Switzerland: SNB Surprise with 25bps Rate Cut

The SNB became the first DM central bank to cut rates with a 25bps reduction to 1.50%, which reflects an even larger forecast inflation undershoot and to counterbalance the strong Swiss Franc (CHF). The inflation forecasts for 2024 and 2025 were significantly lowered even with the new 1.50% policy rate, which suggests that a further cut is highly likely in both June and September. A December cut is possible, but will depend on the September inflation forecast and how the CHF is performing.

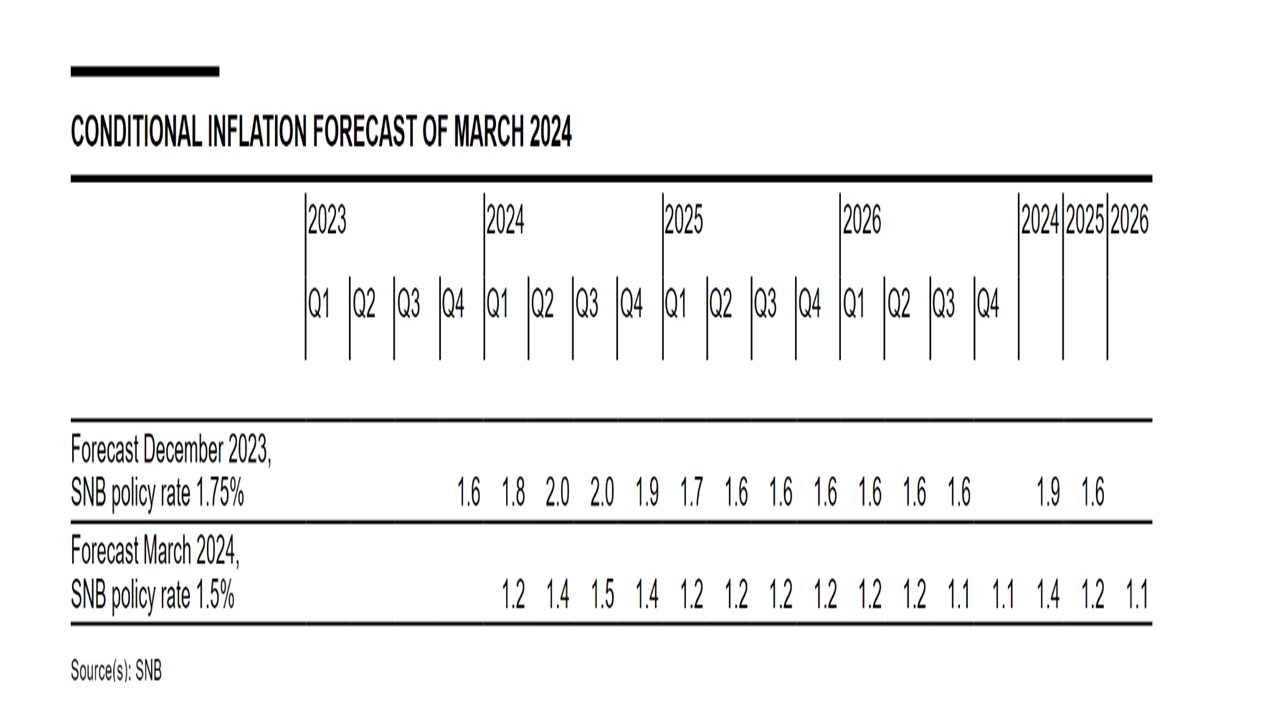

Figure 1: SNB Significant Reduces 2024 and 2025 Inflation Projection

Source: SNB.

The March SNB statement and inflation forecasts provides some interesting insights

· The inflation forecast (Figure 1) has been reduced in 2024 due to incoming lower than expected CPI, while the SNB also noted that mortgage lending has been soft. They expect the Swiss economy to grow by 1% this year (which we largely echo) and the statement also noted downside risks from the global economy turning out to be softer than expected. For 2025 and 2026, the inflation projection was also lowered, as the SNB now expects less 2 round effects from the previous pick-up in inflation.

· This significant reduction in the inflation forecast is based on the new 1.50% policy rate, which helps to back the earlier than expected cut from the SNB. Additionally, the SNB statement made clear that the easing was also partially to counterbalance the tightening of financial conditions from the real appreciation of the CHF. The SNB also appears to remain keen to intervene and sell CHF to restrain the CHF, but want the FX market to understand that it can move quicker than other central banks on interest rate reductions as well.

· A further 25bps cut in June and September is now our forecast, as the new inflation forecast is too low for SNB comfort. Additionally, the SNB statement noted that other central banks are still likely to reduce the degree of restriction and this likely means an expectation that the ECB will start easing in June. SNB needs to cut to keep pace with the ECB and avoid CHF upward pressure. A cut in December is also possible, but would depend on the September inflation forecast and the performance of the CHF.

· It is noteworthy that the SNB has not only become the first DM central bank to cut conventionally but having dropped formally in December plans of further FX sales, it is now seemingly doing the opposite to a degree that is seeing its balance sheet re-expand as it intervenes to curb CHF strength.