U.S. August PPI - Correction from shocking July rise

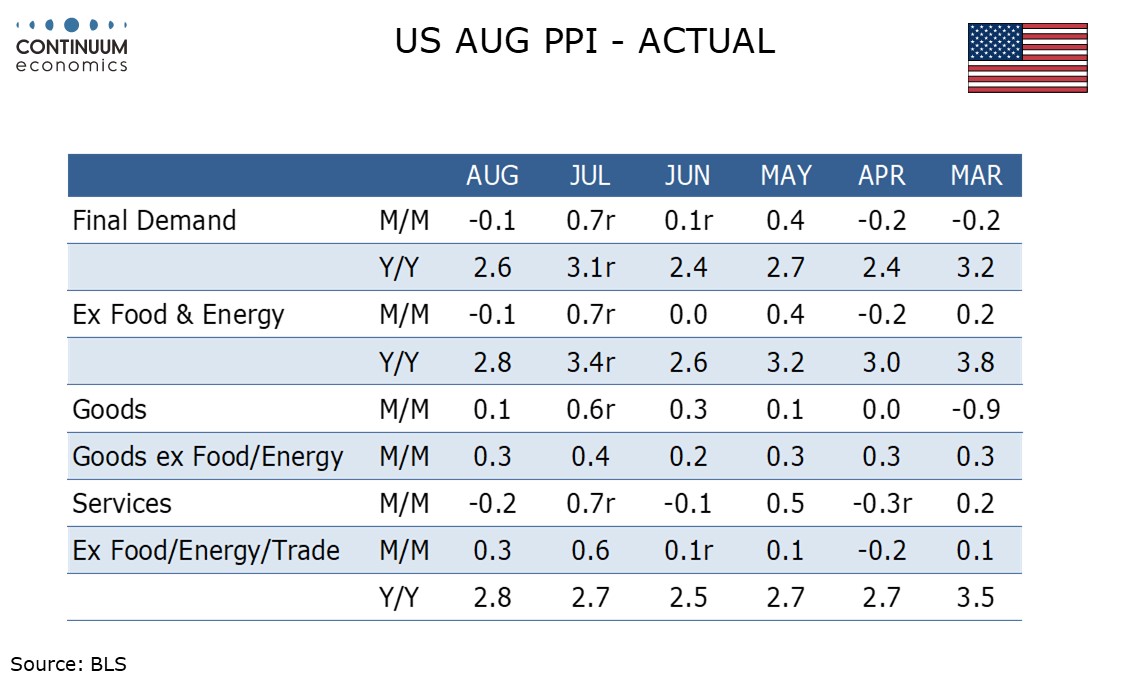

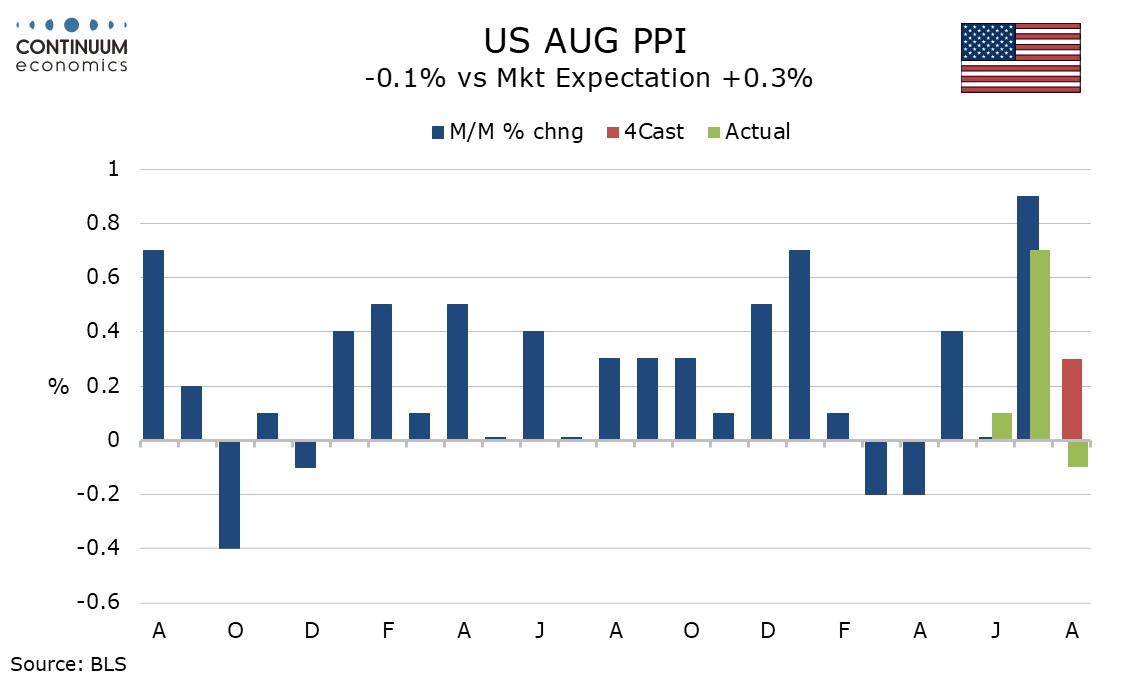

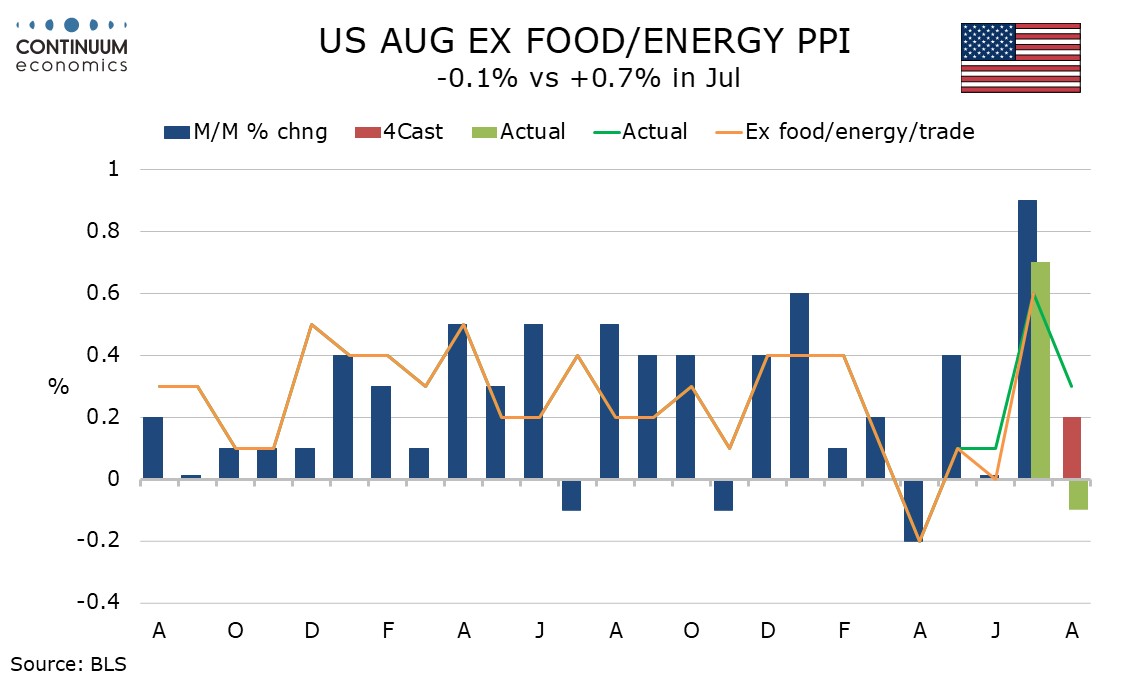

August PPI has slipped by 0.1% both overall and ex food and energy, with the shocking gains of 0.9% in each both revised down to 0.7%, leaving a moderate average gain of 0.3% over the two months. PPI ex food, energy and trade however rose by 0.3% in August after a 0.6% rise in July.

The strength of July did follow a subdued string of numbers from March through June, with PPI ex food, energy and trade up by 0.1% in three of those months and down by 0.2% in April.

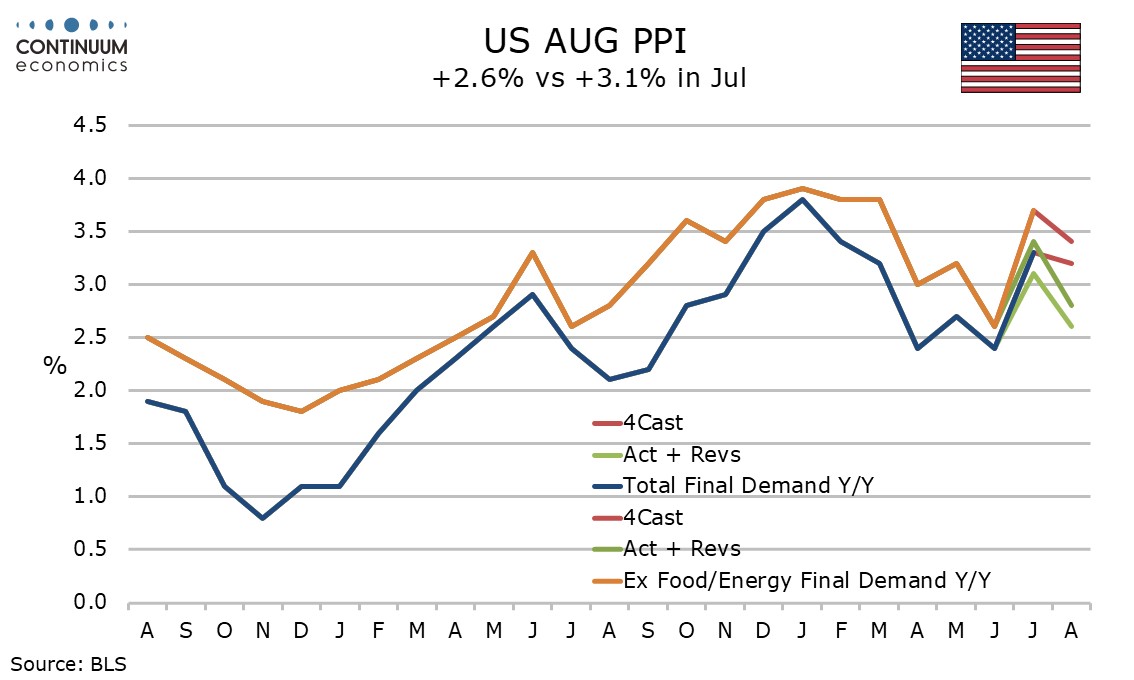

Yr/yr growth ex food energy and trade of 2.8% is up from 2.7% in July and 2.5% in June but below a pace of around 3.5% at the start of the year. The overall yr/yr pace fell to 2.6% from 3.1% and ex food and energy slipped sharply to 2.8% from 3.4%. The inflation pace is higher than the Fed would like but not clearly accelerating, with July’s very strong month in contrast to most recent outcomes.

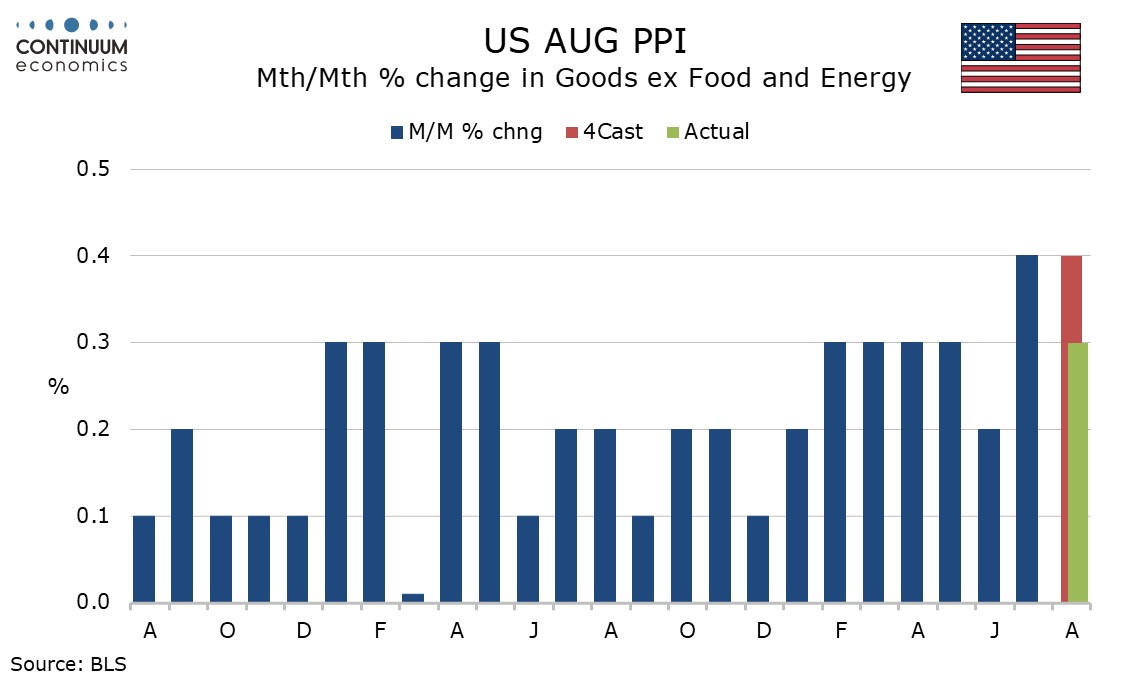

Goods PPI rose by 0.1% with food up only 0.1% and energy down by 0.4%, both after strong July gains. Goods ex food and energy rose by 0.3%. This is in line with trend seen though most of this year and about twice as fast as where trend was in late 2024, a sign that tariffs have lifted trend.

Services PPI fell by 0.2% after a 0.7% July rise. Trade plunged by 1.7% after a 1.2% rise but transport and warehousing with a second straight ruse of 0.9% looks firm while other services rose by 0.3% after a 0.6% July gains.

Processed intermediate goods look quite firm, up 0.4% both overall and ex food and energy, but unpr8cessed goods fell by 1.1% with a 0.5% fall ex food and energy. Intermediate services rise by 0.3% after a 0.7% July rise. The last two months have seen a pick up in trend which was very subdued in the first half of the year.