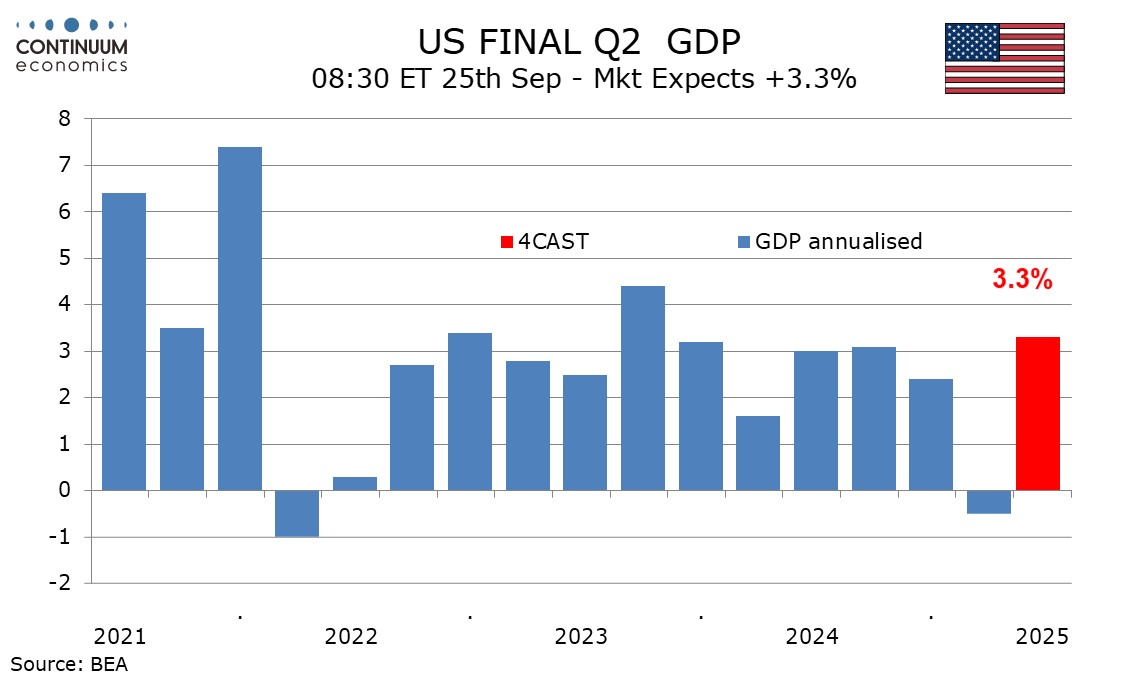

Preview: Due September 25 - U.S. Final (Third) Estimate Q2 GDP - Historical revisions due

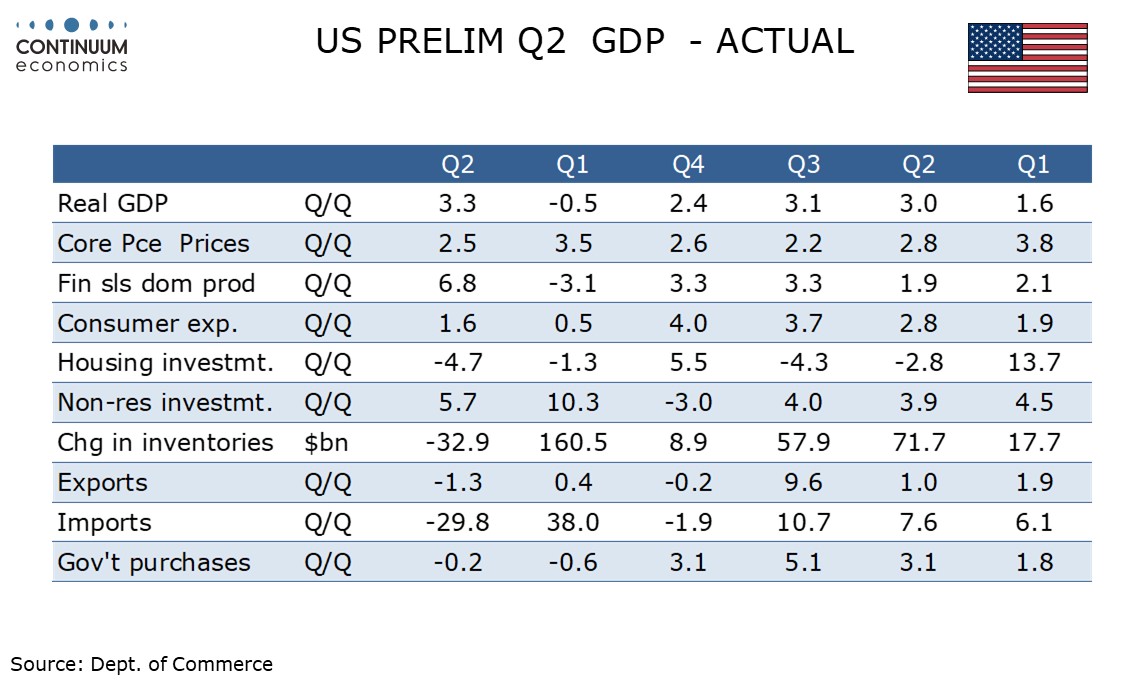

We do expect any significant revision in the third (final) estimate of Q2 GDP from the second (preliminary) estimate of 3.3%. However the data will include historical revisions, and here risk is on the downside, particularly for 2024.

The 3.3% increase in Q2 can be seen as corrective from a 0.5% decline in Q1, with the volatility caused by a pre-tariff surge in imports in Q1 followed by a reversal in Q2. The average of Q1 and Q2 of 1.4% suggests an underlying slowing though final sales to private domestic buyers at 1.9% in each quarter held up better. In existing data, GDP rose by 2.5% Q4/Q4 in 2024.

Employment was revised significantly lower, by 911k or 0.6%, in the preliminary estimate for the March 2025 non-farm payroll benchmark and that suggests downward revisions to personal income in the four quarters to Q1 2025. If spending is revised lower that would impact GDP though if spending holds up the downward revisions would be to savings.

The Fed will also be watching the price indices for historical revisions, though we do not expect any substantial revisions here. Core PCE prices rose by 2.5% annualized in the preliminary Q2 data.