Published: 2025-09-12T13:22:58.000Z

Preview: Due September 23 - U.S. Q2 Current Account - Correction from record pre-tariff deficit

1

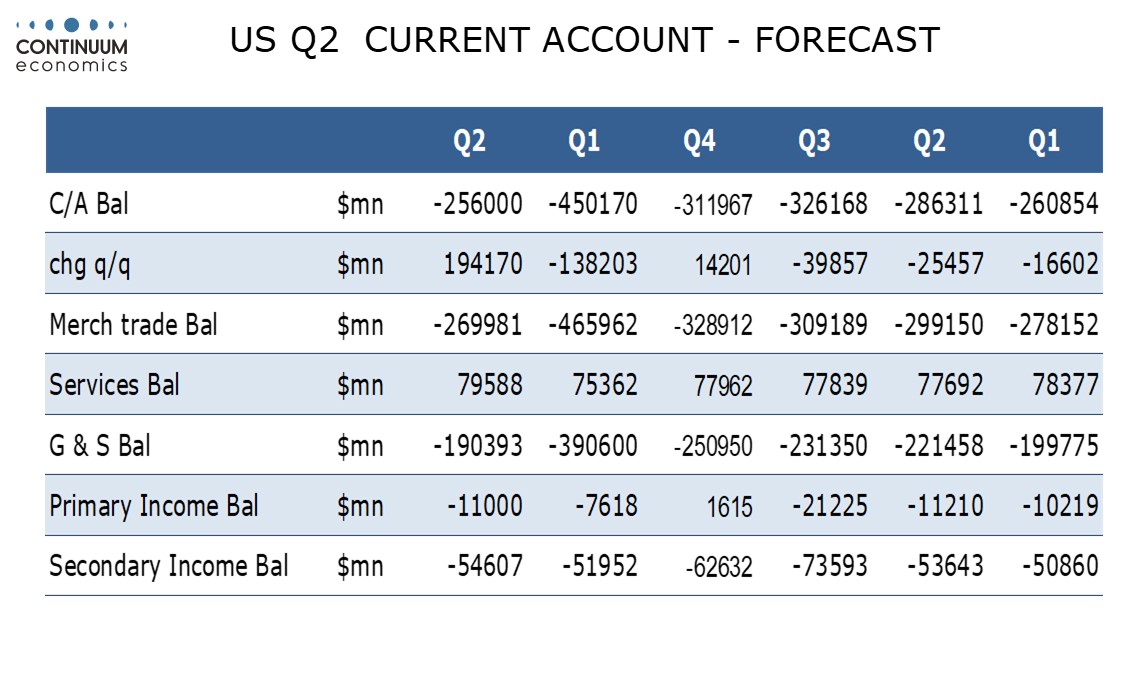

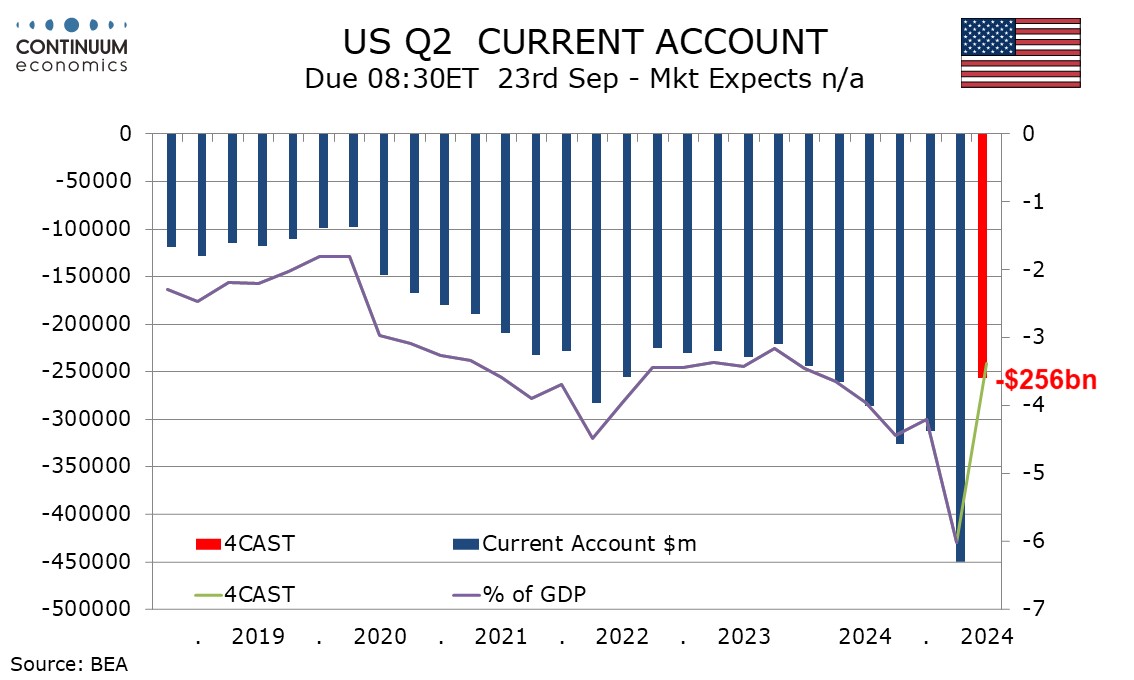

We expect a Q2 US current account deficit of $256bn, down from the record $450.2bn in Q1, when imports surged in anticipation of tariffs, before correcting sharply lower in Q2. Q2’s deficit would then be the lowest since Q4 2023. As a proportion of GDP the deficit would be 3.4%, down from 6.0% in Q1.

Monthly trade data on goods and services has already been released. The Q2 goods deficit plunged to $270.0bn from $465.8bn (a minimal revision from $466.0bn in the Q1 release). The Q2 services surplus slipped to $79.6bn from $80.3bn. Here the revision from the $75.4bn surplus reported in the Q1 release was substantial.

Still to be released are data on primary (investment) income and secondary (unilateral transfers) income. Fed flow of funds data however suggests a modest deterioration in each balance, the former to a deficit of $11.0bn from $7.6bn, and the latter to a deficit of $54.6bn from $52.0bn. This will leave the Q2 narrowing of the current account deficit fully explained by the correction in goods trade.