Preview: Due September 25 - U.S. August Durable Goods Orders - Correcting lower

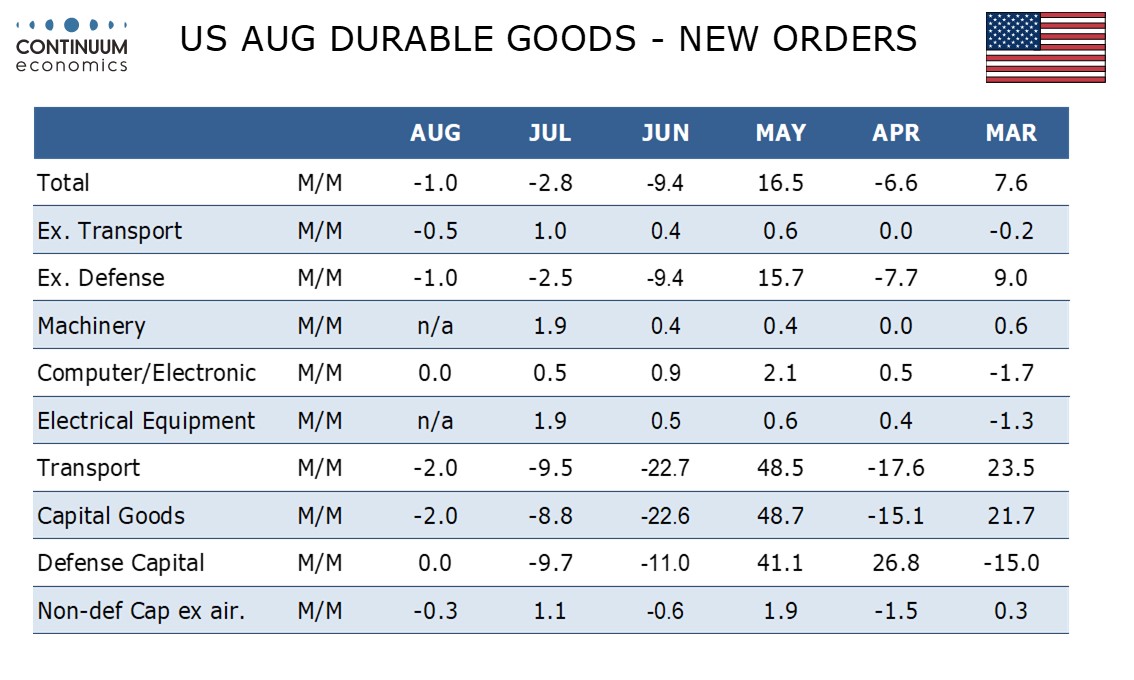

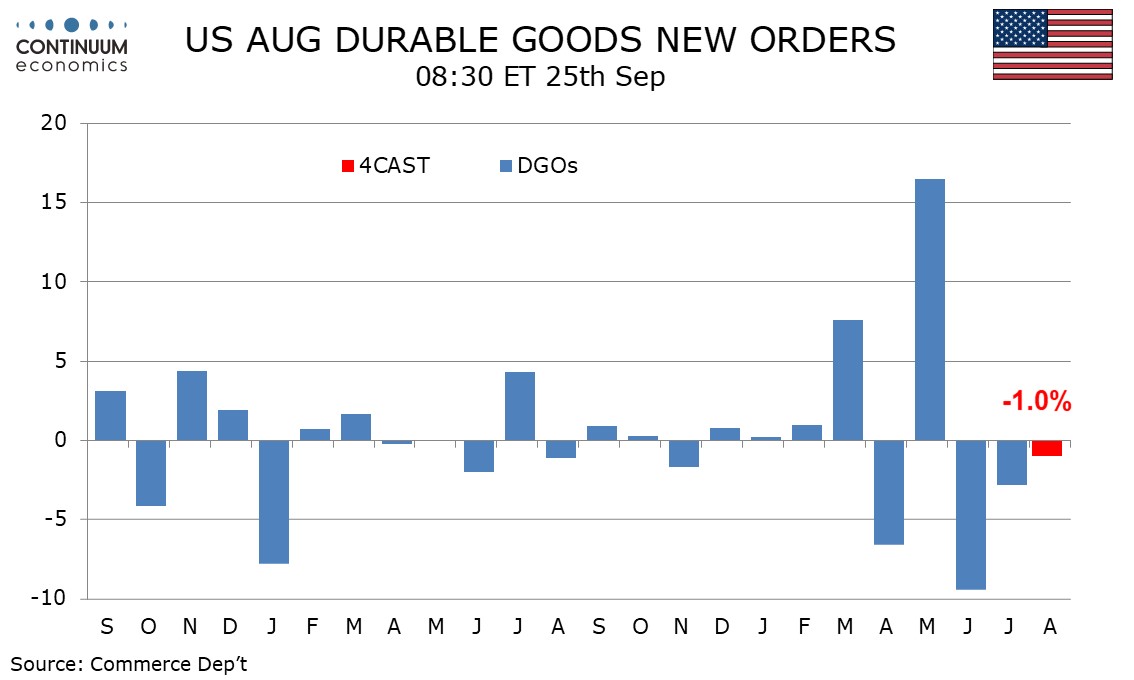

We expect August durable goods orders to fall by 1.0% in a third straight fall, though still not fully reversing a surge of 16.6% in May, while ex transport orders fall by 0.5% in a correction from a 1.0% July increase, that was the strongest of three straight gains.

May’s surge was led by aircraft. Boeing data for July showed aircraft had returned to a more normal level and August showed a further modest decline. We also expect a modest negative from autos. We expect defense, which has a large overlap with transport, to be neutral, with orders ex defense also falling by 1.0%.

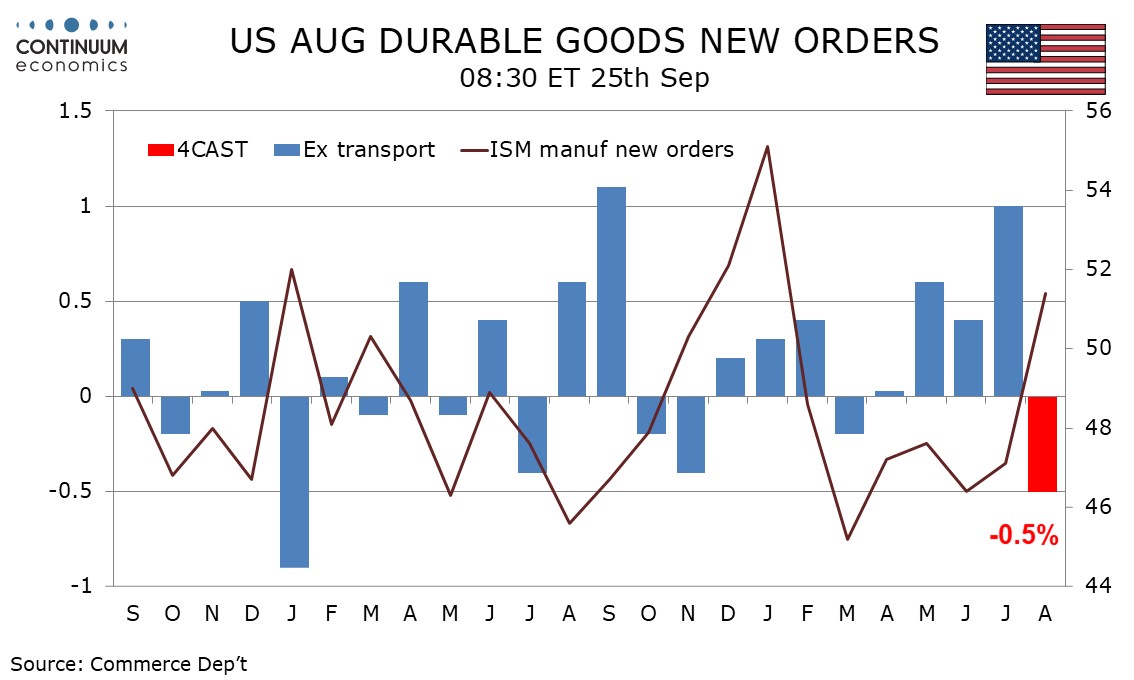

ISM manufacturing new orders turned positive in July but this appears to be catch up with an improvement in trend already seen in ex transport orders, which rose in May. June and July. July’s 1.0% rise was the strongest since September 2024 and a correction is likely. Two straight declines followed the September 2024 increase.

We expect non-defense capital orders ex aircraft, a key indicator of business investment, to also see a modest correction lower, by 0.3% after a 1.1% increase in July. This series has not seen two straight increases since January.