k is the lowest since April and the 6-month average of -97k is the lowest since September 2024. This implies a weakening of trend, but not yet a dramatic one.

Hirings rise a modest 41k and separation fell by a modest 52k, with quits at -1k almost unchanged. However the difference between hires and separations has slowed markedly in the last two months, at a positive 19k in July and negative at -74k in June, both weaker than the non-farm payroll backing signals of a labor market slowing. The two weak months however follow strong positive differentials of 221k in March, 302k in April and 252k in May.