SNB Preview: Preparing to Ease?

It is noteworthy that the SNB has already started to the reverse the policy course it initiated some two years ago, having dropped formally in December plans of further FX sales. But now it is seemingly doing the opposite to a degree that is seeing its balance sheet re-expand. Moreover, having also dropped any notion of further rate hikes in December that also saw a revised inflation projection envisaging an even clearer and sustained undershoot of the target out to 2026, it created a rationale for cutting the policy rate sooner rather than later, something that may help chime with its aspiration to stem Franc strength. But despite more recent CPI downside surprises, caution will be the watchword, for the Mar 21 policy assessment, albeit leaving a clear pointer for joining with what may be other DM central banks, and starting formal easing in June. We see that producing the first of two 25 bp rate cuts this year!

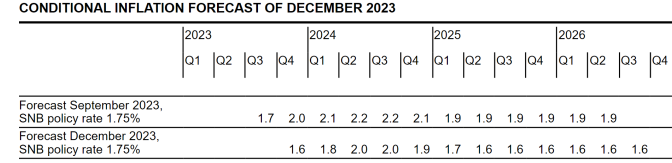

Figure 1: SNB CPI Inflation Projections Clearly Below Target

Source: SNB

SNB Sees Marked Inflation Undershoot…

The SNB paused the rate hike cycle In September, again keeping the policy rate at 1.75% for the December quarterly policy assessment and will surely do so again for the next verdict due on Mar 20. If anything, the decision may be more clear-cut as growth downside risks remain, house price inflation has dissipated while CPI inflation has fallen further with the last few months seeing a more discernible undershoot of SNB thinking (Figure 1). Indeed, this inflation drop will have been quite a development for the SNB which in December was so adamant that the combination of higher electricity prices and rents, as well as a rise in VAT, would pull inflation higher.

…But Domestic Price Pressures Remain

However CPI headline and core inflation have fallen further, the former slumped 0.4 ppt to a 27-month low, also encompassing almost as marked a fall in the core rate to two-year low of 1.2%. This drop suggests the SNB’s downwardly revised Q1 CPI projection made in December look too high at 1.8% - our long-standing view envisages a 1.3% average this quarter. But this is not the whole story; it is somewhat ironic that the sharp and surprising slump in CPI inflation in January which resulted in a weakening of the Franc, masks the fact the currency’s recent and still clear strength is actually the major factor behind this seemingly clearer disinflation.

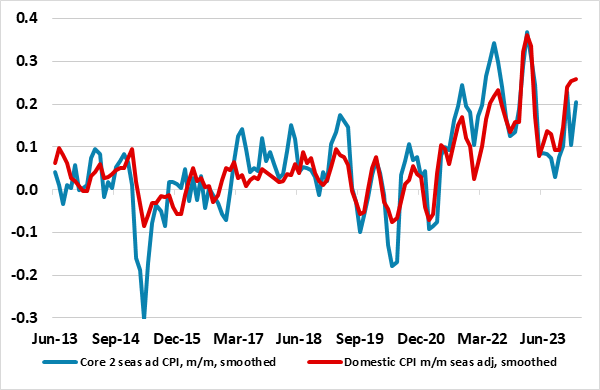

Indeed, imported inflation has turned negative in y/y terms but that for domestic pressures remain around the 2% target. This juxtaposition is even clearer in adjusted m/m CPI data which suggest underlying inflation, which a few months ago was running nearer an annualized 1%, seems to have picked up back towards the 2% SNB target (Figure 2), very probably reflecting the price pressure factors that the SNB pointed to back in December.

All of which to us implies that the Board need do no further reset of the inflation outlook to that offered back in December. But as Figure 1 shows that is a considerable undershoot being projected, not just at the end of the 2-3 year forecast horizon but on a sustained basis through all of 2025 and 2026. Given that the SNB is still presiding over a cumulative 250 bp hikes in its policy rate, we see this sizeable undershoot being projected again in the March assessment, thereby reinforcing what are already both scope and rationale for reversing the conventional hikes put in place in the last two year.

Figure 2: Volatile CPI Inflation Dynamics?

Source: SNB, CE

Currency Issues in Perspective

Of course, the strength in the Franc is also a headache for the SNB as well as a clear price pressure safety valve. However, worries about competiveness repercussions, are overdone, not least as the manufacturing and services based exports industries are so specialized that price sensitivity is a secondary issue. Moreover, the competitiveness issue of the strong Franc is tempered by low inflation itself – the CPI adjusted trade weighted currency index has risen far less than its nominal counterpart. Regardless, the SNB does seem to have been conducting some FX intervention, given the rise in FX reserves reported for the last few months, which effectively means that the SNB is the first DM central bank to have started to rebuild its balance sheet after such concerted efforts to shrink it hitherto – NB: the balance sheet situation is clouded by the possible impact that the annual loss made through 2023 may have caused.