Published: 2025-09-16T14:44:49.000Z

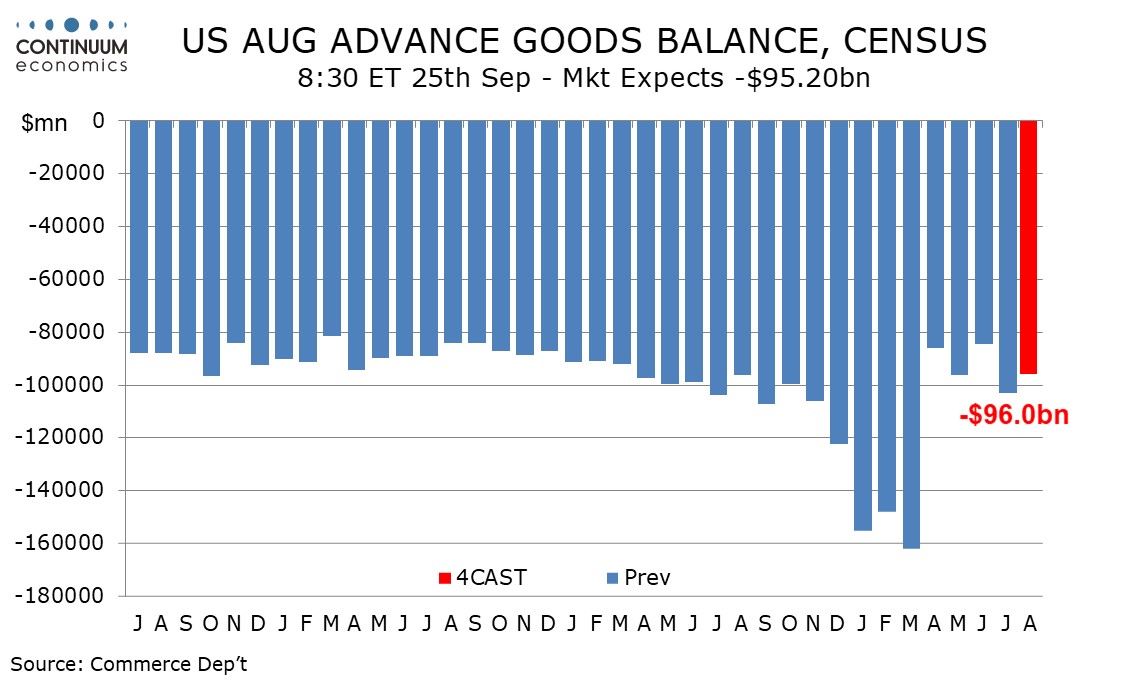

Preview: Due September 25 - U.S. August Advance Goods Trade Balance - Returning to trend

1

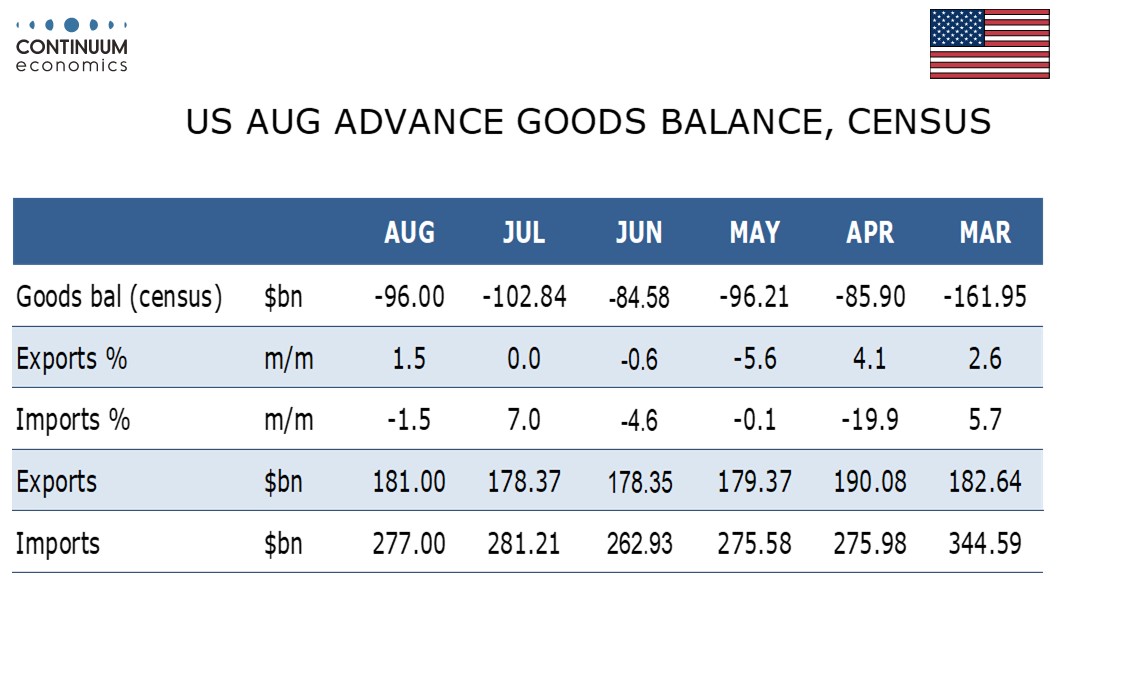

We expect an August goods trade deficit of $96.0bn, down from $102.8bn in July and slightly wider than the average of July and June’s $84.5bn. The deficit will be similar to May’s and well below the Q1-pre-tariff levels, but not far from the pre-election trend.

Exports and import prices both rise by 0.3% in August leaving little net impact. We expect exports to rise by 1.5%, in their first increase since April. Stronger monthly exports from Boeing will provide support.

We expect a 1.5% fall in imports to correct a 7.0% July rise which followed a 4.6% June decline. July saw an rebound in imports from China where tariffs have fallen from peak levels. The imports picture may soon stabilize.

July’s trade deficit was wider than each month of Q2 and thus negative for GDP. In addition to August trade data, advance retail and wholesale inventory data for August is due with this report, and should be watched fir GDP implications.