South Africa Inflation Slightly Softened to 3.3% YoY in August

Bottom Line: Statistics South Africa (Stats SA) announced on September 17 that annual inflation softened to 3.3% YoY in August from 3.5% in July thanks to slower food price growth and falling fuel costs. Despite inflation is still within the South African Reserve Bank’s (SARB) 3%-6% target range, we think unpredictable outlook for the global economy, increases in utility costs, and climate-related agricultural disruptions will likely continue to pressurize prices in Q4, and we foresee average inflation will hit 3.4% in 2025. We think the SARB will keep its repo rate unchanged at 7% during the MPC on September 18 since it tries to bring the inflation down to new 3% anchor, while the decision is a close call.

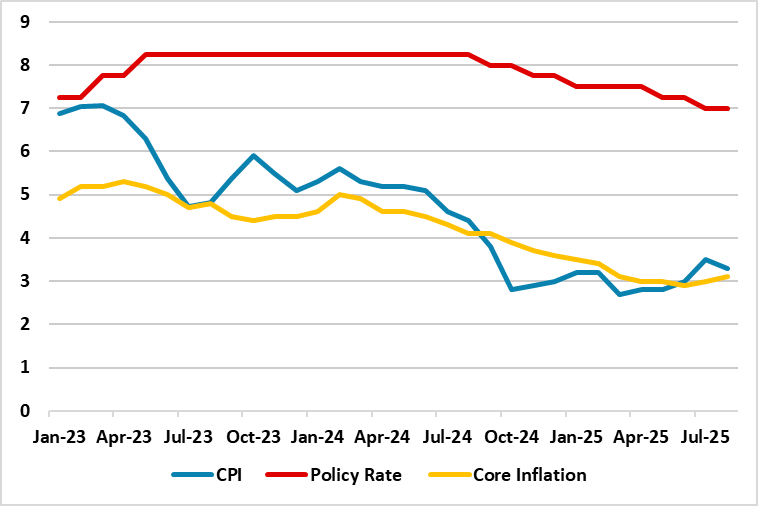

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – August 2025

Source: Continuum Economics

After hitting a ten-month high in July with 3.5% in, annual inflation softened to 3.3% YoY in August thanks to slower food price growth and falling fuel costs. According to StatsSA, the annual rate for fuel was -5.7%, down from -5.5% recorded in July. Petrol prices decreased 28c per litre, resulting in a 1.3% monthly decline. Annual inflation for food & non-alocholic beverages subsided to 5.2% from 5.7% in July.

MoM prices edged down by 0.1% after surging by 0.9% in July. Annual core inflation rate slightly surged by 3.1% in August, up from 3.0% in July. We think inflation staying over 3.0% signals the uncertainty over the inflation outlook in the upcoming months since unpredictable outlook for the global economy, increase in utility costs, and climate-related agricultural disruptions will likely continue to pressurize prices in Q4, and we foresee average inflation will hit 3.4% in 2025.

One good news for South Africa’s inflation outlook was the recent drop in inflation expectations to a record low. The Bureau for Economic Research’s (BER) latest survey for the SARB demonstrates that five-year inflation expectations have slipped to 4.2% in Q3, down from 4.5% last quarter, the lowest level since 2005.

We still feel a risk factor for the inflation trajectory is the power cuts as Stage 2-3 loadshedding was implemented in Q2. Eskom recently announced there has few load shedding since Q2, and noted that its winter 2025 period concluded on August 31 with only 26 hours of loadshedding across four evenings, supplying electricity 97% of the time to support South Africa’s economy. Despite few loadshedding in Q3, some energy analysts think blackouts are still a threat and further power disruptions are likely.

Under current circumstances, we foresee average inflation will hit 3.4% in 2025. We believe the key for the inflation trajectory will be the global developments, tariffs, oil prices and government’s determination to address the electricity shortages, logistical constraints and financing needs. Global uncertainties such as 30% additional tariffs over South Africa is a major threat while the SARB has said the impact from the tariffs on growth and inflation could be modest, which is yet to be viewed in official data.

We think the SARB will keep its repo rate unchanged at 7% during the MPC on September 18 since it tries to bring the inflation down to new 3% anchor, while the decision is a close call.