Published: 2025-09-15T12:48:24.000Z

U.S. September Empire State Manufacturing Survey - Softer but underlying picture near flat and prices still firm

-

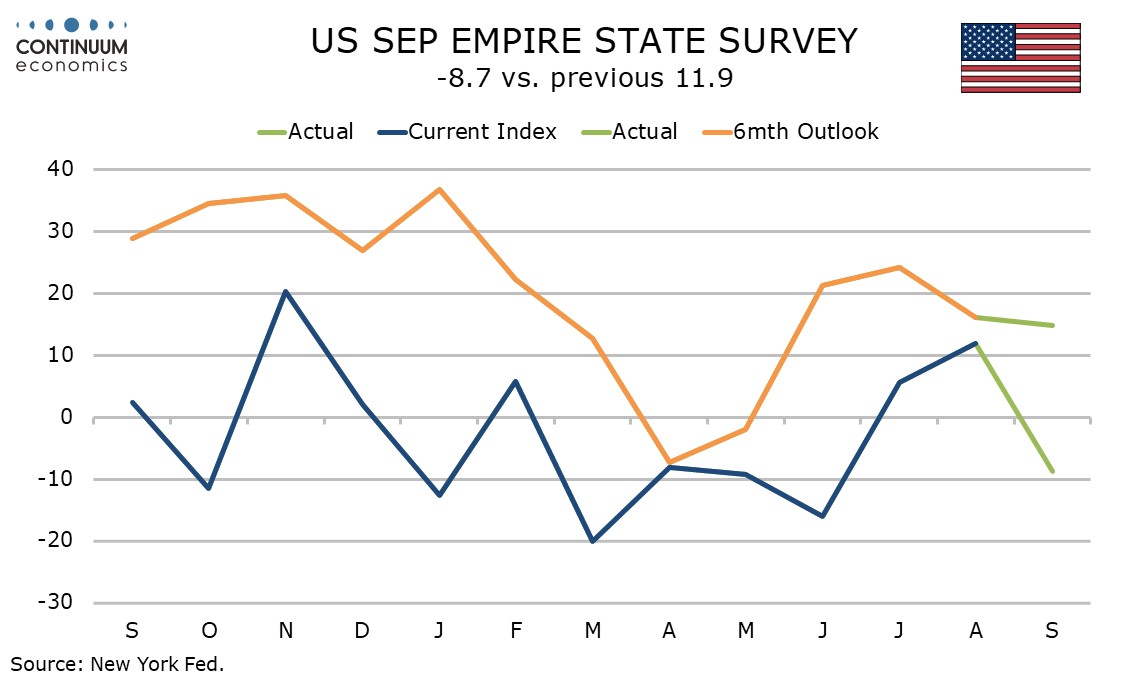

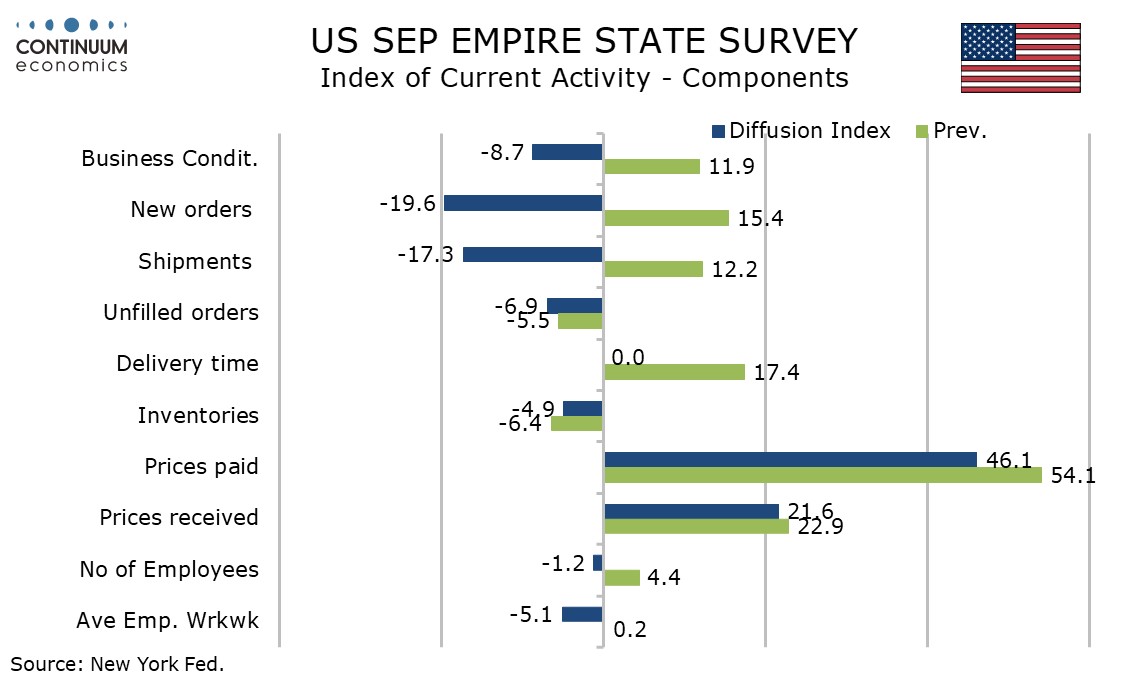

September’s Empire State manufacturing index at -8.7 from a positive 11.9 has broken a string of three straight positives which followed four straight negatives. The index is volatile but now it looks like that the three straight positives were not signaling an untrend. The underlying picture is probably near flat.

New orders at -19.6 from 15.4 showed a particularly sharp reversal and are now the weakest since April 2024. Employment is however only marginally negative at -1.2, down from 4.4 in August.

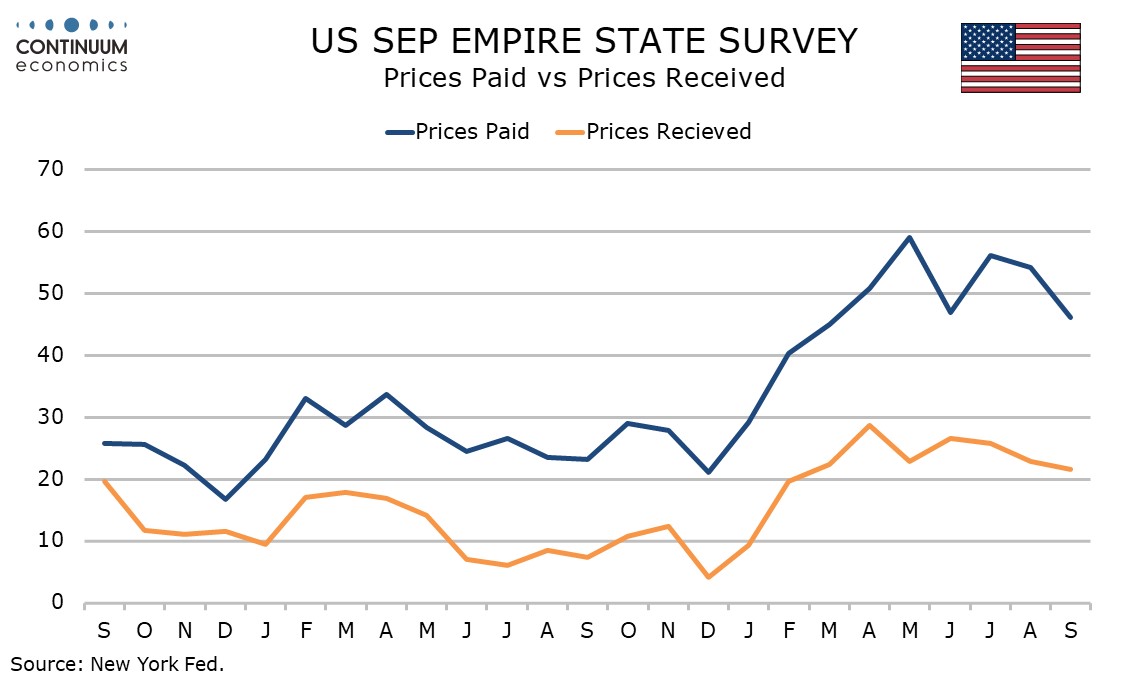

Price data is slightly slower, paid at 46.1 from 54.1 and received at 21.6 from 22.9. While not dramatic moves and still well above 2024 levels these are the slowest since March and February respectively.

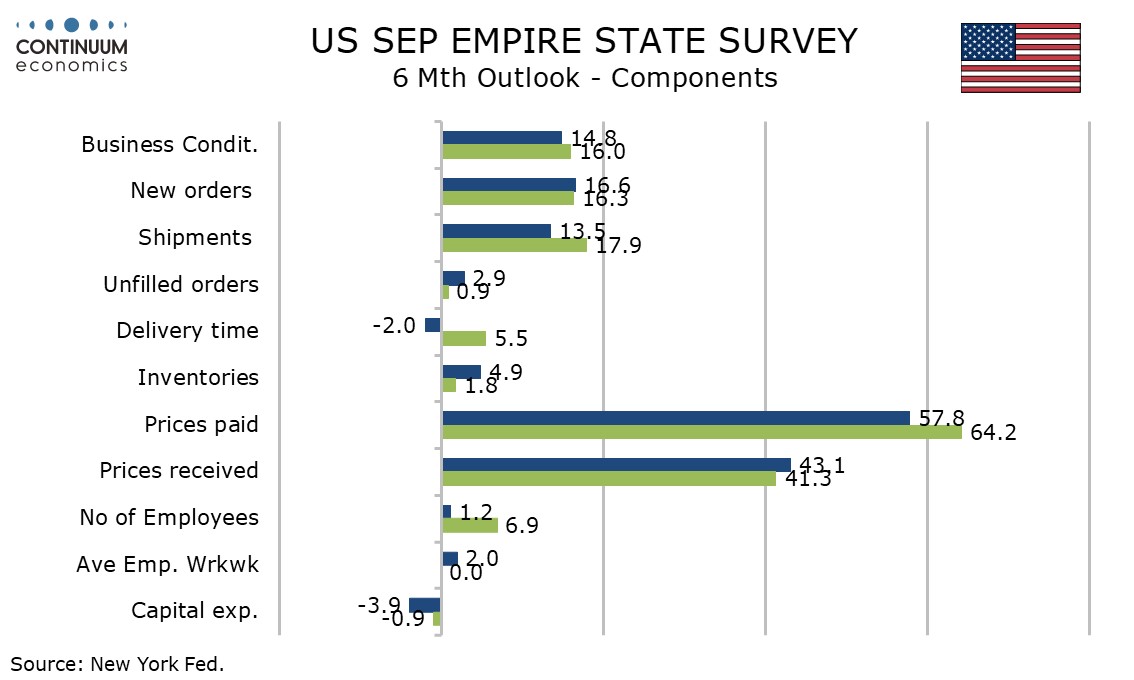

Six month expectations on activity at 14.8 from 16.0 saw a marginal dip but we still have four straight positives after negatives seen in April in May when tariff concerns were at their peak.

Six month expectations on prices paid at 57.8 from 64.2 are at their slowest since February but 6 month expectations on prices received at 43.1 from 41.3 are at their highest since April. Inflationary pressure remains concerning.