U.S. August ISM Manufacturing - New orders positive but production slips

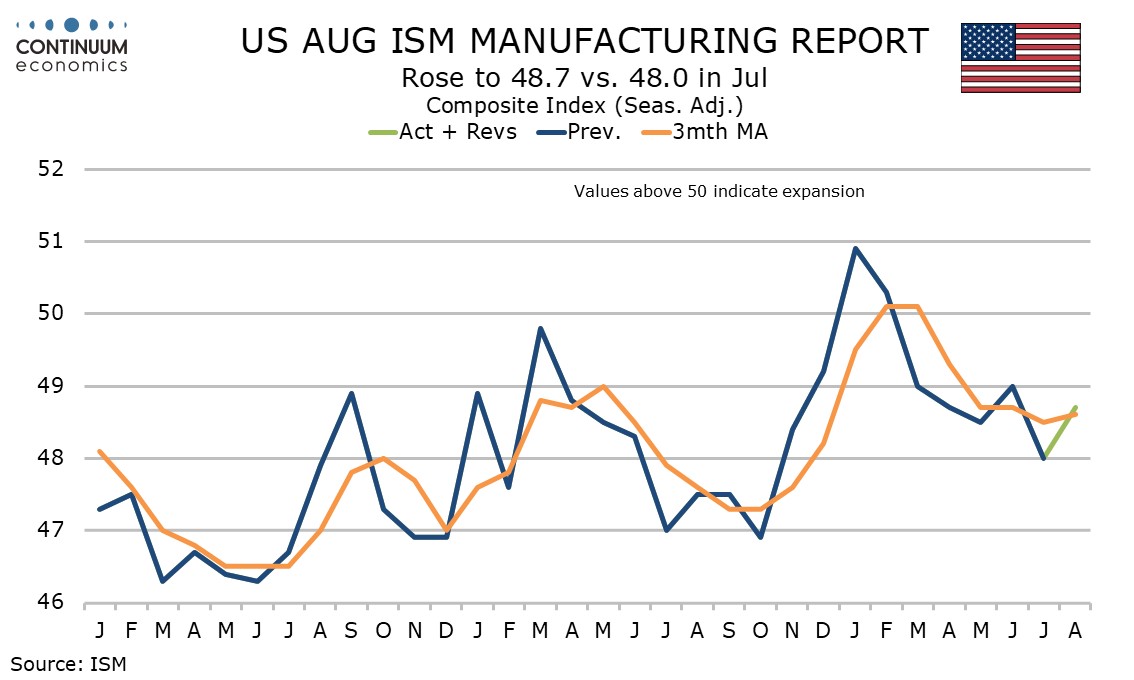

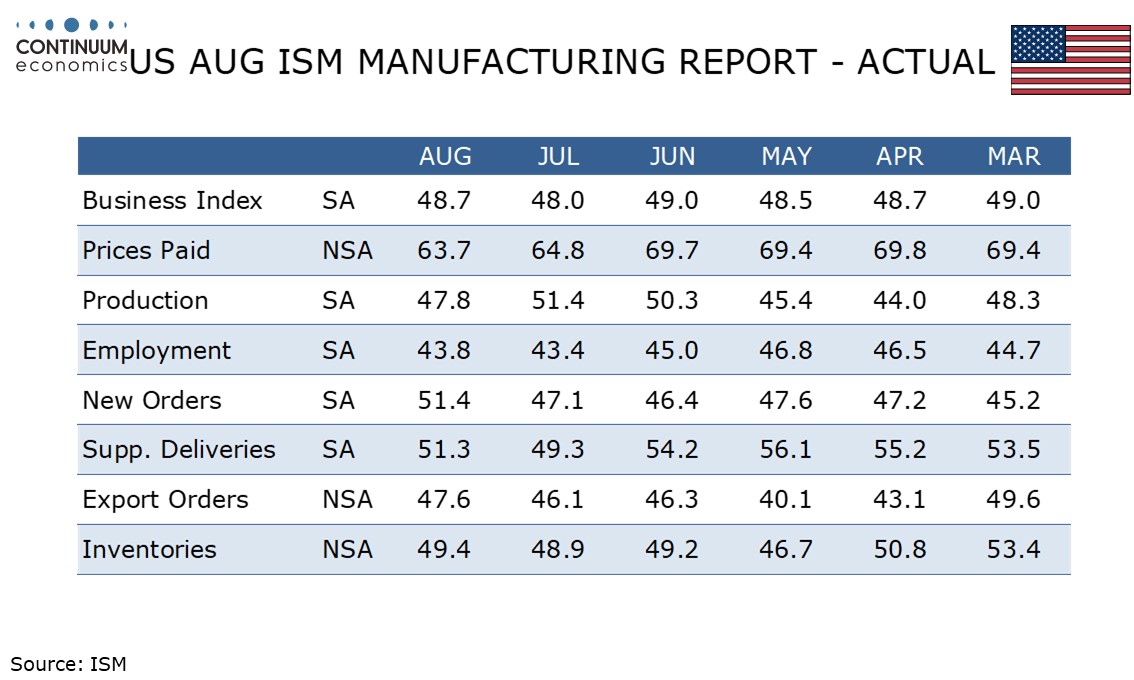

August’s ISM manufacturing index of 48.7 us up from July’s 48.0 but still below June’s 49.0 and weaker than the S and P manufacturing PMI and several regional Fed surveys had implied.

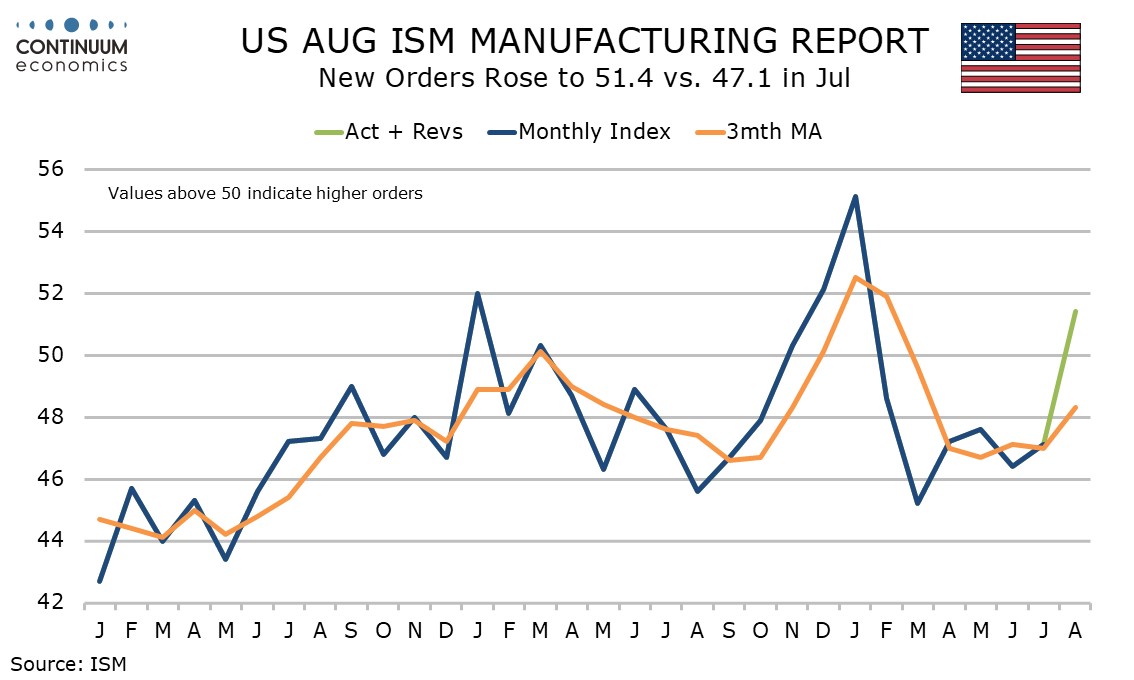

Details show new orders at 51.4 from 47.1, reaching their highest level since January.

Also boosting the composite were modest corrections higher from weaker July data in employment to 43.8 from 43.4, inventories at 49.4 from 48.9 and deliveries at 51.3 from 49.3. Only inventories fully reversed its July slippage.

Restraining the composite was a dip in production to 47.8 from 51.4, this a three month low. We feel that a positive new orders index outweighs the weaker production index but the picture is still of a subdued manufacturing sector.

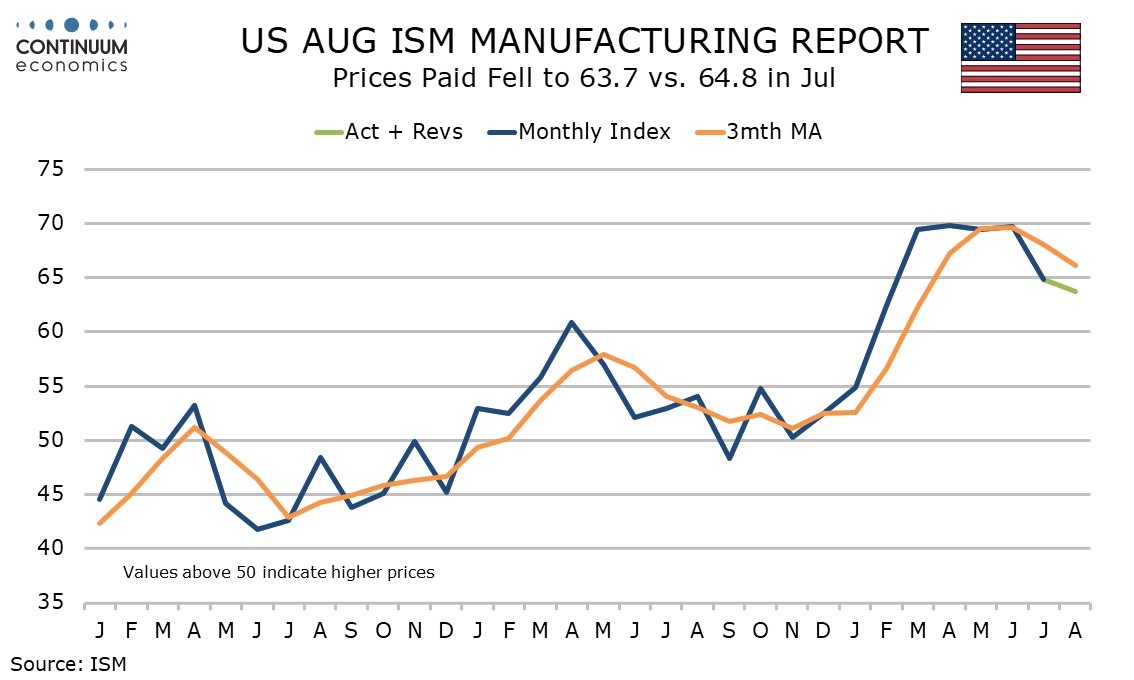

Prices paid do not contribute to the composite but at 63.7 from 64.8 extend a slowing after four straight months above 69, suggesting that the boost to inflationary pressure from tariffs is starting to fade.

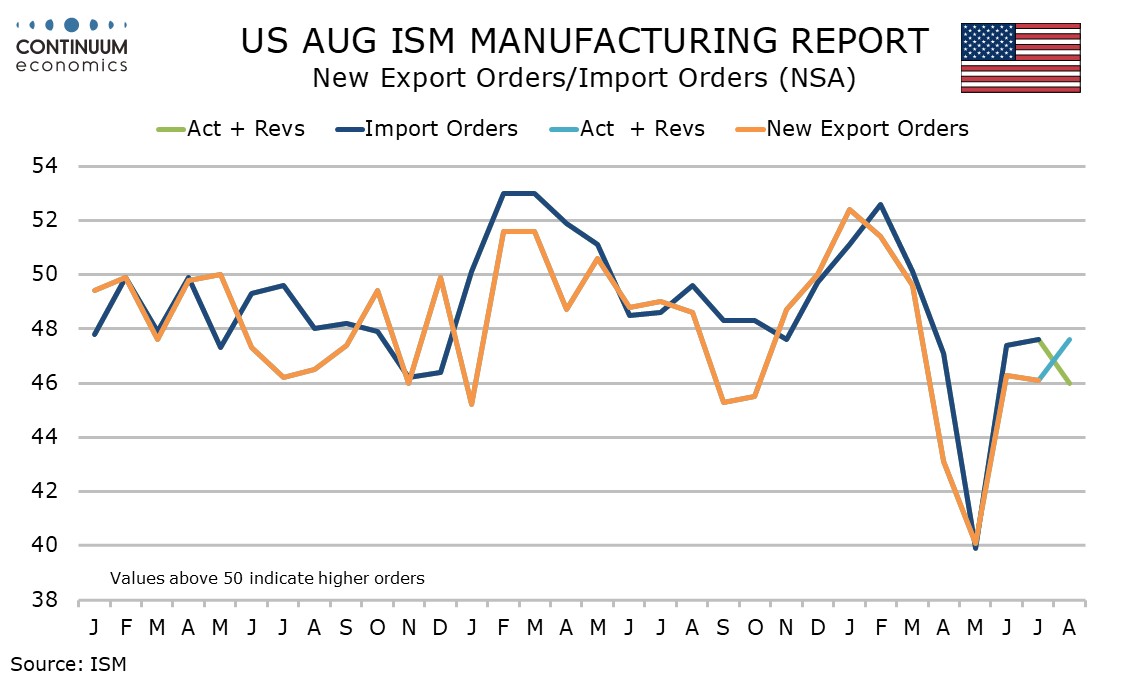

The exports and imports indices also do not contribute to the composite. Both remain weak if off May lows, exports rising to 47.6 from 46.1 but imports falling to 46.0 from 47.6.