U.S. March 2025 Non-Farm Payroll Benchmark Revised Down by a Preliminary 911k

The preliminary estimate for the downward revision to the March 2025 non-farm payroll benchmark at -911k is steeper than generally than expected and exceeds even the unusually sharp 818k negative revision reported a year ago for the March 2024 benchmark. The data will be incorporated into the January non-farm payroll data due for release in early February.

Exactly how the revision will be distributed by month is unclear. The quarterly Business Employment dynamics survey, which hinted at a large negative revision in line with what has just been released, suggests that Q2 2024 could see the largest revisions. However, we suspect that stronger Q4 2024 data is also vulnerable to large revisions.

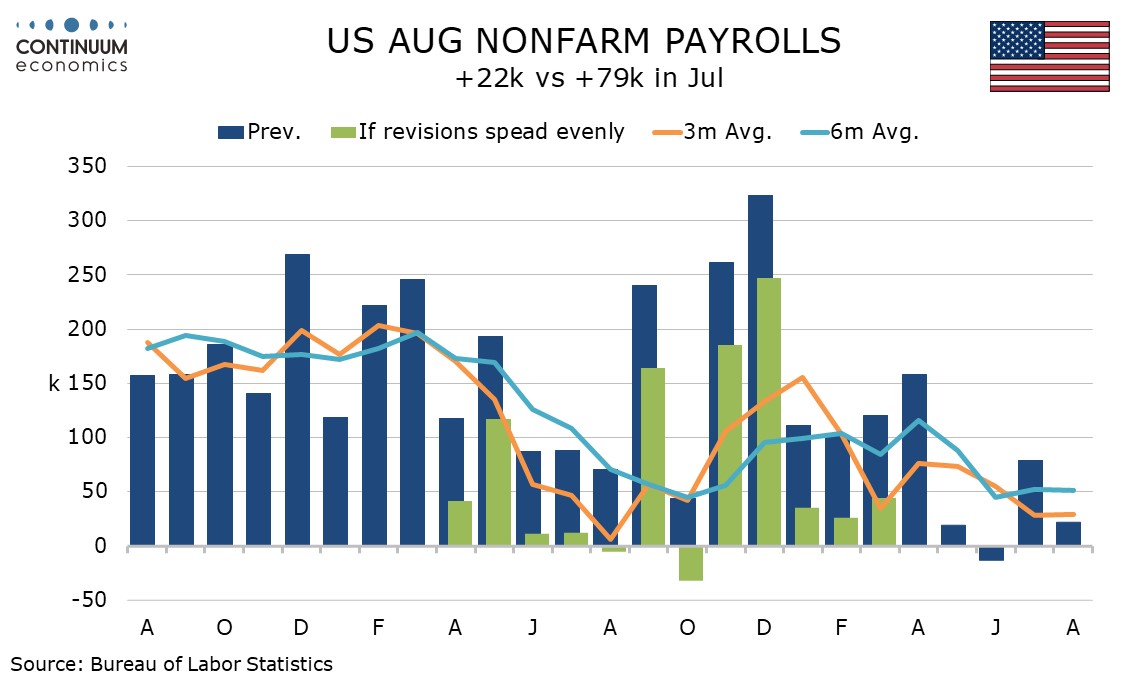

The chart above shows how payrolls would look like if the revision was spread evenly from April 2024 through March 2025. Then growth in each month from April 2024 through March 2025 would be revised down by 76k. The recent slowdown in job growth would then look less pronounced with the 6-month average below 100k in most of the months from August 2024 assuming evenly distributed revisions.

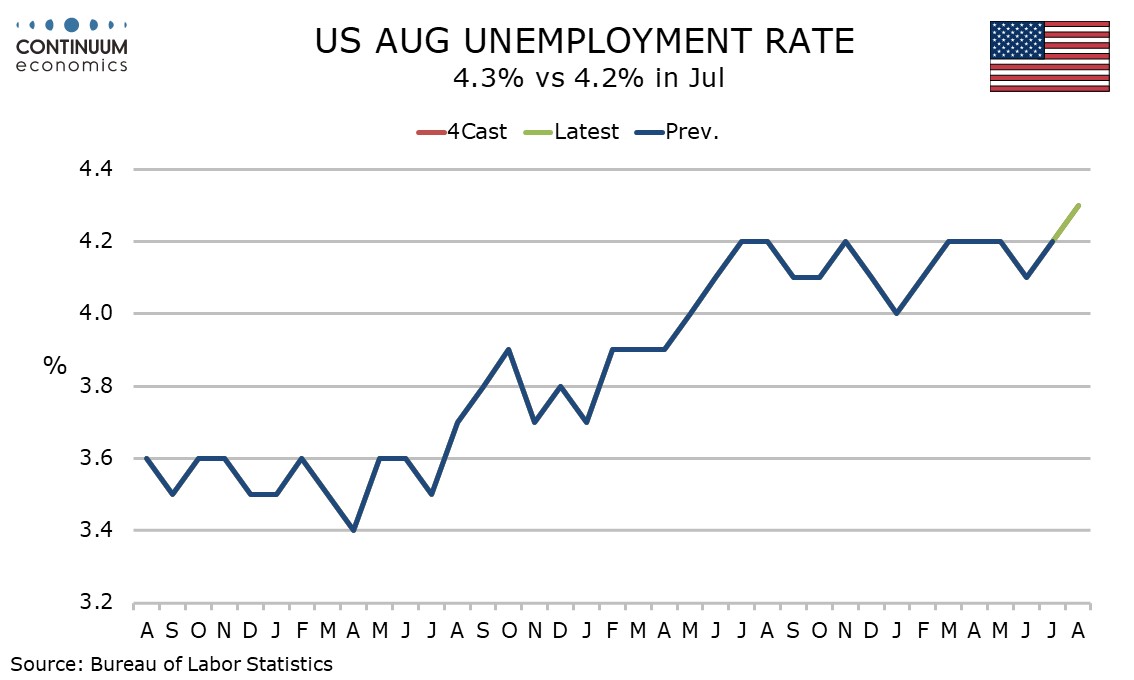

The revisions to employment will not impact the unemployment rate which has been fairly stable near 4.2% over the last year, though August 2025 at 4.3% was the highest since October 2021. The data does however suggest the employment slowdown may be less due to reduced labor supply as a consequence of Trump’s immigration clampdown than previously thought, with Trump policies likely to have had a limited impact by March 2025. This strengthens the case for Fed easing though we still feel that inflation concerns will keep September’s move to 25bps.