Preview: Due September 23 - U.S. September S&P PMIs - Recent strength difficult to sustain

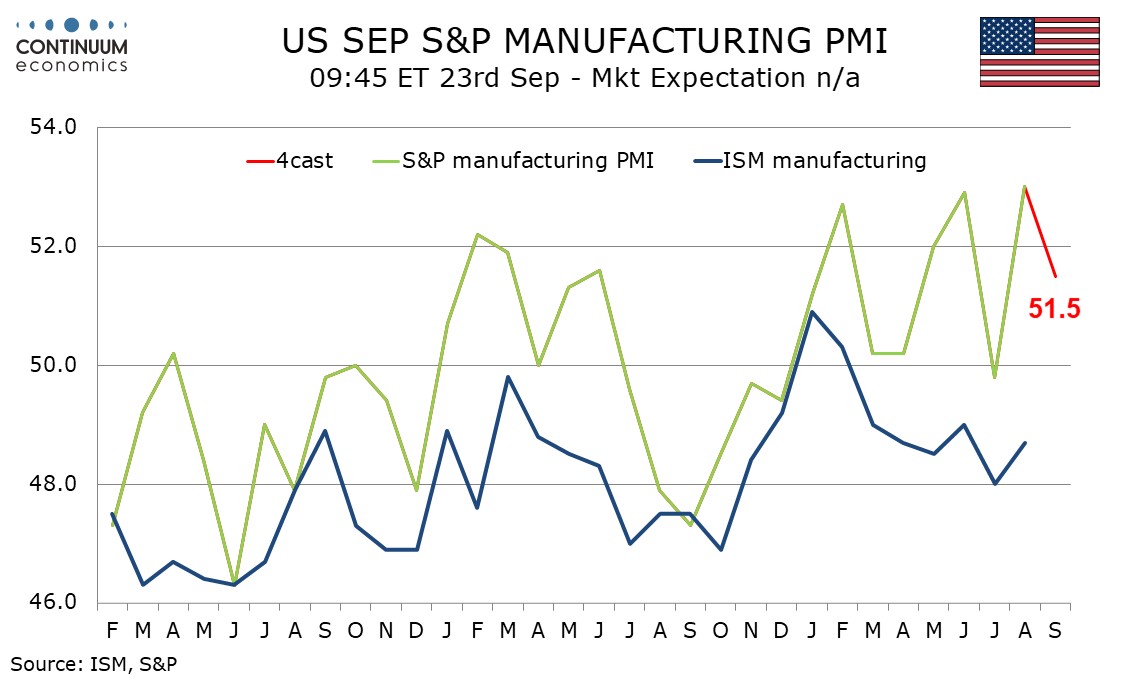

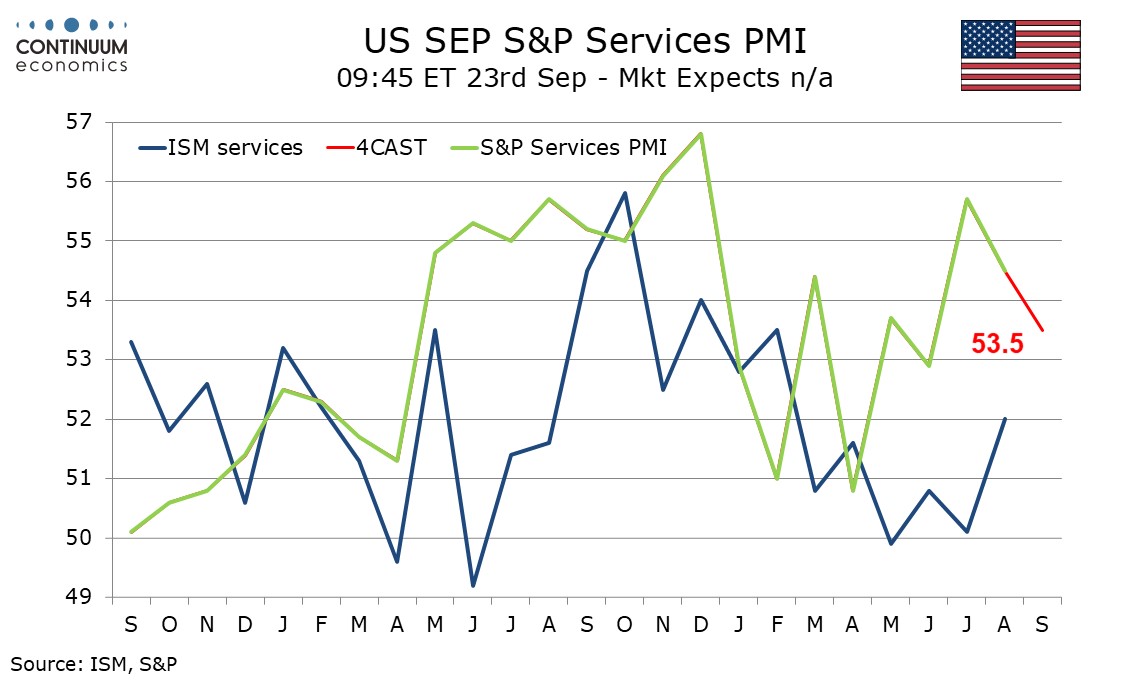

We expect September’s S and P PMIs to slip, manufacturing to 51.5 from 53.0 and services to 53.5 from 54.5. We expect slippage more because recent strength looks difficult to sustain rather than because of any clear signals for weakness.

The S and P manufacturing index has been holding in near neutral to positive territory since January with no clear direction but some volatility. A 51.5 outcome in September would put the index back in mid-range after marginally extending it to the upside in August. The S and P index has been outperforming the ISM’s and most other manufacturing surveys, though the August ISM manufacturing survey did see new orders move above the neutral 50 for the first time since January.

The S and P services PMI has also been outperforming its ISM counterpart, though the ISM index did pick up in August, and its new orders component at 56.0 was the strongest since October 2024. However that looks like catch up with the S and P index rather than a signal. With employment growth now weak we expect the S and P index to extend its correction from July’s 7-month high of 55.7, falling to 53.5 in September from 54.5 in August.

.