SNB Review: Easing Bias Toned Down?

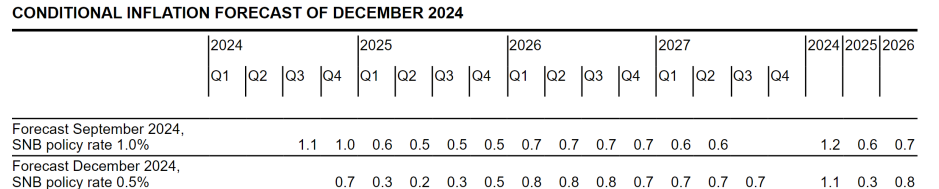

In what seems to be ever-clearer policy front-loading, the SNB cut its policy rate by 50 bp (to 0.5%), thereby accentuating an easing cycle that had delivered three 25 bp moves since March. Possibly, this larger, but far from unexpected, reduction was driven by a fresh assessment that the inflation undershoots (both that seen of late and that projected out to 2027) is increasingly a reflection of weaker underlying price pressures rather than currency induced disinflation. But notably, and despite the marked anticipated inflation undershoot (Figure 1), the SNB was less explicit this time around about further cuts, save to repeat its long-standing mantra that it ‘will adjust its monetary policy if necessary to ensure inflation remains within the range consistent with price stability over the medium term’. Possibly, and maybe reflecting recovery property prices, this signals a policy pause, but we still see another 25 bp cut in Q1 next year.

Figure 1: SNB CPI Inflation Projections Remain Clearly Below Target

Source: SNB

Back in September, the updated outlook suggested an even larger undershoot in the medium-term which flagged further easing not least as the SNB was explicit in suggesting that ‘Further cuts in the SNB policy rate may become necessary in the coming quarters’, rhetoric then repeated (end Oct) by SNB President Schlegel. This rhetoric was not repeated this time around, even though the inflation backdrop has proved to be weaker than expected and that even with a halving of the policy rate. Indeed, the medium-term inflation outlook still sees a marked undershoot of target (Figure 1), albeit where (again) the ‘new forecast is within the range of price stability over the entire forecast horizon’.

Perhaps somewhat excessively, much of this inflation weakness has hitherto been attributed (at least by the SNB) to the strong Swiss Franc, but where we have suggested weaker global and domestic demand has been also playing a part. This now seems to be something the SNB is accepting, noting that in regard to weaker price pressures ‘both goods and services contributed to this decline’ as opposed to imported weakness discussed previously.

But the outlook painted by the SNB very much highlights continued disinflation. It notes that the moderate pace of global growth should continue while uncertainty about the economic outlook has increased in recent months. In particular, the future course of economic policy in the US is still uncertain, and political uncertainty has also risen in Europe. Against this backdrop, the SNB is seemingly anticipating continued below-trend Swiss growth. While it expects GDP growth of between 1% and 1.5% for 2025, it suggests this is consistent with unemployment continuing to rise slightly, while the utilisation of production capacity is likely to decline somewhat.

New President Martin Schlegel (previous Vice Chair) took over the SNB helm for this meeting and he may have considered other and fresh considerations; there are better signs in terms of property prices, this possibly explain the omission of the now familiar warning about vulnerabilities in the mortgage and real estate markets. He has who has also refused to rule out a return to negative policy rates. But it is clear that the Swiss franc is still an important factor and where policy rate cuts continue to be our main instrument should monetary policy have to be eased further, this being another indication of a toned down easing bias.

At this juncture, such a policy shift is a risk than a likelihood and we have still see a terminal policy rate of 0.25% in Q1 next year and then staying there.